Deutsche Bank Depositary Receipts Virtual Investor Conference: May 15, 2025

Table of Contents

Keywords: Deutsche Bank Depositary Receipts, Deutsche Bank GDRs, GDR, Virtual Investor Conference, May 15, 2025, Investor Relations, Financial Performance, Investment Opportunity, Stock Market, Equity Market, Dividend, Revenue Growth, Earnings Per Share

The Deutsche Bank Depositary Receipts (GDRs) virtual investor conference, held on May 15, 2025, provided valuable insights into the bank's performance and future outlook. This article summarizes the key announcements, financial highlights, and answers to investor questions, offering a comprehensive overview for those interested in Deutsche Bank GDRs and the investment opportunities they present.

Key Announcements and Highlights from the Deutsche Bank GDR Virtual Conference

The May 15th conference unveiled several significant developments impacting Deutsche Bank GDRs. These announcements highlighted the bank's strategic focus and positive trajectory.

- New Strategic Partnerships: Deutsche Bank announced a major strategic partnership with a leading fintech company, aiming to enhance its digital banking offerings and improve efficiency. This is expected to positively impact the long-term value of Deutsche Bank GDRs.

- Expansion into New Markets: The bank revealed plans to expand its operations into several high-growth emerging markets. This expansion strategy is anticipated to fuel revenue growth and strengthen the position of Deutsche Bank GDRs in the global equity market.

- Enhanced ESG Initiatives: Deutsche Bank emphasized its commitment to Environmental, Social, and Governance (ESG) principles. These initiatives are expected to attract socially responsible investors and further enhance the appeal of Deutsche Bank GDRs.

- Improved Risk Management: The bank detailed its enhanced risk management strategies, demonstrating a proactive approach to mitigating potential challenges and safeguarding the value of GDR investments.

- Strong Q1 2025 Performance: The company reported strong financial results for Q1 2025, exceeding analyst expectations, signifying a robust performance for Deutsche Bank GDRs.

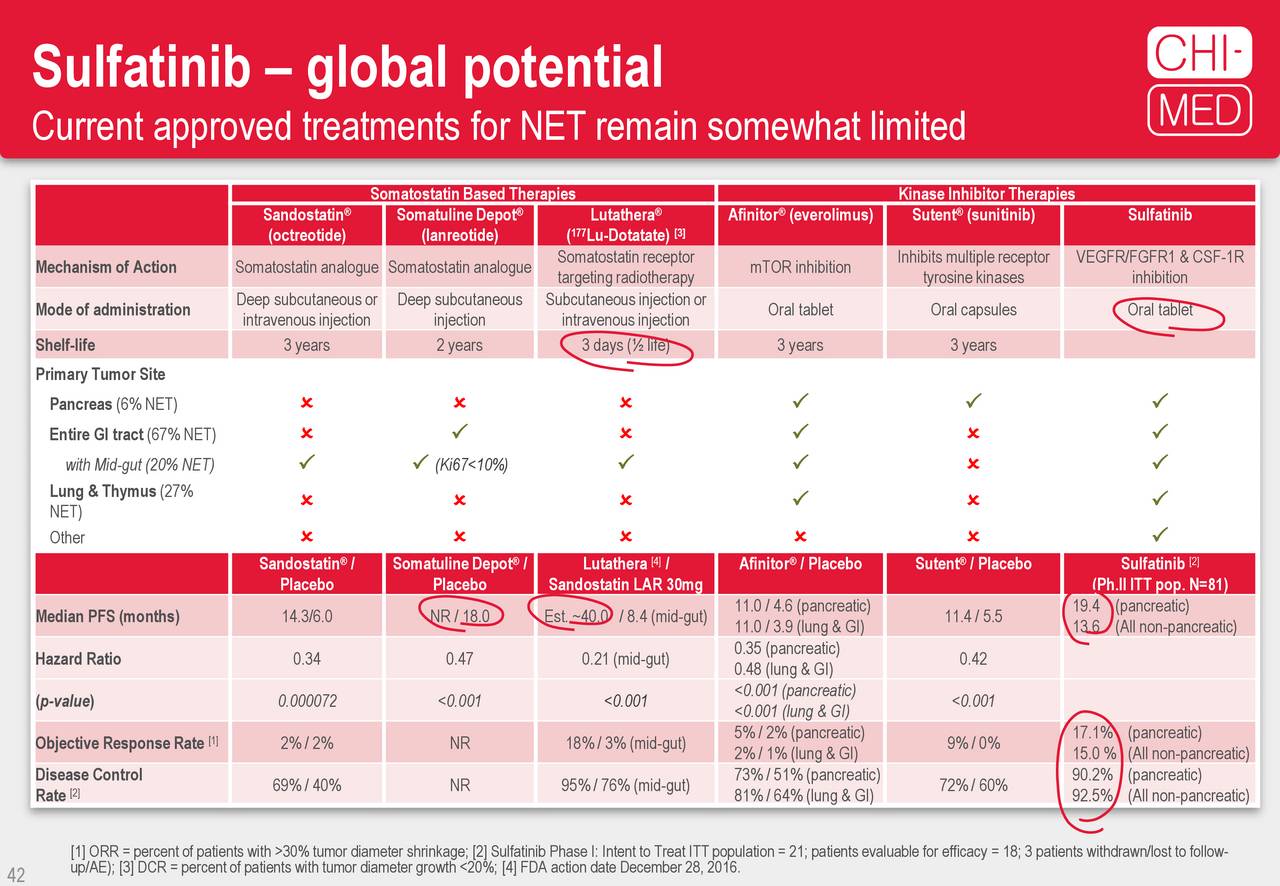

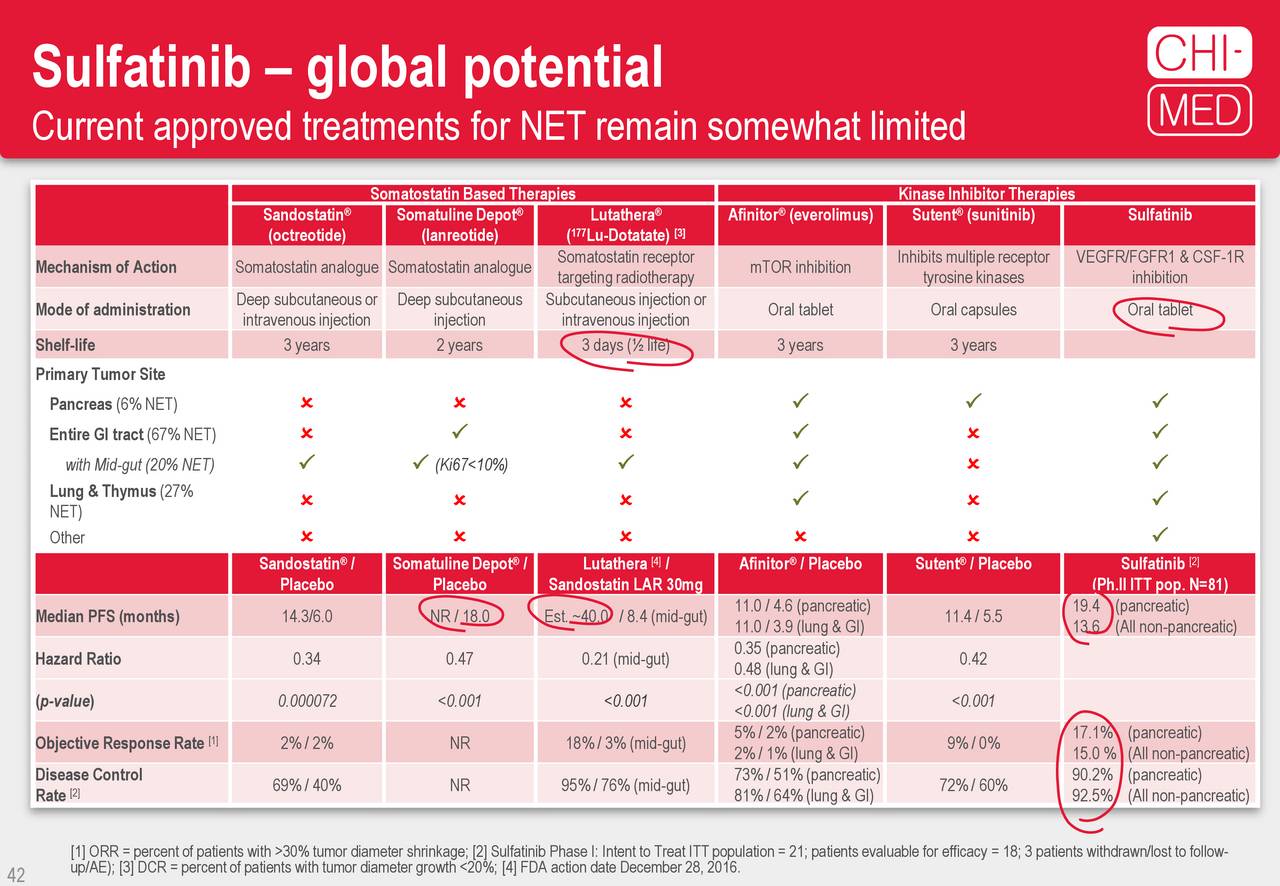

Deutsche Bank's Financial Performance and Outlook for Depositary Receipts

Deutsche Bank presented compelling financial data emphasizing the strong performance of its GDRs.

- Revenue Growth: Revenue increased by 12% year-over-year, driven by strong performance across several key business segments. This significant growth signals a positive trend for GDR holders.

- Earnings Per Share (EPS): EPS saw a remarkable 15% increase compared to the same period last year, exceeding market expectations and reinforcing the attractiveness of Deutsche Bank GDRs as an investment.

- Dividend Announcement: The bank announced an increased dividend payout of 20%, showcasing confidence in its future performance and rewarding existing GDR investors.

[Insert a chart or graph here visually representing revenue growth, EPS, and dividend payout.]

- Positive Outlook: Management expressed confidence in maintaining this positive momentum, projecting further growth in the coming quarters. This optimistic forecast underscores the potential for continued value appreciation of Deutsche Bank GDRs.

Q&A Session Insights: Addressing Investor Concerns Regarding Deutsche Bank GDRs

The Q&A session addressed several key investor concerns regarding Deutsche Bank GDRs and market volatility.

-

Market Volatility: Management acknowledged the impact of market volatility on GDR prices but emphasized the bank's robust financial position and its ability to navigate market uncertainties.

-

Growth Strategies: The long-term growth strategies, including the new partnerships and market expansions, were highlighted as key drivers of future GDR value appreciation.

-

Risk Mitigation: The bank detailed its comprehensive risk management framework, outlining the strategies in place to mitigate potential risks and protect investor interests.

-

GDR Liquidity: Investors' concerns about the liquidity of Deutsche Bank GDRs were addressed, highlighting the bank's commitment to maintaining a healthy and liquid market for its GDRs.

Understanding Deutsche Bank Depositary Receipts (GDRs): A Quick Guide

Deutsche Bank Depositary Receipts (GDRs) represent ownership in Deutsche Bank shares but are traded on international stock exchanges. They provide a convenient way for international investors to participate in the bank's growth.

- Key Features: GDRs offer exposure to Deutsche Bank without the need to invest directly in the German stock market. They are typically denominated in US dollars or other major currencies.

- Benefits: GDRs offer diversification benefits, liquidity, and accessibility to international investors.

- Associated Risks: Like any investment, GDRs carry inherent risks, including market fluctuations, currency exchange rate volatility, and overall economic conditions.

Investment Opportunities and Future Outlook for Deutsche Bank GDRs

The conference painted a positive picture of the future outlook for Deutsche Bank GDRs.

- Long-Term Growth: The bank's strategic initiatives, coupled with a strong financial performance, suggest considerable long-term growth potential for Deutsche Bank GDRs.

- Value Appreciation Catalysts: Successful execution of the announced strategic partnerships and market expansions is expected to act as key catalysts for further GDR value appreciation.

- Potential Headwinds: While the outlook is positive, management acknowledged potential headwinds, such as global economic uncertainty and regulatory changes, which could impact GDR performance.

Conclusion

The Deutsche Bank Depositary Receipts virtual investor conference of May 15, 2025, provided a clear and positive outlook for GDR investors. Key announcements, strong financial performance, and the management's confident outlook suggest attractive investment opportunities. The strategic initiatives and enhanced risk management strategies signal a promising future for Deutsche Bank GDRs. Stay informed about future developments concerning Deutsche Bank GDRs by visiting [link to Deutsche Bank Investor Relations]. Explore the investment opportunity presented by Deutsche Bank Depositary Receipts today!

Featured Posts

-

Augsburg Zoekt Nieuwe Trainer Na Ontslag Thorup

May 30, 2025

Augsburg Zoekt Nieuwe Trainer Na Ontslag Thorup

May 30, 2025 -

Manitobas Child Welfare System Examining 20 Years Of Intervention Among First Nations Parents

May 30, 2025

Manitobas Child Welfare System Examining 20 Years Of Intervention Among First Nations Parents

May 30, 2025 -

Glastonbury Festival Tickets Resale Rush Sold Out In Half An Hour

May 30, 2025

Glastonbury Festival Tickets Resale Rush Sold Out In Half An Hour

May 30, 2025 -

Longorias Retirement The End Of An Era For The Tampa Bay Rays

May 30, 2025

Longorias Retirement The End Of An Era For The Tampa Bay Rays

May 30, 2025 -

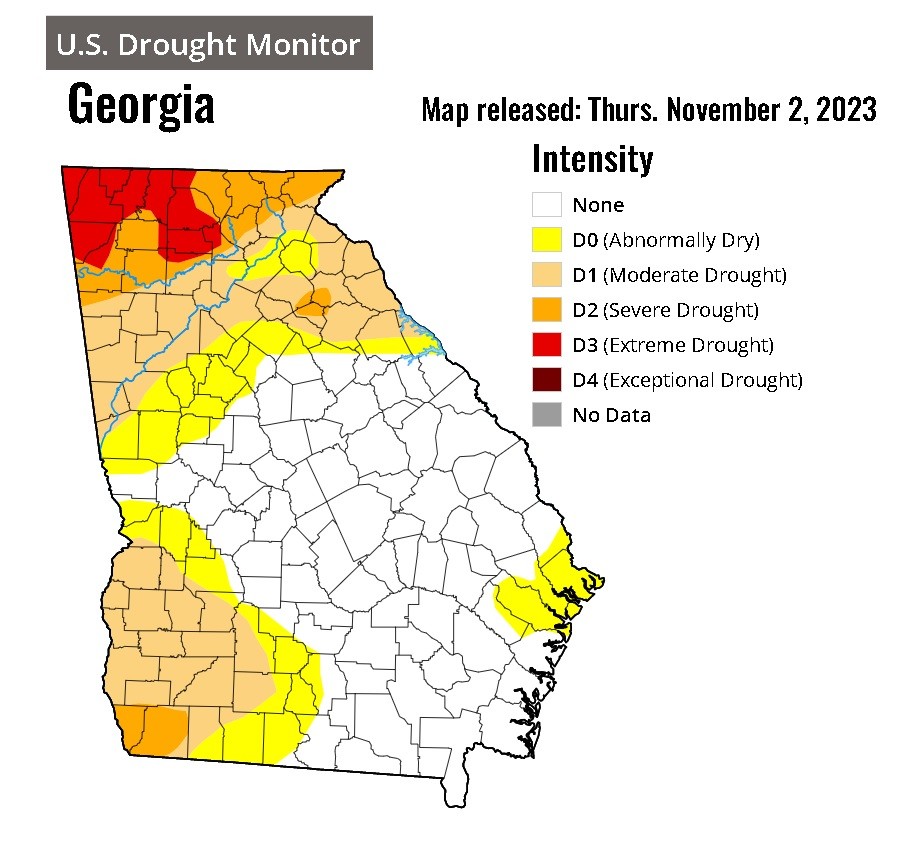

Insufficient Rainfall In March Water Deficit Continues

May 30, 2025

Insufficient Rainfall In March Water Deficit Continues

May 30, 2025