XRP's 400% Surge: What's Next For The Crypto?

Table of Contents

2. Analyzing the Drivers Behind XRP's 400% Surge:

The Ripple vs. SEC Lawsuit:

The ongoing legal battle between Ripple Labs and the SEC significantly impacts XRP's price. The SEC's claim that XRP is an unregistered security has created regulatory uncertainty, causing significant price volatility. However, recent court rulings have shown some positive developments for Ripple.

- Positive Developments: [Cite specific court rulings or statements that were positive for Ripple. Link to reputable news sources]. These developments suggest a potential lessening of regulatory uncertainty, boosting investor confidence and driving up the price.

- Expert Opinions: [Quote or summarize analyses from reputable crypto analysts or legal experts regarding the potential outcomes of the lawsuit. Link to these sources]. The ongoing nature of the lawsuit means the price remains sensitive to any news or developments.

- Keywords: Ripple SEC lawsuit, XRP legal battle, regulatory uncertainty, court ruling, SEC regulations.

Increased Institutional Interest and Adoption:

Beyond the legal battles, XRP's price surge reflects growing institutional interest and adoption. RippleNet, Ripple's payment network, facilitates faster and cheaper cross-border transactions, attracting financial institutions seeking efficient solutions.

- Partnerships and Collaborations: [List examples of partnerships between Ripple and financial institutions. Include links to official announcements if possible]. These partnerships demonstrate a growing acceptance of XRP as a viable tool for international payments.

- Potential for Increased Investment: The increasing efficiency and lower costs of cross-border payments using RippleNet position XRP favorably for increased institutional investment. Larger players entering the market could fuel further price increases.

- Keywords: Institutional adoption, cross-border payments, RippleNet, financial institutions, XRP utility.

Market Sentiment and Speculative Trading:

Market sentiment and speculative trading play a significant role in XRP's price volatility. The FOMO (Fear Of Missing Out) effect, fueled by positive news and social media hype, can lead to rapid price increases.

- Social Media Influence: Positive news coverage and social media discussions about XRP can significantly influence investor sentiment and trigger buying sprees, driving the price higher.

- Price Volatility Risks: The speculative nature of the crypto market, coupled with the legal uncertainty surrounding XRP, makes it susceptible to significant price swings. Investors need to be aware of the inherent risks involved.

- Keywords: Market sentiment, FOMO, speculative trading, price volatility, crypto market, XRP price prediction.

2.2. Current Market Sentiment and Technical Analysis:

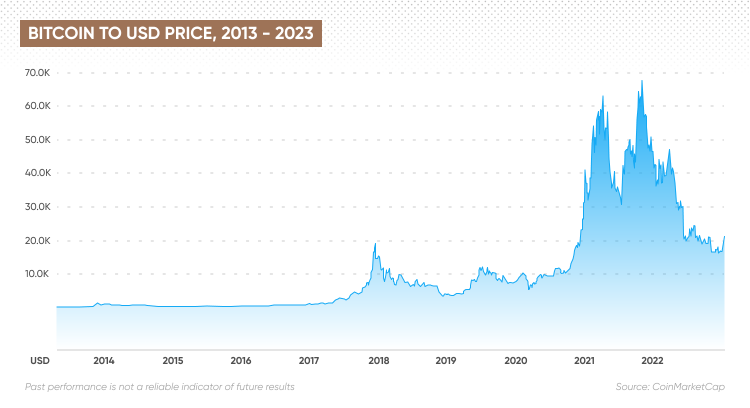

Examining Current Price Trends and Charts:

Analyzing XRP's price chart reveals key support and resistance levels. [Insert a relevant chart or link to a reputable charting website]. Technical indicators like RSI and MACD can provide insights into potential price movements.

- Support and Resistance Levels: [Identify and discuss key support and resistance levels visible on the chart. Explain their significance].

- Technical Indicators: [Analyze the RSI and MACD, or other relevant indicators, and explain their implications for short-term and long-term price trends].

- Keywords: XRP price chart, technical analysis, support levels, resistance levels, RSI, MACD, price trends.

Predicting Future Price Movements (with caution):

Predicting cryptocurrency prices is inherently challenging. Numerous factors influence XRP's future price, including the Ripple vs. SEC lawsuit outcome, regulatory clarity, and adoption rates.

- Scenario 1 (Positive): A favorable court ruling combined with increased institutional adoption could propel XRP's price significantly higher.

- Scenario 2 (Neutral): A prolonged legal battle or slow adoption could lead to sideways price movement or consolidation.

- Scenario 3 (Negative): An unfavorable court ruling could trigger a significant price drop.

- Keywords: XRP price prediction, market analysis, risk management, crypto investment strategy.

2.3. The Future of XRP: Long-Term Prospects and Potential:

Ripple's Ongoing Development and Innovation:

Ripple continues to develop its technology and expand its network. Innovations in blockchain technology and new partnerships could influence XRP's long-term prospects.

- Technological Advancements: [Mention any recent advancements in Ripple's technology or RippleNet. Link to relevant sources].

- New Partnerships: [Highlight any recent or potential partnerships that could drive adoption and increase demand for XRP].

- Keywords: Ripple technology, blockchain technology, fintech innovation, XRP utility, RippleNet.

Regulatory Landscape and its Impact on XRP:

The evolving regulatory landscape for cryptocurrencies significantly impacts XRP's future. Increased regulatory clarity could boost investor confidence, while ongoing uncertainty could hinder growth.

- Global Regulatory Trends: [Discuss the global regulatory environment for cryptocurrencies and how it might affect XRP specifically].

- Potential for Regulatory Clarity: Increased regulatory clarity could reduce uncertainty and attract more mainstream investors.

- Keywords: Crypto regulation, regulatory compliance, SEC regulations, legal framework, regulatory uncertainty.

3. Conclusion: Navigating the Future of XRP After its 400% Surge

XRP's recent 400% surge is a result of a complex interplay of factors, including positive developments in the Ripple vs. SEC lawsuit, growing institutional interest, and market speculation. While the current market sentiment is positive, it’s crucial to remember the inherent volatility of the cryptocurrency market. Technical analysis suggests potential for further growth, but also highlights risks associated with the ongoing legal uncertainty. The future of XRP hinges on the outcome of the lawsuit, the pace of adoption, and the evolving regulatory landscape.

While the recent 400% surge in XRP is impressive, it's crucial to approach investing in XRP with caution and a thorough understanding of the market dynamics. Conduct your own research and develop a well-informed investment strategy before engaging with XRP or any other cryptocurrency. Remember, investing in cryptocurrencies involves significant risk.

Featured Posts

-

Xrps Trading Volume Surges Past Solana On Etf Hopes

May 08, 2025

Xrps Trading Volume Surges Past Solana On Etf Hopes

May 08, 2025 -

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025 -

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025 -

The Champions League Final How Inter Beat Barcelona

May 08, 2025

The Champions League Final How Inter Beat Barcelona

May 08, 2025 -

Rain Shortened Game Paris Home Run Lifts Angels Past White Sox

May 08, 2025

Rain Shortened Game Paris Home Run Lifts Angels Past White Sox

May 08, 2025

Latest Posts

-

Dwp Cuts Benefits Letter Notifications And Next Steps For Claimants

May 08, 2025

Dwp Cuts Benefits Letter Notifications And Next Steps For Claimants

May 08, 2025 -

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025 -

Dwp Benefit Checks A Surge In Home Visits

May 08, 2025

Dwp Benefit Checks A Surge In Home Visits

May 08, 2025 -

Dwp Benefit Scrapped Thousands Affected By April 5th Changes

May 08, 2025

Dwp Benefit Scrapped Thousands Affected By April 5th Changes

May 08, 2025 -

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025