Ethereum Forecast: 1.11M ETH Accumulated, Implications For Price

Table of Contents

Whale Accumulation and its Significance

"Whales," in the cryptocurrency market, refer to entities holding massive amounts of a particular cryptocurrency, wielding significant influence over its price movements. Their actions, such as buying or selling large quantities of ETH, can trigger substantial price swings. The recent accumulation of 1.11 million ETH points towards a strong belief among these major players in the future potential of Ethereum.

Several factors could be driving this accumulation:

-

Anticipation of future price increases: Whales might be anticipating positive catalysts like successful Ethereum upgrades or increased adoption, leading them to accumulate ETH in expectation of future profits.

-

Upcoming upgrades: The upcoming Shanghai upgrade and other planned developments could be fueling this accumulation, as whales position themselves to benefit from these advancements.

-

Institutional investment: Increasing institutional interest in Ethereum might be a major driver, with large firms and funds acquiring substantial quantities of ETH.

-

Analysis of on-chain data: Examining on-chain data reveals a consistent influx of ETH into specific wallets, supporting the claim of significant accumulation.

-

Comparison to previous accumulation patterns: Comparing this accumulation to past instances reveals similarities in patterns preceding significant price rallies.

-

Long-term vs. short-term strategies: While some whales might be aiming for short-term gains, others might be employing long-term strategies, accumulating ETH for potential future price appreciation.

Market Sentiment and Ethereum's Future

Current market sentiment towards Ethereum is predominantly bullish, though subject to constant shifts. While recent price movements have impacted investor confidence, the overall feeling is cautiously optimistic. Several factors contribute to this sentiment:

- Positive news and events: Successful Ethereum upgrades, growing adoption in DeFi applications, and positive regulatory developments contribute to bullish sentiment.

- Social media sentiment analysis: Social media sentiment tracking shows a prevalence of positive sentiment surrounding Ethereum and its future prospects.

- Impact of recent price movements: While short-term price fluctuations can influence sentiment, the overall trend in recent months points towards a positive outlook.

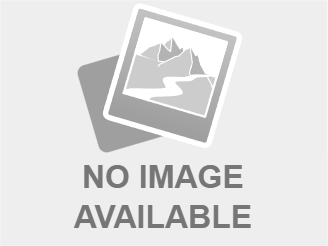

- Correlation with the overall cryptocurrency market: Ethereum's price often correlates with the broader cryptocurrency market. A positive trend in the overall market generally supports a bullish Ethereum forecast.

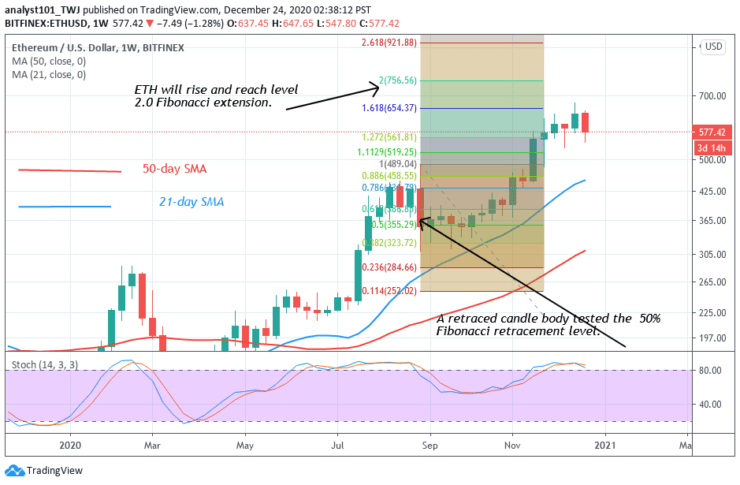

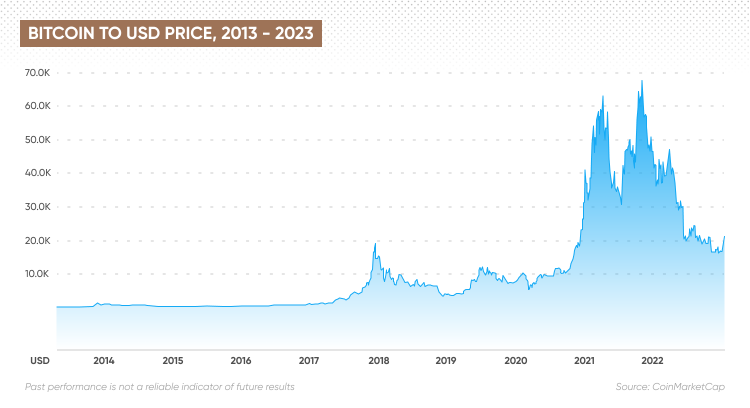

Technical Analysis: Chart Patterns and Price Predictions

Technical analysis uses historical price and volume data to predict future price movements. Analyzing Ethereum's charts reveals several key patterns:

- Support and Resistance levels: Identifying key support and resistance levels helps predict potential price bounces or breakouts.

- Moving averages: Analyzing moving averages offers insights into the overall trend and potential momentum shifts.

Based on this analysis, potential price targets can be suggested; however, it's crucial to remember that price predictions are inherently speculative. While the 1.11M ETH accumulation provides a bullish signal, several factors need consideration before making firm predictions.

- Charts and graphs: Visual representations of price action, support/resistance levels, and moving averages are crucial for understanding the technical analysis.

- Technical indicators: Various indicators, such as RSI and MACD, provide further insights into price trends and momentum.

- Price targets: While specific price targets can be derived, it's essential to emphasize the uncertain nature of price forecasting in the volatile cryptocurrency market.

Risk Factors and Considerations

Despite the bullish signals from the ETH accumulation, several risks could negatively impact the Ethereum price forecast:

-

Regulatory uncertainty: Government regulations and their impact on the cryptocurrency market are a significant risk factor.

-

Market volatility: The inherently volatile nature of the cryptocurrency market poses a considerable risk.

-

Competing cryptocurrencies: Competition from other cryptocurrencies can affect Ethereum's price.

-

Macroeconomic factors: Global economic events and conditions can have a significant impact on the cryptocurrency market, affecting Ethereum's price.

-

Specific regulatory risks: Changes in tax laws, restrictions on trading, or outright bans can dramatically affect the price of ETH.

-

Impact of macroeconomic factors: Inflation, recessionary fears, and geopolitical instability can influence investor sentiment and Ethereum's price.

-

Volatility inherent in crypto investments: Investors should always be prepared for significant price swings and potential losses.

Conclusion: Ethereum Forecast – Making Informed Decisions Based on 1.11M ETH Accumulation

The accumulation of 1.11 million ETH presents a strong bullish signal, suggesting significant confidence in Ethereum's future. However, it's essential to consider various risk factors like market volatility and regulatory uncertainty. While the large-scale ETH accumulation offers a positive outlook for the Ethereum price, investors should approach any price predictions with caution. The information provided here should serve as a starting point for your own research. Remember, the cryptocurrency market is highly dynamic.

To make informed decisions, stay updated on the latest Ethereum forecast, monitor ETH accumulation trends, and learn more about Ethereum price predictions from reputable sources. Conduct thorough research and consider your risk tolerance before investing in Ethereum. Remember, this analysis provides insights, but investing in cryptocurrencies always involves risk.

Featured Posts

-

Initial D C Meeting Carneys View Of Trump As A Transformational President

May 08, 2025

Initial D C Meeting Carneys View Of Trump As A Transformational President

May 08, 2025 -

Inter Milans All Time Classic Win Against Barcelona Champions League Final

May 08, 2025

Inter Milans All Time Classic Win Against Barcelona Champions League Final

May 08, 2025 -

Central Cordoba Fortaleza Institucional En Su Estadio El Gigante De Arroyito

May 08, 2025

Central Cordoba Fortaleza Institucional En Su Estadio El Gigante De Arroyito

May 08, 2025 -

Dyshime Te Medha Rrethojne Arsenalin Pas Ndeshjes Me Psg Akuza Per Shkelje Te Rregullave Te Uefa S

May 08, 2025

Dyshime Te Medha Rrethojne Arsenalin Pas Ndeshjes Me Psg Akuza Per Shkelje Te Rregullave Te Uefa S

May 08, 2025 -

Pavle Grbovic I Prelazna Vlada Prihvatljivi Predlozi

May 08, 2025

Pavle Grbovic I Prelazna Vlada Prihvatljivi Predlozi

May 08, 2025

Latest Posts

-

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025 -

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025 -

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025 -

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025 -

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025