Ethereum Price Analysis: Resistance Broken, $2,000 On The Horizon?

Table of Contents

Keywords: Ethereum price, ETH price prediction, Ethereum price analysis, ETH analysis, cryptocurrency price, $2000 Ethereum, Ethereum resistance, Ethereum market, crypto market analysis

The cryptocurrency market is constantly evolving, and Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is no exception. Recent price action suggests a potential breakout, leaving many investors wondering: is Ethereum on the verge of reaching $2,000? This Ethereum price analysis delves into the recent market movements, technical indicators, and fundamental factors influencing ETH's price, offering insights into its potential future trajectory.

Recent Price Action and Technical Analysis

Ethereum's price has shown considerable volatility in recent weeks. After consolidating around the $1,600 to $1,800 range, a decisive break above a key resistance level has ignited optimism. This analysis will examine the technical aspects of this move.

-

Resistance Levels Broken: The recent surge saw ETH decisively break through previous resistance levels around $1,850 and $1,900, suggesting strong buying pressure. This is a bullish signal for many technical analysts.

-

Chart Patterns: Analysis of the ETH/USD chart reveals the potential formation of a bullish flag pattern, which often precedes a significant price increase. This, combined with the volume surge accompanying the breakout, strengthens the bullish outlook.

-

Technical Indicators: Key technical indicators like the Relative Strength Index (RSI) are showing signs of bullish momentum, moving out of oversold territory. The Moving Average Convergence Divergence (MACD) also indicates a potential upward trend. [Insert Chart/Graph showing RSI, MACD, and price action]

-

Ethereum technical analysis suggests a positive trend; however, it's crucial to remember that technical analysis is not foolproof.

Fundamental Factors Influencing Ethereum's Price

The price of Ethereum isn't solely driven by technical indicators; fundamental factors play a crucial role.

-

Ethereum 2.0 and Scalability: The ongoing rollout of Ethereum 2.0 significantly improves the network's scalability and efficiency, addressing previous concerns about transaction speeds and fees. This upgrade is a major catalyst for long-term price growth.

-

DeFi Ecosystem Growth: The decentralized finance (DeFi) ecosystem built on Ethereum continues to expand rapidly. The total value locked (TVL) in DeFi protocols on Ethereum remains substantial, indicating strong underlying demand for ETH.

-

NFT Market Activity: Non-fungible tokens (NFTs) built on the Ethereum blockchain continue to generate significant interest. While NFT market activity can be volatile, it often correlates with ETH price movements.

-

Regulatory Developments: The regulatory landscape for cryptocurrencies is constantly evolving. Positive regulatory developments can boost investor confidence and drive up ETH price, while negative news can lead to corrections.

-

Bitcoin Ethereum Correlation: Ethereum's price often shows correlation with Bitcoin's price. A strong Bitcoin bull run often positively impacts the price of other cryptocurrencies, including Ethereum.

Potential for $2,000 and Future Price Predictions

Given the recent price action and the underlying fundamental strengths of the Ethereum network, a move towards $2,000 is certainly a possibility.

-

Catalysts for Growth: Further adoption of Ethereum 2.0, the launch of new DeFi applications, and increasing NFT market activity could all contribute to significant price appreciation.

-

Potential Roadblocks: Regulatory uncertainty, a broader cryptocurrency market correction, and unforeseen technical issues could hinder ETH's price growth.

-

Price Prediction Ranges: Predicting cryptocurrency prices is inherently speculative. However, based on the current market conditions and technical analysis, a short-term price range of $1,800-$2,200 is possible. Mid-term (6-12 months) predictions are even more uncertain, with a broader range of possibilities. Long-term price predictions are highly speculative and depend on numerous factors.

-

Disclaimer: Investing in cryptocurrencies like Ethereum is inherently risky. The market is highly volatile, and significant price swings are common. Always conduct your own research and only invest what you can afford to lose.

Risk Management and Investing in Ethereum

Before investing in Ethereum, consider the following:

-

Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio to mitigate risk.

-

Affordable Risk: Only invest an amount you're comfortable losing completely. Cryptocurrency markets are exceptionally volatile.

-

Thorough Research: Before investing in any cryptocurrency, thoroughly research the project, its technology, and the market conditions.

Alternative Cryptocurrencies and Comparison

While Ethereum is a leading cryptocurrency, it's essential to compare it with its competitors.

-

Bitcoin vs Ethereum: Bitcoin remains the dominant cryptocurrency, holding a significantly larger market capitalization. However, Ethereum's expanding ecosystem and utility in DeFi and NFTs provide unique strengths.

-

Ethereum Competitors: Other platforms like Solana, Cardano, and Avalanche compete with Ethereum in various aspects. Each offers different strengths and weaknesses regarding scalability, transaction fees, and features. Understanding these differences is crucial.

-

Market Capitalization and Market Share: Ethereum holds a significant market share in the cryptocurrency space, but its market dominance is constantly challenged by emerging competitors.

Conclusion

This Ethereum price analysis indicates a potential for a significant price increase towards $2,000, driven by both technical and fundamental factors. However, the cryptocurrency market remains highly volatile, and investing in Ethereum carries substantial risk. Thorough research, risk management strategies, and a clear understanding of the factors influencing Ethereum's price are paramount before making any investment decisions.

Call to Action: Stay informed on the latest Ethereum price analysis and market trends to make well-informed investment decisions. Keep an eye on our website for further updates on the Ethereum price and future analysis. Learn more about Ethereum price movements and predictions.

Featured Posts

-

April 9th Lotto Jackpot Results Check The Winning Numbers

May 08, 2025

April 9th Lotto Jackpot Results Check The Winning Numbers

May 08, 2025 -

Batmans New Beginning Dc Comics Unveils 1 Issue And Updated Suit

May 08, 2025

Batmans New Beginning Dc Comics Unveils 1 Issue And Updated Suit

May 08, 2025 -

Breaking News F4 Elden Ring Possum And Superman Updates

May 08, 2025

Breaking News F4 Elden Ring Possum And Superman Updates

May 08, 2025 -

Lotto Plus 1 And 2 Results Find The Latest Winning Lotto Numbers

May 08, 2025

Lotto Plus 1 And 2 Results Find The Latest Winning Lotto Numbers

May 08, 2025 -

Kripto Lider Kripto Para Duenyasinda Yeni Bir Devir Mi

May 08, 2025

Kripto Lider Kripto Para Duenyasinda Yeni Bir Devir Mi

May 08, 2025

Latest Posts

-

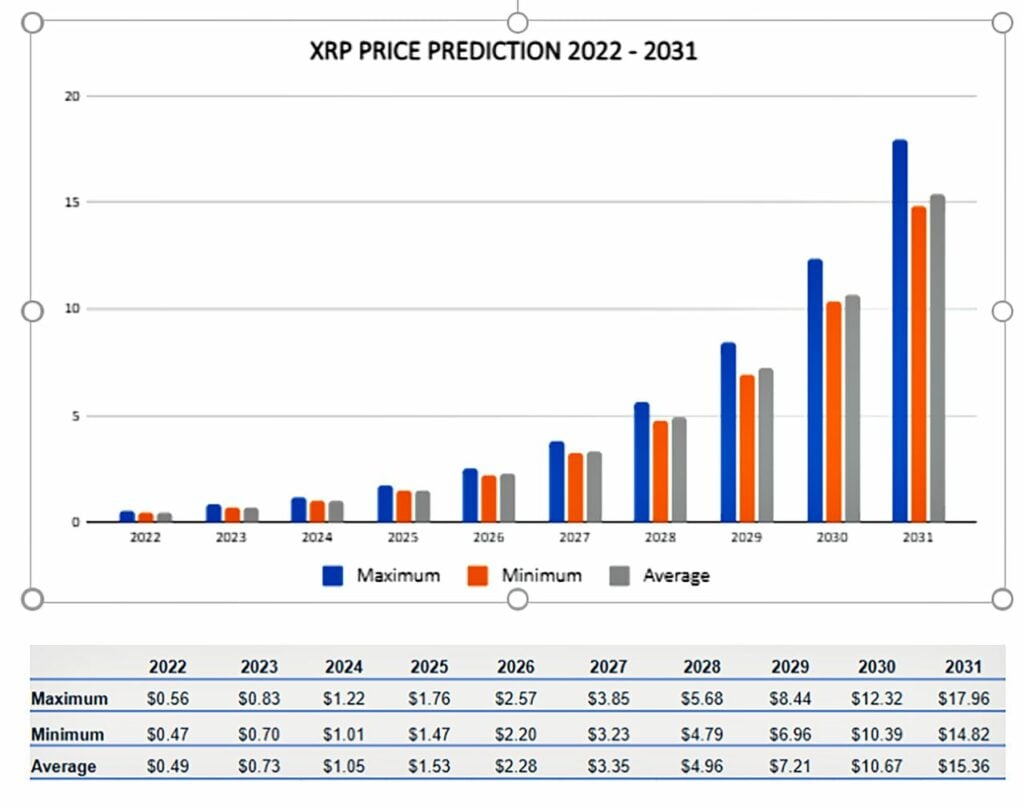

Xrp Future Price Analyzing The Potential For Growth Following The Sec Case

May 08, 2025

Xrp Future Price Analyzing The Potential For Growth Following The Sec Case

May 08, 2025 -

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025 -

Will Xrp Reach 5 An Xrp Price Prediction Analysis Post Sec Lawsuit

May 08, 2025

Will Xrp Reach 5 An Xrp Price Prediction Analysis Post Sec Lawsuit

May 08, 2025 -

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 08, 2025

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 08, 2025 -

Official Lotto And Lotto Plus Results April 2 2025 Wednesday

May 08, 2025

Official Lotto And Lotto Plus Results April 2 2025 Wednesday

May 08, 2025