Falling Retail Sales: A Sign Of Impending Bank Of Canada Rate Cuts?

Table of Contents

H2: The Current State of Canadian Retail Sales

H3: Declining Consumer Spending

Recent retail sales data paints a concerning picture for the Canadian economy. Several key sectors are experiencing significant drops in sales, signaling a weakening consumer spending environment. This decline is not isolated to a single sector; rather, it reflects a broader trend of reduced consumer confidence and purchasing power.

- Clothing and footwear: Sales are down by an average of 3%, reflecting consumers' reduced discretionary spending.

- Furniture and home furnishings: This sector has seen a steeper decline, with sales falling by approximately 5%, potentially indicating a slowdown in home renovations and purchases.

- Electronics and appliances: This sector, often sensitive to economic shifts, has reported a 4% decrease in sales, mirroring a cautious consumer approach to big-ticket purchases.

Several factors contribute to this decline: persistently high inflation continues to erode purchasing power, increased interest rates make borrowing more expensive, and decreased consumer confidence creates uncertainty about future economic prospects. These factors combine to create a perfect storm impacting consumer spending and, consequently, retail sales. Data from Statistics Canada and the Bank of Canada’s Monetary Policy Reports confirm these trends.

H3: Impact of Inflation and Interest Rates

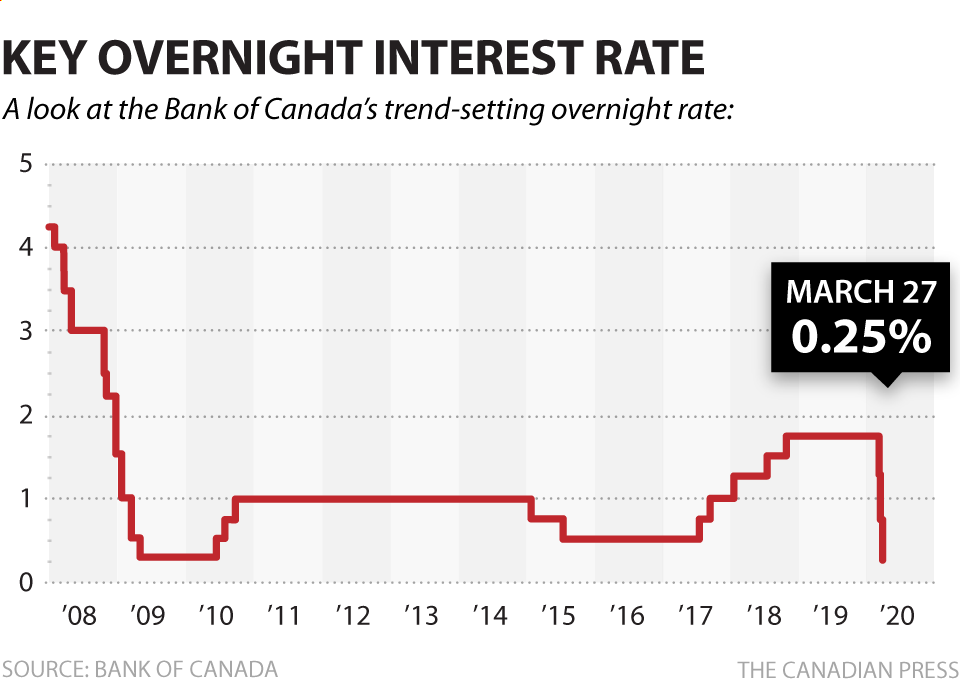

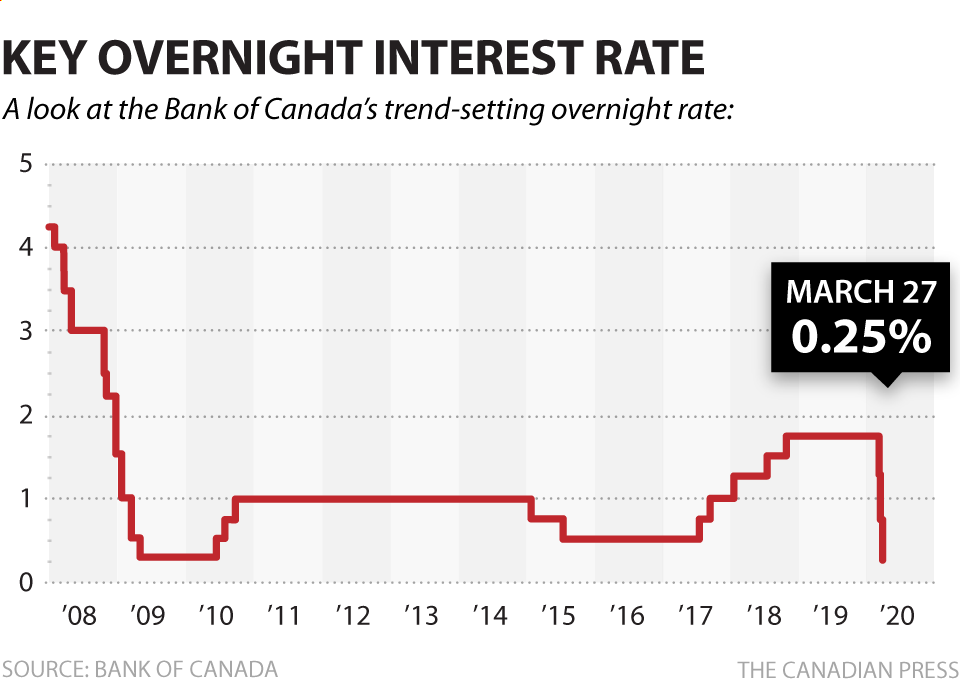

The Bank of Canada's aggressive interest rate hikes over the past year, aimed at curbing inflation, have had a significant impact on consumer spending and retail sales. Higher interest rates increase borrowing costs for consumers, making it more expensive to finance purchases like homes, cars, and appliances. This directly reduces disposable income, leaving less money for non-essential purchases.

- Increased mortgage payments: Higher interest rates dramatically increase monthly mortgage payments, forcing many households to cut back on discretionary spending.

- Reduced borrowing power: Consumers are less likely to take out loans for large purchases, further impacting retail sales.

- Diminished consumer confidence: The uncertainty created by high inflation and rising interest rates erodes consumer confidence, leading to a reluctance to spend.

The relationship between inflation, disposable income, and consumer confidence is crucial. When inflation is high, the real value of disposable income falls, and consumers tend to postpone or reduce their spending, leading to a direct impact on retail sales and overall economic activity.

H2: The Bank of Canada's Response to Economic Slowdown

H3: Analyzing Monetary Policy Indicators

The Bank of Canada closely monitors several key economic indicators to guide its monetary policy decisions, including:

- Inflation rate: The Bank's primary mandate is to maintain price stability. Currently, inflation remains stubbornly above the target of 2%.

- Unemployment rate: The unemployment rate provides insights into the health of the labor market and the overall economy.

- GDP growth: GDP growth is a key indicator of the overall economic health of the country. Recent slowdowns are causing concern.

The Bank's recent statements indicate a cautious approach. While previous rate hikes aimed to curb inflation, the recent slowdown in retail sales and other economic indicators might signal a potential shift towards easing monetary policy.

H3: Predicting Future Rate Adjustments

Given the current economic climate and the significant decline in retail sales, the likelihood of future rate cuts by the Bank of Canada is a subject of ongoing debate among economists.

- Arguments for rate cuts: The weakening retail sales, combined with slowing GDP growth, suggests that the economy may be cooling more rapidly than anticipated, potentially warranting rate cuts to stimulate economic activity.

- Arguments against rate cuts: Persistently high inflation might lead the Bank of Canada to remain cautious about rate cuts, even with weakening retail sales. Concerns about inflation persisting longer than predicted could prevent immediate action.

Alternative scenarios include a period of sustained high interest rates or a more gradual easing of monetary policy, depending on evolving economic data and inflation projections.

H2: Alternative Factors Influencing Retail Sales

H3: Global Economic Uncertainty

Global economic uncertainty plays a significant role in influencing Canadian retail sales. Factors such as supply chain disruptions, geopolitical instability, and the performance of global economies can significantly affect consumer confidence and spending.

- Supply chain disruptions: Ongoing disruptions can lead to higher prices and reduced availability of goods, negatively impacting retail sales.

- Geopolitical events: International conflicts and political uncertainty can create volatility in financial markets and affect consumer confidence.

H3: Changes in Consumer Behavior

Shifts in consumer behavior also contribute to the current retail sales landscape. Increased savings rates, a preference for experiences over material goods, and the rise of online shopping are all reshaping the retail environment.

- Increased savings: Consumers might be prioritizing savings due to economic uncertainty, leading to reduced spending on non-essential goods.

- Experience economy: Consumers may increasingly favor experiences (travel, entertainment) over material possessions.

- Rise of e-commerce: The continued growth of e-commerce continues to shift sales away from brick-and-mortar stores.

3. Conclusion

Falling retail sales in Canada are a significant concern, and their relationship to potential Bank of Canada rate cuts is complex. While declining sales may indicate a need for stimulus, other factors like global uncertainty and evolving consumer behavior also play critical roles. While a direct causal link between falling retail sales and impending rate cuts isn't guaranteed, the current economic climate suggests a strong possibility of a policy shift. Stay informed about the impact of falling retail sales on the Canadian economy by regularly checking reliable financial news sources and searching for updates using the term "falling retail sales."

Featured Posts

-

The Grim Truth About Retail Sales And The Bank Of Canadas Next Move

Apr 28, 2025

The Grim Truth About Retail Sales And The Bank Of Canadas Next Move

Apr 28, 2025 -

Assessing The Economic Fallout A Fed Snapshot Of The Canadian Travel Boycott

Apr 28, 2025

Assessing The Economic Fallout A Fed Snapshot Of The Canadian Travel Boycott

Apr 28, 2025 -

The Current Gpu Market High Prices And Limited Availability

Apr 28, 2025

The Current Gpu Market High Prices And Limited Availability

Apr 28, 2025 -

Analyzing The Countrys New Business Hot Spots Trends And Opportunities

Apr 28, 2025

Analyzing The Countrys New Business Hot Spots Trends And Opportunities

Apr 28, 2025 -

75

Apr 28, 2025

75

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

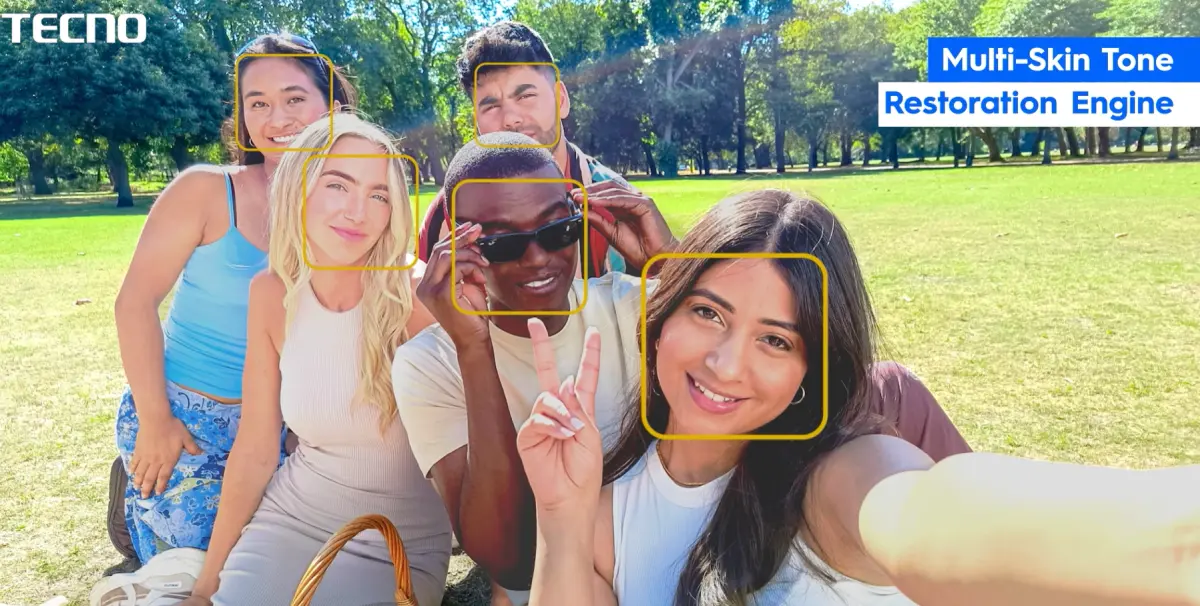

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025 -

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025