Get Pre-Approved For A Personal Loan: Check Rates Today

Table of Contents

Understanding Personal Loan Pre-Approval

Personal loan pre-approval is a preliminary assessment by a lender to determine your eligibility for a loan before you formally apply. It gives you a strong indication of how much you can borrow and at what interest rate. This differs from pre-qualification, which is a less formal process often based on less detailed information.

- What information lenders need: Lenders will typically request basic personal and financial details, including your income, employment history, credit score, and debt levels. Providing accurate information is vital for a smooth process.

- How long the process takes: Pre-approval usually takes only a few minutes to a few days, depending on the lender and the complexity of your financial situation.

- Impact on credit score: The impact on your credit score is minimal to none, as pre-approval typically involves a "soft" credit pull, which doesn't affect your credit rating.

Benefits of Getting Pre-Approved for a Personal Loan

Pre-approval offers several significant benefits when searching for a personal loan.

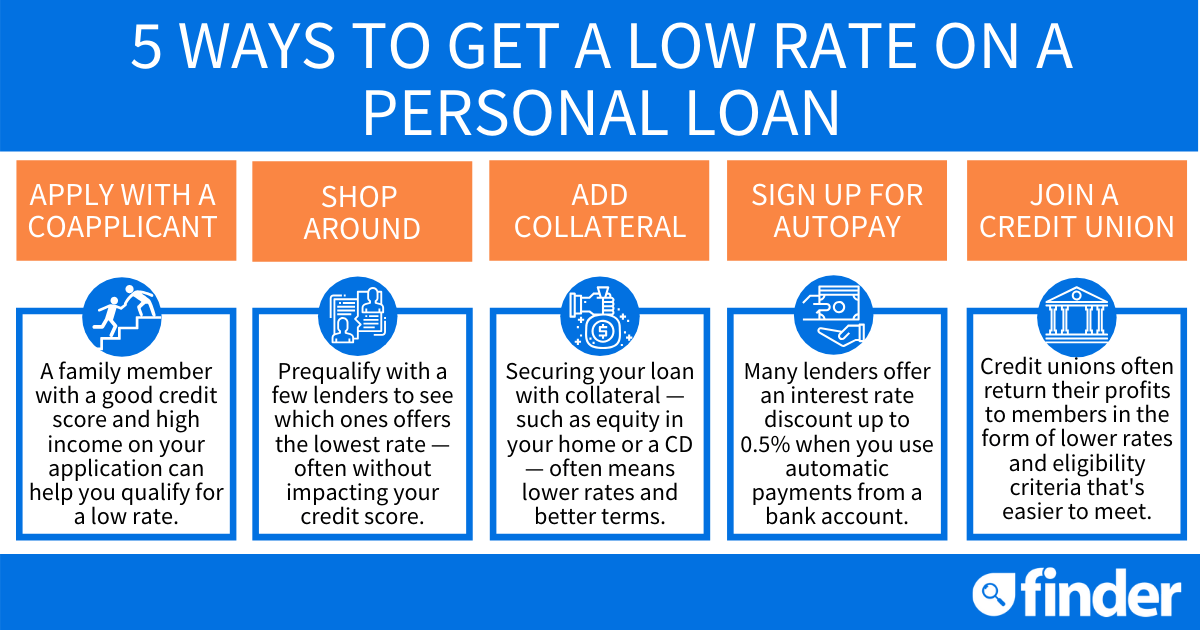

- Shop around for better interest rates: Knowing your pre-approved offers allows you to compare rates from multiple lenders and negotiate for a better deal. This can save you thousands of dollars over the life of the loan.

- Know your borrowing power before applying: Pre-approval provides clarity on how much you can borrow, helping you make informed decisions about the loan amount and repayment terms.

- Faster loan processing time: When you're formally applying for a loan, the lender already has your preliminary information, potentially speeding up the approval and funding process.

- Increased confidence during negotiations: Armed with a pre-approval, you can approach lenders with greater confidence, knowing you're a qualified borrower.

How to Get Pre-Approved for a Personal Loan

The application process for personal loan pre-approval is generally straightforward.

- Gather necessary documents: Prepare documents like your income statements (pay stubs or tax returns), proof of employment, and a copy of your credit report.

- Compare lenders and their rates: Explore different lenders – banks, credit unions, and online lenders – to compare their interest rates, fees, and loan terms. Use online loan comparison websites to streamline this process.

- Complete the pre-approval application online: Most lenders offer convenient online applications that can be completed in minutes. Be sure to review the terms and conditions carefully before submitting.

- Review the pre-approval offer: Once you receive your pre-approval offer, carefully review the terms, including the interest rate, loan amount, repayment schedule, and any associated fees.

Factors Affecting Personal Loan Approval and Rates

Several factors influence your chances of getting approved for a personal loan and the interest rate you'll receive.

- Credit score: A higher credit score typically leads to better interest rates and a higher likelihood of approval.

- Debt-to-income ratio: Lenders assess your debt-to-income ratio (DTI) to gauge your ability to manage additional debt. A lower DTI improves your chances of approval.

- Income stability: Consistent income demonstrates your ability to repay the loan, influencing lender decisions.

- Loan amount and term: The loan amount and repayment term also play a role, with shorter terms often commanding higher interest rates.

Where to Check Personal Loan Rates Today

Comparing rates from multiple sources is essential to secure the best deal.

- Online lenders: Online lenders often offer competitive rates and a convenient application process.

- Banks and credit unions: Traditional financial institutions can offer personal loans, though their rates might not always be as competitive as online lenders.

- Loan comparison websites: These websites allow you to compare offers from numerous lenders simultaneously, making it easier to find the best personal loan rates.

Get Pre-Approved for a Personal Loan and Secure the Best Rate

Getting pre-approved for a personal loan empowers you to shop around confidently, compare interest rates effectively, and ultimately secure the best possible deal. By following these steps and understanding the influencing factors, you can significantly improve your chances of approval and obtain favorable loan terms. Don't wait – check loan rates today and start your personal loan journey with pre-approval! [Link to a reputable loan comparison site] [Link to a reputable lender]

Featured Posts

-

Three Withdrawals Rock Barcelona Open Before First Serve

May 28, 2025

Three Withdrawals Rock Barcelona Open Before First Serve

May 28, 2025 -

Ajaxs Title Hopes Dashed A Detailed Analysis Of Nine Crucial Points

May 28, 2025

Ajaxs Title Hopes Dashed A Detailed Analysis Of Nine Crucial Points

May 28, 2025 -

Check Todays Personal Loan Interest Rates And Apply Now

May 28, 2025

Check Todays Personal Loan Interest Rates And Apply Now

May 28, 2025 -

Rayan Cherki News A German Insiders Perspective

May 28, 2025

Rayan Cherki News A German Insiders Perspective

May 28, 2025 -

Open De France Surprise Eliminations Alcaraz Et Swiatek En Tete

May 28, 2025

Open De France Surprise Eliminations Alcaraz Et Swiatek En Tete

May 28, 2025