Ethereum Price Holds Above Key Support: Could A Drop To $1,500 Be Next?

Table of Contents

Analyzing Ethereum's Current Support Levels

Understanding Ethereum's current position requires a thorough examination of several key indicators and metrics.

Key Technical Indicators

Technical analysis provides valuable insights into potential price movements. Let's look at some key indicators:

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A reading above 70 generally suggests an overbought market, while a reading below 30 indicates an oversold market. Currently, the Ethereum RSI is [insert current RSI value and interpretation, e.g., at 55, suggesting neither overbought nor oversold conditions]. (Include a chart here)

- Moving Averages (MA): Moving averages, such as the 50-day and 200-day MA, smooth out price fluctuations to identify trends. A bullish crossover occurs when a shorter-term MA crosses above a longer-term MA, indicating potential upward momentum. Conversely, a bearish crossover suggests a potential price decline. [Insert current MA values and interpretation, including chart].

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. A bullish signal is generated when the MACD line crosses above the signal line, suggesting a potential price increase. [Insert current MACD value and interpretation, including chart].

On-Chain Metrics

On-chain data provides a deeper understanding of Ethereum's network activity and user engagement:

- Active Addresses: The number of unique addresses interacting with the Ethereum network is a strong indicator of network health and user adoption. A rising number of active addresses typically suggests positive price momentum. [Insert current data and source link, e.g., Glassnode].

- Transaction Volume: High transaction volume indicates increased network activity and demand for Ethereum. [Insert current data and source link].

- Gas Fees: Gas fees reflect the cost of transactions on the Ethereum network. High gas fees can indicate congestion and high demand, but also potentially deter users, impacting price. [Insert current data and source link].

Impact of Recent Market Events

Recent events significantly influence Ethereum's price:

- Regulatory Developments: Any regulatory announcements regarding cryptocurrencies, particularly in major markets like the US, can cause significant price swings. [Describe specific recent regulatory events and their impact].

- Market Sentiment: Overall market sentiment towards cryptocurrencies heavily impacts Ethereum's price. Negative news or market crashes can trigger widespread selling pressure. [Discuss current market sentiment and its effects].

- Competitor Developments: The progress and adoption of competing blockchain technologies can affect Ethereum's market share and price. [Discuss advancements from competitors and their potential impact].

Factors Suggesting a Potential Drop to $1,500

Several factors could contribute to a potential drop in Ethereum's price to $1,500:

Bearish Market Sentiment

- Negative predictions from analysts and experts can create a self-fulfilling prophecy, leading to increased selling pressure. [Cite examples of negative predictions].

- Fear, Uncertainty, and Doubt (FUD) in the crypto community can cause a rapid price decline.

Macroeconomic Factors

- High inflation and rising interest rates can cause investors to move away from riskier assets like cryptocurrencies, impacting Ethereum's price.

- Recession fears can further dampen investor confidence, leading to a sell-off.

Technical Resistance Levels

- The price of Ethereum may encounter resistance at certain price points, hindering upward movement. [Explain specific resistance levels and their significance, including chart].

- Failure to break through these resistance levels could trigger a price correction, potentially leading to a drop toward $1,500.

Factors Supporting Ethereum's Price Above $1,500

Despite the potential for a drop, several factors support Ethereum's price remaining above $1,500:

Strong Fundamental Base

- Ethereum's role in decentralized finance (DeFi) and the non-fungible token (NFT) market provides a strong fundamental base for its value.

- Ongoing developments like layer-2 scaling solutions improve Ethereum's efficiency and scalability, attracting more users and developers.

Institutional Adoption

- Increased institutional investment in Ethereum signifies growing confidence in its long-term prospects. [Cite examples of institutional investments].

- This institutional adoption often acts as a stabilizing force for the price.

Positive Developer Activity

- The continuous development and improvement of the Ethereum network attract more developers and users, leading to increased network activity and potential price appreciation. [Mention specific recent upgrades and developments].

- A robust and active developer community is a key indicator of a project's long-term viability.

Conclusion: Ethereum Price Outlook and Next Steps

The possibility of Ethereum dropping to $1,500 is real, influenced by bearish market sentiment, macroeconomic headwinds, and technical resistance levels. However, Ethereum's strong fundamentals, growing institutional adoption, and positive developer activity offer a counterbalance. Monitoring key support and resistance levels, along with crucial on-chain metrics and macroeconomic indicators, is vital. A balanced outlook acknowledges both risks and opportunities. Stay informed about the evolving Ethereum price and its key support levels to make well-informed investment decisions. A drop to $1500 could present a buying opportunity for long-term investors, but careful analysis is crucial.

Featured Posts

-

Nc State Faces Recruiting Challenge After Raphaels Exit

May 08, 2025

Nc State Faces Recruiting Challenge After Raphaels Exit

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025 -

Exceptional Okc Thunder Performances A Rare Double Feat

May 08, 2025

Exceptional Okc Thunder Performances A Rare Double Feat

May 08, 2025 -

5 Military Movies Blending Heart And Action Warfare On Screen

May 08, 2025

5 Military Movies Blending Heart And Action Warfare On Screen

May 08, 2025 -

Sony Ps 5 Pro A Deep Dive Into Its Liquid Metal Cooling System Via Teardown

May 08, 2025

Sony Ps 5 Pro A Deep Dive Into Its Liquid Metal Cooling System Via Teardown

May 08, 2025

Latest Posts

-

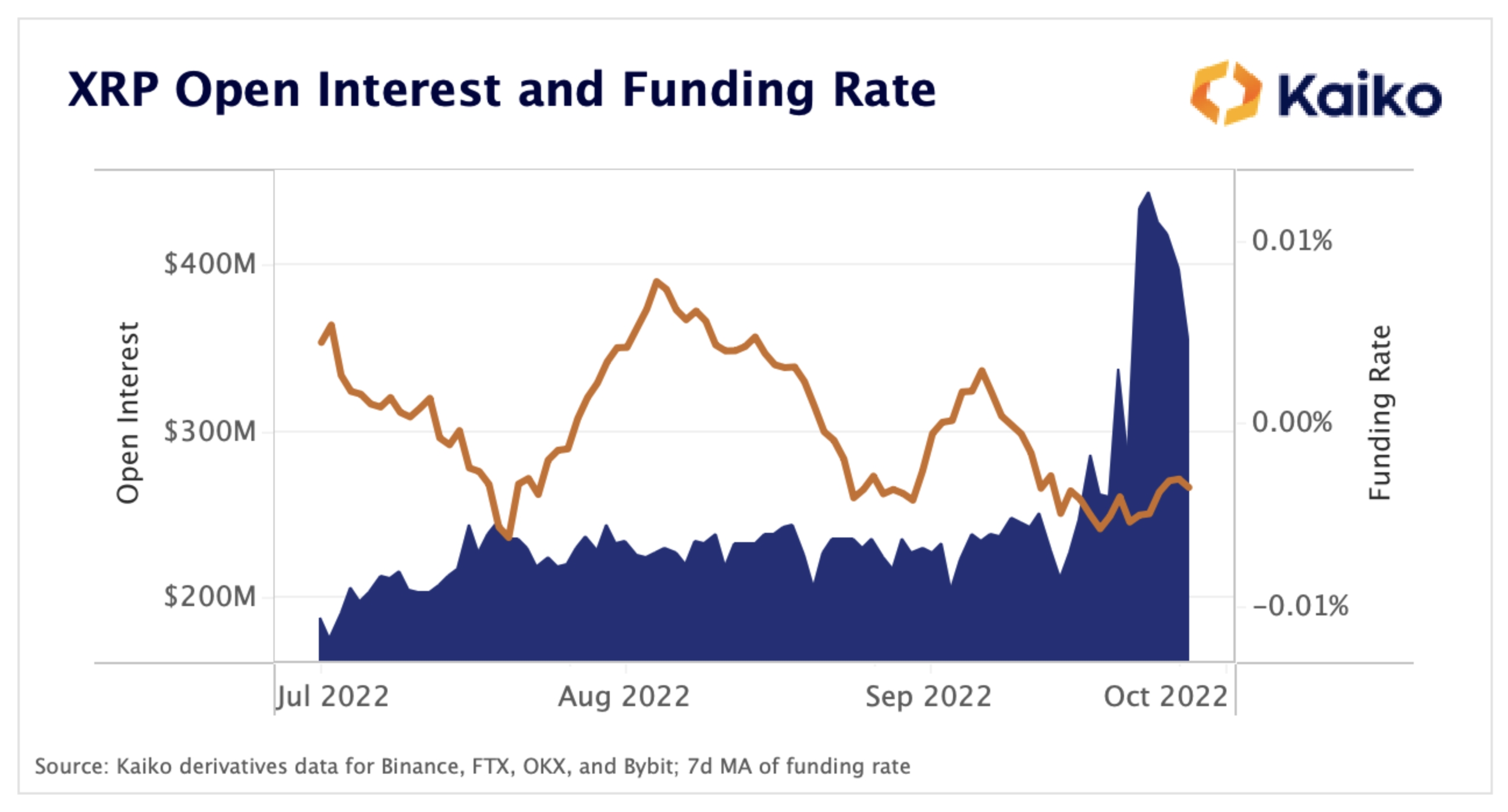

Can Xrp Reach New Heights After A 400 Price Increase

May 08, 2025

Can Xrp Reach New Heights After A 400 Price Increase

May 08, 2025 -

Xrps Trading Volume Surges Past Solana On Etf Hopes

May 08, 2025

Xrps Trading Volume Surges Past Solana On Etf Hopes

May 08, 2025 -

Xrps 400 Surge Whats Next For The Crypto

May 08, 2025

Xrps 400 Surge Whats Next For The Crypto

May 08, 2025 -

Xrp Etf Launch By Pro Shares Details And Market Analysis

May 08, 2025

Xrp Etf Launch By Pro Shares Details And Market Analysis

May 08, 2025 -

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025