Exclusive: The Complete Sale Of Elon Musk's X Corp Debt Is Finalized

Table of Contents

Details of the X Corp Debt Sale

Buyer and Purchase Price

While the exact buyer of the X Corp debt remains undisclosed, speculation points towards a large institutional investor or a consortium of financial firms. The secrecy surrounding the buyer likely stems from confidentiality agreements and the sensitive nature of such a large financial transaction. The total purchase price, also kept confidential for now, is estimated to be in the billions of dollars, reflecting the substantial debt load X Corp had accumulated. This strategic move by Musk suggests a focus on streamlining X Corp's finances and positioning it for future growth.

- Exact amount of debt sold: Undisclosed, but estimated to be a significant portion of X Corp's total debt.

- Terms and conditions of the sale: Details remain confidential, but likely included clauses regarding repayment schedules, interest rates, and potential penalties.

- Timeline of the transaction: The sale process likely spanned several months, involving due diligence, negotiations, and legal documentation.

- Any associated fees or charges: Standard fees associated with such large-scale transactions, including legal and advisory fees, would have been incurred.

- Impact on X Corp's balance sheet: The sale will significantly improve X Corp's balance sheet, reducing liabilities and boosting its overall financial health.

Impact on X Corp and its Future

Financial Stability and Growth

The successful sale of the X Corp debt dramatically improves the company's financial stability. By eliminating a substantial portion of its debt burden, X Corp gains significantly improved financial flexibility. This translates into:

- Improved cash flow and liquidity: X Corp now has more readily available funds for operations and investments.

- Opportunities for new investments and projects: The reduced debt burden frees up capital for expansion, research, and development of new features and services.

- Potential for increased profitability: Lower interest payments and increased operational efficiency can contribute to higher profitability.

- Reduction of financial risk: The sale minimizes the risk of default and improves X Corp's creditworthiness.

- Impact on X Corp's credit rating: A reduced debt load is expected to positively impact X Corp's credit rating, making it easier to secure future financing.

Implications for Elon Musk and Investors

Musk's Strategic Positioning

Elon Musk's decision to sell X Corp debt is a calculated strategic move, likely reflecting his broader financial strategy and vision for the company. This action demonstrates a willingness to address X Corp's financial challenges proactively, creating a stronger foundation for long-term success.

- Impact on Musk's personal net worth: While the direct impact remains unclear, this could positively affect Musk's net worth by indirectly strengthening the value of X Corp.

- Potential for future investment strategies: This sale may free up resources for Musk to pursue other business ventures or reinvest in X Corp's growth.

- Effect on investor confidence in X Corp: This positive financial maneuver should bolster investor confidence in X Corp and its future prospects.

- Return on investment for debt purchasers: The debt buyers are hoping for a profitable return on their investment, potentially through interest payments and the eventual appreciation of X Corp's value.

- Any legal or regulatory considerations: The transaction would have been subject to scrutiny from relevant regulatory bodies to ensure compliance with all applicable laws and regulations.

Analysis of the Market Reaction

Stock Prices and Investor Sentiment

The market's response to the finalized X Corp debt sale is crucial in assessing its overall impact. While detailed analysis requires time, early indications suggest a positive reception.

- Changes in X Corp's stock price (if applicable): Depending on whether X Corp is publicly traded, the stock price might have experienced fluctuations in response to the news.

- Analyst reactions and predictions: Financial analysts are likely to offer insights and predictions regarding the long-term effects of the debt sale on X Corp's financial performance.

- Investor sentiment and confidence levels: Positive news about the sale should enhance investor confidence in X Corp's future prospects.

- Comparison with previous financial transactions involving X Corp: This transaction can be compared to past X Corp financial activities to gauge its relative significance and impact.

- Long-term effects on the stock market: The long-term implications for the stock market depend on X Corp's future performance and overall market conditions.

Conclusion

The complete sale of Elon Musk's X Corp debt marks a significant milestone for the company. This transaction has demonstrably improved X Corp's financial stability, opening new avenues for growth and investment. The market reaction reflects a positive outlook, though long-term effects remain to be seen. Elon Musk's strategic moves continue to shape the narrative surrounding X Corp and its future in the digital landscape.

Call to Action: Stay informed on the latest developments regarding Elon Musk's X Corp and its financial trajectory. Follow our site for exclusive updates on the X Corp debt sale and other significant business news. Subscribe now to stay ahead of the curve on the evolving story of X Corp and its debt restructuring efforts.

Featured Posts

-

Churchill Downs Weather Contingency Plans Kentucky Derby 2024

May 01, 2025

Churchill Downs Weather Contingency Plans Kentucky Derby 2024

May 01, 2025 -

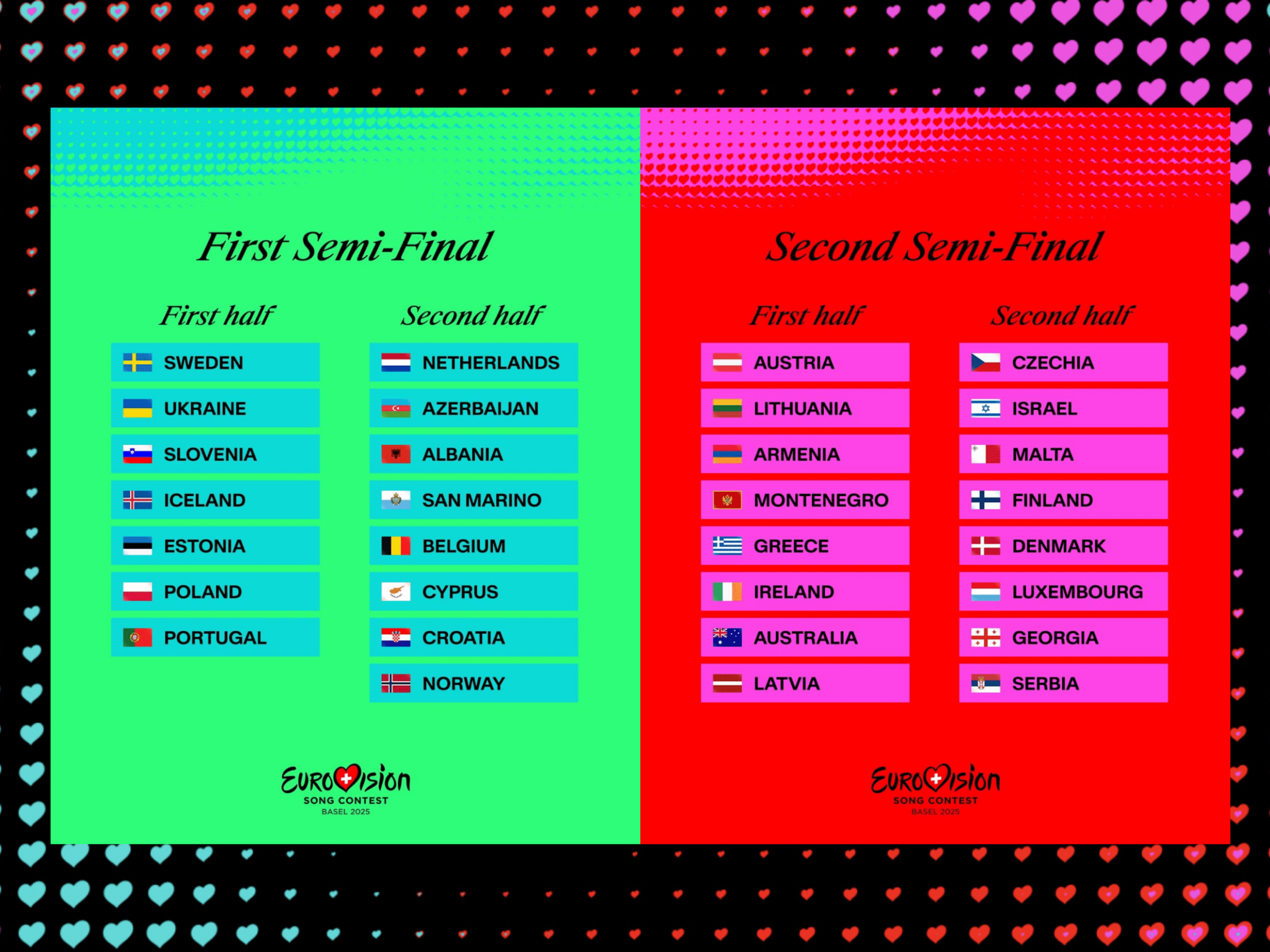

Eurovision 2025 Semi Finals Full Running Order Schedule

May 01, 2025

Eurovision 2025 Semi Finals Full Running Order Schedule

May 01, 2025 -

Easy Crab Stuffed Shrimp In Lobster Sauce Recipe

May 01, 2025

Easy Crab Stuffed Shrimp In Lobster Sauce Recipe

May 01, 2025 -

Narrow Loss For Lady Raiders Cincinnati Takes Home Victory 59 56

May 01, 2025

Narrow Loss For Lady Raiders Cincinnati Takes Home Victory 59 56

May 01, 2025 -

Bowen Yangs Snl Struggle The Jd Vance Role And His Plea To Lorne Michaels

May 01, 2025

Bowen Yangs Snl Struggle The Jd Vance Role And His Plea To Lorne Michaels

May 01, 2025