Stock Market Today: Dow Futures Rise, Earnings Drive Trading

Table of Contents

Dow Futures Point to a Positive Open

Dow futures are a powerful indicator of how the stock market might open. They represent contracts to buy the Dow Jones Industrial Average at a future date. A rise in Dow futures, as we're seeing today, generally suggests a positive opening bell. Currently, Dow futures are up 200 points, indicating a potential 0.7% increase at the market open.

Several factors contribute to this positive outlook:

- Strong Economic Data: Recent employment figures have exceeded expectations, boosting investor confidence. The positive jobs report indicates a robust economy, encouraging investment.

- Geopolitical Stability: The absence of major geopolitical upheavals is also contributing to the positive sentiment. A relatively calm international landscape reduces uncertainty in the market.

- Anticipation of Strong Earnings: The ongoing earnings season is driving much of the optimism. Several major companies are expected to report strong results, further bolstering market sentiment.

Earnings Season Drives Trading Activity

Earnings season is a pivotal period in the stock market, significantly impacting individual stock prices and the overall market. Companies release their financial results, and these reports can cause significant price swings depending on whether they beat or miss analysts' expectations. Today's trading activity is heavily influenced by several key earnings announcements.

Key companies reporting earnings today include:

- Tech Giant XYZ Corp: Analysts predict strong growth, potentially leading to a significant price increase if results meet expectations.

- Financial Institution ABC Bank: Market watchers are keenly observing this report, as it will provide insight into the overall health of the financial sector.

- Pharmaceutical Company DEF Pharma: The performance of this company will influence the perception of the broader healthcare sector.

The types of companies reporting today span various sectors, providing a broad view of the current economic climate. How these earnings reports compare to expectations will dictate the direction of individual stocks and, potentially, the entire market.

Sector-Specific Performance and Market Breadth

Analyzing sector-specific performance offers a more nuanced understanding of the stock market today. While Dow futures suggest a positive overall trend, individual sectors might perform differently.

- Technology Sector: The tech sector is generally performing well, driven by strong earnings from some key players.

- Energy Sector: Oil prices remain a key factor influencing the energy sector's performance. Recent price increases have boosted energy stocks.

- Healthcare Sector: This sector's performance is more varied, dependent on the individual companies' earnings reports.

Market breadth—the ratio of advancing to declining stocks—is another crucial indicator. A strong market breadth (a high proportion of advancing stocks) indicates widespread optimism, while weak breadth suggests a less robust market. Today, market breadth appears relatively strong, further supporting the positive market sentiment.

Technical Analysis and Trading Strategies

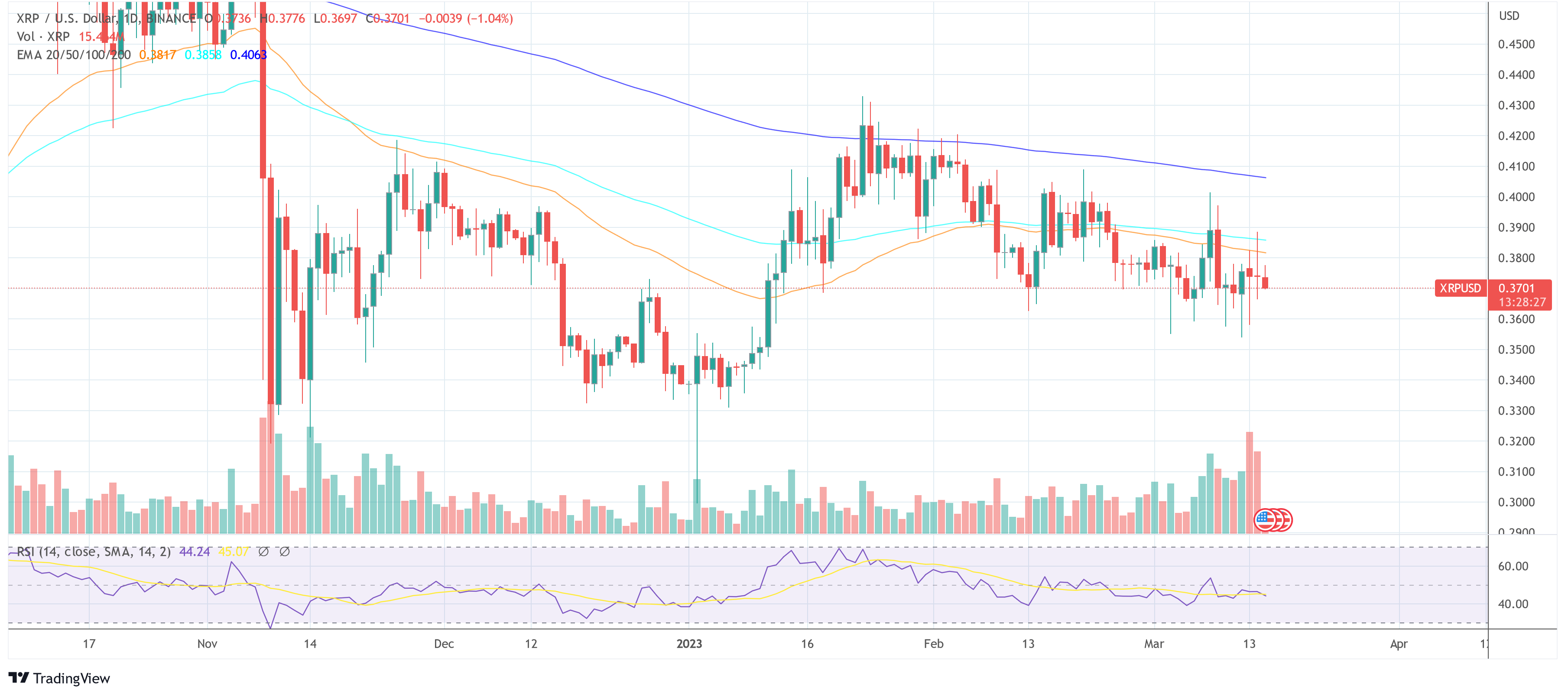

(Optional) While fundamental analysis (earnings reports, economic data) is crucial, technical analysis can provide additional insight. Indicators such as moving averages and the Relative Strength Index (RSI) can help identify potential support and resistance levels and predict short-term price movements.

Potential trading strategies based on today's market conditions might include:

- Buying the dip: If a stock experiences a temporary price drop, buying it could prove profitable if the overall market remains positive.

- Momentum trading: Capitalizing on stocks experiencing rapid price increases driven by positive earnings news.

Disclaimer: This is not financial advice. Consult a professional before making any investment decisions. The information provided here is for educational purposes only.

Conclusion: Staying Informed on the Stock Market Today

In summary, the stock market today is exhibiting a positive trend, fueled by a surge in Dow futures and anticipated strong earnings reports. The overall market sentiment is optimistic, though individual sectors show varied performances. Keeping abreast of daily market updates and economic data is vital for informed investment decisions.

To stay informed on the stock market today and benefit from detailed stock market analysis, subscribe to our newsletter or follow us on social media for daily market updates and insightful commentary. Understanding the nuances of Dow futures and the implications of earnings season is key to making sound investment strategies. Stay informed, and make smarter investment choices!

Featured Posts

-

Nvidia Faces Broader Political Headwinds Than Just China

May 01, 2025

Nvidia Faces Broader Political Headwinds Than Just China

May 01, 2025 -

Louisville Tornado Anniversary Reflecting On The 2012 Disaster

May 01, 2025

Louisville Tornado Anniversary Reflecting On The 2012 Disaster

May 01, 2025 -

Kshmyr Army Chyf Ka Wadh Pygham

May 01, 2025

Kshmyr Army Chyf Ka Wadh Pygham

May 01, 2025 -

Should You Invest In Ripple Xrp While Its Under 3

May 01, 2025

Should You Invest In Ripple Xrp While Its Under 3

May 01, 2025 -

Is Xrps 400 Price Jump A Buying Opportunity Analysis And Predictions

May 01, 2025

Is Xrps 400 Price Jump A Buying Opportunity Analysis And Predictions

May 01, 2025