Focus On PMI: European Market Briefing At Midday

Table of Contents

PMI Breakdown: Key Sectors in Focus

Analyzing PMI data across different sectors is crucial for a comprehensive understanding of the European market. The PMI offers granular insights, allowing us to assess the health of key economic drivers. Let's examine the key sectors:

-

Manufacturing PMI: The European manufacturing PMI reflects the current state of the manufacturing industry. Recent trends show [insert current data and trend, e.g., a slight contraction due to persistent supply chain disruptions and high energy prices]. Factors impacting this include:

- Supply Chain Issues: Ongoing global supply chain bottlenecks continue to constrain production and impact delivery times.

- Energy Prices: Soaring energy costs significantly increase production expenses, impacting profitability and potentially leading to reduced output.

- Geopolitical Uncertainty: The ongoing conflict in Ukraine and its ripple effects on global trade contribute to the volatility in the manufacturing sector. This is a crucial element when considering the European manufacturing PMI.

-

Services PMI: The services sector constitutes a significant portion of the European economy. The European services PMI [insert current data and trend, e.g., shows modest growth, indicating resilience despite inflationary pressures]. Key considerations include:

- Consumer Spending: Consumer confidence and spending patterns directly impact the performance of the services sector.

- Tourism and Hospitality: The recovery of the tourism sector significantly influences the overall services PMI.

- Inflationary Pressures: Rising prices impact consumer spending and business investment, affecting the service sector's growth trajectory.

-

Construction PMI: The construction PMI in Europe [insert current data and trend, e.g., reveals a slowdown due to rising interest rates and material costs]. This sector is sensitive to economic shifts:

- Interest Rates: Higher interest rates increase borrowing costs, impacting investment in new construction projects.

- Material Costs: Rising costs of building materials and labor contribute to reduced activity.

- Government Spending: Public investment in infrastructure projects plays a significant role in shaping construction sector performance. Observing the construction PMI Europe is vital for understanding investment trends.

Interpreting the Data: What the Numbers Mean for Investors

Understanding how to interpret PMI numbers is crucial for investors. A PMI reading above 50 indicates expansion, signifying growth in the sector. Conversely, a reading below 50 signals contraction, suggesting a decline in economic activity. Analyzing PMI data effectively involves:

- Investment Implications: A strong PMI reading (above 50) generally suggests a positive outlook, potentially indicating opportunities for investment in related sectors. Conversely, a weak PMI (below 50) might warrant a more cautious approach.

- Market Reaction to PMI: The market often reacts swiftly to PMI releases. Significant deviations from expectations can lead to market volatility, creating both risks and opportunities for investors.

- Considering Other Economic Indicators: It's essential to analyze PMI data in conjunction with other economic indicators like inflation rates, unemployment figures, and GDP growth to gain a more comprehensive picture of the European economy. Effective PMI data analysis requires a holistic approach, encompassing multiple factors.

Geopolitical Impacts: External Factors Affecting the European PMI

Several external factors significantly influence the European PMI. Understanding these geopolitical risks is vital for accurate forecasting and strategic decision-making.

- The Impact of the War in Ukraine: The ongoing conflict in Ukraine has created significant economic uncertainty across Europe, impacting supply chains, energy prices, and overall economic sentiment. This geopolitical risk has demonstrably affected the European PMI.

- Energy Prices and their Impact on PMI: Soaring energy prices, exacerbated by the war in Ukraine, significantly impact production costs across various sectors, directly affecting PMI readings.

- Global Inflation and its Effects on European PMI Readings: High global inflation rates negatively influence consumer spending and business investment, consequently impacting the European PMI.

Midday Briefing: Actionable Insights and Predictions

Our midday PMI briefing summarizes the key findings and offers actionable insights. Based on the current PMI data:

- Short-Term Outlook: [Insert short-term economic outlook based on PMI data, e.g., "The European economy is expected to experience moderate growth in the coming months, but significant uncertainties remain due to geopolitical factors and inflationary pressures."]

- Potential Investment Strategies: [Insert potential investment strategies, e.g., "Investors might consider focusing on sectors less vulnerable to energy price fluctuations, such as technology or healthcare."]

- Unexpected Trends: [Insert any unexpected trends or developments revealed by the data, e.g., "The resilience of the services sector despite inflationary pressures is a noteworthy development."] The European PMI forecast requires a constant review of these shifting trends.

Conclusion: Focus on the PMI: Your Key to Understanding the European Market

The PMI is a crucial indicator for understanding the nuances of the European market. By analyzing the PMI across different sectors and considering the broader geopolitical landscape, investors and businesses can make more informed decisions. This midday briefing highlights the importance of regularly monitoring PMI data for timely insights. Staying informed about the European market through regular updates on the PMI and accessing our detailed midday briefings is crucial for navigating this dynamic economic environment. Understanding the PMI is key to successful navigation of the European economic landscape, allowing for proactive and effective strategic planning. Regularly check for updates on the European PMI analysis to stay ahead.

Featured Posts

-

From Actor To Bull Rider Neal Mc Donoughs Training Journey

May 23, 2025

From Actor To Bull Rider Neal Mc Donoughs Training Journey

May 23, 2025 -

Wwe Wrestle Mania 41 Memorial Day Weekend Ticket On Sale Golden Belts Revealed

May 23, 2025

Wwe Wrestle Mania 41 Memorial Day Weekend Ticket On Sale Golden Belts Revealed

May 23, 2025 -

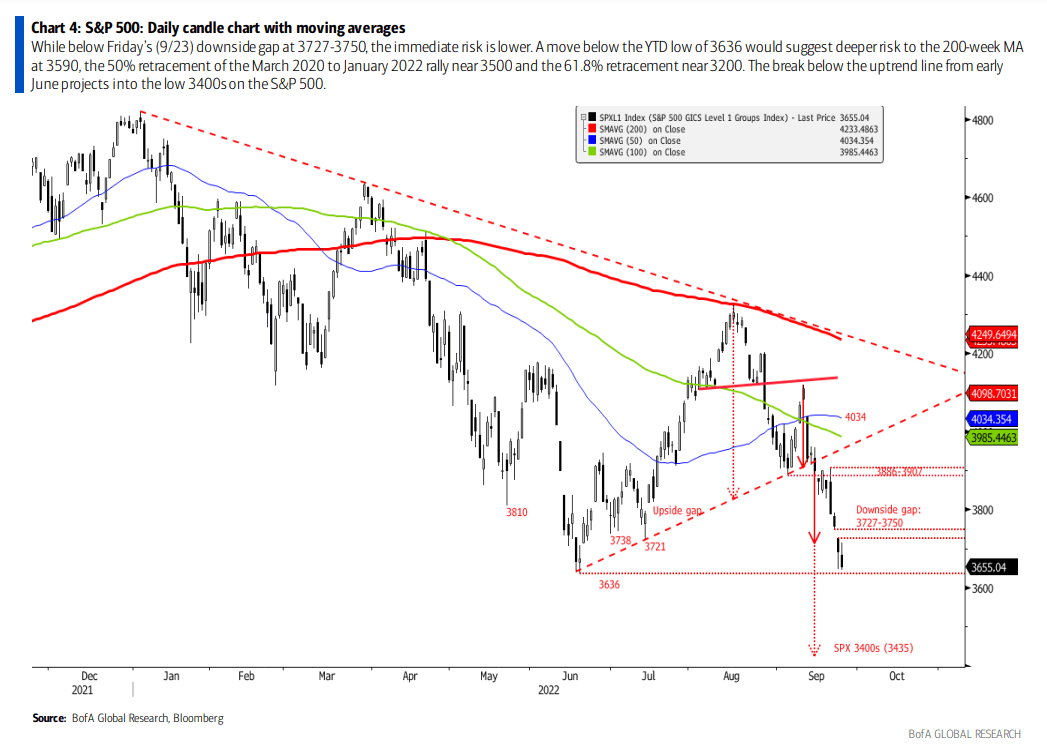

Bof As Reassuring View On Current Stock Market Valuations

May 23, 2025

Bof As Reassuring View On Current Stock Market Valuations

May 23, 2025 -

Succession Sky Atlantic Hd Why You Need To Watch This Show

May 23, 2025

Succession Sky Atlantic Hd Why You Need To Watch This Show

May 23, 2025 -

Italy Simplifies Citizenship Application Great Grandparents Route

May 23, 2025

Italy Simplifies Citizenship Application Great Grandparents Route

May 23, 2025