Ethereum Price Analysis: Resilience And Future Outlook

Table of Contents

Current Market Conditions and Ethereum's Performance

Analyzing Ethereum's current price requires a multifaceted approach. We need to consider its performance relative to its all-time high, recent lows, and its relationship with other cryptocurrencies and the overall market sentiment. Currently, Ethereum (ETH) is trading at [insert current ETH/USD price] – a [insert percentage change] fluctuation from its previous [daily/weekly/monthly] closing price. This movement needs to be contextualized within the broader cryptocurrency market.

- Current ETH/USD Price: [Insert current price and percentage change from 24 hours, 7 days, and 30 days ago].

- Trading Volume: [Insert current trading volume and compare it to recent averages. Analyze whether this indicates high investor activity or market stagnation]. High trading volume, for example, often signifies significant market interest and potential for price movement. Conversely, low volume might point to consolidation or a lack of momentum.

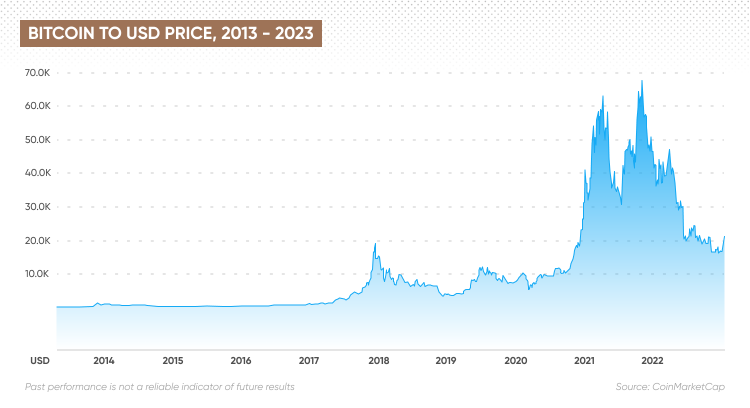

- Correlation with Bitcoin (BTC): The correlation coefficient between ETH and BTC is currently [insert correlation coefficient]. A strong positive correlation suggests ETH price movements often mirror Bitcoin's, whereas a weaker correlation might imply increasing independence.

- Altcoin Season: The current market sentiment suggests [bullish/bearish/neutral] conditions for altcoins. [Explain whether altcoin season is expected to influence the ETH price positively or negatively. Provide data or evidence supporting your explanation.]

Factors Influencing Ethereum's Price

Numerous factors contribute to Ethereum's price volatility. Understanding these influences is crucial for predicting future price movements. Both positive and negative developments significantly affect the ETH price.

- Ethereum 2.0: The ongoing transition to Ethereum 2.0, with its shift to a proof-of-stake consensus mechanism, is expected to enhance scalability, security, and energy efficiency. This upgrade is likely to have a long-term positive impact on Ethereum's price, reducing transaction fees and boosting adoption.

- DeFi Growth: The thriving Decentralized Finance (DeFi) ecosystem built on Ethereum continues to attract significant investment and user activity. The increasing popularity of DeFi applications directly impacts the demand for ETH, as it's used for transactions and governance within these platforms.

- NFT Market: The explosive growth of the Non-Fungible Token (NFT) market has strongly correlated with Ethereum's price. NFTs often rely on the Ethereum blockchain for their creation and trading, increasing the demand for ETH.

- Blockchain Adoption: Wider adoption of blockchain technology across various sectors, from supply chain management to healthcare, increases the overall value proposition of Ethereum and consequently, its price.

- Regulatory Landscape: Evolving regulations concerning cryptocurrencies globally can significantly influence investor confidence and, in turn, affect Ethereum's price. Stringent regulations might dampen enthusiasm, whereas supportive frameworks can boost investor interest.

- Institutional Investment: Increased institutional investment in Ethereum by large financial institutions adds legitimacy and stability to the cryptocurrency, potentially leading to price appreciation.

- Technological Advancements: Continued development and innovation within the Ethereum ecosystem, including improvements to smart contracts and layer-2 scaling solutions, enhance its utility and attract more users.

Technical Analysis of Ethereum's Price

Technical analysis offers a valuable tool for interpreting Ethereum's price trends. By examining historical price data and using various technical indicators, we can identify potential support and resistance levels, predict short-term price movements, and gain insights into overall market momentum. However, it's crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

- Support and Resistance Levels: Based on current charts, key support levels for ETH are [insert levels] and resistance levels are [insert levels]. A break above resistance could indicate bullish momentum.

- Moving Averages: The 50-day moving average is currently [insert value] and the 200-day moving average is at [insert value]. A bullish crossover (50-day MA crossing above 200-day MA) might suggest a potential price increase.

- Technical Indicators: Indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) show [insert current values and interpretation]. For example, an RSI above 70 might suggest the market is overbought, while an RSI below 30 could signal an oversold condition.

- Chart Patterns: The current ETH chart might exhibit [mention any observable chart patterns, e.g., head and shoulders, triangles, flags] which could suggest [interpret the implications of the pattern for potential future price movements].

- Disclaimer: Technical analysis is not a guaranteed prediction tool and should be considered alongside other factors.

Ethereum Price Prediction and Future Outlook

Predicting the future price of Ethereum is inherently speculative. However, by considering the factors discussed above, we can construct plausible scenarios.

- Short-term Prediction (Next Few Months): Considering the current market conditions and technical analysis, a [bullish/bearish/neutral] outlook is anticipated, with a price range of [insert price range]. This prediction hinges on [mention key factors influencing the prediction].

- Medium-term Prediction (Next Year): Assuming successful implementation of Ethereum 2.0 and continued growth in DeFi and NFTs, a price range of [insert price range] is possible. However, potential regulatory changes and macroeconomic factors could significantly impact this forecast.

- Long-term Prediction (Next 5 Years): Over the long term, Ethereum's potential for growth remains high, driven by increased blockchain adoption and the ongoing development of its ecosystem. A potential price range of [insert price range] is not unreasonable, but this is highly speculative and subject to various external and internal factors.

- Potential Risks: Factors like regulatory uncertainty, competition from other blockchain platforms, and overall macroeconomic conditions pose significant risks to Ethereum's price.

- Speculative Nature: It is imperative to remember that all price predictions are inherently speculative. This analysis should not be taken as financial advice.

Conclusion

This Ethereum price analysis highlights the complex interplay of factors driving ETH's price. While its resilience is evident in its recovery from previous lows, the inherent volatility of the cryptocurrency market demands a cautious approach. The ongoing development of Ethereum 2.0, the growth of DeFi and NFTs, and broader blockchain adoption present significant potential for future growth. However, regulatory hurdles, market sentiment shifts, and competition remain substantial risks. Remember to conduct thorough research and consider your own risk tolerance before making any investment decisions related to Ethereum. For more in-depth Ethereum price analysis and predictions, continue exploring resources dedicated to cryptocurrency market analysis.

Featured Posts

-

Two Home Runs For Mike Trout Not Enough As Angels Fall To Giants

May 08, 2025

Two Home Runs For Mike Trout Not Enough As Angels Fall To Giants

May 08, 2025 -

The Life Of Chuck Movie Stephen Kings Positive Review And Trailer Launch

May 08, 2025

The Life Of Chuck Movie Stephen Kings Positive Review And Trailer Launch

May 08, 2025 -

Chinas Growing Presence In Greenland A Threat To Us Interests

May 08, 2025

Chinas Growing Presence In Greenland A Threat To Us Interests

May 08, 2025 -

Where To Watch The Thunder Vs Trail Blazers Game On March 7th

May 08, 2025

Where To Watch The Thunder Vs Trail Blazers Game On March 7th

May 08, 2025 -

Psg Vence Al Lyon En Su Propio Estadio

May 08, 2025

Psg Vence Al Lyon En Su Propio Estadio

May 08, 2025

Latest Posts

-

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025 -

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025 -

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025 -

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025 -

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025