Financial Times Report: PwC Withdraws From 12+ Countries

Table of Contents

The Scale of PwC's Withdrawals: A Geographical Overview

PwC's strategic retreat represents a significant shift in its global footprint. The Financial Times report highlights withdrawals from numerous countries, impacting PwC's global reach and market share. While the exact number of countries remains fluid, reports suggest the figure exceeds twelve. The scale of this action is unprecedented for a firm of PwC's size and stature.

-

Specific Countries Affected: While the Financial Times report hasn't explicitly named all countries, sources suggest significant withdrawals are occurring in several regions including parts of Africa, Latin America, and potentially some smaller European markets. More detailed information is expected to emerge as the situation unfolds.

-

Services Affected: The withdrawals aren't limited to a single service area. The affected services are likely to include audit, tax advisory, consulting, and other business services depending on the specific market. This broad impact underscores the depth and scope of PwC's strategic reassessment.

-

Market Significance: The markets from which PwC is withdrawing vary greatly in size and importance. Some may represent relatively small segments of PwC’s global revenue, while others might have held more significant contributions. The strategic rationale behind the decisions in each market requires closer scrutiny.

-

Geographical Visualization: [Insert a world map here, ideally interactive, highlighting the regions reportedly affected by PwC's withdrawals. If an interactive map is not feasible, a static map clearly indicating the affected regions will suffice].

Reasons Behind PwC's Decision: Unpacking the Financial Times Report

The Financial Times report doesn't offer a singular, overarching reason for PwC's actions, instead pointing towards a confluence of factors:

-

Regulatory Pressure: Increased regulatory scrutiny and tougher enforcement across various jurisdictions could be a significant contributing factor. The cost of compliance, coupled with heightened reputational risks associated with regulatory breaches, may have prompted these withdrawals.

-

Reputational Damage: Previous controversies and scandals, impacting the firm’s reputation, may have played a role. Proactive measures to mitigate further reputational damage could be driving some of the withdrawal decisions.

-

Cost-Cutting and Strategic Restructuring: In the face of economic headwinds and a potentially changing market landscape, PwC might be engaging in cost-cutting measures, streamlining its global operations, and focusing resources on more profitable areas.

-

Financial Performance: Specific markets might have experienced declining profitability, prompting PwC to make tough decisions regarding their continued presence. This is a likely factor in smaller, less profitable markets.

-

PwC Statements: PwC has yet to release a comprehensive public statement explaining the full scope and rationale behind the withdrawals, leaving many questions unanswered.

The Impact on Clients and the Broader Market: Ripple Effects of PwC's Actions

PwC's actions will have far-reaching consequences for clients, competitors, and the wider accounting industry:

-

Client Disruption: Clients in the affected countries will face the challenge of finding alternative audit and consulting firms, potentially leading to operational disruptions and increased costs. The transition process could be lengthy and complex.

-

Competitive Landscape: Existing competitors, such as Deloitte, EY, and KPMG, are likely to benefit from PwC's withdrawal, gaining market share and potentially attracting clients who were previously with PwC.

-

Industry Consolidation: The situation might accelerate industry consolidation, potentially leading to mergers and acquisitions as firms seek to expand their reach and fill the gaps left by PwC's departure.

-

Auditing Standards: The withdrawals might influence future regulatory discussions about auditing standards and oversight, potentially leading to changes in industry practices.

Potential Long-Term Consequences for PwC and the Accounting Profession

PwC's decision has significant long-term implications:

-

Future Strategy: The withdrawals suggest a fundamental shift in PwC's global strategy. The firm will likely focus its resources on key markets while reassessing its approach to less profitable or high-risk regions.

-

Global Presence: This restructuring could reshape PwC's global presence and influence, potentially affecting its standing as one of the "Big Four" accounting firms.

-

Brand Reputation: While intended to mitigate future risk, the withdrawals could initially damage PwC's brand reputation, raising questions about its commitment to various markets.

-

Industry Trust: The overall event could affect the public's trust in the auditing profession, highlighting the need for greater transparency and stricter regulatory frameworks.

-

Regulatory Reform: Expect increased regulatory scrutiny and potential reforms driven by the situation, impacting the global accounting industry.

Conclusion

The Financial Times report on PwC's withdrawal from 12+ countries reveals a significant shift in the global accounting landscape. The reasons behind this decision, ranging from regulatory pressures to strategic restructuring, highlight the challenges facing large multinational firms. The impact on clients, competitors, and the overall industry will undoubtedly be substantial, requiring further analysis and potentially leading to significant changes in the coming years.

Call to Action: Stay informed about the developing story surrounding PwC's global restructuring by regularly checking reputable news sources like the Financial Times and other business publications. Understanding the implications of the PwC withdrawals is crucial for businesses and stakeholders across multiple sectors. Continue to follow developments related to PwC withdrawals and their ripple effects in the global financial industry.

Featured Posts

-

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025 -

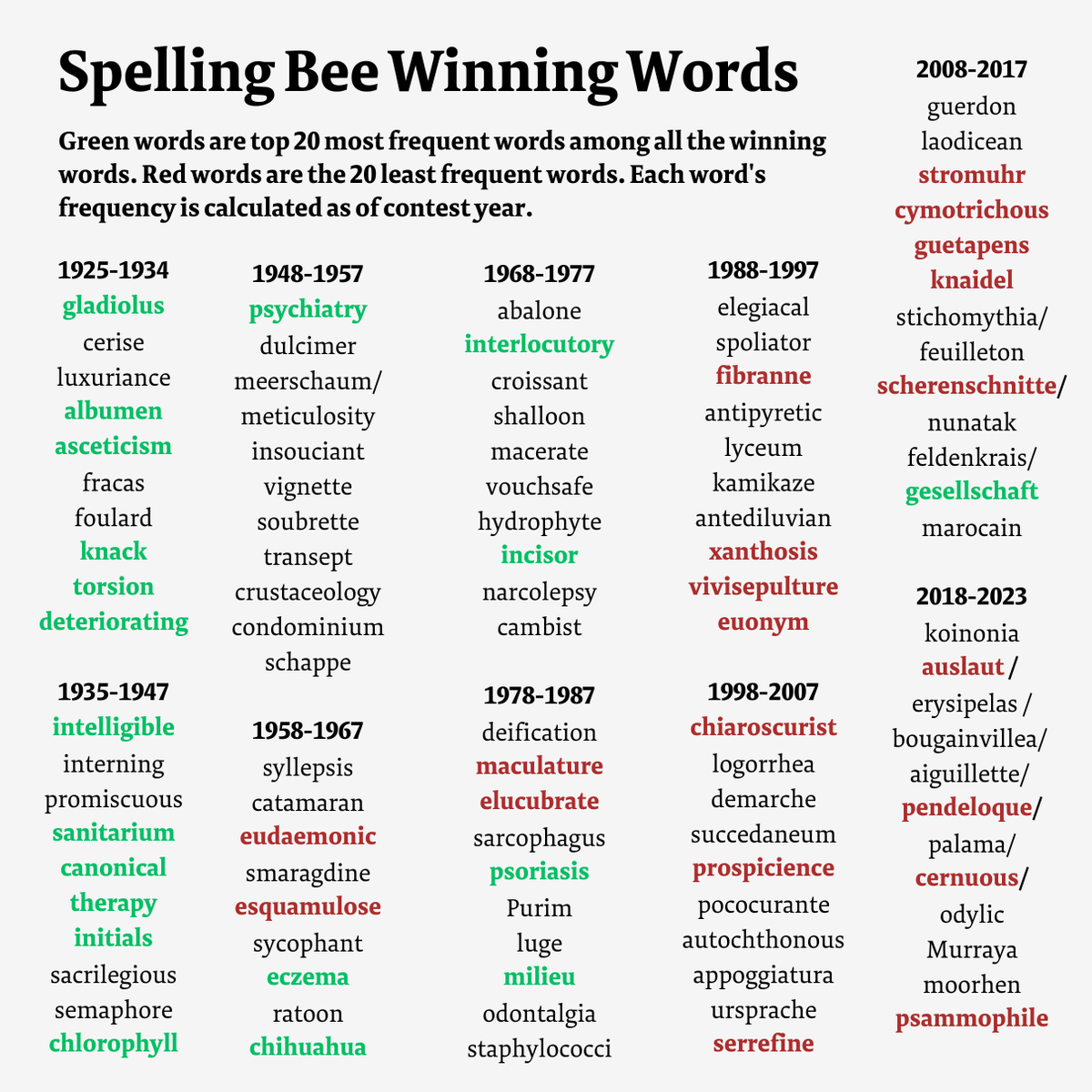

Nyt Spelling Bee March 15 2025 Complete Solutions And Spangram

Apr 29, 2025

Nyt Spelling Bee March 15 2025 Complete Solutions And Spangram

Apr 29, 2025 -

The Implications Of Pw Cs Exit From Nine African Countries

Apr 29, 2025

The Implications Of Pw Cs Exit From Nine African Countries

Apr 29, 2025 -

Nyt Strands Today April 1 2025 Clues Hints And Solutions

Apr 29, 2025

Nyt Strands Today April 1 2025 Clues Hints And Solutions

Apr 29, 2025 -

Is It Adhd 8 Common Yet Subtle Signs In Adults

Apr 29, 2025

Is It Adhd 8 Common Yet Subtle Signs In Adults

Apr 29, 2025

Latest Posts

-

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025 -

Our Yorkshire Farm Reuben Owen Opens Up About His Childhood Struggles

Apr 30, 2025

Our Yorkshire Farm Reuben Owen Opens Up About His Childhood Struggles

Apr 30, 2025 -

Our Yorkshire Farm Channel 4 Announcement Sparks Further Complaints Against Amanda Owen

Apr 30, 2025

Our Yorkshire Farm Channel 4 Announcement Sparks Further Complaints Against Amanda Owen

Apr 30, 2025 -

Amanda Owen Raising 9 Children On Our Farm Next Door

Apr 30, 2025

Amanda Owen Raising 9 Children On Our Farm Next Door

Apr 30, 2025 -

Our Farm Next Doors Amanda Owen Family Photos And Rural Life

Apr 30, 2025

Our Farm Next Doors Amanda Owen Family Photos And Rural Life

Apr 30, 2025