China Life's 2023 Profits: A Story Of Investment Success

Table of Contents

Strategic Investment Portfolio: The Foundation of Success

China Life's 2023 investment success is firmly rooted in its diversified investment portfolio and shrewd asset allocation strategy. The company strategically allocates its assets across a range of asset classes, mitigating risk and maximizing returns. This diversified approach ensures resilience against fluctuations in any single market segment.

-

Diversification Across Asset Classes: China Life's portfolio includes a blend of bonds, equities, real estate, and alternative investments. This balanced approach reduces the impact of market volatility on overall returns.

-

Successful Investments in Key Sectors: Significant gains were realized through strategic investments in high-growth sectors such as technology and infrastructure, capitalizing on China's ongoing economic development. Specific examples, while not publicly detailed in full, showcase the effectiveness of China Life's investment research and selection process.

-

Strategic Partnerships and Collaborations: China Life's proactive approach to forming strategic alliances and collaborations with other leading financial institutions further enhanced its investment capabilities and access to exclusive opportunities.

-

Effective Risk Management Strategies: Rigorous risk management practices, including robust due diligence and sophisticated risk modeling, are integral to China Life's investment strategy. This ensures the long-term sustainability of its investment returns while protecting policyholders' interests. The company continuously monitors and adjusts its risk profile in response to evolving market conditions. This commitment to risk management is a key factor in its consistent investment success. Keywords: investment portfolio, asset allocation, risk management, diversification, China Life investments.

Strong Performance in Core Insurance Businesses

Beyond its investment prowess, China Life's 2023 profits were also driven by a strong performance in its core insurance businesses. The company witnessed substantial growth across its range of insurance products, demonstrating the effectiveness of its product offerings and customer acquisition strategies.

-

Growth in Policyholders: A significant increase in the number of policyholders reflects the growing trust and confidence in China Life's insurance products and services.

-

Increase in Premium Income: Higher premium income showcases the success of China Life's sales efforts and the increasing demand for its insurance solutions. This underlines the company's market leadership and its ability to attract and retain customers.

-

Improved Customer Retention Rates: China Life's focus on customer satisfaction has resulted in improved customer retention rates, ensuring the long-term profitability and stability of its core insurance operations. This reflects the value provided to policyholders and a successful approach to building customer loyalty. Keywords: insurance products, premium income, policy sales, customer retention, China Life insurance performance.

Favorable Macroeconomic Conditions in China

China's positive macroeconomic environment played a significant role in boosting China Life's 2023 profits. The robust growth of the Chinese economy, increased consumer spending, and supportive government policies created a favorable backdrop for both investment returns and insurance sales.

-

GDP Growth: China's continued GDP growth fueled investment opportunities and increased consumer disposable income, leading to higher demand for insurance products.

-

Consumer Spending: Rising consumer spending contributed to increased demand for insurance products, particularly in the health and life insurance segments. This trend further boosted premium income and overall financial performance.

-

Government Policies: Supportive government policies, including initiatives to promote financial inclusion and encourage investment in key sectors, have created a positive environment for China Life's operations. Keywords: Chinese economy, macroeconomic factors, GDP growth, consumer spending, government policies.

Future Outlook and Challenges for China Life

While 2023 marked a year of significant success for China Life, the future holds both opportunities and challenges. The company must navigate a dynamic environment characterized by geopolitical risks, regulatory changes, and intensifying competition within the insurance sector.

-

Geopolitical Risks: Global geopolitical uncertainties could impact investment returns and overall market stability.

-

Regulatory Changes: Changes in regulatory frameworks could affect China Life's operations and investment strategies.

-

Competition in the Insurance Market: Increased competition from both domestic and international players requires continuous innovation and adaptation. Keywords: future outlook, challenges, risks, opportunities, China Life future.

Conclusion: China Life's 2023 Investment Success: A Roadmap for Future Growth

China Life's remarkable 2023 profit results are a testament to its strategic investment decisions, strong performance in its core insurance businesses, and the favorable macroeconomic conditions in China. The company's diversified investment portfolio, effective risk management, and focus on customer retention have all contributed to its success. While future challenges exist, China Life's proven ability to adapt and innovate positions it well for continued growth. Learn more about how China Life's 2023 investment success can inform your own investment strategies. Explore the potential of the Chinese insurance market and discover China Life's future prospects.

Featured Posts

-

Bayern President Rejects Far Right Af D Member Joining Club Board

May 01, 2025

Bayern President Rejects Far Right Af D Member Joining Club Board

May 01, 2025 -

Friday Night Nba Celtics Vs Cavaliers Predictions And Best Bets

May 01, 2025

Friday Night Nba Celtics Vs Cavaliers Predictions And Best Bets

May 01, 2025 -

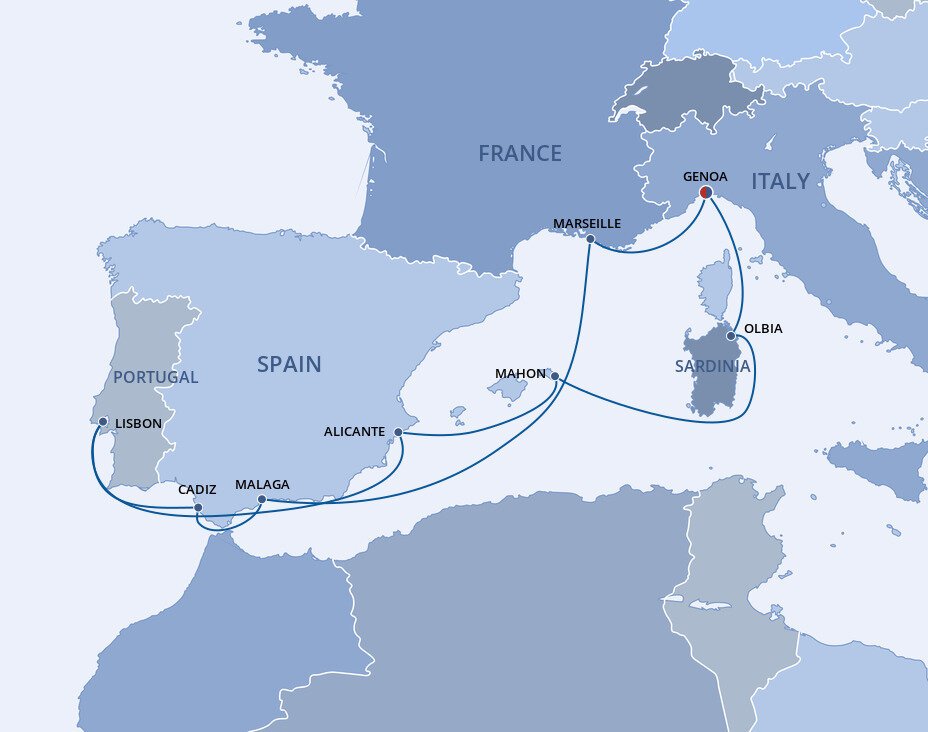

New Southern Cruises For 2025 Top Picks And Itineraries

May 01, 2025

New Southern Cruises For 2025 Top Picks And Itineraries

May 01, 2025 -

Wkrns Nikki Burdine And Neil Orne Partner On Post News Projects

May 01, 2025

Wkrns Nikki Burdine And Neil Orne Partner On Post News Projects

May 01, 2025 -

Stock Market Today Dow Futures Rise Earnings Drive Trading

May 01, 2025

Stock Market Today Dow Futures Rise Earnings Drive Trading

May 01, 2025