Check Your Payslip: Are You Due An HMRC Refund?

Table of Contents

Many UK workers unknowingly leave money on the table each year. Are you one of them? Checking your payslip carefully can reveal potential overpayments of tax, leading to a valuable HMRC refund. This guide will show you exactly what to look for and how to claim back what you deserve. Don't miss out on potentially hundreds of pounds – let's find out if you're owed an HMRC tax refund.

Common Payslip Errors Leading to HMRC Refunds

Several common errors on your payslip can result in overpaying tax, leading to a potential HMRC refund. Let's explore some key areas to scrutinize:

Incorrect Tax Code

Your tax code determines how much income tax is deducted from your salary. An incorrect tax code can lead to significant overpayment. For example, an incorrect code like 1100L instead of 1257L could mean you're paying too much tax each month.

- Examples of incorrect tax codes and their impact: A code that's too low will deduct too much tax, while a code that's too high will deduct too little (though you'll eventually owe the difference).

- Common reasons for incorrect tax codes:

- Change in employment status (e.g., part-time to full-time)

- Marriage or civil partnership

- Changes in income from other sources

- Pension contributions

- Incorrect information provided to HMRC

- Finding your correct tax code: You can find your correct tax code through your HMRC online account or by contacting HMRC directly.

Incorrect National Insurance Contributions (NICs)

National Insurance Contributions (NICs) fund the UK's social security system. Errors in calculating your NICs can also result in overpayment.

- How NICs are calculated and potential errors: NICs are calculated based on your earnings. Errors can arise from incorrect earnings reported or miscalculations by your employer.

- Examples of NIC overpayment scenarios: Incorrectly classifying your employment status or failing to account for benefits-in-kind.

- Consequences of incorrect NIC deductions: Overpaying NICs means you're contributing more than you need to, potentially leading to a significant refund.

Pension Contributions and Tax Relief

Pension contributions often qualify for tax relief, reducing your overall tax bill. Incorrect calculations of this relief can mean you're not getting the full benefit.

- Tax relief on pension contributions: Tax relief effectively reduces the amount of tax you pay. The government tops up your pension contributions.

- Incorrect calculation of tax relief: This can occur due to errors in reporting your contributions or applying the wrong tax relief rate.

- Scenarios where errors might occur: Incorrect reporting of pension contributions by your employer or mistakes in your self-assessment tax return if you contribute to a personal pension.

How to Check Your Payslip for Potential Refunds

Regularly reviewing your payslip is crucial to identify potential overpayments.

Understanding Your Payslip Components

Familiarize yourself with the key components of your payslip:

- Gross pay: Your total earnings before deductions.

- Net pay: Your take-home pay after deductions (tax, NICs, pension contributions).

- Tax: The amount of income tax deducted.

- NICs: The amount of National Insurance contributions deducted.

- Pension Contributions: The amount deducted for your pension scheme.

Example Payslip (with annotations): (Include a simple example payslip image here with key components clearly labelled)

Comparing payslips over time can help you spot inconsistencies or unusual deductions.

Comparing Your Payslip to Your Tax Code

Verify that the tax code used on your payslip matches your official tax code from HMRC. Any discrepancy could be the source of an overpayment.

- Verifying tax code accuracy: Access your HMRC online account or contact them directly to confirm your official tax code.

Using HMRC Online Services

HMRC's online services provide access to your tax information, allowing you to independently verify your tax calculations.

- Accessing your tax information: Log in to your HMRC online account to view your tax details, including your tax code, tax calculations, and payment history. This allows you to check your tax code, and see if it has been correctly applied to your earnings.

Claiming Your HMRC Refund

If you've identified an overpayment, here's how to claim your refund:

Gathering Necessary Documents

To claim your refund, you will need:

- Your P60 (end-of-year tax summary)

- Relevant payslips showing the overpayment

- Any other supporting documentation

The HMRC Claim Process

HMRC offers various methods for making a claim. This may involve contacting them directly or using their online portal. The specific process will vary depending on the type of overpayment and the circumstances.

- Using the HMRC website: The HMRC website contains comprehensive information on claiming refunds. Refer to their online guides for a step-by-step guide to making your claim.

Time Limits for Claiming

There are time limits for claiming tax refunds, typically four years from the end of the tax year in question. Claiming promptly is essential to avoid missing out on your refund.

Conclusion

Regularly checking your payslip for potential errors is crucial for ensuring you receive the correct amount of pay. Incorrect tax codes, NICs, and pension contributions can all lead to significant overpayments, resulting in substantial HMRC refunds. This guide has provided you with the tools to identify these errors and claim back what's rightfully yours.

Call to Action: Don't delay! Check your payslip today and see if you are due an HMRC refund. Take control of your finances and reclaim any overpaid tax. Use the resources provided and the HMRC website to start your claim. Start your HMRC refund claim now!

Featured Posts

-

Hmrcs Voice Recognition System Faster Call Handling For Taxpayers

May 20, 2025

Hmrcs Voice Recognition System Faster Call Handling For Taxpayers

May 20, 2025 -

Legal Ruling Impacts E Bay Section 230 Doesnt Shield Banned Chemical Sales

May 20, 2025

Legal Ruling Impacts E Bay Section 230 Doesnt Shield Banned Chemical Sales

May 20, 2025 -

Nyt Mini Crossword Answers March 13

May 20, 2025

Nyt Mini Crossword Answers March 13

May 20, 2025 -

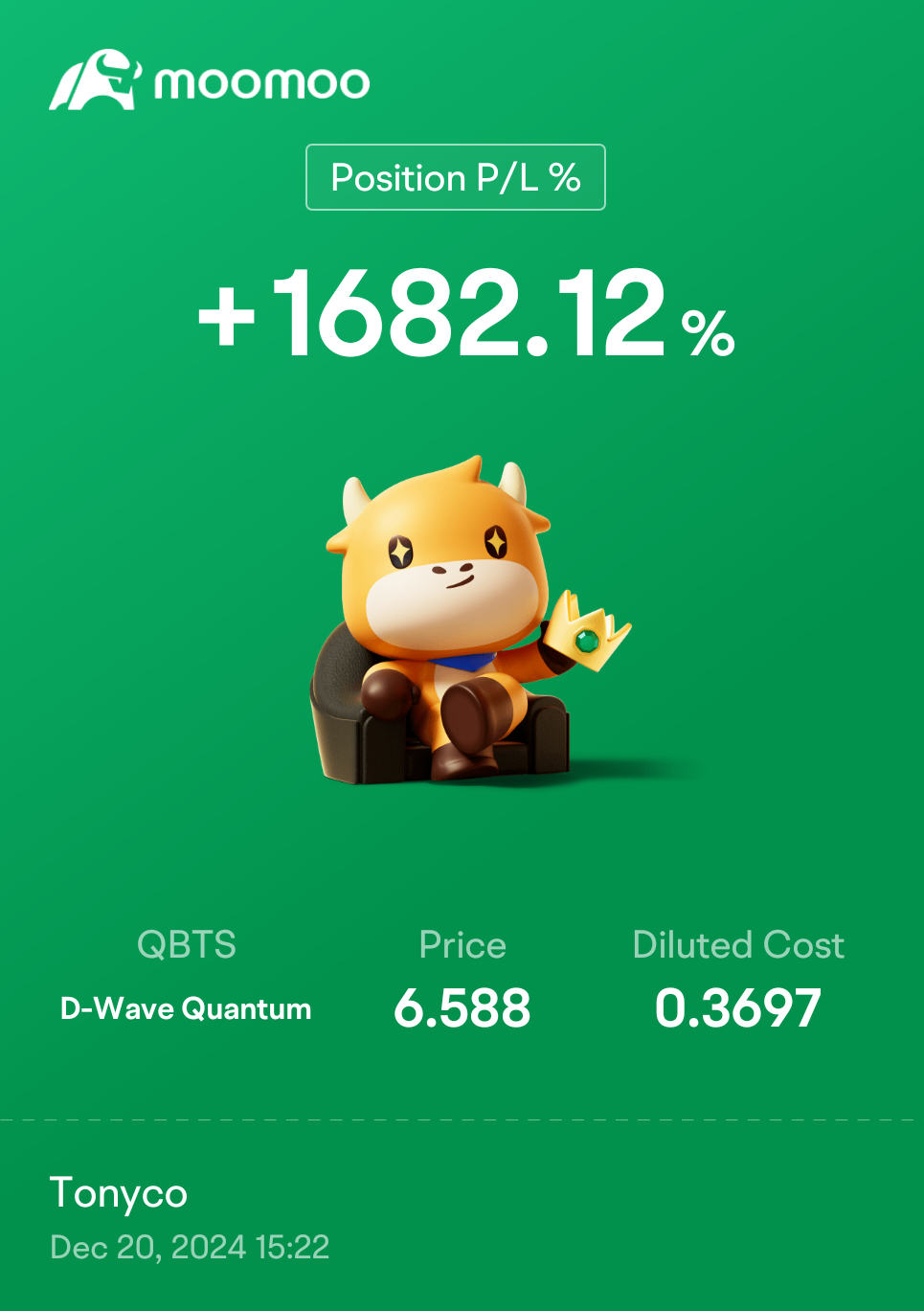

Mondays Market Drop Analyzing The D Wave Quantum Qbts Stock Crash

May 20, 2025

Mondays Market Drop Analyzing The D Wave Quantum Qbts Stock Crash

May 20, 2025 -

Colombian Models Murder Femicide Condemnation Grows After Mexican Influencers Live Stream Killing

May 20, 2025

Colombian Models Murder Femicide Condemnation Grows After Mexican Influencers Live Stream Killing

May 20, 2025