Decoding The Proxy Statement (Form DEF 14A): A Practical Overview

Table of Contents

Understanding the Purpose and Structure of a Proxy Statement (Form DEF 14A)

The DEF 14A filing is mandated by the SEC, ensuring transparency and shareholder rights. The proxy statement (Form DEF 14A) serves as a communication channel between a company and its shareholders, providing essential information needed to cast informed votes on various matters. This document is not just a formality; it's a vital tool for understanding a company's governance, strategy, and executive compensation. The information within allows shareholders to participate meaningfully in corporate decisions.

Key information a proxy statement provides includes:

- Company performance and outlook: An overview of the company's recent financial performance and future plans.

- Executive compensation details: A breakdown of salaries, bonuses, and other forms of compensation for top executives.

- Board of director information: Backgrounds and qualifications of current and proposed board members.

- Shareholder proposals: Details about any proposals submitted by shareholders for a vote.

- Auditor selection: Information about the company's independent auditor.

Common sections found within a proxy statement include:

- Notice of Meeting: Details on the date, time, and location (physical or virtual) of the shareholder meeting.

- Shareholder Proposals: Proposals submitted by shareholders for consideration and voting.

- Director Elections: Information on the election of directors to the company's board.

- Executive Compensation: Detailed breakdown of compensation packages for company executives.

- Auditor Selection: The process for selecting and approving the independent auditor for the company's financial statements.

- Other significant matters requiring shareholder vote: This section may cover various issues, such as mergers and acquisitions, stock splits, or other material events.

It's highly recommended to compare proxy statements year over year. This comparative analysis reveals trends in executive compensation, board composition, and shareholder proposals, providing valuable insights into the company's long-term governance and strategic direction.

Deciphering Key Sections of the Proxy Statement: A Detailed Analysis

Understanding the key sections of the proxy statement (Form DEF 14A) is crucial for making informed investment decisions.

Executive Compensation

The executive compensation disclosure section details the pay packages of top executives. This includes salaries, bonuses, stock options, restricted stock units, and other benefits. Analyzing this information allows investors to assess whether executive compensation aligns with company performance and shareholder interests. Key aspects to examine include pay ratios (comparing CEO pay to average employee pay) and the presence of "golden parachutes" – lucrative severance packages for executives.

Director Elections

This section outlines the process of electing board members. Scrutinize the nominees' backgrounds, experience, and independence. Understanding the nomination process and the independence of the board is vital for assessing the quality of corporate governance. Keywords like "board nominations," "independent directors," and "corporate governance" are key to understanding this section.

Shareholder Proposals

This section details shareholder activism – the ability of shareholders to propose items for the company's agenda. Understanding the process for submitting and voting on these proposals is important. Keywords like "shareholder activism," "proxy access," and "corporate social responsibility" are critical in understanding this section. This allows investors to gauge the company's responsiveness to shareholder concerns and its commitment to environmental, social, and governance (ESG) factors.

Auditor Selection

The selection and approval of the company's independent auditor are crucial for maintaining the integrity of its financial statements. This section outlines the process for selecting and approving the auditor, ensuring the independence and objectivity of the audit. Keywords like "independent audit," "financial statements," and "audit committee" are relevant here.

Utilizing Proxy Statements for Informed Investment Decisions

Analyzing proxy statements empowers investors to make informed voting decisions. Understanding the implications of voting for or against specific proposals directly impacts the company's direction and shareholder value. By carefully reviewing the proxy statement (Form DEF 14A), investors can identify potential red flags, such as excessive executive compensation or questionable corporate governance practices.

Using proxy information helps investors:

- Assess management's performance: Analyze compensation and strategic decisions against company performance.

- Evaluate corporate governance practices: Review board composition, independence, and responsiveness to shareholder concerns.

- Identify potential risks and opportunities: Uncover potential issues within the company through the information disclosed.

- Engage in constructive dialogue with the company: Use the information to engage in discussions with management and the board.

Conclusion: Mastering the Proxy Statement (Form DEF 14A) for Enhanced Investment Outcomes

Understanding and utilizing proxy statements (Form DEF 14A) is crucial for informed investment decisions and active participation in corporate governance. Active participation in shareholder voting significantly impacts the long-term success of your investments and the direction of the companies you own. Become a more informed investor by mastering the proxy statement. To further enhance your understanding, explore additional resources on corporate governance and shareholder rights available from the SEC and other reputable financial organizations. Take control of your investments and actively engage with the proxy statements of the companies in your portfolio.

Featured Posts

-

Parents Less Worried About College Costs New Survey Reveals Shifting Trends

May 17, 2025

Parents Less Worried About College Costs New Survey Reveals Shifting Trends

May 17, 2025 -

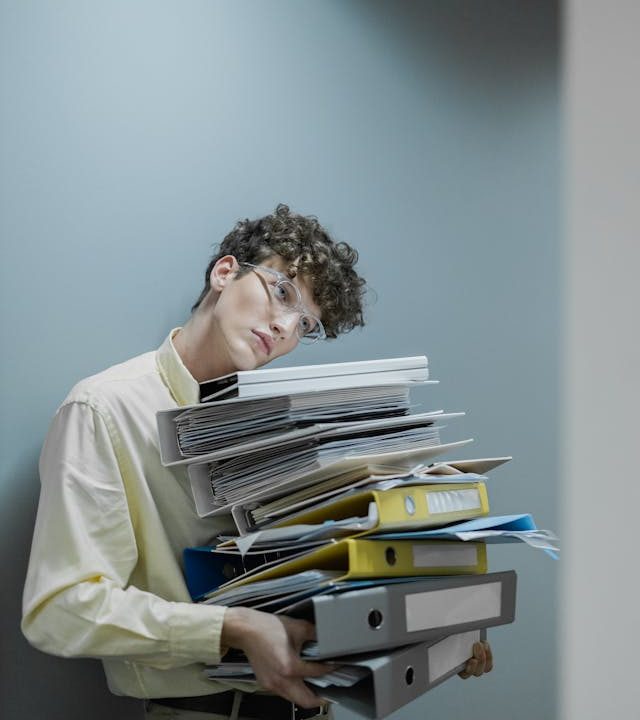

Betting On Tragedy The Case Of The Los Angeles Wildfires

May 17, 2025

Betting On Tragedy The Case Of The Los Angeles Wildfires

May 17, 2025 -

Rune Neocekivani Pobednik U Barseloni

May 17, 2025

Rune Neocekivani Pobednik U Barseloni

May 17, 2025 -

Hailey Van Liths Rookie Season Mentorship From Angel Reese

May 17, 2025

Hailey Van Liths Rookie Season Mentorship From Angel Reese

May 17, 2025 -

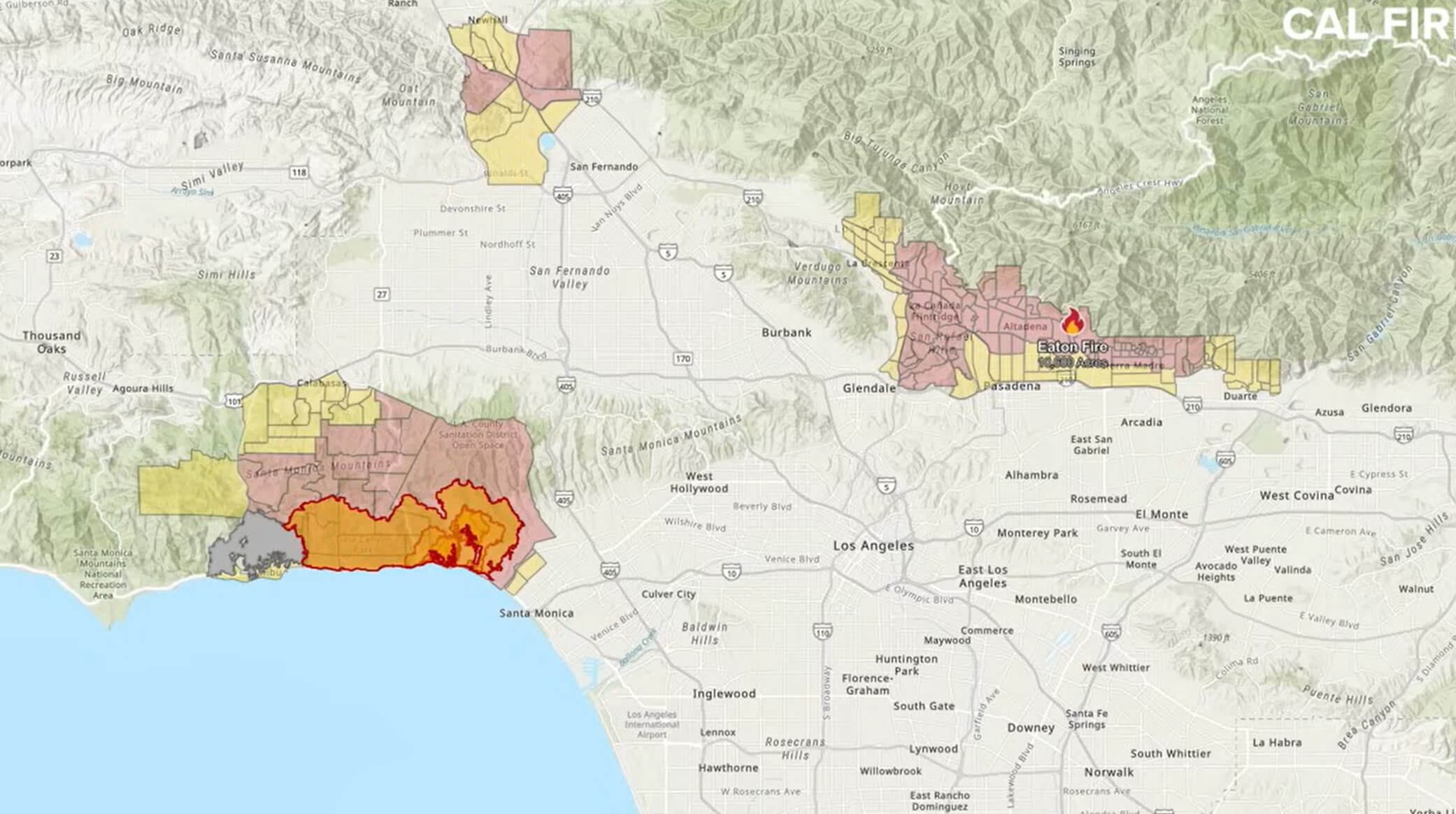

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025

Latest Posts

-

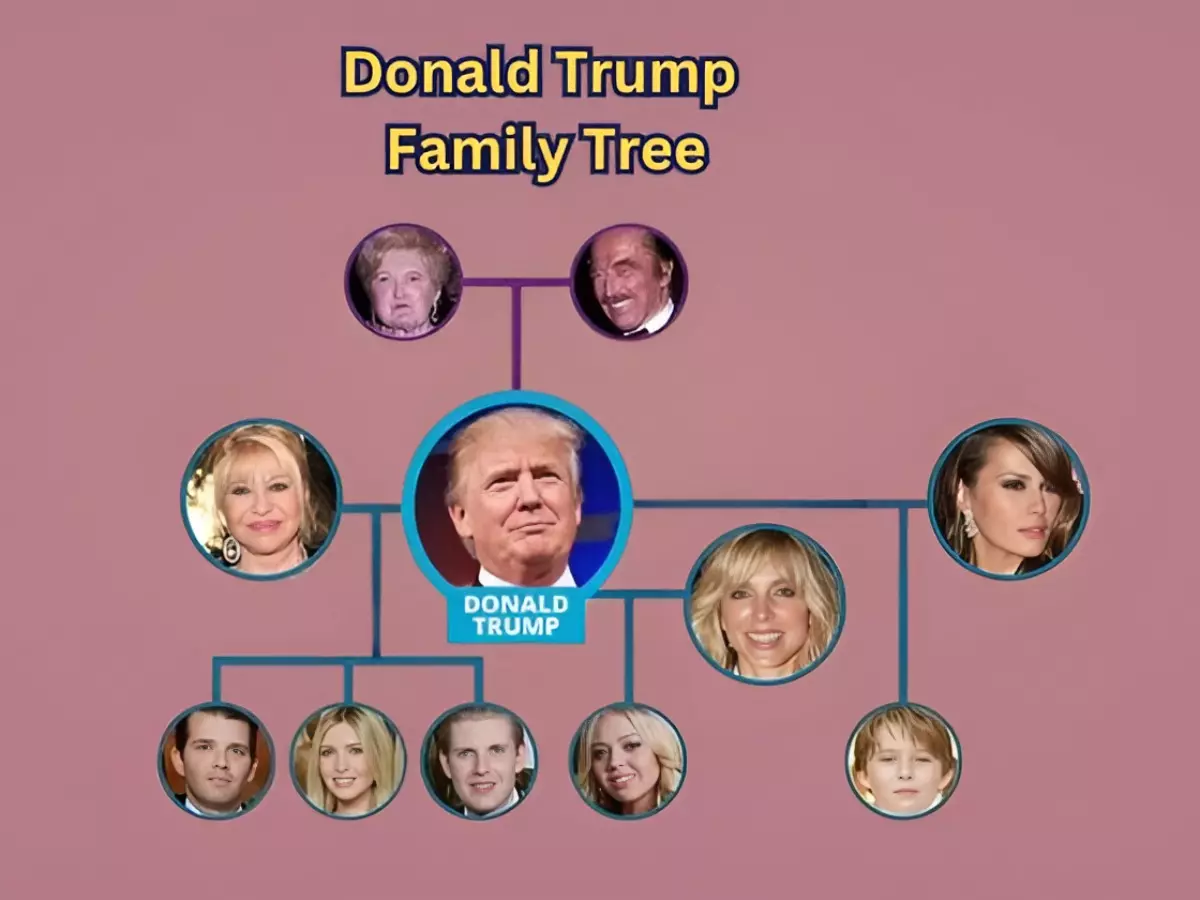

The Trump Family Grows Tiffany Trumps Son Alexander And The Family Lineage

May 17, 2025

The Trump Family Grows Tiffany Trumps Son Alexander And The Family Lineage

May 17, 2025 -

Upad U Teslin Showroom U Berlinu Prosvjednici I Poruka O Planetarnoj Prijetnji

May 17, 2025

Upad U Teslin Showroom U Berlinu Prosvjednici I Poruka O Planetarnoj Prijetnji

May 17, 2025 -

Alexander Boulos Arrives Exploring The Expanding Trump Family Tree

May 17, 2025

Alexander Boulos Arrives Exploring The Expanding Trump Family Tree

May 17, 2025 -

The Night Trump Was Humiliated Lawrence O Donnells Unforgettable Broadcast

May 17, 2025

The Night Trump Was Humiliated Lawrence O Donnells Unforgettable Broadcast

May 17, 2025 -

Melania Trumps Current Role And Public Appearances

May 17, 2025

Melania Trumps Current Role And Public Appearances

May 17, 2025