DRAM Market Shift: SK Hynix Emerges As Potential Leader With AI Boost

Table of Contents

The Booming Demand for DRAM in AI Applications

AI's Insatiable Appetite for Memory

The exponential growth in data generated by AI applications is driving an insatiable demand for high-capacity, high-speed DRAM chips. This demand is fueled by several key factors:

- Increased use of deep learning models: Deep learning algorithms require massive amounts of data and processing power, significantly increasing the need for high-bandwidth memory.

- Expansion of large language models (LLMs): The development and deployment of LLMs, such as those powering advanced chatbots and language translation services, are exceptionally memory-intensive.

- Growth of cloud computing infrastructure: Cloud data centers, crucial for supporting AI applications, require vast amounts of DRAM to handle the massive data processing demands.

The specific types of DRAM crucial for AI applications include High Bandwidth Memory (HBM) and GDDR (Graphics Double Data Rate) memory. HBM offers significantly higher bandwidth compared to traditional DRAM, crucial for handling the immense data flow in AI processing. GDDR memory, primarily used in graphics cards, also plays a vital role in AI acceleration, particularly in applications involving image and video processing. These specialized DRAMs offer superior performance characteristics, including higher bandwidth and lower latency, making them indispensable for AI workloads.

The Impact of AI on DRAM Pricing and Supply

The heightened demand for DRAM fueled by AI is significantly impacting DRAM prices and the overall supply chain. This surge in demand is leading to:

- Increased competition for DRAM chips: Major players like Samsung, Micron, and SK Hynix are all vying for a larger share of this rapidly expanding market.

- Potential shortages: The inability to meet the escalating demand could result in DRAM shortages, leading to price increases and potential delays in AI deployments.

- Impact on consumer electronics: The increased demand for DRAM in AI applications could potentially lead to price increases and reduced availability of DRAM for consumer electronics devices.

The resulting price fluctuations have significant implications for both manufacturers and end-users. Manufacturers face challenges in managing production capacity and costs, while end-users might experience higher prices for devices incorporating AI capabilities. Predicting these fluctuations accurately remains a challenge, highlighting the volatility of the DRAM market in this dynamic environment.

SK Hynix's Strategic Moves and Technological Advantages

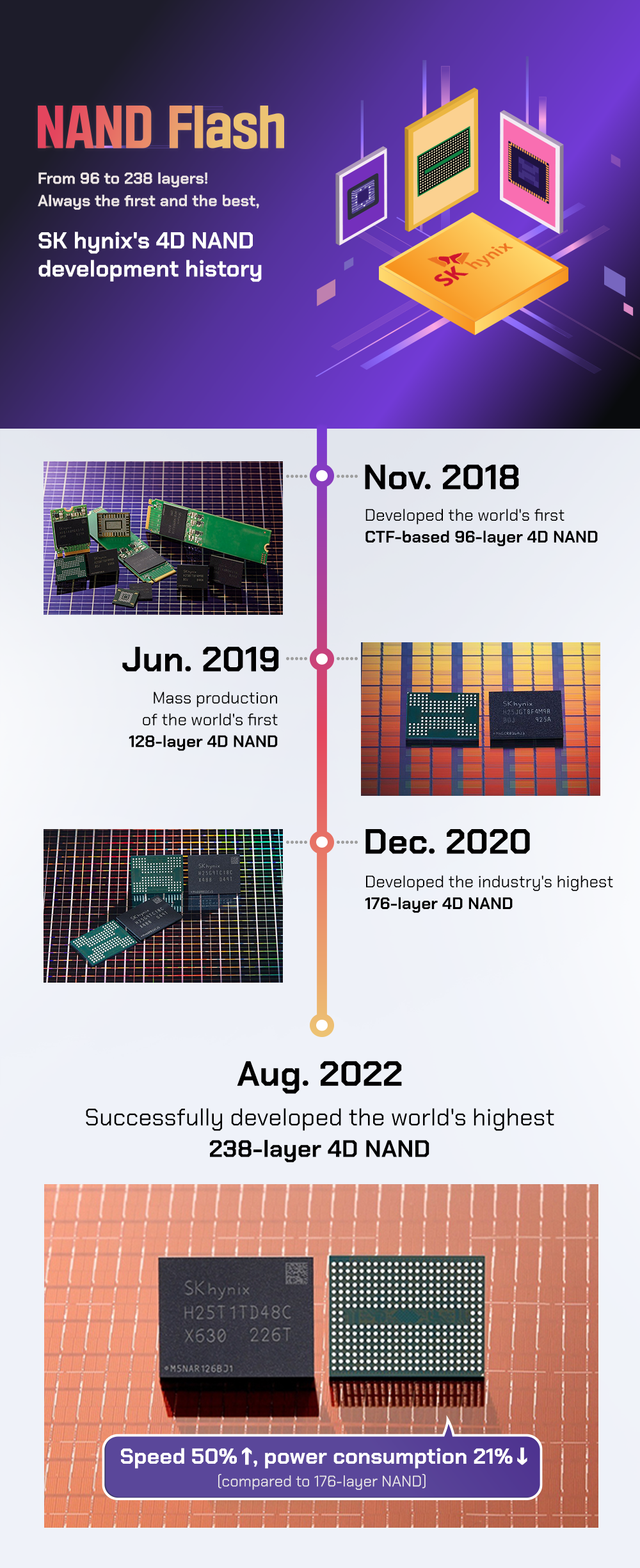

Investments in R&D and Advanced Technologies

SK Hynix has made significant investments in research and development, focusing on next-generation DRAM technologies to maintain its competitive edge. These investments include:

- Advanced packaging technologies (e.g., HBM): SK Hynix is actively developing and deploying HBM technology, crucial for high-performance computing and AI applications.

- Development of high-density DRAM chips: The company is continuously improving the density of its DRAM chips, allowing for greater data storage in smaller spaces.

- Focus on process technology nodes: SK Hynix is investing in advanced process technology nodes to improve the efficiency and performance of its DRAM chips.

These innovations provide SK Hynix with a significant competitive advantage in the rapidly evolving DRAM market. Their focus on high-bandwidth memory solutions positions them strongly within the growing AI sector.

Strategic Partnerships and Acquisitions

SK Hynix has strategically pursued collaborations and acquisitions to further solidify its position in the DRAM market. These include:

- Partnerships with AI companies: Collaborating with leading AI companies provides SK Hynix with valuable insights into the evolving needs of the AI market and allows for joint development of specialized memory solutions.

- Acquisitions of related technology firms: Acquiring companies with complementary technologies can accelerate SK Hynix's innovation efforts and expand its product portfolio.

These strategic partnerships and acquisitions significantly enhance SK Hynix's technological capabilities and market reach, giving them a stronger foothold in the competitive landscape.

Expanding Production Capacity

To meet the growing demand for DRAM, SK Hynix is aggressively expanding its manufacturing capabilities. This includes:

- New fab construction: Investing in new fabrication plants (fabs) increases overall production capacity.

- Capacity upgrades: Upgrading existing fabs with advanced equipment allows for higher production yields and efficiency.

- Investment in automation: Implementing automation technologies improves manufacturing efficiency and reduces costs.

This expansion of production capacity is crucial for SK Hynix to meet the burgeoning demand for DRAM and maintain its competitive position. The increased supply can help stabilize prices and ensure sufficient DRAM availability for the expanding AI market.

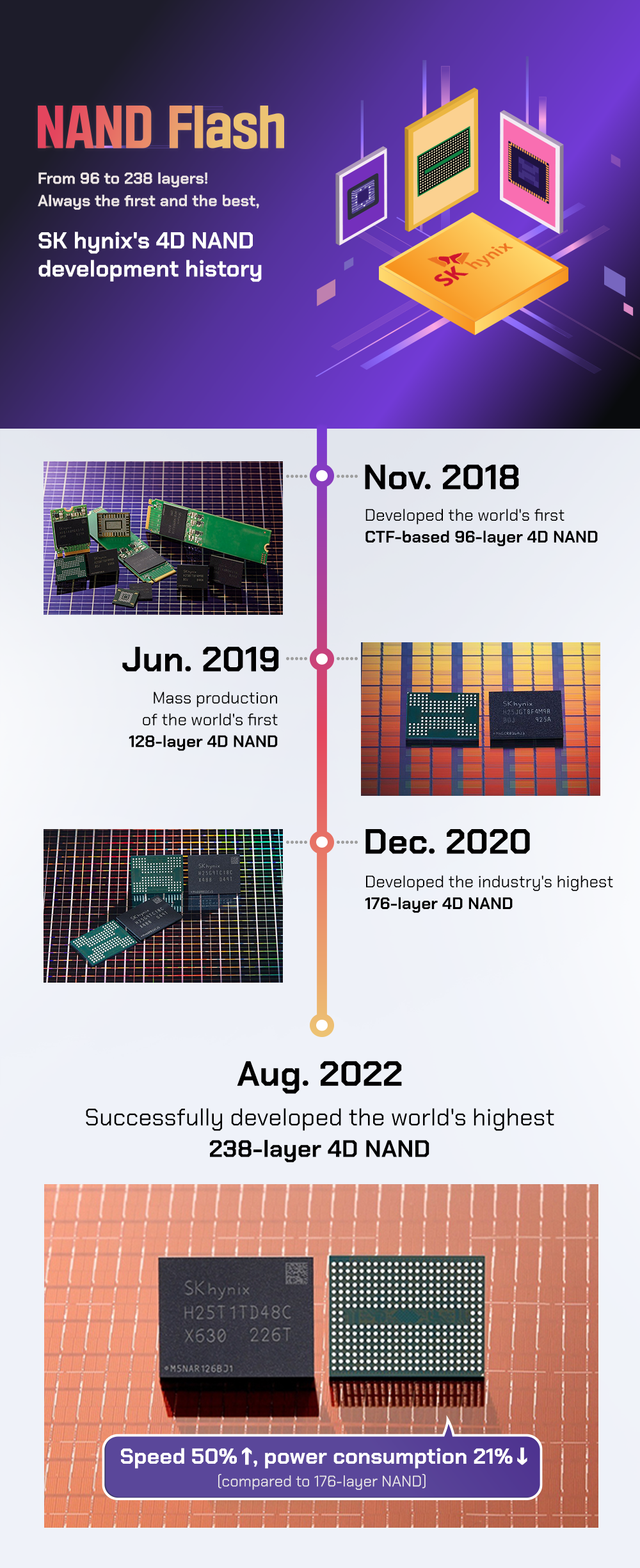

Competitive Landscape and Market Share Analysis

Analyzing SK Hynix's Position Against Major Competitors

SK Hynix competes with other major DRAM manufacturers, primarily Samsung and Micron. Analyzing market share and performance provides insight into SK Hynix's relative standing:

- Market share comparisons: While precise market share figures fluctuate, SK Hynix consistently maintains a significant portion of the global DRAM market.

- Revenue growth analysis: SK Hynix's revenue growth, particularly in the AI-related sector, indicates its success in capitalizing on the growing demand.

- Competitive advantages: SK Hynix's strategic investments in R&D and advanced technologies give it key advantages over competitors.

Analyzing these metrics provides a clear picture of SK Hynix's competitive strengths and potential for growth. Data visualization, such as charts and graphs showcasing market share and revenue growth over time, provides further clarity.

Potential for Market Leadership

Based on its current trajectory, SK Hynix possesses considerable potential to become a leading player in the DRAM market:

- Strengths: Strong R&D capabilities, focus on advanced technologies, strategic partnerships, and increased production capacity are key strengths.

- Weaknesses: Dependence on the cyclical nature of the semiconductor industry and potential geopolitical risks are potential challenges.

- Market trends: The continued growth of AI and its increasing demand for high-bandwidth memory strongly favor SK Hynix's position.

- Future projections: Analysts predict continued growth in the DRAM market, with SK Hynix well-positioned to benefit from this expansion.

However, a balanced assessment acknowledges potential challenges and risks. Maintaining technological leadership, navigating geopolitical uncertainties, and managing the cyclical nature of the semiconductor industry are crucial for SK Hynix’s continued success.

Conclusion

The DRAM market is undergoing a dramatic transformation driven by the relentless growth of artificial intelligence. SK Hynix, through strategic investments in R&D, advanced technologies, and increased production capacity, is well-positioned to capitalize on this shift and potentially emerge as a dominant player. While challenges remain, the company's proactive approach and focus on innovation suggest a promising future in the evolving landscape of the DRAM market. Stay informed about the latest developments in the DRAM market and SK Hynix's progress to understand the future of this crucial technology sector. Understanding the DRAM market shift is crucial for investors and industry professionals alike. Keep an eye on SK Hynix's advancements in DRAM chip technology and its impact on the semiconductor industry.

Featured Posts

-

Invest Smart A Geographic Analysis Of The Countrys Best Business Opportunities

Apr 24, 2025

Invest Smart A Geographic Analysis Of The Countrys Best Business Opportunities

Apr 24, 2025 -

Recent Shifts In The Canadian Dollar Exchange Rate

Apr 24, 2025

Recent Shifts In The Canadian Dollar Exchange Rate

Apr 24, 2025 -

Remembering Sophie Nyweide Child Star Of Mammoth And Noah Passes Away At 24

Apr 24, 2025

Remembering Sophie Nyweide Child Star Of Mammoth And Noah Passes Away At 24

Apr 24, 2025 -

B And B April 3 Recap Liams Dramatic Collapse After A Row With Bill

Apr 24, 2025

B And B April 3 Recap Liams Dramatic Collapse After A Row With Bill

Apr 24, 2025 -

B And B April 9 Recap Steffy Blames Bill Finns Icu Status Liams Demand For Secrecy

Apr 24, 2025

B And B April 9 Recap Steffy Blames Bill Finns Icu Status Liams Demand For Secrecy

Apr 24, 2025