Could XRP ETF Approval Unleash $800 Million In First-Week Investments?

Table of Contents

The Potential Market Demand for an XRP ETF

The projected influx of $800 million hinges on significant underlying market forces. Both institutional and retail investors are poised to capitalize on the opportunity presented by an XRP ETF.

Growing Institutional Interest in XRP

Institutional investors are increasingly recognizing the potential of digital assets. XRP, with its unique functionalities within the Ripple network, is attracting significant attention.

- Grayscale's ongoing filings for various cryptocurrency investment products signal a broader trend towards institutional adoption.

- Several other prominent asset managers have publicly expressed interest in diversifying their portfolios with digital assets, including XRP.

- XRP's relatively high market capitalization and substantial daily trading volume further solidify its appeal to institutional investors seeking diversification and potentially higher returns.

Retail Investor Appetite

An XRP ETF would significantly lower the barrier to entry for retail investors. The ease and convenience of investing through an ETF, compared to directly purchasing and managing XRP, are expected to fuel considerable retail investment.

- ETFs offer a simple, regulated, and diversified way to gain exposure to XRP, eliminating the complexities of self-custody and trading on cryptocurrency exchanges.

- This accessibility is anticipated to attract a considerable number of less experienced investors seeking exposure to the cryptocurrency market through a regulated vehicle.

- Numerous online surveys and polls demonstrate a strong level of public interest in XRP and a desire for easier access to its potential returns.

Factors Influencing the $800 Million Projection

The $800 million figure isn't arbitrary; it's based on an analysis of several key factors impacting investment strategies and market sentiment.

Investment Strategies & Allocation Models

Investment firms are likely to allocate a portion of their portfolios to an XRP ETF, mirroring diversification strategies employed in other asset classes.

- Conservative allocation models might allocate a small percentage (e.g., 1-5%) to XRP, while more aggressive strategies might allocate a significantly larger portion.

- The initial investment volume will heavily depend on the allocation strategies adopted by major institutional investors.

- Analyzing the initial investments in similar ETF launches offers valuable insights into potential XRP ETF investment levels. For example, the initial investment in the first Bitcoin ETF provided a benchmark for what we might expect with XRP.

Price Volatility and Market Sentiment

XRP's price volatility and overall market sentiment will significantly influence the initial investment volume.

- Positive market sentiment, fueled by regulatory clarity and broader adoption of cryptocurrencies, would amplify investment.

- Conversely, negative sentiment or uncertainty could dampen investor enthusiasm and reduce initial investment.

- Historical data shows a correlation between XRP price movements and broader market events, indicating the importance of analyzing market conditions.

Regulatory Hurdles and Uncertainties

The path to XRP ETF approval is fraught with uncertainties, primarily stemming from regulatory scrutiny and ongoing legal battles.

SEC Approval Process and Timeline

The SEC's approval process for ETFs is notoriously lengthy and complex.

- Potential delays could significantly affect the timeline for an XRP ETF launch, potentially impacting the initial investment surge.

- Factors like the SEC's assessment of XRP's regulatory status and market risks will influence the approval process.

- Analyzing historical SEC approval times for similar ETFs provides a framework for predicting potential delays.

Ongoing Legal Battles

The ongoing legal dispute between Ripple and the SEC adds another layer of complexity.

- The outcome of the case could significantly impact the SEC's decision on XRP ETF approval.

- Uncertainty surrounding the legal implications of the case creates hesitation among some investors.

- Key events and outcomes of the Ripple-SEC case will directly influence investor confidence and subsequent investment decisions.

Alternative Investment Vehicles for XRP Exposure

While an XRP ETF offers significant advantages, investors have alternative options for gaining XRP exposure.

Direct XRP Ownership vs. ETF Investment

Directly purchasing XRP offers greater control but entails higher risks and requires a deeper understanding of cryptocurrency markets.

- Direct ownership exposes investors to higher volatility and the risks associated with self-custody.

- ETFs provide diversification, lower management fees, and greater ease of access.

- Comparing transaction costs, potential returns, and the level of risk associated with each investment method is crucial.

Other Crypto Investment Options

Investors can diversify their portfolio through various other cryptocurrency investments.

- Other crypto ETFs offer diversified exposure to various digital assets.

- Alternative strategies such as staking or lending cryptocurrencies offer different investment opportunities.

- These alternative approaches offer flexibility and diversified options, depending on risk tolerance and investment goals.

Conclusion

The potential approval of an XRP ETF presents a significant opportunity for investors. The projected $800 million in first-week investments reflects the considerable market demand from both institutional and retail investors. However, the regulatory landscape and ongoing legal battles create uncertainties. Understanding these factors and exploring alternative investment options is crucial. Stay tuned for further updates on XRP ETF approval and its impact on the market. Learn more about the potential of XRP ETF investments and its implications for the future of crypto.

Featured Posts

-

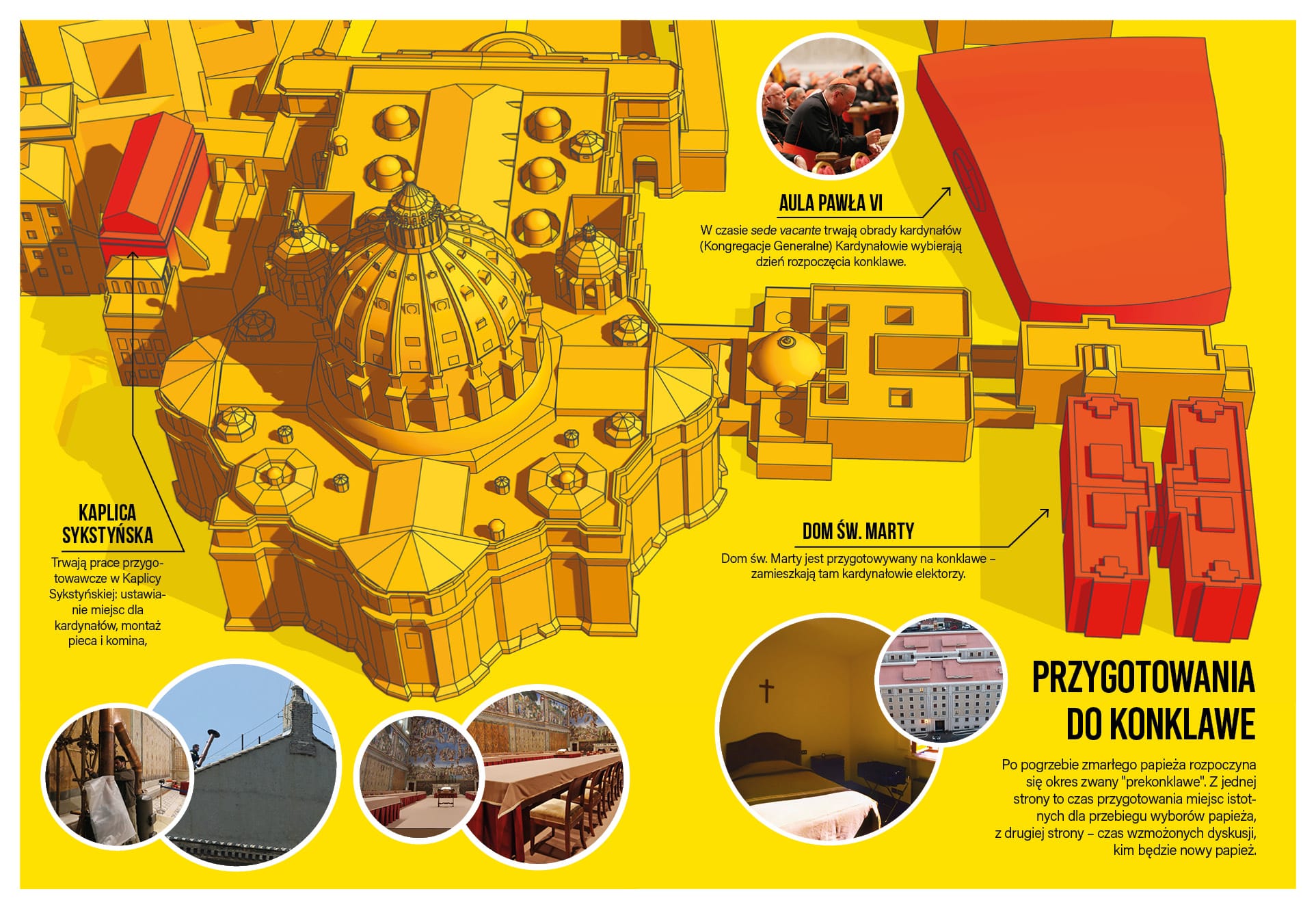

Ks Sliwinski Prezentuje Konklawe Tajemnice Wyborow Papieskich Warszawa

May 07, 2025

Ks Sliwinski Prezentuje Konklawe Tajemnice Wyborow Papieskich Warszawa

May 07, 2025 -

South Harrison Ffas Outstanding Agricultural Program A Four Year Legacy

May 07, 2025

South Harrison Ffas Outstanding Agricultural Program A Four Year Legacy

May 07, 2025 -

Jacek Harlukowicz Najwiekszy Zasieg Publikacji Onetu W 2024 Roku

May 07, 2025

Jacek Harlukowicz Najwiekszy Zasieg Publikacji Onetu W 2024 Roku

May 07, 2025 -

Cavaliers Heat Une Victoire Humiliante De 55 Points Un Record Nba Pulverise

May 07, 2025

Cavaliers Heat Une Victoire Humiliante De 55 Points Un Record Nba Pulverise

May 07, 2025 -

Yes Bank And Smfg A Strategic Partnership On The Horizon

May 07, 2025

Yes Bank And Smfg A Strategic Partnership On The Horizon

May 07, 2025