Europe: Stock Markets Rise On Trump's Tariff Hints, LVMH Shares Dive

Table of Contents

European Stock Market Gains: A Reaction to Trump's Tariff Signals

Trump's Statements and Market Interpretation

President Trump's recent statements regarding potential tariff reductions were met with cautious optimism by European investors. Specific comments hinting at a more conciliatory approach to trade negotiations fueled a rally in several key indices.

- Statement 1: "We're looking at some very substantial tariff reductions." This statement, interpreted as a potential de-escalation of trade tensions, boosted investor confidence.

- Statement 2: "We're working on a deal that will be good for both the US and Europe." This fostered a sense of hope for a resolution to the ongoing trade disputes.

The DAX (Germany), CAC 40 (France), and FTSE 100 (UK) all saw significant gains, with percentage increases ranging from 1.5% to 2.5% on the day. This positive reaction reflects a broader belief that reduced trade barriers could stimulate economic growth and boost corporate earnings, particularly for export-oriented stocks. The underlying economic factor contributing to the positive market reaction was the expectation of increased trade volume and reduced uncertainty.

Sector-Specific Performance

While the overall market experienced gains, the impact of Trump's statements varied across different sectors.

- Beneficiaries: Export-oriented sectors, such as automobiles and industrial goods, saw particularly strong gains, as reduced tariffs would directly benefit their profitability.

- Lagging Sectors: Import-sensitive sectors, while not declining significantly, showed less robust growth than the market as a whole.

This differential performance underscores the market's nuanced response to the potential changes in trade policy.

Investor Confidence and Future Outlook

Trump's comments undoubtedly boosted investor confidence in the short term. However, the sustainability of this rally remains uncertain. Market analysts express cautious optimism, highlighting the need for concrete action to follow the verbal assurances. The future outlook hinges on the actual implementation of tariff reductions and the overall resolution of trade disputes. Sustained market growth will depend on several factors, including the ongoing geopolitical landscape and consumer confidence. High market volatility remains a risk, highlighting the need for careful monitoring of economic forecasts and global developments.

LVMH Share Price Plunge: Understanding the Declines

Factors Contributing to LVMH's Fall

The significant drop in LVMH's share price defied the overall positive trend in the European stock market. Several factors likely contributed to this decline:

- Negative News Related to the Company: Any specific negative news concerning LVMH's financial performance, brand image, or supply chain disruptions could have directly impacted investor sentiment.

- Macroeconomic Conditions Affecting Luxury Goods: Concerns about slowing global economic growth and reduced consumer spending, particularly within the luxury goods segment, could have contributed to the share price decrease.

- Investor Sentiment Shifts: A general shift in investor sentiment towards the luxury goods sector might have caused a sell-off, irrespective of company-specific news.

It's crucial to analyze company-specific factors alongside broader macroeconomic trends to understand this dramatic drop.

Impact on the broader luxury sector

LVMH's decline did not trigger a widespread sell-off in the luxury sector. While some other luxury brands experienced minor dips, the impact was largely contained. This suggests that the LVMH drop was largely attributable to company-specific factors, rather than a broader shift in investor sentiment towards the entire luxury goods market. However, close monitoring of other luxury brand performance is crucial to assess any potential contagion effects.

Long-term implications for LVMH

The long-term implications of this share price drop are difficult to predict. The company's recovery will depend on its ability to address any underlying issues that contributed to the decline, maintain its brand image, and adapt to evolving macroeconomic conditions. The long-term outlook necessitates a close examination of LVMH's strategic response to these challenges.

Geopolitical Implications and Global Market Uncertainty

Trade War Concerns

The ongoing concerns regarding trade wars continue to cast a shadow over global market stability. While Trump's comments offered a glimmer of hope, the long-term outcome of trade negotiations remains uncertain. Any escalation of trade tensions could significantly impact the European economy, and thus the European stock market.

Global Market Interdependence

The interconnectedness of global markets cannot be overstated. Events in one region invariably impact others, highlighting the importance of monitoring global economic developments. The interplay between US trade policy, European market performance, and global economic stability makes predicting future market trends exceptionally challenging. Recognizing these risk factors is paramount for any investor.

Conclusion: Analyzing European Stock Market Fluctuations and the LVMH Case

The contrasting performance of the European stock markets and LVMH's significant share price drop highlight the complex dynamics at play. While hints of tariff reductions by President Trump led to a general market rise, driven largely by investor optimism and improved sentiment in export-oriented sectors, LVMH's decline showcases how company-specific factors can override broader market trends. It is crucial to understand the interplay between political pronouncements, investor sentiment, and the unique circumstances facing individual companies. To navigate the complexities of the European stock market, you must monitor the European stock market closely, track LVMH's share price, and stay updated on Trump's trade policies. Stay informed and adapt your strategies accordingly to successfully navigate this volatile environment.

Featured Posts

-

Will Jonathan Groffs Just In Time Performance Earn A Tony

May 24, 2025

Will Jonathan Groffs Just In Time Performance Earn A Tony

May 24, 2025 -

Aex Stijgt Positief Beurzenherstel Na Trumps Aankondiging

May 24, 2025

Aex Stijgt Positief Beurzenherstel Na Trumps Aankondiging

May 24, 2025 -

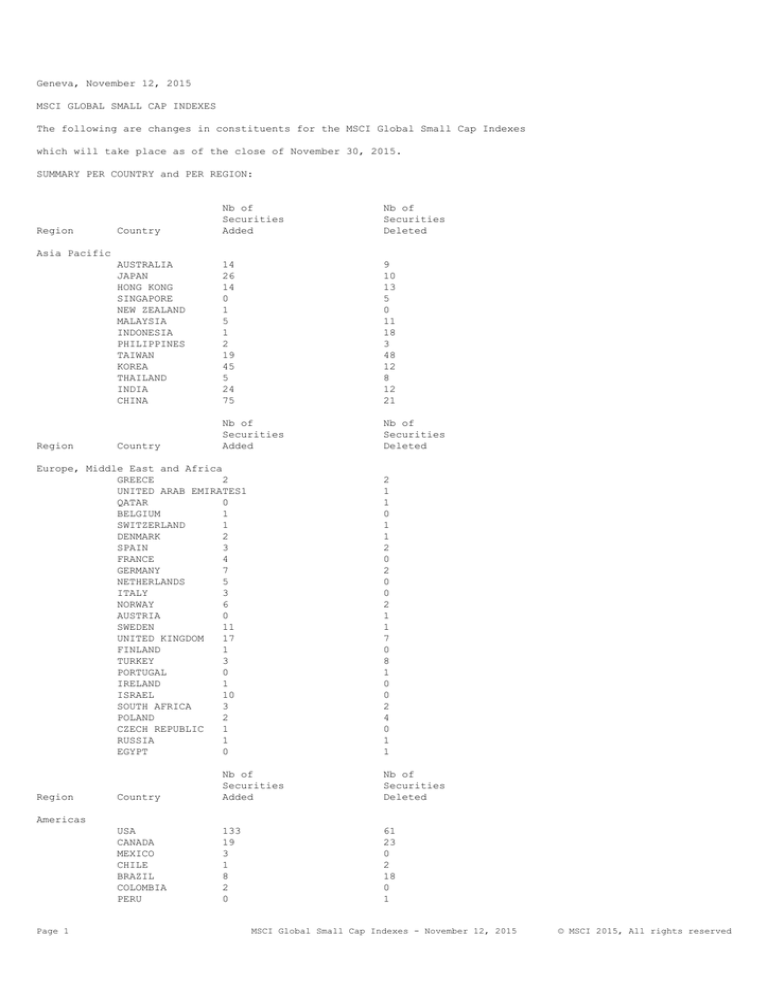

Pertimbangan Investasi Mtel Dan Mbma Di Msci Small Cap Index

May 24, 2025

Pertimbangan Investasi Mtel Dan Mbma Di Msci Small Cap Index

May 24, 2025 -

Berkshire Hathaways Apple Holdings Analyzing The Post Buffett Era

May 24, 2025

Berkshire Hathaways Apple Holdings Analyzing The Post Buffett Era

May 24, 2025 -

Jorja Smith Biffy Clyro Blossoms To Headline Bbc Radio 1 Big Weekend

May 24, 2025

Jorja Smith Biffy Clyro Blossoms To Headline Bbc Radio 1 Big Weekend

May 24, 2025