Dow Futures Fall: Moody's Downgrade Impacts Dollar And Markets

Table of Contents

Dow Futures Plummet Following Moody's Downgrade

Immediate Market Reaction

The announcement of Moody's downgrade sent shockwaves through the financial world, leading to a sharp decline in Dow futures. Within minutes of the news breaking, contracts experienced a significant drop, reflecting immediate investor concerns.

- Magnitude of the drop: Dow futures fell by X%, the largest single-day drop in Y months. (Replace X and Y with actual figures once available).

- Comparison to previous dips: This decline surpasses the market dips seen during [mention relevant previous market events], highlighting the severity of the current situation.

- Sectors most affected: The technology and financial sectors were particularly hard hit, showcasing their vulnerability to shifts in investor confidence and overall economic health.

The immediate drop can be attributed to a sudden decrease in investor confidence. A lowered credit rating signals increased risk associated with US Treasury bonds, impacting overall market sentiment and pushing investors towards safer assets. Experts predict further volatility in the coming days as markets absorb the full impact of this news.

The Dollar's Response to the Downgrade

Weakening of the US Dollar

The Moody's downgrade triggered a weakening of the US dollar against other major currencies. The correlation between a lowered credit rating and currency devaluation is well-established. As investor confidence in the US economy wanes, the demand for the dollar decreases, leading to its depreciation.

- Specific examples of currency fluctuations: The USD/EUR exchange rate saw a rise of Z%, while the USD/JPY pair experienced a similar shift of W%. (Replace Z and W with actual figures once available).

- Implications for international trade and investment: This weakening could make US exports more competitive, but also increase the cost of imports. Foreign investors may become hesitant to invest in US assets, impacting capital flows.

- Short-term and long-term effects: The short-term impact is likely to be significant volatility. The long-term effect will depend on the US government's response and the overall trajectory of the US economy.

The dollar's reaction reflects the global market's assessment of the downgrade’s impact on the US economy's long-term stability. This uncertainty is fueling speculation and driving currency market fluctuations.

Broader Market Implications – Beyond the Dow

Impact on other indices

The impact of Moody's downgrade wasn't confined to Dow futures. Other major indices also experienced significant declines, reflecting a broader market reaction.

- Percentage changes in other indices: The S&P 500 fell by A%, and the Nasdaq dropped by B%. (Replace A and B with actual figures once available).

- Sectors or companies affected: Beyond the technology and finance sectors, the energy and consumer staples sectors also showed vulnerability, indicating a widespread impact.

- Overall market sentiment: Fear and uncertainty dominate the market sentiment as investors grapple with the implications of the downgrade and the potential for further economic instability.

The ripple effect across indices underscores the interconnected nature of global markets and the far-reaching implications of events affecting the US economy.

Potential Future Scenarios and Investor Strategies

Short-term and Long-term Outlook

Predicting the future is always challenging, but several potential scenarios exist following Moody's downgrade.

- Potential for further declines or a market rebound: The market might experience further declines in the short term as investors digest the news and assess the risks. However, a rebound is also possible if the government takes swift action to address the concerns raised by Moody's.

- Strategies for investors: Diversification, risk management, and careful monitoring of market trends are crucial for investors navigating this uncertainty. Hedging strategies might prove beneficial.

- Potential government responses: Government intervention, including fiscal or monetary policy changes, could influence the market's direction.

The situation calls for a cautious approach. Investors should carefully consider their risk tolerance and adjust their investment strategies accordingly, focusing on diversification and risk management.

Conclusion

Moody's downgrade has had a significant impact on Dow futures, causing a sharp decline and impacting the dollar's strength. The broader market implications are substantial, with other indices also experiencing notable drops. The future remains uncertain, calling for cautious navigation and informed decision-making by investors. Stay informed on the latest developments regarding the Dow Futures Fall by following reputable financial news sources and carefully monitoring market fluctuations. Further research into US economic forecasts and currency trading strategies is advisable during this period of market volatility.

Featured Posts

-

Femicide Examining The Factors Behind The Growing Number Of Cases

May 20, 2025

Femicide Examining The Factors Behind The Growing Number Of Cases

May 20, 2025 -

D Wave Quantum Qbts Unpacking Todays Significant Stock Price Movement

May 20, 2025

D Wave Quantum Qbts Unpacking Todays Significant Stock Price Movement

May 20, 2025 -

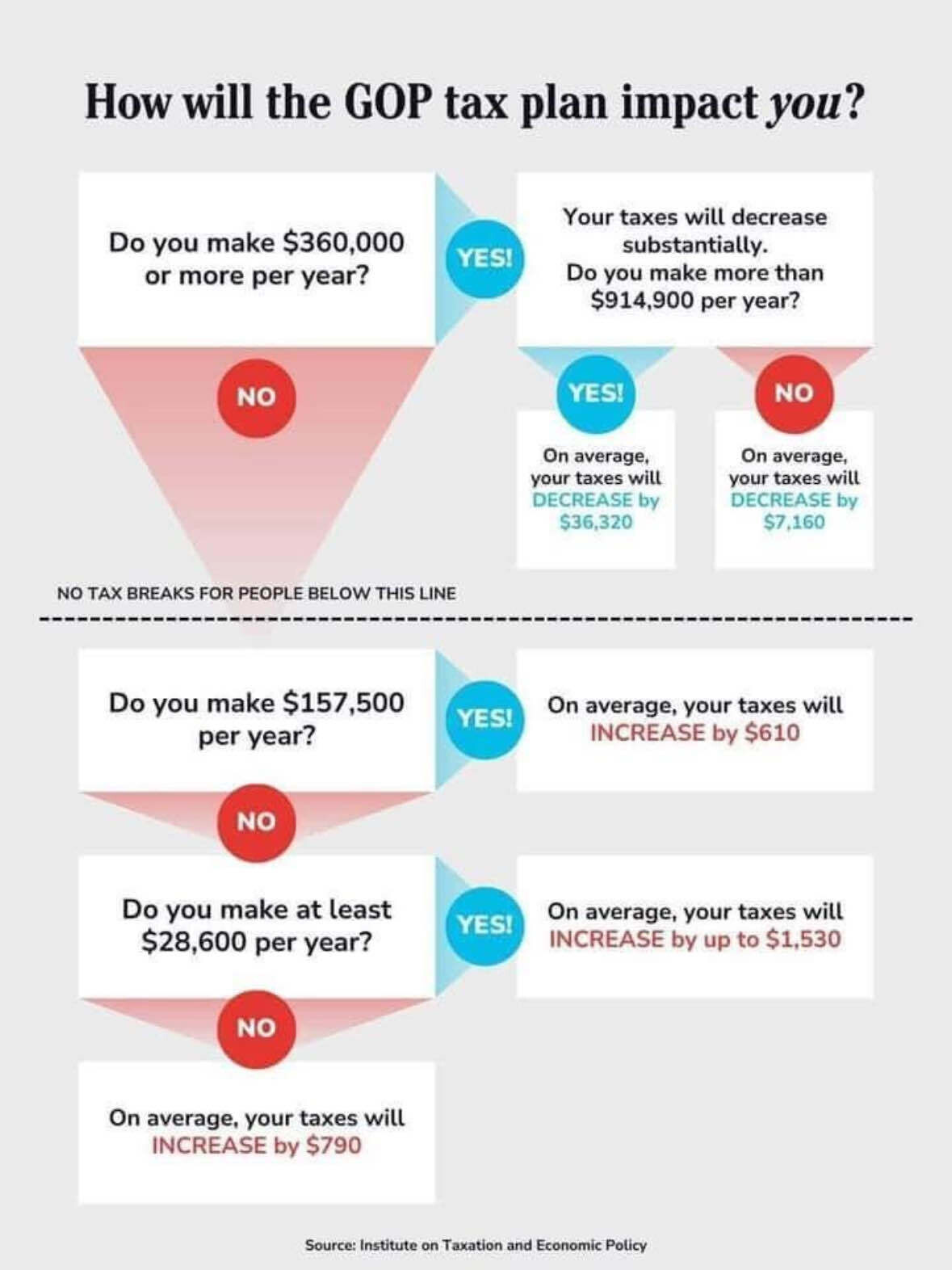

Analyzing The Gop Tax Plan The Reality Of Deficit Reduction

May 20, 2025

Analyzing The Gop Tax Plan The Reality Of Deficit Reduction

May 20, 2025 -

F1 Kaoset Detaljerad Analys Av Hamilton Och Leclercs Diskvalificeringar

May 20, 2025

F1 Kaoset Detaljerad Analys Av Hamilton Och Leclercs Diskvalificeringar

May 20, 2025 -

The Enduring Appeal Of Agatha Christies Poirot An Analysis Of His Popularity

May 20, 2025

The Enduring Appeal Of Agatha Christies Poirot An Analysis Of His Popularity

May 20, 2025