Financial Planning Strategies For Student Loan Repayment

Table of Contents

Understanding Your Student Loans

Before you can effectively tackle your student loan repayment, you need a clear understanding of your debt. This includes knowing the types of loans you have, their interest rates, and repayment terms.

Types of Student Loans

Student loans are broadly categorized into federal and private loans. Each type has its own set of rules and implications for your repayment.

- Federal Student Loans: These loans are offered by the U.S. government and generally offer more borrower protections than private loans. They include subsidized and unsubsidized loans. Subsidized loans don't accrue interest while you're in school (under certain conditions), whereas unsubsidized loans accrue interest from the time they're disbursed.

- Private Student Loans: These loans are offered by banks, credit unions, and other private lenders. They often come with higher interest rates and less flexible repayment options compared to federal loans. Be sure to carefully compare interest rates, fees, and repayment terms before borrowing. Always be cautious of predatory lending practices.

Resources: For detailed information on your federal student loans, visit the National Student Loan Data System (NSLDS) website: [Insert NSLDS link here].

Consolidating Your Student Loans

Consolidating your student loans means combining multiple loans into a single loan. This can simplify repayment by reducing the number of payments you have to make.

- Benefits: Simpler monthly payments, potentially a lower monthly payment amount (though the total interest paid might be higher).

- Drawbacks: Potentially higher overall interest paid over the life of the loan. You may lose certain benefits associated with specific loan types (e.g., loan forgiveness programs).

Consolidating federal student loans can be done through the Department of Education’s website. Carefully weigh the pros and cons before making a decision, and consider consulting a financial advisor.

Creating a Realistic Repayment Plan

Developing a realistic repayment plan is crucial for successfully managing your student loan debt. This involves budgeting, tracking expenses, and exploring different repayment options.

Budgeting and Tracking Expenses

Creating a detailed budget is the cornerstone of effective student loan repayment. This helps you understand your income and expenses, allowing you to prioritize debt repayment.

- Budgeting Apps and Tools: Mint, YNAB (You Need A Budget), Personal Capital.

- Tracking Income and Expenses: Use spreadsheets, budgeting apps, or even a simple notebook to monitor your income and expenses.

Exploring Repayment Options

Several repayment options are available for federal student loans, allowing you to tailor your plan to your financial situation.

- Standard Repayment: Fixed monthly payments over 10 years.

- Graduated Repayment: Payments start low and gradually increase over time.

- Extended Repayment: Payments are spread over a longer period (up to 25 years).

- Income-Driven Repayment (IDR) Plans: Monthly payments are based on your income and family size. These plans often lead to loan forgiveness after 20-25 years, depending on the plan. Examples include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

- Public Service Loan Forgiveness (PSLF): For borrowers working in public service, this program can forgive the remaining balance of your federal student loans after 120 qualifying monthly payments.

For details on eligibility requirements and application processes for these plans, visit the Federal Student Aid website: [Insert Federal Student Aid link here].

Improving Your Financial Situation for Faster Repayment

Accelerating your student loan repayment requires improving your financial situation through increased income and reduced expenses.

Increasing Your Income

Exploring additional income streams can significantly accelerate your repayment journey.

- Side Hustles: Freelancing, gig work (Uber, DoorDash), tutoring, part-time jobs.

- Career Advancement: Pursuing professional development opportunities, networking, and seeking promotions can lead to higher salaries.

- Salary Negotiation: Research industry standards and confidently negotiate your salary during job interviews and performance reviews.

Reducing Expenses

Identify and eliminate unnecessary expenses to free up more money for student loan repayment.

- Cutting Unnecessary Spending: Cable TV, eating out frequently, expensive entertainment subscriptions.

- Prioritizing Debt Repayment: Make student loan repayment a top priority in your budget.

- Budget-Friendly Alternatives: Cooking at home instead of eating out, using public transportation or carpooling, finding free or low-cost entertainment options.

Seeking Professional Help

Navigating student loan repayment can be challenging. Don't hesitate to seek professional help when needed.

Consulting a Financial Advisor

A financial advisor can provide personalized guidance and create a tailored repayment strategy.

- Benefits: Personalized repayment plan, exploring debt management options, broader financial advice.

Utilizing Nonprofit Credit Counseling Services

Nonprofit credit counseling agencies can offer assistance with budgeting, debt management, and loan repayment.

- Reputable Agencies: Check for accreditation with the National Foundation for Credit Counseling (NFCC).

- Services Offered: Budgeting assistance, debt management plans, educational resources.

Conclusion

Effective student loan repayment requires a well-defined financial plan encompassing understanding your loans, creating a realistic budget, exploring repayment options, and potentially seeking professional guidance. By implementing these strategies, you can manage your debt effectively and pave your way towards a financially secure future.

Call to Action: Take control of your financial future and start planning your student loan repayment strategy today. Don't let student loan debt define you; let it motivate you to achieve financial freedom! Start planning now by utilizing the resources mentioned in this article.

Featured Posts

-

A Look Back This Weeks Business Failures

May 17, 2025

A Look Back This Weeks Business Failures

May 17, 2025 -

Ben Mc Collum Former D2 National Champion Hired By Iowa

May 17, 2025

Ben Mc Collum Former D2 National Champion Hired By Iowa

May 17, 2025 -

University Of Utah To Build New Hospital And Medical Campus In West Valley City

May 17, 2025

University Of Utah To Build New Hospital And Medical Campus In West Valley City

May 17, 2025 -

Hl Alhb Ytjawz Farq Alsn Twm Krwz Wana Dy Armas Mthala

May 17, 2025

Hl Alhb Ytjawz Farq Alsn Twm Krwz Wana Dy Armas Mthala

May 17, 2025 -

The Geopolitics Of Rare Earth Minerals A Looming Cold War

May 17, 2025

The Geopolitics Of Rare Earth Minerals A Looming Cold War

May 17, 2025

Latest Posts

-

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025 -

Novak Djokovic Miami Acik Final Yolunda

May 17, 2025

Novak Djokovic Miami Acik Final Yolunda

May 17, 2025 -

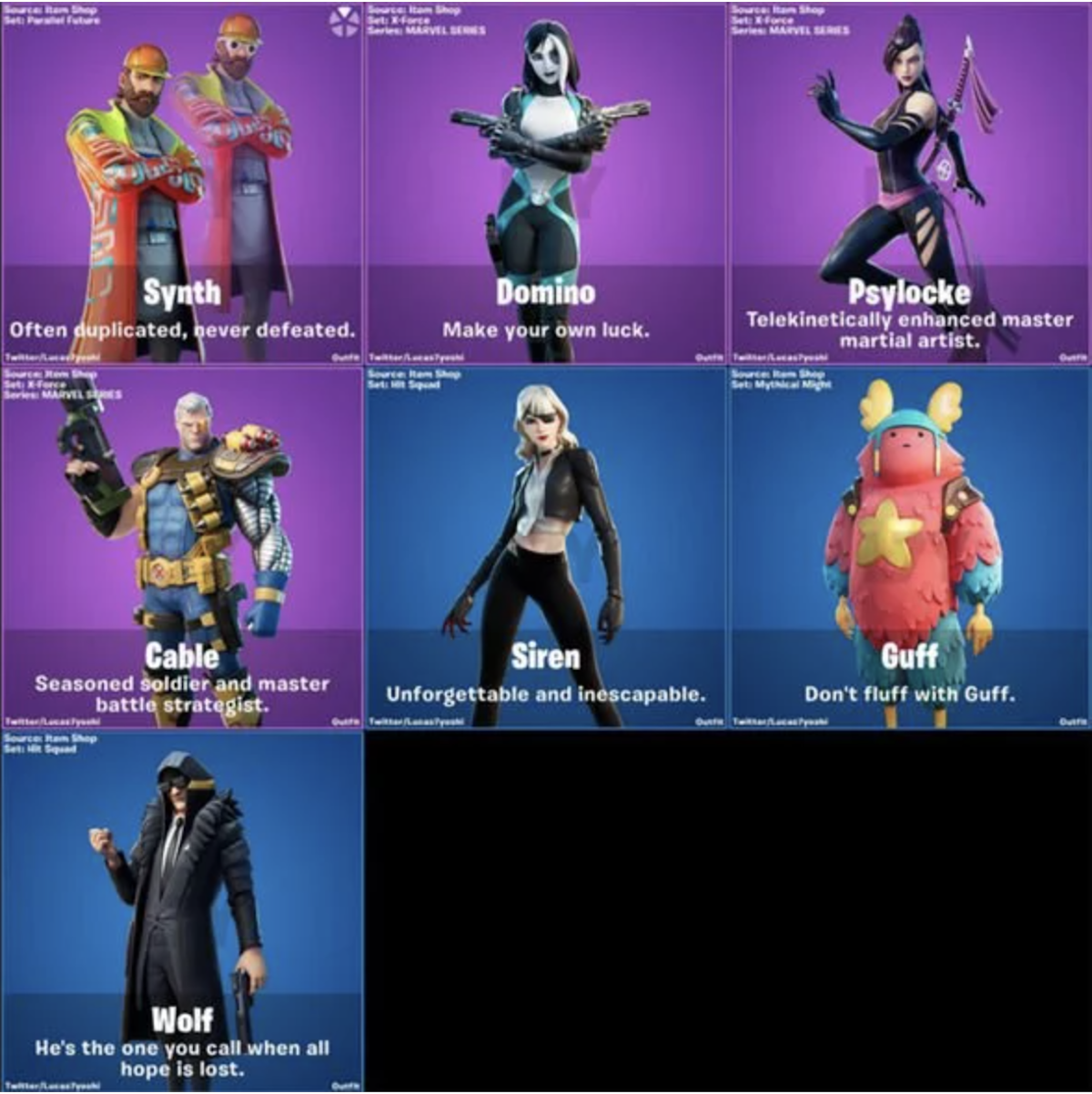

Limited Time Offer Free Cowboy Bebop Themed Items In Fortnite

May 17, 2025

Limited Time Offer Free Cowboy Bebop Themed Items In Fortnite

May 17, 2025 -

Fortnite Cowboy Bebop Skins A Guide To Getting The Free Rewards

May 17, 2025

Fortnite Cowboy Bebop Skins A Guide To Getting The Free Rewards

May 17, 2025 -

Fortnite Item Shop Navigating The Latest Update For Players

May 17, 2025

Fortnite Item Shop Navigating The Latest Update For Players

May 17, 2025