Cantor's $3 Billion Crypto SPAC Deal: Tether And SoftBank Involvement

Table of Contents

Cantor Fitzgerald's Strategic Move into the Crypto Market

Cantor Fitzgerald, a well-established player in the traditional financial markets, known for its brokerage services and trading expertise, has historically focused on equities, fixed income, and other established financial instruments. This foray into the cryptocurrency market represents a significant strategic shift, demonstrating a willingness to embrace the burgeoning digital asset landscape.

This move is highly significant for several reasons:

-

Diversification Strategy into High-Growth Crypto Sector: By entering the crypto market, Cantor Fitzgerald diversifies its portfolio, mitigating risk associated with relying solely on traditional assets. The cryptocurrency market, despite its volatility, presents substantial growth potential.

-

Access to a Wider Range of Financial Instruments: This acquisition grants Cantor Fitzgerald access to a new array of financial instruments, expanding its product offerings and potentially attracting a new clientele interested in crypto-related investments.

-

Potential for Increased Market Share and Profitability: The crypto market is rapidly expanding, and Cantor Fitzgerald's entry positions them to capitalize on this growth, leading to increased market share and potentially higher profitability.

-

Positioning for Future Regulatory Changes in the Crypto Market: By becoming a major player in the crypto space, Cantor Fitzgerald positions itself favorably to influence and adapt to future regulatory changes in the evolving landscape of cryptocurrency legislation.

The Role of Tether (USDT) in the Deal

Tether, the issuer of the USDT stablecoin, plays a crucial role in this deal. USDT's position as a leading stablecoin, pegged to the US dollar, makes it a vital component in the cryptocurrency ecosystem. Its involvement brings both potential benefits and risks:

-

Increased Legitimacy for Tether within the Traditional Finance World: The association with a reputable financial institution like Cantor Fitzgerald lends credibility to Tether, helping address concerns surrounding its reserves and transparency.

-

Potential for Expanded Adoption of Tether as a Stable Payment Method: Cantor Fitzgerald's established infrastructure could facilitate wider adoption of Tether as a stable and reliable payment method within traditional financial systems.

-

Risk Assessment of Tether's Reserves and Regulatory Scrutiny: The deal will likely increase scrutiny of Tether's reserves and operations, potentially leading to greater transparency and regulatory compliance.

-

Exploring the Implications of This Partnership on Tether's Market Capitalization and User Trust: The partnership could positively impact Tether's market capitalization and increase user trust, provided it successfully navigates regulatory hurdles and maintains transparency.

SoftBank's Investment and its Strategic Implications

SoftBank, a global technology investment firm known for its bold investments in disruptive technologies, further solidifies the significance of this deal. SoftBank's participation underscores the growing confidence of major investors in the long-term potential of the crypto market.

-

SoftBank's Confidence in the Crypto Market's Long-Term Growth: SoftBank's investment signals its belief in the crypto market's resilience and future growth prospects, despite its inherent volatility.

-

Potential for SoftBank to Leverage its Global Network and Expertise: SoftBank's vast network and expertise in technology and finance can provide invaluable support and guidance to the merged entity.

-

Influence on the Direction and Future of the Merged Entity: SoftBank's investment likely grants them significant influence on the strategic direction and future development of the combined entity.

-

Risk Mitigation Strategies Employed by SoftBank in This High-Risk Investment: Given the inherent risks in the crypto market, SoftBank's investment likely incorporates sophisticated risk mitigation strategies to protect its investment.

Potential Market Impact and Future Outlook for Crypto SPACs

Cantor Fitzgerald's $3 billion crypto SPAC deal has far-reaching implications for the cryptocurrency market and the future of Crypto SPACs:

-

Increased Institutional Investment in Crypto Assets: The deal is expected to encourage further institutional investment in the crypto space, boosting market maturity and stability.

-

Potential for Further Consolidation within the Crypto Space: This merger might trigger further consolidation within the crypto industry, leading to larger, more established players.

-

Increased Regulatory Scrutiny and the Need for Compliance: The increased involvement of traditional financial institutions is likely to attract greater regulatory scrutiny, highlighting the need for enhanced compliance.

-

Opportunities for Growth and Innovation in the Crypto Industry: The deal creates opportunities for growth and innovation, fostering development in decentralized finance (DeFi), non-fungible tokens (NFTs), and other crypto-related technologies.

-

Long-Term Effects on Cryptocurrency Prices and Market Volatility: The long-term impact on cryptocurrency prices and market volatility remains to be seen, but the deal could contribute to increased stability and reduce volatility over time.

Conclusion

Cantor Fitzgerald's $3 billion crypto SPAC deal, with the substantial participation of Tether and SoftBank, represents a monumental leap forward in the integration of traditional finance and the cryptocurrency world. This bold venture signifies growing acceptance of crypto assets by established institutions and opens exciting possibilities for future growth and innovation. The implications are profound, impacting not only the valuation of cryptocurrencies but also shaping future regulatory environments and investment strategies. To stay ahead of the curve in this rapidly evolving landscape, keep following updates on Cantor Fitzgerald's $3 billion crypto SPAC deal and its reverberations throughout the financial world.

Featured Posts

-

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 24, 2025

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 24, 2025 -

Utac Chip Tester Chinese Buyout Firm Explores Sale Options

Apr 24, 2025

Utac Chip Tester Chinese Buyout Firm Explores Sale Options

Apr 24, 2025 -

Canadian Auto Industry Responds To Us Trade War With Five Point Action Plan

Apr 24, 2025

Canadian Auto Industry Responds To Us Trade War With Five Point Action Plan

Apr 24, 2025 -

Musks Political Involvement Impacts Teslas Q1 Earnings

Apr 24, 2025

Musks Political Involvement Impacts Teslas Q1 Earnings

Apr 24, 2025 -

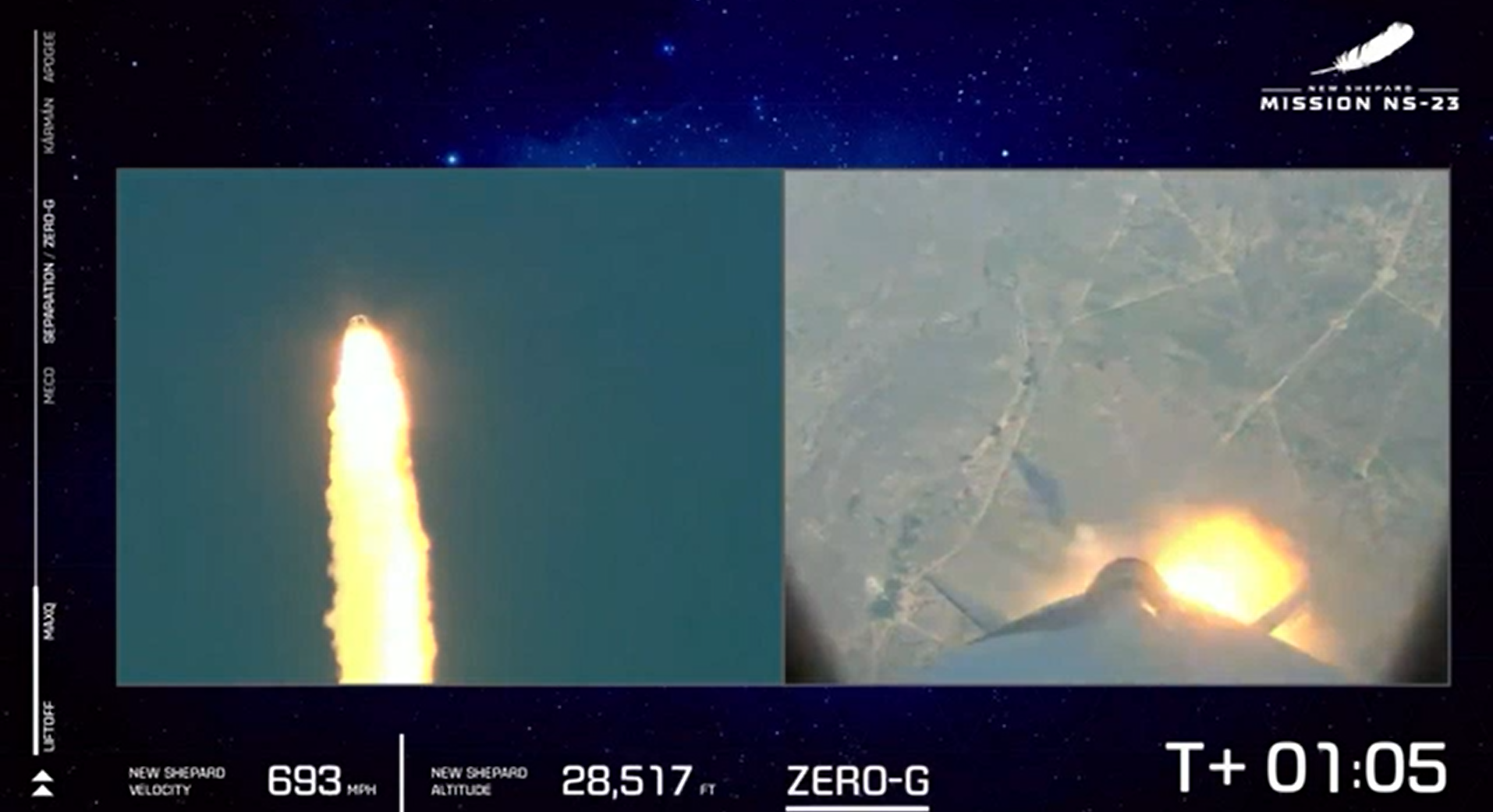

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 24, 2025

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 24, 2025