Chinese Stock Market Surge Following Recent Downturn: Analysis Of US Relations And Economic Indicators

Table of Contents

Improved US-China Relations and Their Impact

The thawing of relations between the US and China has played a pivotal role in the recent Chinese stock market surge. Reduced trade tensions and increased political stability have significantly boosted investor confidence.

De-escalation of Trade Tensions

The easing of trade tensions between the US and China has been a key catalyst. Specific agreements and policy shifts have helped to reduce uncertainty and encourage investment.

- Reduced Tariffs: Several rounds of tariff reductions have lessened the burden on Chinese exports to the US, improving profitability for Chinese companies and boosting their stock prices.

- Increased Dialogue: The resumption of high-level diplomatic talks and increased communication between the two countries has signaled a commitment to resolving trade disputes peacefully, creating a more predictable environment for businesses.

- Collaborative Efforts: Joint efforts on specific trade issues demonstrate a willingness to cooperate, which in turn fosters trust and confidence among investors. This reduced uncertainty is a major factor contributing to the increased investment in the Chinese stock market.

Increased Political Stability

Improved diplomatic relations have fostered a more stable geopolitical climate, positively impacting market sentiment.

- High-Level Meetings: Several high-profile meetings between US and Chinese officials have indicated a commitment to managing disagreements constructively and avoiding escalation, creating a more stable investment environment.

- Bilateral Agreements: The signing of various bilateral agreements on issues ranging from climate change to technology cooperation signals a shift towards greater collaboration and reduces political risk for investors.

- Reduced Geopolitical Risk: This improved relationship translates into reduced geopolitical risk, which encourages investment in the Chinese market. Investors are less worried about sudden policy shifts or disruptions caused by escalating tensions.

Positive Chinese Economic Indicators Fueling Growth

Robust economic indicators within China itself have provided further fuel for the stock market surge. Strong GDP growth, controlled inflation, and robust consumer spending all point towards a healthy and expanding economy.

Strong GDP Growth

Recent GDP figures showcase impressive growth, significantly impacting the stock market.

- Positive Growth Percentages: China's GDP growth has consistently exceeded expectations in recent quarters, indicating a strong economic recovery. (Source: [Insert reputable source, e.g., National Bureau of Statistics of China]). For example, [Insert specific percentage and quarter].

- Driving Factors: This growth is driven by a combination of factors, including increased consumer spending, robust industrial production, and government infrastructure investment.

- Market Confidence: Strong GDP figures instill confidence in investors, leading to increased capital inflows and higher stock valuations.

Inflation and Interest Rates

Inflation and interest rate trends in China remain relatively stable, creating a favorable environment for investment.

- Controlled Inflation: Inflation rates have remained within the government's target range, reducing concerns about inflationary pressures eroding corporate profits. (Source: [Insert reputable source]).

- Interest Rate Stability: Interest rate adjustments have been measured and predictable, allowing businesses to plan effectively and investors to gauge risk more accurately. (Source: [Insert reputable source]).

- Investor Sentiment: This stability supports positive investor sentiment and encourages increased investment.

Robust Consumer Spending

Increased consumer spending signals strong domestic demand and fuels economic growth, further boosting the stock market.

- Rising Consumption: Data indicates significant increases in consumer spending across various sectors, reflecting rising disposable incomes and increased consumer confidence. (Source: [Insert reputable source]).

- Positive Consumer Sentiment: Growing consumer confidence is a vital indicator of a healthy economy and encourages further investment in the stock market.

- Impact on Stock Prices: This increased spending translates directly into higher revenues for companies, leading to increased profitability and higher stock valuations.

Sector-Specific Analysis of the Surge

The stock market surge isn't uniform across all sectors; some sectors are experiencing more significant gains than others.

Technology Sector Performance

China's technology sector has been a standout performer, driving a significant portion of the overall market surge.

- Strong Company Performance: Specific technology companies have seen substantial stock price increases, fueled by advancements in areas such as AI, 5G, and cloud computing. (Examples: [Insert examples of relevant companies]).

- Government Support: Government support for technological innovation and development has also played a significant role.

- Global Competition: The sector's strong performance reflects China's increasing competitiveness in the global technology landscape.

Real Estate Market Trends

While experiencing some volatility, the real estate sector is also contributing to the overall market upswing.

- Government Regulation: The government's efforts to regulate the real estate market, although causing some short-term adjustments, ultimately aim for long-term stability and sustainable growth.

- Property Prices: While there have been adjustments, property prices in many key cities remain relatively strong. (Source: [Insert reputable source]).

- Sales Volume: Sales volume varies regionally, but overall shows resilience. (Source: [Insert reputable source]).

Conclusion

The recent surge in the Chinese stock market is a result of a confluence of factors. Improved US-China relations, characterized by de-escalation of trade tensions and increased political stability, have significantly boosted investor confidence. Simultaneously, robust Chinese economic indicators, including strong GDP growth, stable inflation and interest rates, and robust consumer spending, have fuelled this market resurgence. While certain sectors, such as technology, have outperformed others, the overall positive trend reflects a strengthening Chinese economy. The surge in the Chinese stock market presents potential investment opportunities, but thorough due diligence and a comprehensive understanding of the underlying factors are crucial. Further research into Chinese stock market trends and economic indicators is highly recommended before making any investment decisions. Stay informed about the evolving Chinese stock market to capitalize on future opportunities.

Featured Posts

-

All Star Game 2024 Steph Currys Victory Overshadows Format Debate

May 07, 2025

All Star Game 2024 Steph Currys Victory Overshadows Format Debate

May 07, 2025 -

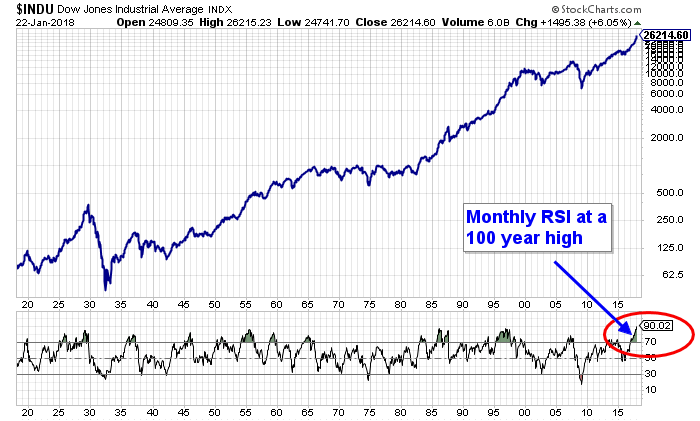

Are High Stock Market Valuations A Cause For Concern Bof A Says No

May 07, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Says No

May 07, 2025 -

The Karate Kid A Comprehensive Guide To The Film Series

May 07, 2025

The Karate Kid A Comprehensive Guide To The Film Series

May 07, 2025 -

Papez Francisek Pozdravi Mnozico Na Trgu Sv Petra

May 07, 2025

Papez Francisek Pozdravi Mnozico Na Trgu Sv Petra

May 07, 2025 -

Find The Daily Lotto Results For Tuesday April 15th 2025

May 07, 2025

Find The Daily Lotto Results For Tuesday April 15th 2025

May 07, 2025