CoreWeave Inc. (CRWV) Stock Drop On Thursday: Understanding The Reasons

Table of Contents

Impact of Recent Market Sentiment on CRWV Stock

The CoreWeave (CRWV) stock drop wasn't an isolated incident; it reflects a broader trend impacting the tech sector.

Broad Tech Sector Downturn

The overall negative sentiment affecting the tech sector played a significant role in CRWV's decline. Interest rate hikes aimed at combating inflation have increased the cost of borrowing, impacting growth stocks like CoreWeave that rely on future growth projections for valuation. This increased risk aversion in the market has led investors to favor more stable, established companies. We've seen similar drops in other high-growth tech stocks recently, indicating a broader trend.

- Negative investor sentiment towards growth stocks: The current economic climate makes investors more cautious about investing in companies with high valuations and uncertain profitability.

- Increased risk aversion in the market: Uncertainty about future economic growth prompts investors to shift towards safer investments.

- Concerns about future economic growth: Global economic headwinds and potential recessions contribute to the pessimistic market outlook.

Specific Concerns Regarding CoreWeave's Business Model

Beyond the broader market trends, specific concerns about CoreWeave's business model likely contributed to the CRWV stock drop. The company's reliance on the rapidly evolving AI and cloud computing market makes it susceptible to shifts in demand and technological advancements.

- Competition from established cloud providers: CoreWeave faces stiff competition from giants like AWS, Azure, and Google Cloud, which have vast resources and established customer bases.

- Dependence on specific clients or industries: A concentration of clients or dependence on specific industries could make CoreWeave vulnerable to shifts in those sectors.

- Concerns about scalability and infrastructure costs: Maintaining and scaling CoreWeave's data center infrastructure requires substantial investment, posing ongoing financial challenges.

Analysis of CoreWeave's Financial Performance and Reporting

A thorough analysis of CoreWeave's financial performance is crucial to understanding the CRWV stock drop.

Examination of Q[Insert Quarter] Earnings Report

[Insert Quarter]'s earnings report (if available at the time of writing) should be carefully analyzed for any signs of weakness. A comparison of reported revenue with previous quarters and analysts' expectations would reveal whether the results fell short of projections.

- Revenue figures compared to previous quarters and expectations: Any significant deviation from anticipated revenue growth could negatively impact investor confidence.

- Profitability margins: A declining profit margin, indicating reduced profitability, would be a cause for concern.

- Key performance indicators (KPIs): A comprehensive analysis of key performance indicators relevant to CoreWeave's business model is necessary for a thorough assessment.

Debt Levels and Financial Health

CoreWeave's debt levels and overall financial health are critical factors to consider. High debt burdens can limit the company's flexibility and increase its vulnerability during economic downturns.

- Debt-to-equity ratio: A high debt-to-equity ratio indicates a higher level of financial risk.

- Cash flow statements: Analyzing cash flow provides insight into the company's ability to generate cash and meet its financial obligations.

- Credit ratings: Credit ratings from agencies like Moody's or S&P provide an independent assessment of CoreWeave's creditworthiness.

The Role of AI and Cloud Computing in the CRWV Stock Drop

The current hype surrounding Artificial Intelligence and the competitive landscape of cloud computing significantly impact CoreWeave's stock price.

Impact of AI Hype Cycle

The recent surge in interest in AI has created a volatile market. While CoreWeave is positioned to benefit from the growth of AI, the market's reaction might be a correction from potentially overinflated expectations.

- Market volatility related to AI investment: The AI sector is prone to rapid price fluctuations due to hype and speculation.

- Comparison of CRWV performance to other AI-related stocks: Benchmarking CoreWeave against competitors can shed light on whether the drop is specific to the company or a broader trend.

- Potential for overvaluation based on AI prospects: The market might have overestimated CoreWeave's future growth based solely on its involvement in the AI sector.

Competition in the Cloud Computing Market

CoreWeave operates in a highly competitive cloud computing market dominated by established players.

- Market share analysis: Analyzing CoreWeave's market share and its growth trajectory compared to its competitors is vital.

- Technological advantages and disadvantages: Assessing CoreWeave's technological strengths and weaknesses relative to its competitors is crucial.

- Competitive pricing strategies: Understanding CoreWeave's pricing strategy and its competitiveness in the market is essential for evaluating its long-term prospects.

Conclusion

The CoreWeave Inc. (CRWV) stock drop on Thursday resulted from a confluence of factors: broader negative market sentiment affecting the tech sector, specific concerns about CoreWeave's business model, and the competitive pressures within the AI and cloud computing markets. Analyzing the company's financial performance, debt levels, and positioning within the industry provides a clearer picture. Understanding the reasons behind the CoreWeave (CRWV) stock drop is crucial for investors. Stay informed about future developments and continue monitoring the company's performance and market conditions to make informed investment decisions regarding CoreWeave stock. Further research on CRWV and the broader AI and cloud computing market is recommended for a thorough understanding of this dynamic sector.

Featured Posts

-

Thong Tin Moi Nhat Cao Toc Dong Nai Vung Tau Thong Xe 2 9

May 22, 2025

Thong Tin Moi Nhat Cao Toc Dong Nai Vung Tau Thong Xe 2 9

May 22, 2025 -

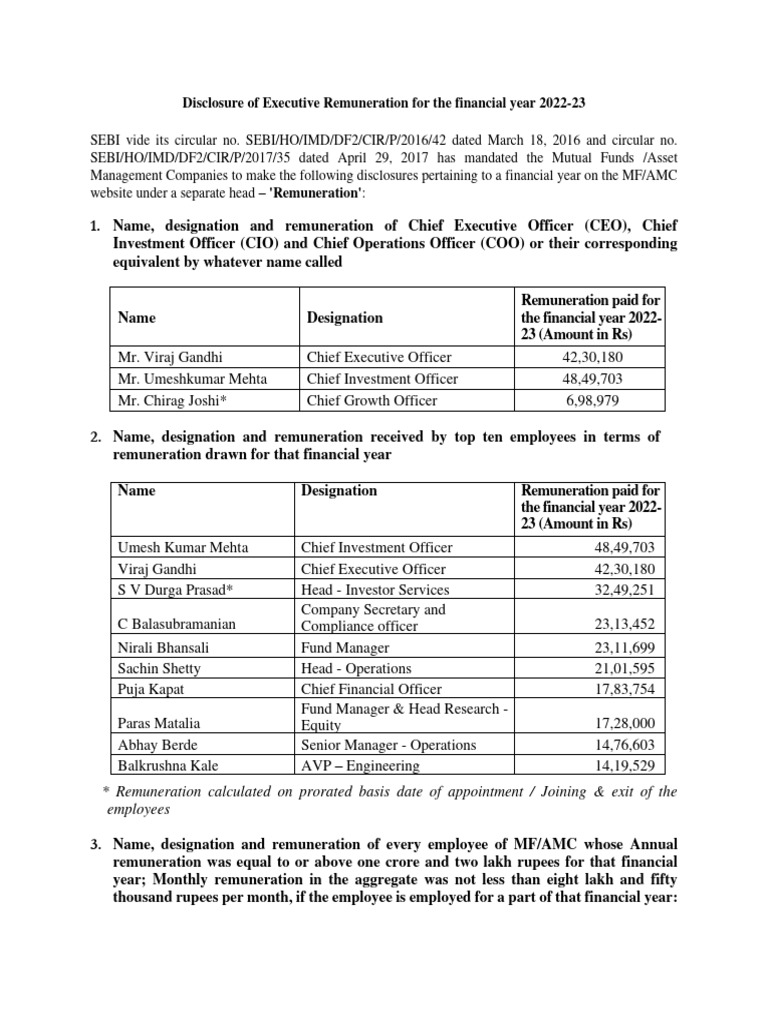

Lower Ceo Pay At Bp 31 Reduction In Executive Remuneration

May 22, 2025

Lower Ceo Pay At Bp 31 Reduction In Executive Remuneration

May 22, 2025 -

Macron Calls On Eu To Buy European Ditch American Products

May 22, 2025

Macron Calls On Eu To Buy European Ditch American Products

May 22, 2025 -

The Goldbergs A Retrospective On The Popular Sitcom

May 22, 2025

The Goldbergs A Retrospective On The Popular Sitcom

May 22, 2025 -

The Meaning Of Peppa Pigs Baby Sisters Name A Heartfelt Explanation

May 22, 2025

The Meaning Of Peppa Pigs Baby Sisters Name A Heartfelt Explanation

May 22, 2025