Canada Election: Conservatives Pledge Tax Cuts And Fiscal Responsibility

Table of Contents

Proposed Tax Cuts: Details and Impact

The Conservative party's proposed tax cuts are central to their election platform. They believe these reductions will stimulate economic growth by boosting disposable income and attracting investment. Let's delve into the specifics:

Individual Income Tax Reductions

The Conservatives have pledged to reduce individual income taxes across various brackets. While precise percentages may vary depending on the final platform, we can expect reductions that aim to provide tangible benefits to taxpayers.

- Specific percentage reductions: The exact figures are subject to change, but expect reductions targeting lower and middle-income earners, potentially with a focus on providing relief to families.

- Estimated impact on individual taxpayers: The projected savings will vary greatly depending on individual income levels. Simulators and detailed breakdowns are expected to be released closer to the election.

- Potential effect on consumer spending and economic growth: The party argues that increased disposable income will lead to greater consumer spending, stimulating economic activity and job creation. However, critics may point to potential inflationary pressures.

Corporate Tax Rate Cuts

Lowering the corporate tax rate is a cornerstone of the Conservative plan. The goal is to enhance Canada's competitiveness, attract foreign investment, and foster business expansion, ultimately leading to job creation.

- Proposed corporate tax rate: The Conservatives haven't yet finalized this number, but expect a reduction from the current rate.

- Comparison to current rates and rates in competing countries: The party will likely emphasize how their proposed rate compares favorably to those in other developed nations, highlighting Canada's attractiveness for businesses.

- Potential benefits for businesses and job creation: The expectation is that lower taxes will incentivize businesses to invest, expand, and hire, leading to increased employment opportunities.

Targeted Tax Credits

The Conservatives may also introduce specific tax credits for families, first-time homebuyers, or other targeted groups. These could take the form of expanded existing credits or entirely new initiatives.

- Details of any proposed targeted tax credits: The specifics of these credits will be revealed closer to the election. Expect information on eligibility criteria, credit amounts, and potential impact.

- Impact on specific demographics: Certain demographics, such as families or first-time homebuyers, are expected to benefit disproportionately from these targeted measures.

- Potential for reducing inequality: The party will likely argue these targeted credits help to reduce economic inequality by supporting vulnerable groups.

Fiscal Responsibility Plan: Balancing the Budget and Debt Reduction

Alongside the proposed tax cuts, the Conservatives emphasize a commitment to fiscal responsibility, aiming to balance the budget and reduce Canada's national debt. Their plan will likely include:

Spending Control Measures

The party will outline measures designed to control government spending and improve efficiency.

- Examples of proposed spending cuts or efficiency measures: Expect details on potential reductions in government programs or streamlining administrative processes.

- Impact on government services: This aspect will likely face scrutiny, with concerns raised about the potential impact on essential public services.

- Projected savings: The Conservatives will present projections demonstrating the cost savings from these measures.

Debt Reduction Strategies

Reducing Canada's national debt is a key objective.

- Proposed strategies for debt reduction: This will likely involve a combination of spending cuts, increased economic activity (from tax cuts), and potentially exploring other revenue-generating options.

- Timeline for achieving debt reduction goals: The party will likely set a timeframe for achieving its debt reduction targets.

- Potential economic consequences of debt reduction: Both positive and negative economic impacts will need to be considered.

Long-Term Economic Growth Plan

The Conservative party will likely present a long-term vision for sustainable economic growth.

- Key elements of their long-term economic growth plan: This might involve investments in infrastructure, skills development, or targeted support for specific sectors.

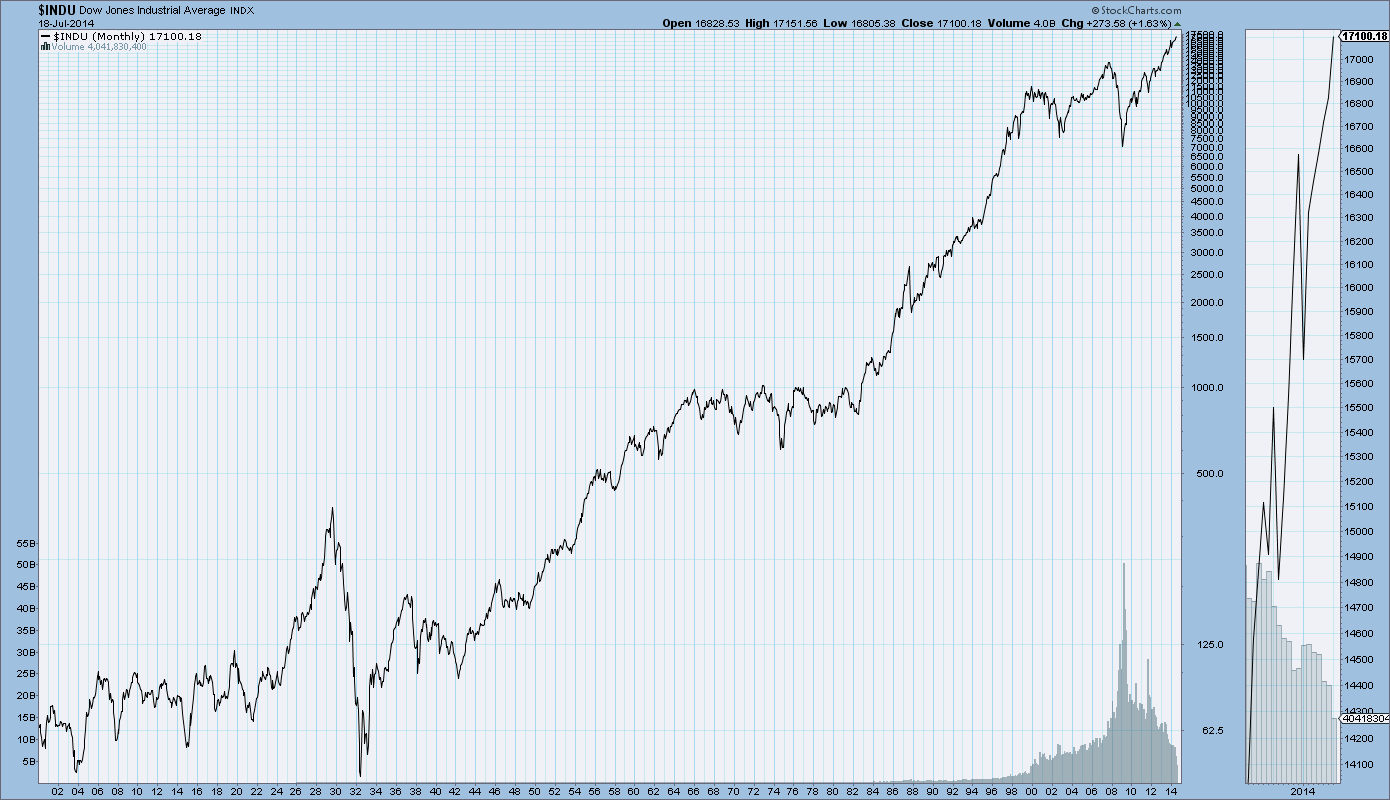

- Projected economic indicators under their plan: The party will provide projections on key economic indicators like GDP growth and job creation under their proposed policies.

- Potential risks and challenges: Thorough analysis will need to account for potential risks and challenges, such as global economic uncertainty.

Potential Challenges and Criticisms of the Conservative Plan

The Conservative plan faces potential challenges and criticisms:

Economic Viability

Independent economists and opposition parties will likely scrutinize the economic viability of the proposed tax cuts, particularly their impact on the federal budget deficit and long-term debt levels. Questions regarding the sustainability of simultaneous tax cuts and spending restraint will be key.

Impact on Social Programs

Proposed spending cuts may lead to concerns about the potential impact on social programs and government services. This will likely be a major point of contention in the election debate.

Opposition Views

Other political parties will undoubtedly offer contrasting perspectives and criticize aspects of the Conservative plan, providing alternative proposals and highlighting potential shortcomings.

Conclusion

The Conservative party's platform for the Canada election rests on a significant promise of tax cuts alongside a pledge of fiscal responsibility. While the tax reductions aim to stimulate the economy and improve the disposable income of Canadians, concerns remain about the potential strain on government services and the overall feasibility of achieving budget balance while simultaneously implementing such substantial tax cuts. Understanding the intricacies of their plan on Conservative tax cuts and fiscal responsibility is critical for informed voting in the upcoming election. We strongly encourage voters to conduct thorough research and analysis of the complete platform before making their choices. Stay informed on the Canada election and the details of the Conservative party's proposed policies to make an educated decision.

Featured Posts

-

Trade Tension Eases Boosting Chinese Stocks Listed In Hong Kong

Apr 24, 2025

Trade Tension Eases Boosting Chinese Stocks Listed In Hong Kong

Apr 24, 2025 -

Trumps Immigration Enforcement New Legal Obstacles Emerge

Apr 24, 2025

Trumps Immigration Enforcement New Legal Obstacles Emerge

Apr 24, 2025 -

Stock Market Update Nasdaq S And P 500 And Dow Jones Gains

Apr 24, 2025

Stock Market Update Nasdaq S And P 500 And Dow Jones Gains

Apr 24, 2025 -

Full List Famous Faces Affected By The Palisades Fires

Apr 24, 2025

Full List Famous Faces Affected By The Palisades Fires

Apr 24, 2025 -

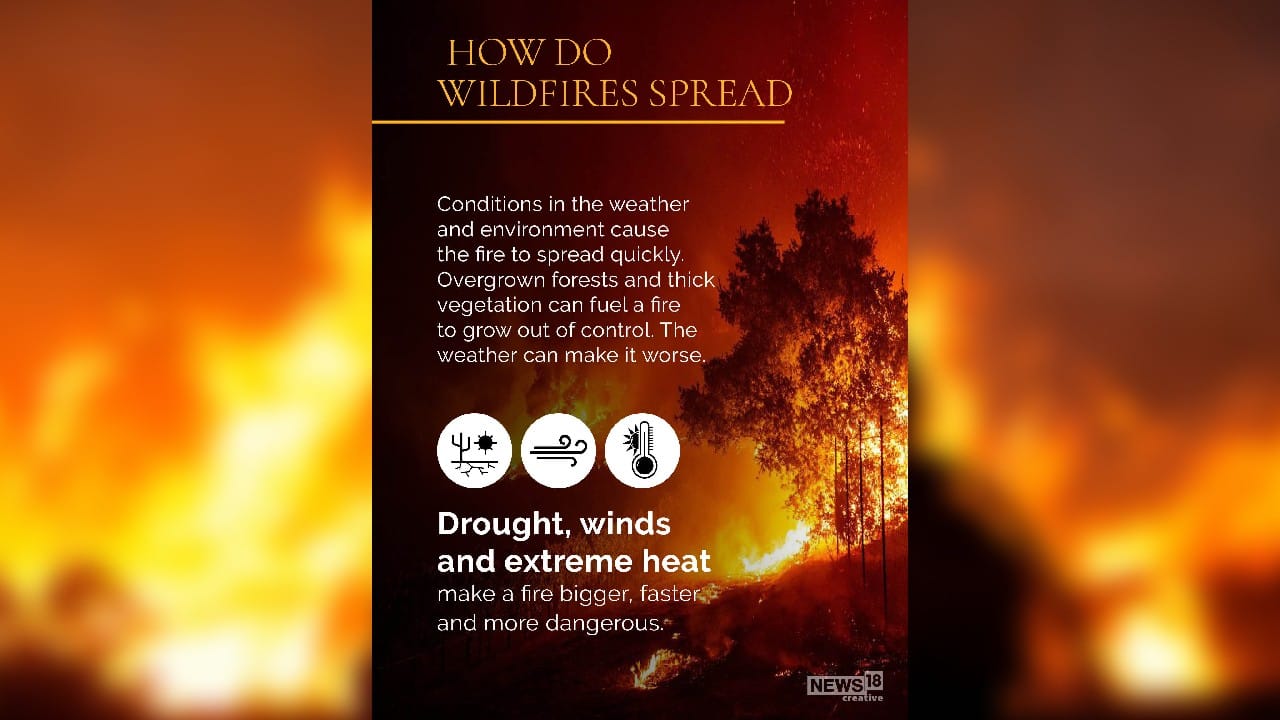

Is Betting On Wildfires Like The La Fires A Sign Of Our Times

Apr 24, 2025

Is Betting On Wildfires Like The La Fires A Sign Of Our Times

Apr 24, 2025