Direct Lender Tribal Loans: Bad Credit & Guaranteed Approval Options

Table of Contents

Understanding Direct Lender Tribal Loans

Direct lender tribal loans are short-term loans offered by lending institutions operating under the jurisdiction of Native American tribes. The unique aspect lies in tribal sovereignty, which allows these lenders to operate under different regulatory frameworks than traditional banks. Understanding the difference between a direct lender and a third-party lender is crucial. A direct lender handles the entire loan process, from application to repayment, while a third-party lender acts as an intermediary, connecting borrowers with multiple lenders. Dealing directly with the lender often provides greater transparency and avoids hidden fees.

- The Loan Process: The application process is typically online, involving a simple form and quick verification. Once approved, funds can be deposited into your account within a matter of hours, sometimes even on the same day – hence the popularity of same-day loans in this sector.

- Loan Requirements: Requirements vary between lenders, but generally include being of legal age (usually 18 or 21), being a US resident, having a verifiable income source, and providing a valid bank account.

- Transparency and Fees: Direct lenders are generally more transparent regarding fees and interest rates. This contrasts with some third-party lenders who may bundle hidden costs into the loan agreement.

Benefits of Choosing Direct Lender Tribal Loans for Bad Credit

For individuals with bad credit, securing a loan can be extremely difficult. Direct lender tribal loans offer several advantages:

- Higher Approval Rates: Compared to traditional banks and credit unions, these lenders often have more flexible approval criteria, making them more accessible to borrowers with poor credit history. This makes them a popular choice for bad credit loans and even sometimes referred to as no credit check loans (though a credit check may still occur).

- Credit Rebuilding Potential: While not a guaranteed method, responsibly repaying a direct lender tribal loan can positively impact your credit score over time. This can be a crucial step in rebuilding your financial standing.

- Flexible Repayment Options: Many lenders offer flexible repayment plans tailored to your financial capabilities, helping you avoid penalties and manage your debt effectively. The convenience of online applications and management is also a significant advantage.

Are Guaranteed Approval Tribal Loans Legitimate?

The term "guaranteed approval" is often used to attract borrowers, but it's crucial to approach it with caution. While direct lender tribal loans often have higher approval rates than traditional loans, no lender can guarantee approval for everyone. Be wary of lenders making such promises without thoroughly verifying your information. High approval rates are beneficial, but don't let the allure of "guaranteed approval" blind you to potential risks.

- Identifying Legitimate Lenders: Always check the lender's website for a physical address, contact information, and clear terms and conditions. Look for secure encryption (HTTPS) and read independent reviews before applying.

- High-Interest Loans: Be prepared for potentially higher interest rates compared to loans from traditional lenders. Understand the Annual Percentage Rate (APR) and total cost of borrowing before signing any agreement.

- Comparing Offers: Don't settle for the first offer you receive. Compare loan terms, interest rates, and fees from multiple lenders to find the most favorable option.

Finding Reputable Direct Lender Tribal Loans Online

Finding a trustworthy lender online requires diligence. Use secure platforms and conduct thorough research:

- Reputable Lender Websites: Look for lenders with secure websites (HTTPS), clear terms and conditions, and easily accessible contact information.

- Independent Reviews: Check independent review websites to see what other borrowers have said about their experiences with various lenders.

- Loan Comparison Tools: Several websites allow you to compare loan offers from different lenders side-by-side, helping you make an informed decision.

Conclusion

Direct lender tribal loans can offer a quicker and more accessible path to obtaining funds, particularly for those with bad credit. They provide potential benefits like higher approval rates and flexible repayment options. However, remember to always research thoroughly, compare offers, and understand the terms and interest rates before committing. Avoid lenders promising "guaranteed approval" without proper verification. By following these guidelines, you can navigate the process responsibly and find the right direct lender tribal loan for your needs. Find the right direct lender tribal loan for your needs today! Explore your options with direct lender tribal loans now!

Featured Posts

-

Housing Permit Decline Challenges To Construction Growth

May 28, 2025

Housing Permit Decline Challenges To Construction Growth

May 28, 2025 -

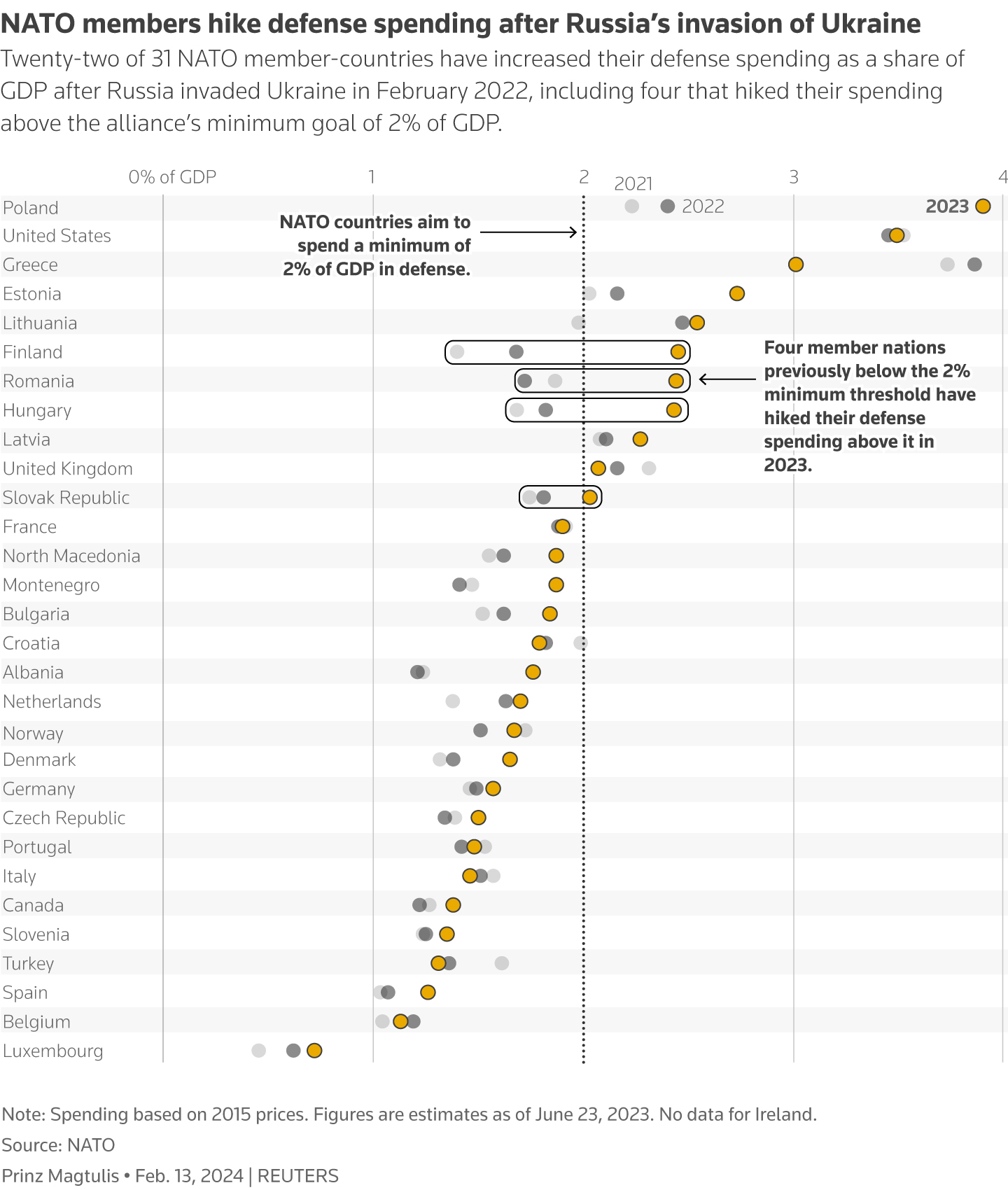

Nato Allies Progressing Towards 2 Defense Spending Goal

May 28, 2025

Nato Allies Progressing Towards 2 Defense Spending Goal

May 28, 2025 -

Cristiano Ronaldo Nun Al Nassr Transferi Beklentiler Ve Analiz

May 28, 2025

Cristiano Ronaldo Nun Al Nassr Transferi Beklentiler Ve Analiz

May 28, 2025 -

Ipswich Town Fc Enciso Phillips And Woolfenden Join The Tractor Boys

May 28, 2025

Ipswich Town Fc Enciso Phillips And Woolfenden Join The Tractor Boys

May 28, 2025 -

Prediksi Pertandingan Bali United Vs Dewa United Skor Akhir Head To Head And Lineup

May 28, 2025

Prediksi Pertandingan Bali United Vs Dewa United Skor Akhir Head To Head And Lineup

May 28, 2025