Climate-Related Risks And Their Potential Effects On Your Home Loan Approval

Table of Contents

Increased Flood Risk and Mortgage Approvals

The growing concern of lenders regarding properties in flood-prone areas is significantly impacting mortgage approvals. The increased frequency and severity of flooding events, directly linked to climate change, are forcing lenders to reassess risk. This means stricter lending criteria and a more thorough evaluation of properties located in potentially hazardous zones.

- Increased insurance premiums and difficulty securing flood insurance: Lenders are increasingly factoring the cost and availability of flood insurance into their risk assessment. Properties in high-risk areas may face exorbitant premiums or even find it impossible to obtain coverage, making them less attractive to lenders.

- Higher down payments or stricter lending criteria for high-risk zones: To mitigate their risk, lenders may demand larger down payments or impose stricter loan-to-value ratios (LTV) for properties situated in flood-prone areas. This can make homeownership less accessible for many potential buyers.

- Potential denial of loan applications in severely at-risk areas: In areas with a high probability of flooding, lenders may outright deny loan applications. This is especially true for properties repeatedly affected by flood damage.

- Examples of flood maps and how they influence lender decisions: Lenders heavily rely on flood maps produced by FEMA (Federal Emergency Management Agency) and other organizations. Properties located in designated flood zones (e.g., Special Flood Hazard Areas) are subject to much stricter lending terms.

- Mentioning FEMA flood zones and their implications: FEMA flood maps categorize areas based on flood risk. Understanding your property's FEMA flood zone designation is crucial for navigating the mortgage process. Properties in high-risk zones face the most significant challenges in obtaining financing.

Climate change exacerbates flood risk, leading to more frequent and severe flooding events. This translates to increased financial risk for lenders, who are consequently becoming more cautious in their lending practices regarding properties susceptible to flooding.

Wildfire Risk and Home Loan Applications

The increasing impact of wildfires on property values and insurability is another significant climate-related risk influencing home loan approvals. Longer and more intense wildfire seasons, fueled by climate change, are making properties in fire-prone areas increasingly difficult to insure and finance.

- Higher insurance premiums in high-risk fire zones: Insurance companies are raising premiums significantly in areas with a high wildfire risk, making homeownership more expensive. Lenders factor these increased costs into their assessment.

- Increased scrutiny of building materials and fire safety measures: Lenders are paying closer attention to the building materials used and the fire safety measures implemented on properties in high-risk areas. Properties lacking adequate fire protection may face loan denials or stricter lending terms.

- Potential for loan denial if the property lacks sufficient fire mitigation: Properties that don't meet minimum fire safety standards or lack sufficient defensible space (the area around a home cleared of flammable materials) may be rejected for mortgage financing.

- Mentioning the role of proximity to wildlands and defensible space: The proximity of a property to wildlands significantly influences its wildfire risk. Maintaining adequate defensible space is crucial for mitigating this risk and improving chances of mortgage approval.

Climate change contributes to longer and more intense wildfire seasons, increasing the frequency and severity of devastating wildfires. This directly impacts lenders' assessments of risk and their willingness to provide financing.

Extreme Weather Events and Their Impact on Mortgage Lending

Beyond flooding and wildfires, other extreme weather events—hurricanes, heat waves, and droughts—also significantly influence mortgage lending. The increased frequency and severity of these events, linked to climate change, present significant challenges for both homeowners and lenders.

- Increased damage assessments and repair costs: Extreme weather events can cause substantial damage to properties, leading to costly repairs and impacting property values. Lenders take this into account when evaluating loan applications.

- Impact on property value due to damage from extreme weather: Properties damaged by extreme weather events often experience a decrease in value, which can affect the lender's willingness to provide financing.

- Difficulty securing home insurance after extreme weather events: Securing adequate home insurance after an extreme weather event can be difficult and expensive. This impacts the lender's risk assessment and may lead to higher interest rates or loan denials.

- Examples of how extreme weather can affect property appraisals: Appraisals may reflect the damage caused by extreme weather, further impacting the loan amount a lender is willing to approve.

The increasing frequency and severity of extreme weather events, directly linked to climate change, are making it more challenging to secure home loans in affected areas.

Mitigating Climate-Related Risks When Applying for a Home Loan

Proactive steps can significantly improve your chances of securing a home loan, even in areas with heightened climate risks.

- Conduct thorough due diligence on the property's location and risk assessment: Research the property's susceptibility to flooding, wildfires, and other extreme weather events. Utilize online tools and resources to assess risk.

- Secure appropriate insurance coverage, including flood and wildfire insurance: Having comprehensive insurance coverage, including flood and wildfire insurance, is crucial for demonstrating your ability to manage climate-related risks.

- Invest in property improvements to mitigate climate-related risks (e.g., fire-resistant roofing): Upgrading your property with climate-resistant features can significantly improve your chances of obtaining a mortgage.

- Work with a mortgage broker experienced in navigating climate-related lending challenges: A knowledgeable mortgage broker can guide you through the complexities of obtaining a mortgage in a climate-changed world.

- Transparency with lenders regarding known risks: Open communication with lenders about potential climate-related risks on the property is crucial for building trust and a stronger application.

Conclusion

Climate change is significantly impacting home loan approvals. Lenders are increasingly scrutinizing properties in high-risk areas, leading to higher premiums, stricter lending criteria, and potential loan denials. Understanding and addressing climate-related risks before applying for a home loan is paramount. Don't let climate-related risks derail your dream of homeownership. Understand the potential effects on your home loan approval and take proactive steps to mitigate these challenges. Research your property's climate risk and work with a knowledgeable lender to secure your mortgage. Learn more about how climate change is impacting home loan applications and safeguard your future by making informed decisions.

Featured Posts

-

Analysis Of Recent Red Light Appearances In French Skies

May 21, 2025

Analysis Of Recent Red Light Appearances In French Skies

May 21, 2025 -

Giakoymakis Sto Mls Analysi Tis Pithanis Metagrafis

May 21, 2025

Giakoymakis Sto Mls Analysi Tis Pithanis Metagrafis

May 21, 2025 -

Wjwh Jdydt Fy Qaymt Mntkhb Amryka Bwtshytynw Ydew Thlatht Laebyn Llmrt Alawla

May 21, 2025

Wjwh Jdydt Fy Qaymt Mntkhb Amryka Bwtshytynw Ydew Thlatht Laebyn Llmrt Alawla

May 21, 2025 -

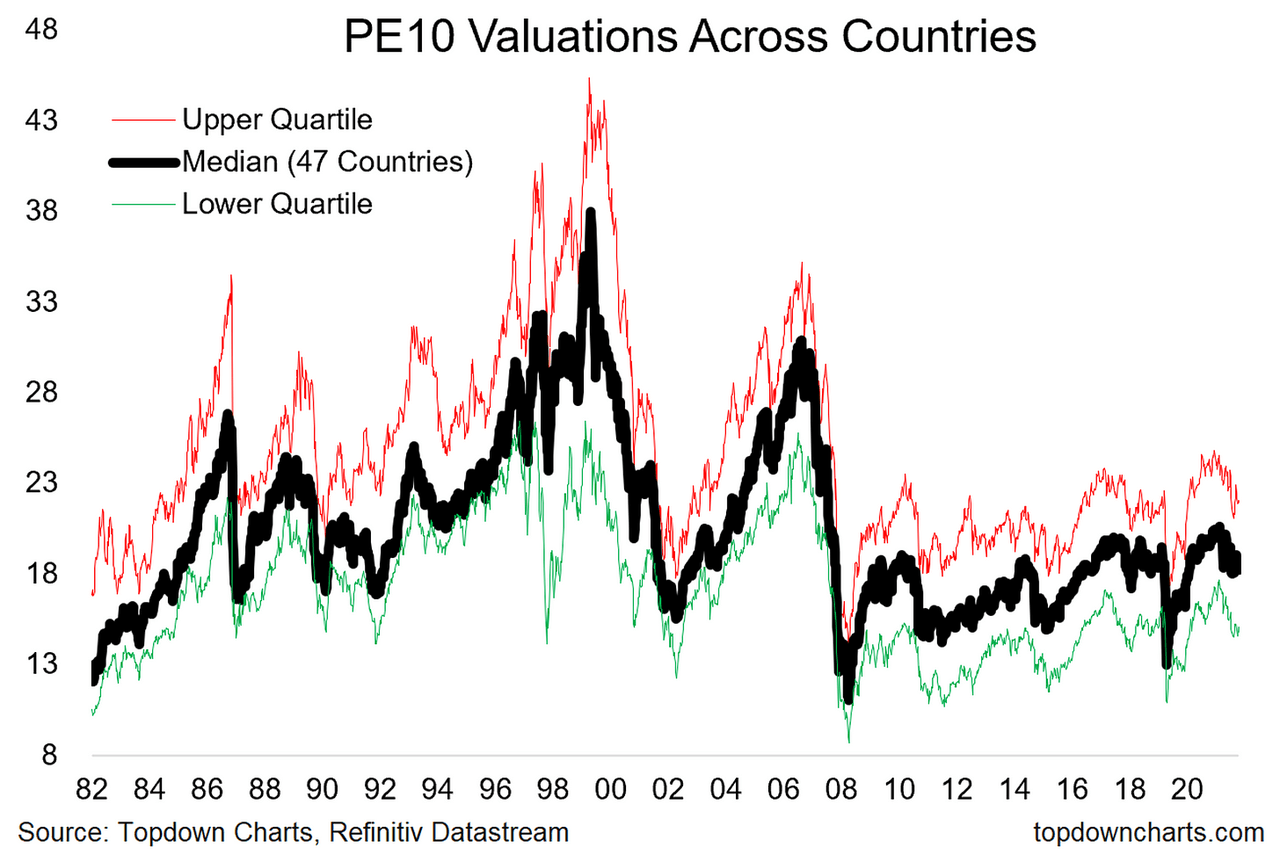

High Stock Market Valuations Bof As Reasons For Investor Calm

May 21, 2025

High Stock Market Valuations Bof As Reasons For Investor Calm

May 21, 2025 -

Wwe Raw The Brutal Attack On Sami Zayn By Rollins And Breakker

May 21, 2025

Wwe Raw The Brutal Attack On Sami Zayn By Rollins And Breakker

May 21, 2025