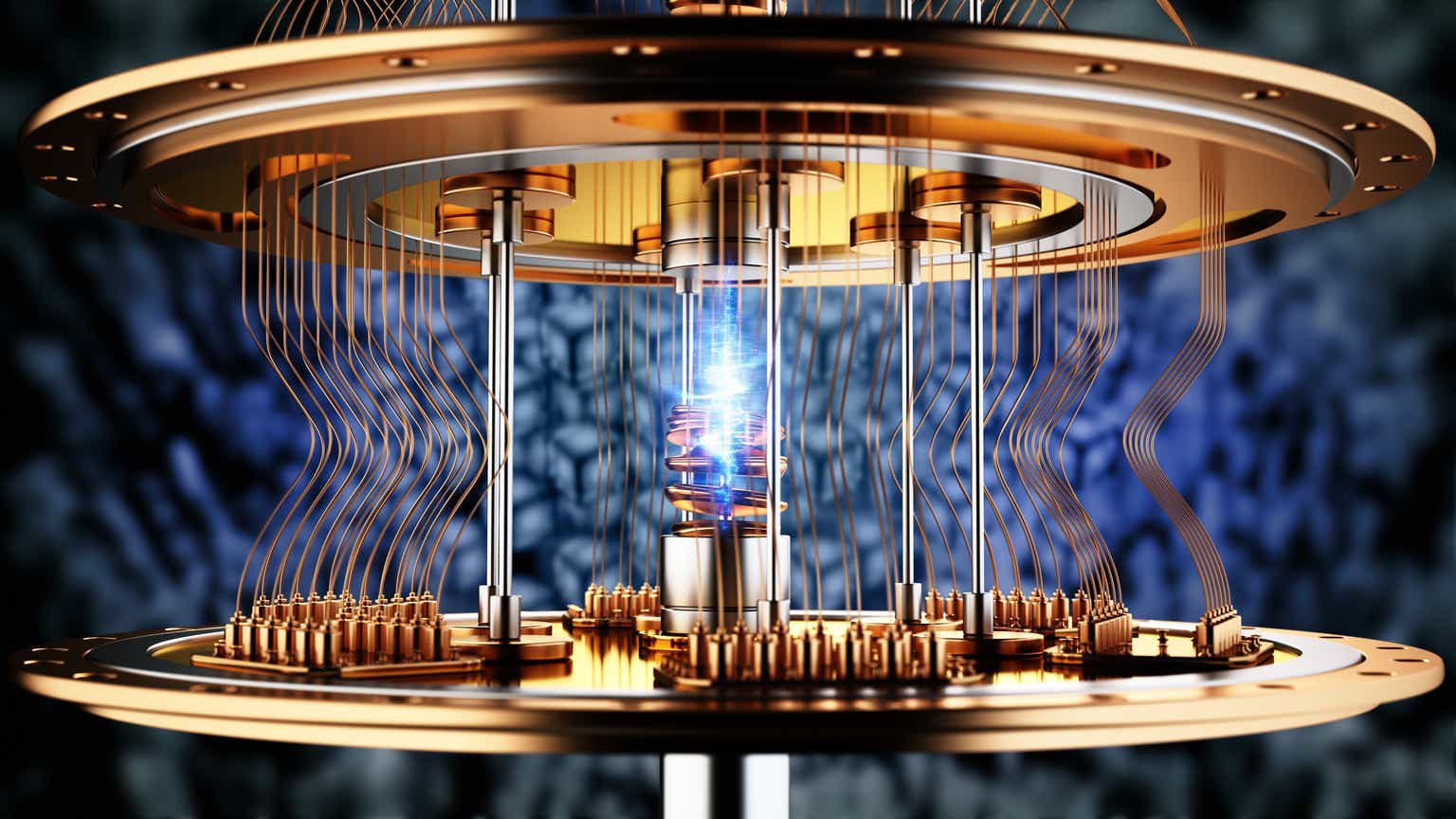

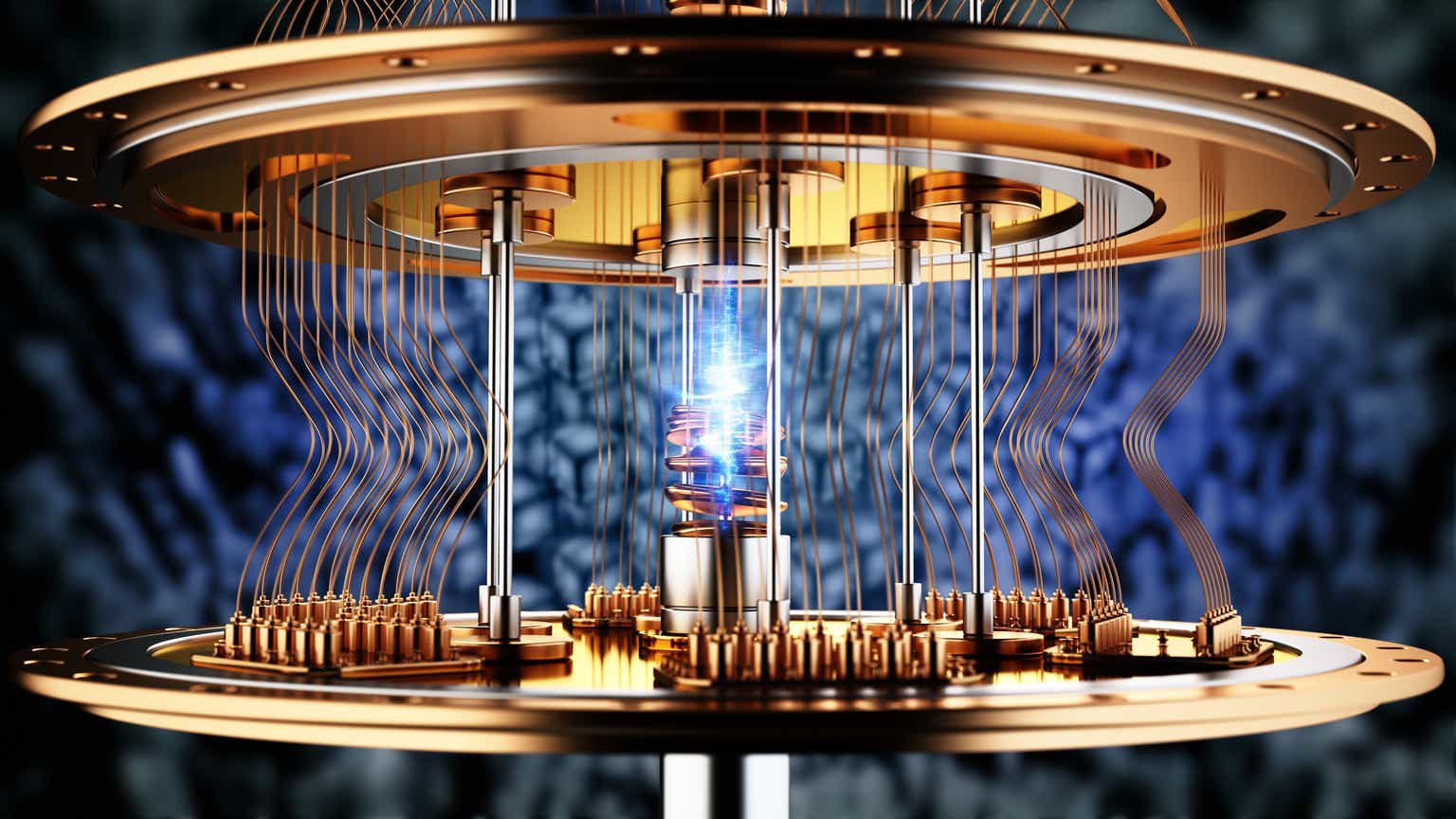

D-Wave Quantum (NYSE: QBTS) Stock Decline: Analyzing Kerrisdale Capital's Critique

Table of Contents

Kerrisdale Capital's Key Criticisms of D-Wave Quantum

Kerrisdale Capital's report levels several serious accusations against D-Wave Quantum, questioning its technology, revenue model, and valuation. These criticisms have significantly impacted investor sentiment and warrant careful consideration.

Overstated Technological Capabilities

Kerrisdale argues that D-Wave's quantum annealing technology is fundamentally limited compared to gate-based quantum computing approaches pursued by competitors like IBM and Google. They claim that:

- Limited Applicability: Quantum annealing is not suitable for a broad range of quantum computing applications, restricting its market potential.

- Technological Inferiority: The report suggests D-Wave's technology is less powerful and less versatile than gate-based systems, hindering its ability to solve complex problems efficiently.

- Overpromising and Underdelivering: Kerrisdale alleges that D-Wave has overstated the capabilities of its quantum annealers, creating unrealistic expectations among investors.

Questionable Revenue Model and Financial Projections

The report expresses significant concerns about D-Wave's revenue streams and financial projections. Specific points of contention include:

- Heavy Reliance on Government Grants: Kerrisdale highlights D-Wave's dependence on government funding, questioning the sustainability of this revenue model.

- Limited Commercial Success: The report suggests that D-Wave has achieved limited commercial success, with few significant paying customers beyond research institutions.

- Unrealistic Financial Projections: Kerrisdale claims that D-Wave's projected future revenue growth is overly optimistic and lacks a strong foundation in current market realities. They point to the lack of widespread commercial adoption as a key weakness supporting this claim.

Concerns Regarding Valuation and Market Position

Kerrisdale contends that D-Wave's current stock valuation is significantly inflated relative to its technological capabilities, revenue generation, and market position within the broader quantum computing sector.

- High Market Capitalization: The report points out the high market capitalization of QBTS relative to its relatively limited revenue and commercial success.

- Intense Competition: The competitive landscape within quantum computing is highly competitive. Kerrisdale argues that D-Wave faces intense pressure from competitors offering alternative, potentially superior technologies.

- Uncertain Future Prospects: The report concludes that the long-term prospects for D-Wave's technology and its ability to generate significant revenue remain uncertain.

Counterarguments and D-Wave Quantum's Response

D-Wave Quantum has responded to Kerrisdale's criticisms, albeit indirectly, by highlighting the unique advantages of its quantum annealing approach and emphasizing its long-term vision.

Defense of Quantum Annealing Technology

D-Wave maintains that quantum annealing is a valuable technology with specific applications, particularly in optimization problems. They argue that their approach offers a distinct advantage in solving certain types of problems more efficiently than classical computers.

Addressing Revenue and Financial Projections

D-Wave likely acknowledges the current challenges in revenue generation but emphasize the long-term potential of the quantum computing market and their future growth plans. They might highlight strategic partnerships and expanding applications as key drivers for future revenue growth.

Long-Term Vision and Market Opportunities

D-Wave continues to focus on building its technology and securing strategic partnerships, positioning itself as a key player in the burgeoning quantum computing landscape despite the short-term concerns raised by Kerrisdale. They likely emphasize the potential of their technology for future breakthroughs and market expansion.

Impact on Investors and Future Outlook for QBTS Stock

Kerrisdale's report has undoubtedly created uncertainty among investors, impacting QBTS stock price. The report's impact depends heavily on how investors weigh the criticisms against D-Wave's counterarguments and future outlook.

Assessing the Validity of Kerrisdale's Claims

It's crucial to critically evaluate the validity of Kerrisdale's claims. Independent analysis of D-Wave's technology, financial performance, and market position is essential before forming an investment opinion.

Investment Recommendations (Cautious)

Investing in QBTS stock carries significant risk. The quantum computing industry is still in its nascent stages, with considerable uncertainty about future market development. Investors should conduct thorough due diligence, considering both the potential for significant returns and the equally substantial risks involved. The information provided here is for informational purposes only and not financial advice.

Conclusion

Kerrisdale Capital's critical report on D-Wave Quantum (QBTS) presents significant concerns about the company's technology, revenue model, and valuation. While D-Wave has attempted to counter these criticisms, the uncertainty surrounding the future of the quantum computing industry and the company’s specific market position remains substantial. Before making any investment decisions regarding D-Wave Quantum (QBTS) stock, thorough independent research and due diligence are paramount. Understanding the risks and potential rewards associated with investing in this emerging sector is crucial for informed decision-making. Further research into D-Wave Quantum's technology, market position, and financial performance is highly recommended before considering any investment in QBTS.

Featured Posts

-

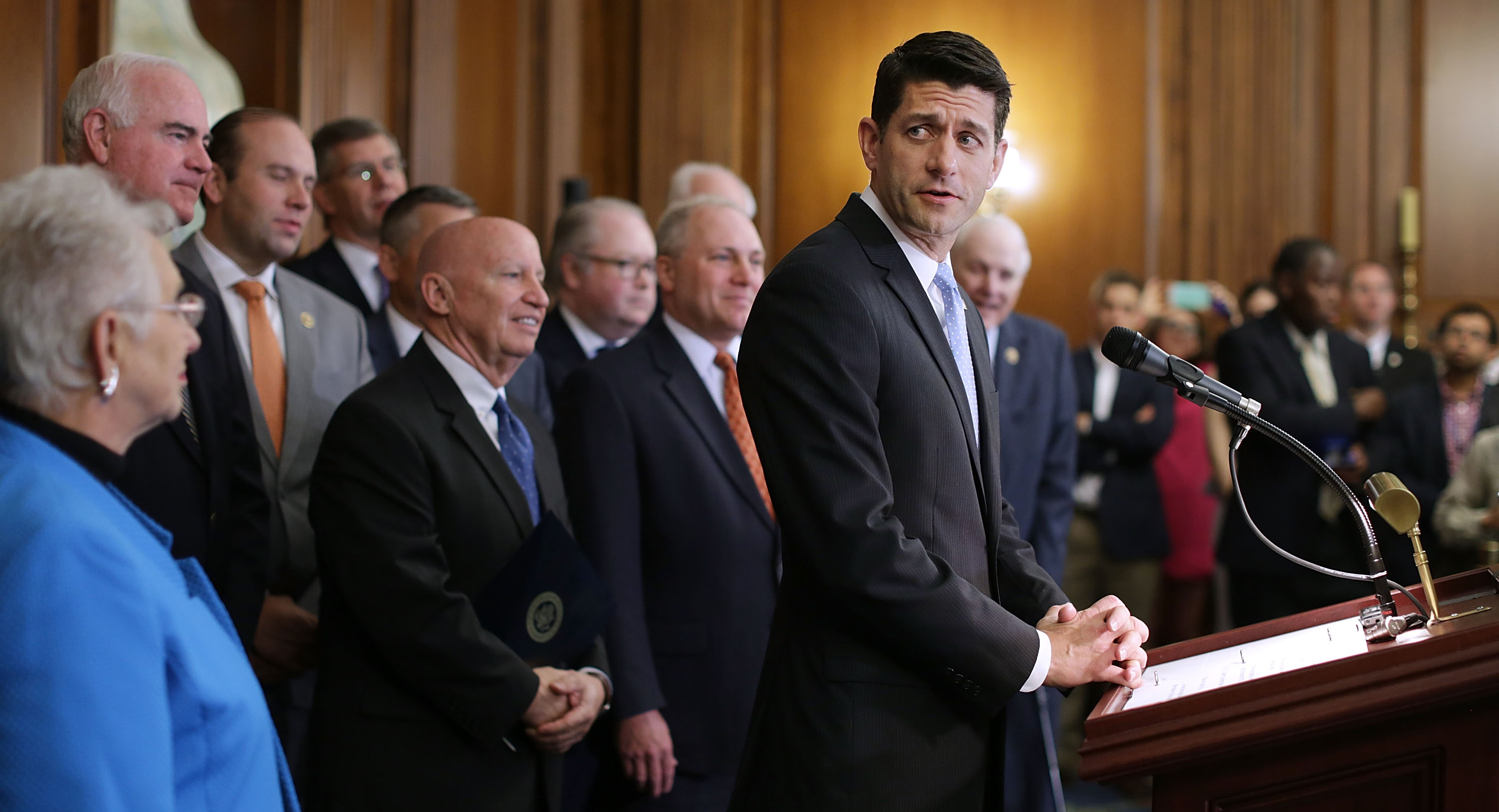

Gop Tax Plan A Hard Look At The Numbers And The Deficit

May 20, 2025

Gop Tax Plan A Hard Look At The Numbers And The Deficit

May 20, 2025 -

Mick Schumacher Separacion Y Nueva Vida Sentimental En Aplicacion De Citas

May 20, 2025

Mick Schumacher Separacion Y Nueva Vida Sentimental En Aplicacion De Citas

May 20, 2025 -

Tadic O Daytonskom Sporazumu Nesvjesnost Sarajeva I Potencijalni Gubici

May 20, 2025

Tadic O Daytonskom Sporazumu Nesvjesnost Sarajeva I Potencijalni Gubici

May 20, 2025 -

Schumacher La Separacion De Mick Y Su Aparicion En Aplicacion De Citas

May 20, 2025

Schumacher La Separacion De Mick Y Su Aparicion En Aplicacion De Citas

May 20, 2025 -

Good Morning Americas Loss Michael Strahans Exit And What Happened

May 20, 2025

Good Morning Americas Loss Michael Strahans Exit And What Happened

May 20, 2025