FTC Appeals Microsoft-Activision Merger Ruling

Table of Contents

The FTC's Case Against the Merger

The FTC's opposition to the Microsoft-Activision merger rests on two primary pillars: concerns about market domination and the potential misuse of power in the burgeoning cloud gaming sector.

Concerns about Market Domination

The FTC argues that the merger would grant Microsoft excessive control over the gaming market, especially within cloud gaming.

- Microsoft's potential control over major franchises: Owning Xbox and gaining control of popular franchises like Call of Duty could severely stifle competition from rival platforms like PlayStation and Nintendo Switch. This dominance could lead to a reduction in choice for consumers.

- Potential for anti-competitive behavior: The FTC highlights the possibility of Microsoft leveraging its market power to harm competitors. This could manifest in higher prices for games, fewer exclusive titles on competing platforms, and reduced innovation.

- Evidence of past practices: The FTC's case relies heavily on presenting evidence of Microsoft's past business practices and arguing that the Activision Blizzard acquisition would only amplify these tendencies. This includes examples of past acquisitions and exclusive deals that allegedly limited competition.

The Role of Cloud Gaming

The FTC’s appeal centers on the critical role of cloud gaming, a rapidly expanding sector. They fear Microsoft could exploit Activision’s titles to establish an insurmountable advantage.

- Exclusive content and platform lock-in: The FTC is worried that Microsoft might make Activision Blizzard games exclusive to its own cloud gaming platform, effectively locking out competitors like Google Stadia and Amazon Luna, thus hindering competition.

- Cloud gaming market analysis: The FTC's argument hinges on the projected growth of the cloud gaming market. They contend that Microsoft's control over key titles could stifle competition and innovation in this crucial area.

- Impact on innovation and consumer choice: The FTC's appeal emphasizes the potential negative consequences for innovation and consumer choice in the dynamic cloud gaming landscape. Limited competition could result in less innovation and fewer options for gamers.

Microsoft's Defense of the Acquisition

Microsoft vehemently defends the acquisition, asserting that it will benefit consumers and foster innovation.

Arguments Against Anti-Competitive Practices

Microsoft counters the FTC's claims by emphasizing its commitment to a competitive market.

- Call of Duty's continued availability: A central plank of Microsoft's defense is its pledge to keep Call of Duty available on PlayStation and other platforms, demonstrating its commitment to fair competition.

- Increased competition and investment: Microsoft argues that the merger will actually increase competition by allowing it to invest more in game development and expand its reach to new audiences. They emphasize their plan to bring more games to more platforms.

- Data and evidence: Microsoft is countering the FTC's arguments with its own data and evidence, aiming to demonstrate a healthy and competitive gaming market that wouldn't be negatively affected by the merger.

The Impact on Innovation and Game Development

Microsoft champions the merger as a catalyst for innovation and enhanced game development.

- Combined resources and expertise: Microsoft highlights the combined resources and expertise of both companies, leading to a potential boost in game development quality and frequency of releases.

- Collaborative projects and technological advancements: The merger, according to Microsoft, will foster collaborative projects, leading to technological advancements and better gaming experiences.

- Refuting claims of stifled innovation: Microsoft directly refutes the FTC's claim that the merger will stifle innovation, presenting a counter-narrative of enhanced innovation and development spurred by the combination of resources and talent.

Potential Outcomes and Implications

The FTC's appeal will have far-reaching consequences.

The Appeal Process

The FTC's appeal will likely involve a lengthy and complex legal process.

- Timeline and potential delays: The appeal process is expected to take considerable time, potentially involving multiple court hearings and legal challenges.

- Possible outcomes: The possible outcomes range from upholding the initial ruling to completely overturning it, leading to a potential block of the merger.

- Legal precedents and antitrust laws: The legal battle will hinge on interpreting relevant antitrust laws and precedents, making it a significant case for future merger considerations.

Impact on the Gaming Industry

The outcome of this appeal will fundamentally impact the gaming industry's future.

- Impact on smaller studios: The decision could influence the landscape for smaller game studios and independent developers, affecting their ability to compete in a potentially consolidated market.

- Implications for competition and pricing: The ruling will influence competition levels and potentially affect game prices for consumers.

- Effects on future mergers and acquisitions: The outcome of this case will set a crucial precedent for future mergers and acquisitions in the tech industry, particularly within the gaming sector.

Conclusion

The FTC's appeal of the Microsoft-Activision merger ruling is a critical juncture for the gaming industry. The arguments presented by both sides illuminate the complexities of antitrust law in the swiftly changing digital landscape. The outcome will significantly shape competition, innovation, and consumer choice in the gaming sector. Staying abreast of developments in the FTC's appeal against the Microsoft-Activision merger is essential for anyone invested in the future of gaming. Keep informed about further developments in this landmark case affecting the Microsoft-Activision merger and its broader implications for the gaming industry.

Featured Posts

-

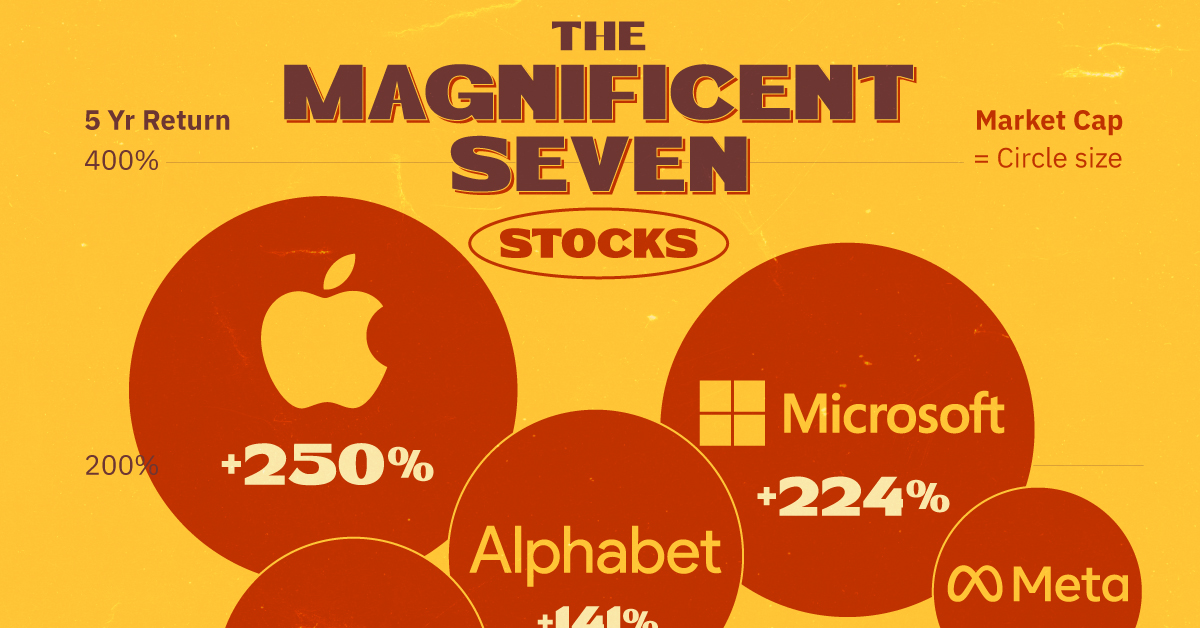

Magnificent Seven Stocks A 2 5 Trillion Market Value Loss In 2024

Apr 29, 2025

Magnificent Seven Stocks A 2 5 Trillion Market Value Loss In 2024

Apr 29, 2025 -

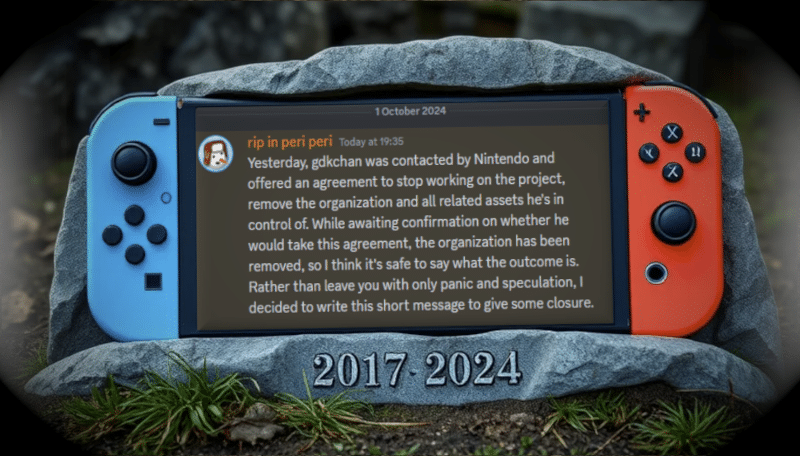

Ryujinx Emulator Project Ends After Alleged Nintendo Intervention

Apr 29, 2025

Ryujinx Emulator Project Ends After Alleged Nintendo Intervention

Apr 29, 2025 -

Teen Guilty Of Murder After Fatal Rock Throwing

Apr 29, 2025

Teen Guilty Of Murder After Fatal Rock Throwing

Apr 29, 2025 -

Bof As View Are High Stock Market Valuations Cause For Concern

Apr 29, 2025

Bof As View Are High Stock Market Valuations Cause For Concern

Apr 29, 2025 -

Historic Anchor Brewing Company Announces Closure After 127 Years

Apr 29, 2025

Historic Anchor Brewing Company Announces Closure After 127 Years

Apr 29, 2025

Latest Posts

-

Starbucks Unions Rejection Of Companys Proposed Wage Hikes

Apr 29, 2025

Starbucks Unions Rejection Of Companys Proposed Wage Hikes

Apr 29, 2025 -

Us Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 29, 2025

Us Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 29, 2025 -

Is The U S Dollar Headed For Its Worst Presidential First 100 Days Since Nixon

Apr 29, 2025

Is The U S Dollar Headed For Its Worst Presidential First 100 Days Since Nixon

Apr 29, 2025 -

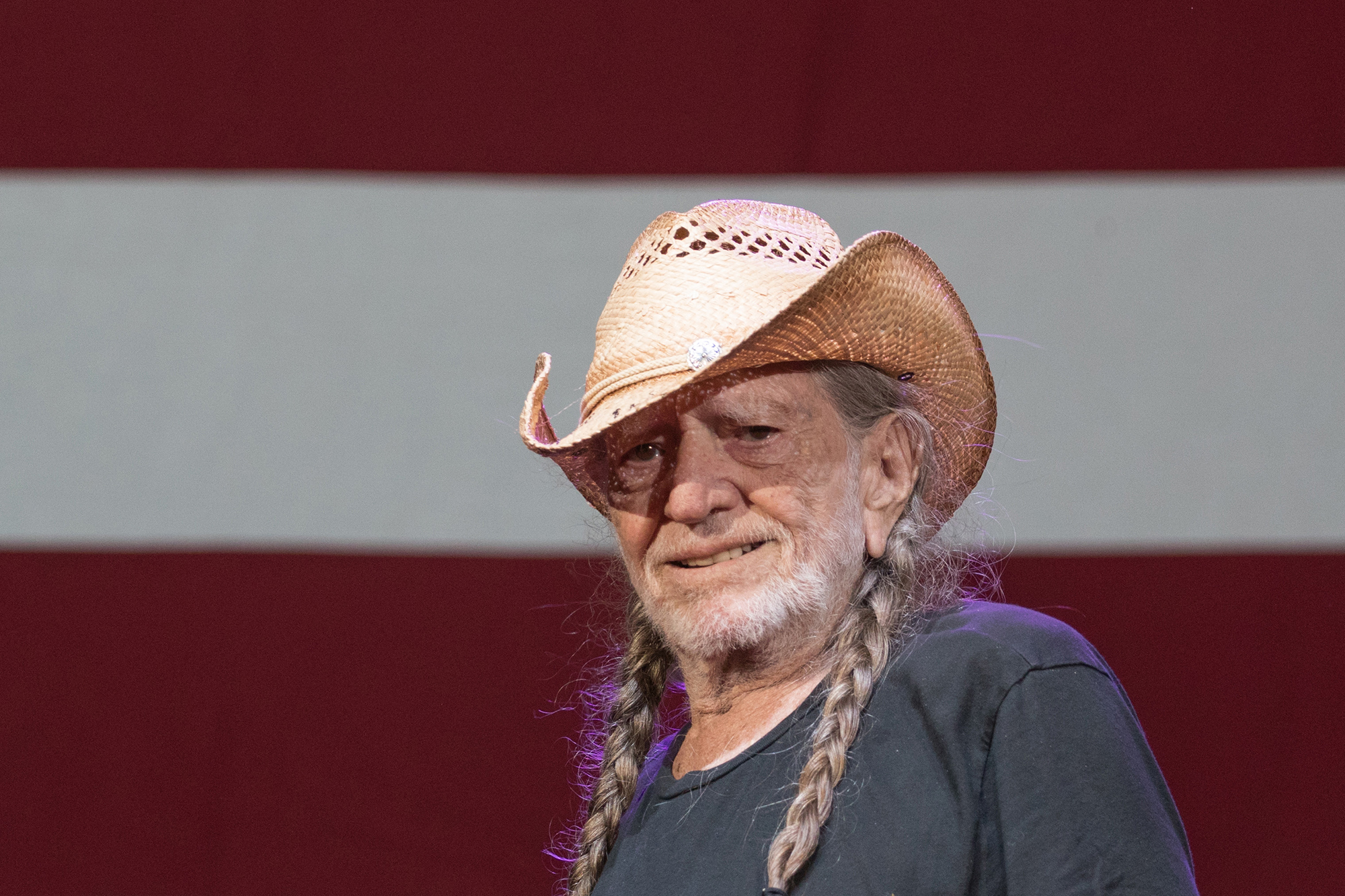

Willie Nelsons Wife Responds To False Media Report

Apr 29, 2025

Willie Nelsons Wife Responds To False Media Report

Apr 29, 2025 -

Resistance Grows Car Dealerships Renew Fight Against Electric Vehicle Regulations

Apr 29, 2025

Resistance Grows Car Dealerships Renew Fight Against Electric Vehicle Regulations

Apr 29, 2025