ETFs And The Autonomous Vehicle Revolution: Is Uber The Key?

Table of Contents

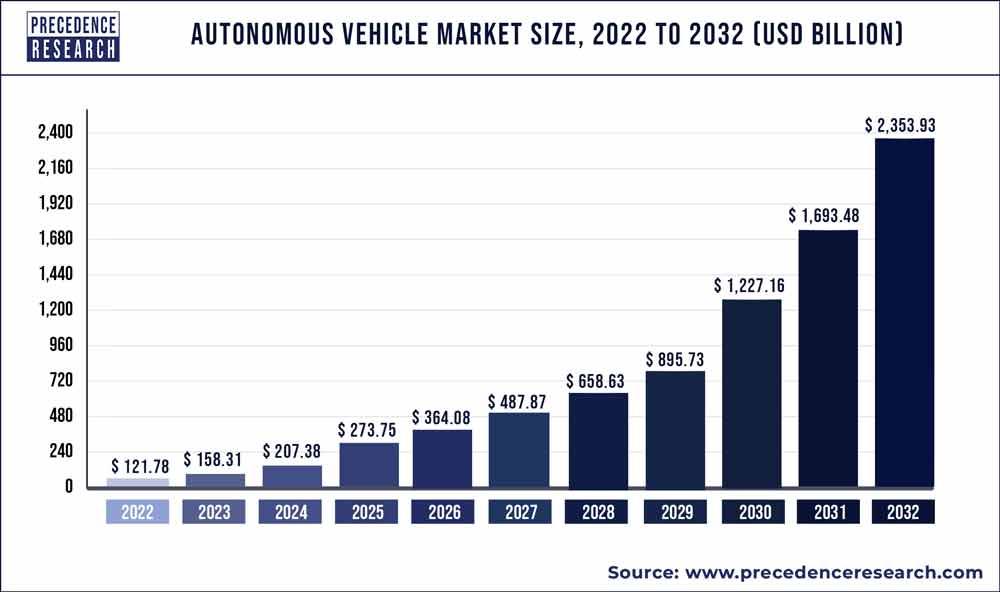

The Promise and Potential of Autonomous Vehicle ETFs

Autonomous vehicle ETFs are investment funds that track the performance of a basket of companies involved in the development and deployment of self-driving technology. These ETFs offer several key benefits for investors:

- Diversification: Instead of investing in a single company, ETFs spread your risk across multiple players in the autonomous vehicle ecosystem, reducing the impact of any one company's underperformance.

- Ease of Access: ETFs are readily available through most brokerage accounts, making it simple to gain exposure to this complex and rapidly evolving sector.

Several types of autonomous vehicle ETFs exist. Some focus on specific companies heavily invested in autonomous driving technology, while others track broader indices encompassing various aspects of the industry, including:

- Technology Companies: Companies like Google's Waymo, Tesla, and Cruise are leading the development of autonomous driving systems.

- Component Suppliers: Companies producing essential components like lidar, sensors, and advanced driver-assistance systems (ADAS) are vital to the success of self-driving vehicles.

- Infrastructure Companies: Those involved in building the necessary infrastructure to support autonomous vehicles (e.g., mapping services, charging stations).

Investing in these ETFs offers:

- Reduced risk through diversification.

- Exposure to multiple companies driving innovation.

- Potential for high growth due to market disruption.

- Access to a sector otherwise difficult to invest in individually.

Uber's Pivotal Role in the Autonomous Vehicle Ecosystem

Uber, through its Advanced Technologies Group (ATG), has made substantial investments in self-driving technology. Its existing infrastructure gives it a significant advantage:

- Massive existing infrastructure: Uber already possesses a vast driver network and a widely used app, providing a ready-made platform for integrating autonomous vehicles.

- Significant research and development efforts: Uber ATG has been actively developing and testing self-driving technology, although its path has been marked by both successes and challenges.

- Potential for market dominance: With its established user base and technological investments, Uber is well-positioned to dominate the ride-sharing and potentially the broader autonomous delivery markets.

- Strategic partnerships: Uber has forged partnerships with various autonomous vehicle technology providers, further strengthening its position in this rapidly evolving landscape.

Identifying Key Players in Autonomous Vehicle ETFs

Several key players beyond Uber significantly influence the success of autonomous vehicle ETFs:

- Technology Giants: Companies like Alphabet (Google's Waymo), Apple, and Tesla are actively developing autonomous driving technology and are major holdings in many autonomous vehicle ETFs.

- Component Suppliers: Companies specializing in lidar (like Velodyne Lidar), radar, and other crucial components are vital to the autonomous vehicle ecosystem. Their success directly impacts the performance of many ETFs.

Identifying ETFs with significant exposure to these key players requires careful research. Consider:

- Technology giants leading the development of self-driving systems.

- Importance of component suppliers for the success of autonomous vehicles.

- Examples of specific ETFs and their holdings (research specific ETF tickers and prospectuses).

- Considerations for diversification across different segments of the industry (e.g., technology, components, infrastructure).

Risks and Considerations for Investing in Autonomous Vehicle ETFs

Investing in autonomous vehicle ETFs carries inherent risks:

- Regulatory uncertainty: The regulatory landscape for autonomous vehicles is still evolving, with potential delays or changes impacting the industry's growth trajectory.

- Technological hurdles: The development of fully autonomous vehicles is a complex technological challenge, and unforeseen setbacks are possible.

- Market volatility: As with any investment in emerging technologies, significant market volatility is expected. A long-term investment strategy is crucial.

- Ethical considerations: Public perception and ethical concerns surrounding autonomous vehicles could negatively impact the industry's growth.

These factors highlight the importance of careful due diligence and a long-term investment horizon when considering autonomous vehicle ETFs.

Conclusion: ETFs and the Autonomous Vehicle Revolution – A Smart Investment Strategy?

Autonomous vehicle ETFs present a compelling investment opportunity, with the potential for substantial returns. Uber's significant role in this revolution adds another layer to the investment equation. While the potential for high returns exists, it's crucial to acknowledge the associated risks, including regulatory uncertainty and technological challenges. Thorough research and a long-term investment strategy are essential. Start exploring autonomous vehicle ETFs today, but remember to carefully research and understand the holdings and risks before investing. Don't miss out on the potential of this transformative technology!

Featured Posts

-

Investing In The Future Of Transportation Ubers Autonomous Vehicle Potential And Etfs

May 17, 2025

Investing In The Future Of Transportation Ubers Autonomous Vehicle Potential And Etfs

May 17, 2025 -

Angel Reese Supports Brother Touching Mothers Day Message During Ncaa Game

May 17, 2025

Angel Reese Supports Brother Touching Mothers Day Message During Ncaa Game

May 17, 2025 -

Save On Apple Tv 3 Months For Just 3

May 17, 2025

Save On Apple Tv 3 Months For Just 3

May 17, 2025 -

Gwendoline Christies Severance Role A Challenge After Game Of Thrones

May 17, 2025

Gwendoline Christies Severance Role A Challenge After Game Of Thrones

May 17, 2025 -

Brace For A Credit Score Drop The Impact Of Missed Student Loan Payments

May 17, 2025

Brace For A Credit Score Drop The Impact Of Missed Student Loan Payments

May 17, 2025

Latest Posts

-

Anunoby Brilla Con 27 Puntos En Victoria De Knicks Sobre 76ers

May 17, 2025

Anunoby Brilla Con 27 Puntos En Victoria De Knicks Sobre 76ers

May 17, 2025 -

Ny Knicks Vs Brooklyn Nets Free Live Stream 4 13 25 Time Tv Channel And Nba Season Finale Details

May 17, 2025

Ny Knicks Vs Brooklyn Nets Free Live Stream 4 13 25 Time Tv Channel And Nba Season Finale Details

May 17, 2025 -

Knicks Derrotan A 76ers 105 91 Anunoby Lidera Con 27 Puntos

May 17, 2025

Knicks Derrotan A 76ers 105 91 Anunoby Lidera Con 27 Puntos

May 17, 2025 -

Anunoby Anota 27 Knicks Vencen A 76ers Novena Derrota Seguida

May 17, 2025

Anunoby Anota 27 Knicks Vencen A 76ers Novena Derrota Seguida

May 17, 2025 -

Piston And Knicks Season Performance A Statistical Comparison

May 17, 2025

Piston And Knicks Season Performance A Statistical Comparison

May 17, 2025