Ethereum Price Analysis: Support At $1,600 – What's Next For ETH?

Table of Contents

Technical Analysis of Ethereum Price

Understanding the technical aspects is crucial for any Ethereum price analysis. Let's examine the key support and resistance levels and the current momentum.

Support and Resistance Levels

The $1,600 level acts as significant support for ETH. A break below this level could trigger further downward pressure, potentially leading to a retest of lower support levels. Conversely, a strong bounce off this support indicates buying pressure and potential upward movement. Resistance levels above $1,600 include $1,800 and $2,000, which could act as hurdles for any significant price rally.

- Moving Averages: The 50-day and 200-day moving averages are key indicators to watch. A bullish crossover (50-day crossing above the 200-day) could signal a potential uptrend.

- RSI (Relative Strength Index): The RSI measures the momentum of price changes. Readings below 30 suggest oversold conditions, potentially indicating a bounce, while readings above 70 suggest overbought conditions, potentially leading to a correction.

- MACD (Moving Average Convergence Divergence): The MACD helps identify changes in momentum. A bullish crossover (MACD line crossing above the signal line) suggests a potential upward trend.

- Breakouts and Breakdowns: A decisive break above $1,800 could signal a strong bullish trend, while a break below $1,600 could signal a bearish trend, potentially leading to further price declines.

Trading Volume and Momentum

Analyzing trading volume alongside price movements provides a more comprehensive Ethereum price analysis. High volume during a price increase confirms the strength of the bullish movement, while high volume during a price decrease confirms bearish pressure. Low volume during price movements, however, suggests weak conviction and potential for reversals.

- Price and Volume Relationship: Increased volume during price increases signifies strong buying pressure, while increased volume during price decreases points to strong selling pressure.

- Momentum Indicators: Indicators like the RSI and MACD can also help gauge the strength of the current momentum. A strong upward momentum, coupled with high volume, suggests a bullish trend is likely to continue.

Market Sentiment and News Affecting Ethereum

Market sentiment and relevant news significantly influence Ethereum's price. Let's examine both the general crypto market and Ethereum-specific factors.

General Market Conditions

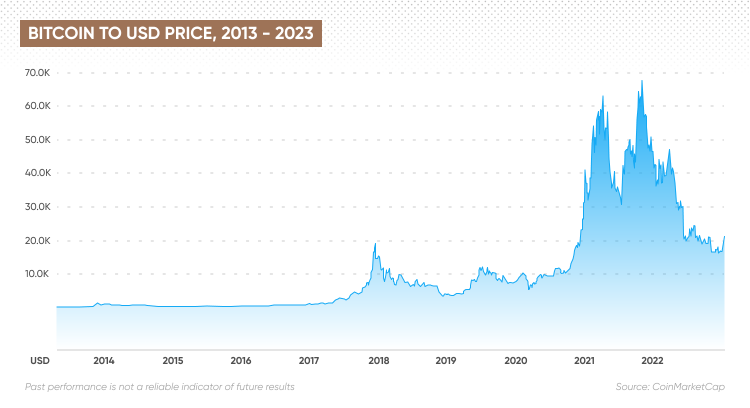

The overall cryptocurrency market sentiment plays a vital role in ETH's price. A positive market sentiment, often reflected in Bitcoin's price, usually boosts ETH's price, while a negative sentiment often results in a decline.

- Correlation with Bitcoin: ETH tends to exhibit a strong correlation with Bitcoin. A significant move in Bitcoin's price often leads to a similar move in ETH's price.

- Regulatory News: Regulatory announcements from governments worldwide can significantly impact the entire crypto market, including ETH.

- Macroeconomic Factors: Global economic conditions, such as inflation and interest rates, can also influence investor sentiment and the price of cryptocurrencies, including ETH.

- Fear and Greed Index: This index gauges overall market sentiment, with high fear suggesting potential for a price drop and high greed suggesting potential for a price increase.

Ethereum-Specific News and Developments

Ethereum-specific news and developments directly impact its price.

- Network Upgrades (e.g., Shanghai Upgrade): Successful network upgrades often lead to positive price movements, reflecting increased confidence in the network's stability and scalability.

- DeFi Activity: Increased activity in the decentralized finance (DeFi) ecosystem on Ethereum typically correlates with a positive price movement.

- NFT Market Trends: The non-fungible token (NFT) market's performance can also influence ETH's price. Increased NFT trading volume generally correlates with higher ETH demand.

- Network Congestion and Transaction Fees: High network congestion and transaction fees can negatively impact user experience and potentially depress price.

Predicting Future Ethereum Price Movement

Based on our analysis, several scenarios are possible.

Bullish Scenarios

A bullish scenario for ETH involves factors such as:

- Increased Institutional Adoption: More significant institutional investment could drive up demand and price.

- Positive Regulatory News: Favorable regulatory developments could boost investor confidence.

- Strong DeFi Activity: Continued growth and innovation within the DeFi ecosystem would support higher prices.

- Bullish Technical Indicators: A bullish crossover in moving averages and positive momentum indicators would signal a potential price increase.

Bearish Scenarios

A bearish scenario could unfold due to factors like:

- Negative Regulatory News: Unfavorable regulatory actions could trigger a sell-off.

- Broader Crypto Market Downturn: A general downturn in the crypto market would likely impact ETH negatively.

- Security Concerns: Any significant security vulnerabilities discovered in the Ethereum network could lead to a price drop.

- Weak Technical Indicators: Negative momentum indicators and bearish crossovers in moving averages could point to further price declines.

Risk Assessment

Investing in Ethereum carries inherent risks. The cryptocurrency market is highly volatile, and prices can fluctuate significantly in short periods. Before making any investment decisions, carefully assess your risk tolerance.

Conclusion

This Ethereum price analysis highlights the importance of the $1,600 support level for ETH. Both bullish and bearish scenarios are possible, depending on several factors, including market sentiment, technical indicators, and Ethereum-specific developments. While a bounce from the support is possible, a break below could lead to further price declines. Conduct thorough research and consider the information presented here before making any investment decisions. Stay informed about the latest Ethereum price analysis to make informed investment decisions. Continue monitoring the Ethereum price and key indicators for future insights. For more in-depth analysis, explore reputable cryptocurrency news sources and technical analysis platforms.

Featured Posts

-

Preview Arsenal Vs Psg Champions League Semi Final Match Analysis

May 08, 2025

Preview Arsenal Vs Psg Champions League Semi Final Match Analysis

May 08, 2025 -

Analysis Trump Media Crypto Com Etf Collaboration And The Cro Surge

May 08, 2025

Analysis Trump Media Crypto Com Etf Collaboration And The Cro Surge

May 08, 2025 -

Is This Ethereum Buy Signal Real Weekly Chart Analysis And Predictions

May 08, 2025

Is This Ethereum Buy Signal Real Weekly Chart Analysis And Predictions

May 08, 2025 -

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025 -

Deandre Dzordan I Nikola Jokic Neobican Obicaj I Uloga Bobija Marjanovica

May 08, 2025

Deandre Dzordan I Nikola Jokic Neobican Obicaj I Uloga Bobija Marjanovica

May 08, 2025

Latest Posts

-

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025 -

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025 -

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025 -

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025 -

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025