Ethereum Price Prediction: Significant ETH Accumulation Fuels Bullish Sentiment

Table of Contents

On-Chain Data Indicates Significant ETH Accumulation

On-chain data provides crucial insights into the behavior of cryptocurrency holders and offers valuable clues for price prediction. By analyzing metrics like exchange flows, the distribution of ETH across addresses, and overall supply, we can gauge market sentiment and potential price movements.

-

Increased Exchange Outflows: Whales, or large ETH holders, are moving substantial amounts of ETH off centralized exchanges. This suggests a decreased likelihood of selling pressure in the near future, as these coins are being held for the long term, rather than being readily available for sale. This is a strong bullish signal often reflected in rising ETH price predictions.

-

Rising Number of ETH Addresses Holding Significant Amounts: A growing number of addresses holding substantial amounts of ETH signals increased confidence and long-term investment in the cryptocurrency. This accumulation further reduces the circulating supply available for trading, potentially fueling price appreciation.

-

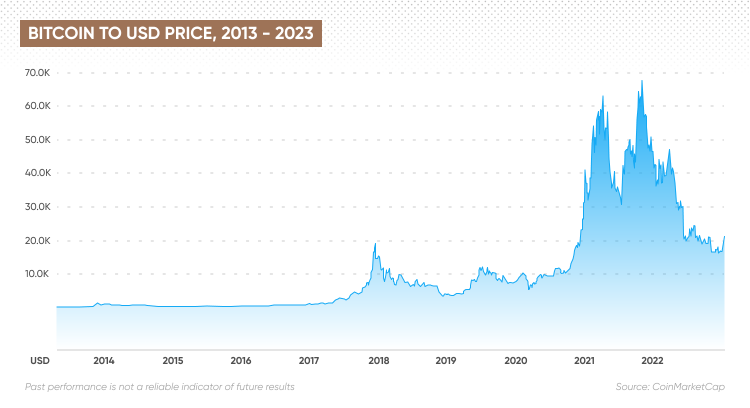

Decreased ETH Supply on Exchanges: The overall decrease in ETH supply on exchanges is a significant indicator of reduced selling pressure. This scarcity, coupled with increased demand, typically leads to price increases. Reputable platforms like Glassnode provide this crucial on-chain data, allowing for objective analysis and forming more accurate Ethereum price predictions. [Insert chart/graph here showing exchange outflow, address distribution, and exchange supply data, citing Glassnode or similar source].

Ethereum's Growing Ecosystem and Development Activity

Ethereum's thriving ecosystem is a key driver of its price appreciation. Constant innovation and development attract new users and investors, contributing to a positive ETH price prediction.

-

DeFi Growth and Innovation: The Decentralized Finance (DeFi) space, built largely on Ethereum, continues to flourish. The increasing number of decentralized applications (dApps) built on the Ethereum network indicates robust utility and attracts further investment, boosting the value of ETH.

-

NFT Market Trends: Non-fungible tokens (NFTs) remain extremely popular, with a large portion of NFT trading occurring on the Ethereum blockchain. The continued growth of this market significantly increases the demand for ETH, thereby influencing its price.

-

Ethereum 2.0 Progress and Implications: The transition to a proof-of-stake (PoS) consensus mechanism, known as Ethereum 2.0, is progressing steadily. This upgrade promises increased scalability, security, and energy efficiency, all of which are positive factors for long-term ETH price predictions. The shift to PoS is expected to reduce the inflationary pressure on ETH, further contributing to its value.

Macroeconomic Factors and Their Influence on ETH Price

Broader macroeconomic trends significantly impact cryptocurrency prices, including the price of ETH. Understanding these factors is crucial for a comprehensive Ethereum price prediction.

-

Bitcoin's Price Correlation with Ethereum: Bitcoin (BTC) often acts as a bellwether for the entire cryptocurrency market. A positive price movement in BTC usually leads to increased interest and price appreciation in altcoins, including ETH.

-

Inflationary Pressures and the Role of Safe-Haven Assets: In times of high inflation, investors may seek alternative assets to hedge against the erosion of purchasing power. Cryptocurrencies, including ETH, are increasingly viewed as a potential safe haven, thus increasing demand and potentially pushing up the price.

-

Regulatory Landscape and its Potential Impact: Government regulations significantly impact the cryptocurrency market. Clearer regulatory frameworks can increase investor confidence, boosting the price of ETH, while uncertainty or negative regulations can cause volatility and price drops.

Potential Risks and Challenges

While the outlook for ETH appears bullish, it’s crucial to acknowledge potential risks and challenges that could impact the Ethereum price prediction.

-

Regulatory Uncertainty: The evolving regulatory landscape presents a significant risk. Unfavorable regulations or unexpected government actions could negatively impact the price of ETH.

-

Competition from Other Layer-1 Blockchains: Ethereum faces competition from other Layer-1 blockchains vying for market share. Technological advancements and innovative solutions from competitors could impact Ethereum's dominance and consequently, its price.

-

Technical Challenges: Despite progress, Ethereum still faces scalability challenges. Network congestion or technical issues could impact the user experience and negatively influence price predictions.

Conclusion: Ethereum Price Prediction: A Bullish Outlook?

Our analysis of on-chain data reveals strong ETH accumulation, suggesting reduced selling pressure and potential for price appreciation. The flourishing Ethereum ecosystem, driven by DeFi growth, NFT popularity, and Ethereum 2.0 progress, further supports a bullish sentiment. While macroeconomic factors and potential risks remain, the overall picture suggests positive momentum. Considering the strong accumulation, growing ecosystem, and positive market sentiment, we predict a potential price range for ETH between $2,500 and $4,000 in the next quarter, but this remains subject to market fluctuations. This Ethereum price prediction is based on current trends and may change based on unforeseen circumstances.

Stay informed about the latest developments in the Ethereum ecosystem to refine your own Ethereum price prediction. Continue researching Ethereum price prediction data and other market analyses to inform your investment decisions. Remember to always conduct your own thorough research before making any investment decisions.

Featured Posts

-

Pressure Mounts For Economic Reform Amidst Taiwan Dollars Rise

May 08, 2025

Pressure Mounts For Economic Reform Amidst Taiwan Dollars Rise

May 08, 2025 -

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case

May 08, 2025

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case

May 08, 2025 -

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

May 08, 2025

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

May 08, 2025 -

Assassins Creed Shadows How Ray Tracing Transforms The Ps 5 Pro Experience

May 08, 2025

Assassins Creed Shadows How Ray Tracing Transforms The Ps 5 Pro Experience

May 08, 2025 -

Is Saving Private Ryan Still The Best War Movie Fans React

May 08, 2025

Is Saving Private Ryan Still The Best War Movie Fans React

May 08, 2025

Latest Posts

-

Die Lottozahlen Des 6aus49 Vom 12 April 2025

May 08, 2025

Die Lottozahlen Des 6aus49 Vom 12 April 2025

May 08, 2025 -

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025 -

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025 -

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025 -

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025