Extreme Price Increase: AT&T On Broadcom's Proposed VMware Acquisition

Table of Contents

AT&T's Stance and Concerns

AT&T, a major player in the telecom industry, has voiced significant concerns regarding Broadcom's takeover of VMware. The potential consequences for AT&T are far-reaching, impacting both its operational costs and its competitive position.

Increased Costs for AT&T's Services

The acquisition could lead to a substantial increase in the cost of various services AT&T relies on. VMware's virtualization and cloud computing solutions are crucial for AT&T's network infrastructure and operations. Broadcom's potential synergies with VMware could lead to higher prices for:

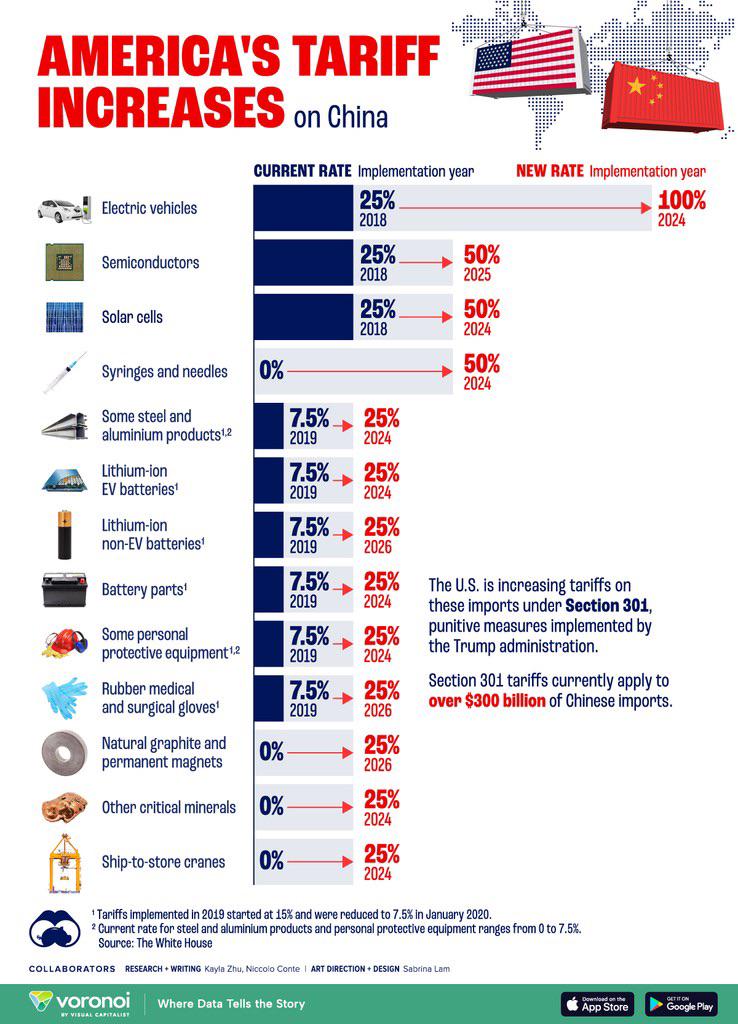

- Networking equipment: Increased prices for hardware and software components essential for AT&T's network operations. Potential percentage increases could range from 10% to 20%, significantly impacting AT&T's bottom line.

- Software licensing: Higher licensing fees for VMware's essential virtualization software, impacting the cost of maintaining and upgrading AT&T's infrastructure.

- Cloud services: Price increases for cloud-based services currently utilized by AT&T, affecting its operational efficiency and overall costs.

These price hikes could force AT&T to either absorb the increased expenses, impacting its profitability, or pass them onto consumers, leading to higher bills for AT&T's customers. AT&T has reportedly engaged in lobbying efforts and issued public statements expressing its concerns about the deal's potential anti-competitive implications.

Reduced Competition and Innovation

The merger raises significant antitrust concerns. The combined market power of Broadcom and VMware could stifle competition in the cloud computing and enterprise software markets. This consolidation could result in:

- Increased market concentration: The merger would significantly increase the market share of Broadcom and VMware, potentially creating a near-monopoly in certain segments.

- Reduced innovation: Lack of competition can lead to less innovation, as the merged entity might have less incentive to develop new and improved products or services.

- Limited choices for consumers and businesses: Reduced competition translates to fewer options and less flexibility for consumers and businesses seeking cloud computing and enterprise software solutions.

The merger echoes past mergers that resulted in similar outcomes, highlighting the potential for reduced choice and stifled innovation in the market.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware deal is currently undergoing intense regulatory scrutiny from antitrust authorities worldwide.

Antitrust Investigations and Potential Roadblocks

The Federal Trade Commission (FTC) in the US and the European Commission are investigating the potential anti-competitive effects of the merger. Potential roadblocks include:

- In-depth investigations: Thorough reviews of the merger’s potential impact on competition in various markets.

- Potential fines or legal action: Significant penalties could be imposed if the acquisition is deemed anti-competitive.

- Precedent-setting cases: The outcome of this case could set a precedent for future mergers and acquisitions in the technology sector.

Several news outlets have reported on the ongoing investigations, and official statements from regulatory bodies can be found on their respective websites. [Link to relevant news article 1] [Link to relevant news article 2]

Impact of Regulatory Decisions on AT&T and the Market

The regulatory outcome will significantly impact AT&T and the broader market. Several scenarios are possible:

- Blocked merger: If the merger is blocked, AT&T would avoid the potential price increases and maintain a more competitive market.

- Modified merger: Regulatory bodies might approve the merger only after certain conditions are met, such as divestitures of certain assets. This could mitigate some of the anti-competitive concerns but may not fully address AT&T's price increase fears.

- Unconditional approval: Approval without conditions could result in significant price increases for AT&T and its customers, potentially stifling innovation and reducing choices for consumers.

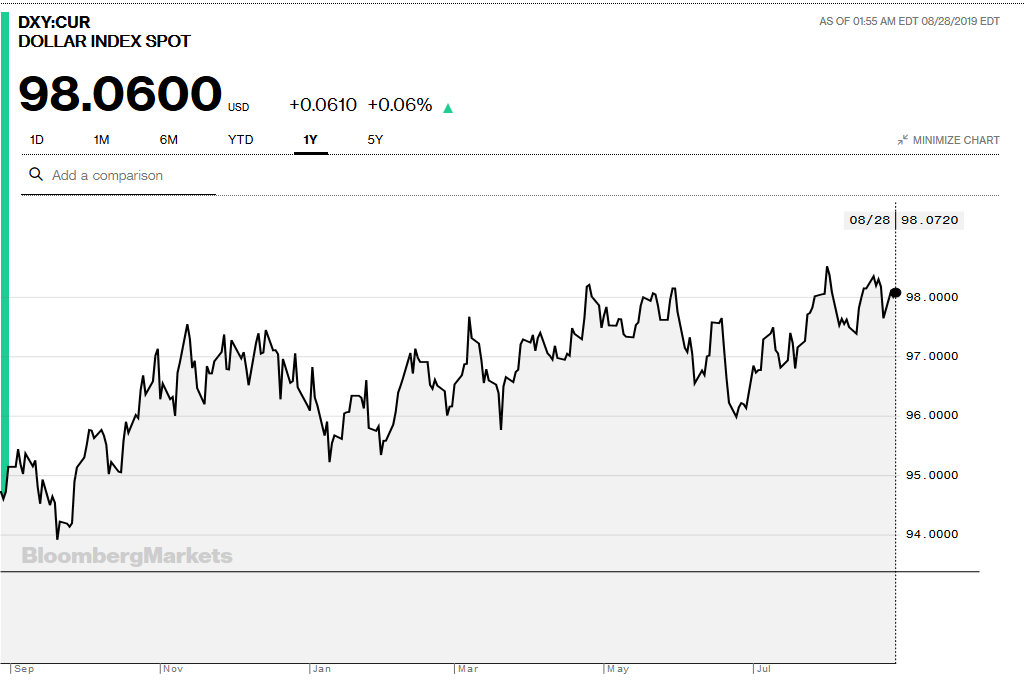

Market analysts are closely monitoring the situation, with stock prices reflecting the uncertainty surrounding the regulatory outcome. Expert opinions vary, reflecting the complexity of the legal and economic considerations.

Long-Term Implications for the Telecom Industry

The Broadcom-VMware merger carries significant long-term implications for the telecom industry.

Shifting Power Dynamics

The acquisition could dramatically shift the power dynamics within the telecom sector. Broadcom's influence over essential infrastructure and services could:

- Impact other telecom providers: Other telecom providers could face increased costs and reduced bargaining power.

- Lead to further consolidation: The merger could trigger a wave of consolidation within the industry, reducing competition and potentially harming consumers.

- Alter supply chains: The merged entity could reshape supply chains, potentially creating dependencies on Broadcom's products and services.

The long-term effects on network infrastructure and deployment are uncertain, raising concerns about potential bottlenecks and limitations.

The Future of Cloud Computing and Enterprise Software

The merger's impact on the cloud computing and enterprise software sectors is profound:

- Future innovation trends: Reduced competition could slow down innovation in these sectors.

- Potential for price increases: Consumers and businesses could face substantial price increases for cloud and enterprise software services.

- Changes in the market landscape: The merger could lead to a significant reshaping of the market, potentially harming smaller companies and startups.

The future of these critical sectors hinges on the outcome of the regulatory review and the actions taken to address the potential for reduced competition and innovation.

Conclusion

Broadcom's proposed acquisition of VMware poses a significant threat to AT&T and the broader telecom industry. AT&T's concerns regarding substantial price increases, coupled with the intense regulatory scrutiny and potential anti-competitive consequences, highlight the far-reaching implications of this mega-merger. The outcome will significantly influence pricing strategies, competitive dynamics, and the future development of cloud computing and enterprise software. Follow the latest developments on the Broadcom VMware acquisition to stay updated on the potential price increases for AT&T and other telecom companies, and learn more about the antitrust implications of this major merger.

Featured Posts

-

Selling Sunset Star Exposes Alleged Landlord Price Gouging Amidst La Fires

May 08, 2025

Selling Sunset Star Exposes Alleged Landlord Price Gouging Amidst La Fires

May 08, 2025 -

Taiwan Dollar Strength Catalyst For Critical Economic Adjustments

May 08, 2025

Taiwan Dollar Strength Catalyst For Critical Economic Adjustments

May 08, 2025 -

Lyon Psg Victoria Parisina En El Estadio De Lyon

May 08, 2025

Lyon Psg Victoria Parisina En El Estadio De Lyon

May 08, 2025 -

The Us Tariff Impact On Gms Canadian Operations An Expert View

May 08, 2025

The Us Tariff Impact On Gms Canadian Operations An Expert View

May 08, 2025 -

Inter Milan Through To Europa League Last Eight After Feyenoord Win

May 08, 2025

Inter Milan Through To Europa League Last Eight After Feyenoord Win

May 08, 2025

Latest Posts

-

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025 -

Cleveland Browns Land De Andre Carter To Enhance Wide Receiver Depth

May 08, 2025

Cleveland Browns Land De Andre Carter To Enhance Wide Receiver Depth

May 08, 2025 -

Cyndi Lauper And Counting Crows Jones Beach Concert Dates Announced

May 08, 2025

Cyndi Lauper And Counting Crows Jones Beach Concert Dates Announced

May 08, 2025 -

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025 -

See Counting Crows Live This Summer Indianapolis Concert Details

May 08, 2025

See Counting Crows Live This Summer Indianapolis Concert Details

May 08, 2025