Ethereum Price Prediction: $2,700 On The Horizon?

Table of Contents

Factors Influencing Ethereum's Price

Several key factors contribute to the ongoing debate surrounding the Ethereum price prediction and its potential to hit $2700. These can be broadly categorized into technological advancements, adoption and use cases, and macroeconomic influences.

Technological Advancements

The Ethereum network is constantly evolving. The much-anticipated Ethereum 2.0 upgrade, now in its various stages of implementation, is a game-changer. This upgrade promises to significantly enhance the network's scalability, reducing transaction fees (gas fees) and improving overall efficiency.

- Enhanced Scalability: Ethereum 2.0's sharding mechanism will dramatically increase the network's transaction throughput, addressing a long-standing bottleneck.

- Reduced Transaction Costs: Lower gas fees will make Ethereum more accessible to a wider range of users and applications.

- Improved Security: The transition to proof-of-stake consensus will enhance the network's security and sustainability.

- Layer-2 Solutions: Projects like Polygon and Optimism provide layer-2 scaling solutions, further improving Ethereum's capacity and speed, even before the full Ethereum 2.0 rollout. These are crucial aspects in any Ethereum price forecast.

These Ethereum upgrades directly impact the Ethereum price prediction, making it a significant factor in our analysis.

Adoption and Use Cases

Ethereum's price is heavily influenced by its adoption across various sectors. The explosive growth of decentralized finance (DeFi), non-fungible tokens (NFTs), and the metaverse are major drivers.

- DeFi Boom: Ethereum is the backbone of numerous DeFi protocols, facilitating lending, borrowing, and trading of crypto assets. The growth of this sector directly correlates with increased demand for ETH.

- NFT Market: Ethereum is the dominant platform for NFTs, creating a significant demand for the cryptocurrency. The popularity of NFT marketplaces fuels the price.

- Metaverse Development: As the metaverse develops, Ethereum's role in powering decentralized applications (dApps) and virtual worlds will continue to grow. This is a key component in any long-term Ethereum price prediction.

- Institutional Investment: Growing institutional interest and adoption of Ethereum as a store of value and investment asset further bolster its price. This increased interest is a key factor driving many crypto price prediction models.

Macroeconomic Factors

Global macroeconomic conditions significantly influence cryptocurrency prices, including the price of ETH.

- Inflation and Interest Rates: High inflation and rising interest rates can negatively impact the cryptocurrency market, potentially affecting the Ethereum price forecast.

- Regulatory Landscape: Regulatory clarity and governmental policies towards cryptocurrencies play a crucial role in market sentiment and investment decisions. Any shift in cryptocurrency regulation can dramatically shift the ETH price.

- Market Sentiment: Overall market sentiment and investor confidence are crucial. Negative news or market crashes can significantly affect even the most bullish Ethereum price prediction.

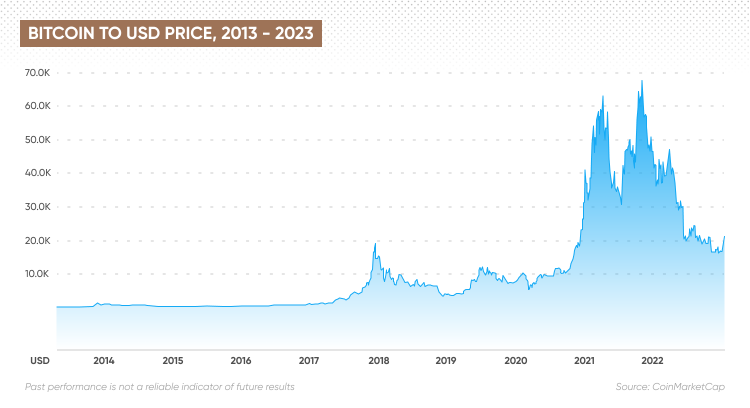

Analyzing Current Market Trends

To formulate a more accurate Ethereum price prediction, we must analyze current market trends through technical and on-chain analysis.

Technical Analysis

Technical analysis uses historical price data and chart patterns to predict future price movements.

- Moving Averages: Examining moving averages (e.g., 50-day, 200-day) can reveal trends and potential support/resistance levels.

- RSI (Relative Strength Index): The RSI indicator helps assess whether ETH is overbought or oversold, offering insights into potential price reversals.

- Support and Resistance Levels: Identifying key support and resistance levels provides potential price targets and areas of consolidation.

On-Chain Metrics

On-chain data provides insights into the underlying activity of the Ethereum network.

- Daily Active Addresses: A rising number of daily active addresses suggests growing network usage and potential price appreciation.

- Transaction Volume: High transaction volume indicates significant network activity and can signal a bullish trend.

- Gas Fees: Monitoring gas fees can reveal network congestion and user activity, giving insight into potential demand.

Potential Scenarios and Risks

Predicting the future price of any cryptocurrency, including Ethereum, is inherently speculative. Let's explore potential scenarios:

Bullish Scenario

A bullish scenario for Ethereum achieving $2700 hinges on continued technological advancements (Ethereum 2.0), widespread adoption across DeFi, NFTs, and the metaverse, and a generally positive macroeconomic climate. Strong institutional investment and positive regulatory developments are also crucial.

Bearish Scenario

A bearish scenario could involve setbacks in Ethereum 2.0 development, a cryptocurrency market downturn triggered by macroeconomic factors, or increased regulatory scrutiny. Negative market sentiment and reduced adoption could also contribute to a lower ETH price.

Neutral Scenario

A neutral scenario acknowledges the inherent uncertainties in cryptocurrency markets. It suggests that ETH might experience periods of both growth and correction before reaching $2700, potentially fluctuating within a certain price range.

Conclusion: Ethereum Price Prediction: A Concluding Look at $2700

The potential for Ethereum to reach $2700 is contingent on a confluence of factors, including technological progress, widespread adoption, and favorable macroeconomic conditions. While the analysis suggests the possibility of ETH reaching this price point, it’s crucial to remember that the cryptocurrency market is inherently volatile and unpredictable. This Ethereum price prediction is not financial advice. Before investing in Ethereum or any other cryptocurrency, conduct thorough research, understand the risks involved, and consider seeking advice from a qualified financial advisor. Learn more about Ethereum price prediction, research the ETH market, stay informed about the future of Ethereum, and monitor the Ethereum price forecast to make informed investment decisions. Remember to always assess your risk tolerance and only invest what you can afford to lose.

Featured Posts

-

Deandre Dzordan I Nikola Jokic Neobican Obicaj I Uloga Bobija Marjanovica

May 08, 2025

Deandre Dzordan I Nikola Jokic Neobican Obicaj I Uloga Bobija Marjanovica

May 08, 2025 -

Trostruki Poljubac Deandre Dzordan I Nikola Jokic Objasnjavaju Tradiciju

May 08, 2025

Trostruki Poljubac Deandre Dzordan I Nikola Jokic Objasnjavaju Tradiciju

May 08, 2025 -

April 16 2025 Daily Lotto Results

May 08, 2025

April 16 2025 Daily Lotto Results

May 08, 2025 -

Kripto Para Mirasi Kayip Sifrelerin Yasal Sonuclari

May 08, 2025

Kripto Para Mirasi Kayip Sifrelerin Yasal Sonuclari

May 08, 2025 -

After Seeing The Long Walk Trailer A Stephen King Adaptation That Defies Expectations

May 08, 2025

After Seeing The Long Walk Trailer A Stephen King Adaptation That Defies Expectations

May 08, 2025

Latest Posts

-

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025 -

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025 -

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025 -

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025 -

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025