Gold Plunges Amidst Trader Profit-Booking On US-China Trade Optimism

Table of Contents

The Role of US-China Trade Optimism in Gold's Decline

Gold, often considered a safe-haven asset, typically sees increased demand during times of economic uncertainty and geopolitical instability. This inverse relationship between gold prices and risk appetite is central to understanding the current market situation. Recent positive developments in US-China trade negotiations have significantly boosted investor confidence, reducing risk aversion and consequently dampening the demand for gold.

- Positive Trade News: Reports of progress towards a "phase one" trade deal, including reduced tariffs on certain goods, have fueled optimism. This represents a significant de-escalation of trade tensions that had previously pushed gold prices higher.

- Impact on Investor Confidence: The positive trade news has led to a surge in investor confidence, encouraging investment in riskier assets like stocks and bonds. This shift in investment strategy has directly impacted gold's appeal.

- Reduced Risk Aversion: With reduced uncertainty surrounding the US-China trade war, investors feel less compelled to seek refuge in gold, resulting in decreased demand and consequently lower prices. The lessening of global trade risk translates into lower gold prices.

Trader Profit-Taking as a Key Driver

Another significant contributor to the gold price plunge is profit-taking by traders. After a period of price increases driven by trade war anxieties, many traders are now locking in their profits. This selling pressure adds to the downward momentum.

- Technical Analysis Signals: Technical analysis indicators may have suggested an overbought condition in the gold market, signaling a potential price correction. This prompted traders to secure their gains before a potential price reversal.

- Potential for Further Decreases: Current market trends suggest that further price decreases in gold are possible as traders continue to book profits. The "Gold Plunges" trend might continue until a new equilibrium is reached.

- Capitalizing on Gains: Traders frequently engage in profit-booking strategies, capitalizing on price increases to secure profits and minimize potential losses if prices decline.

Alternative Investment Opportunities and Gold's Appeal

The shift away from gold is also influenced by the attractiveness of alternative investment opportunities. In the current market environment, stocks and bonds appear more appealing to some investors due to their perceived higher potential returns.

- Comparing Returns: The potential returns offered by stocks and bonds, especially with a more optimistic economic outlook, currently surpass those expected from gold, influencing investment decisions.

- Impact of Rising Interest Rates: Rising interest rates generally reduce the appeal of gold, which doesn't yield interest income. This factor adds to the decreased demand.

- Currency Fluctuations: Currency fluctuations, particularly the US dollar's strength against other currencies, also affect gold's price, impacting its attractiveness as an investment.

Geopolitical Factors and their Diminishing Impact

While geopolitical uncertainties persist globally, their influence on gold prices has been overshadowed, for the time being, by the optimism surrounding US-China trade relations.

- Lessened Effect of Geopolitical Events: Recent geopolitical events, which might typically push investors towards gold, have had a relatively muted impact due to the prevailing positive sentiment regarding the trade deal.

- Trade Optimism Takes Precedence: The positive news on the trade front has effectively diminished the impact of these other geopolitical risks on the minds of investors.

- Future Importance: However, it's important to note that these geopolitical factors could regain significance if US-China trade negotiations falter or new global uncertainties emerge.

Conclusion: Analyzing the Gold Plunge and Future Outlook

The recent gold price drop, summarized as "Gold Plunges Amidst Trader Profit-Booking on US-China Trade Optimism," is primarily due to two key factors: improved US-China trade relations, reducing risk aversion and stimulating demand for other assets, and traders booking profits after recent price increases. It’s crucial to monitor US-China trade developments closely, as they significantly influence gold prices. The future volatility of gold prices remains a key consideration. Stay updated on the latest developments surrounding the US-China trade war and its impact on gold prices to effectively manage your gold investments and navigate this volatile market. Understanding the factors behind gold price movements, including profit-booking and the impact of broader economic and geopolitical news, is key to making informed investment decisions in the gold market.

Featured Posts

-

Alex Fine And Pregnant Cassie Ventura At Mob Land Premiere

May 18, 2025

Alex Fine And Pregnant Cassie Ventura At Mob Land Premiere

May 18, 2025 -

King Day 2024 Celebration Plans Vs Abolition Calls

May 18, 2025

King Day 2024 Celebration Plans Vs Abolition Calls

May 18, 2025 -

Debate Heats Up Car Dealers And The Future Of Ev Mandates

May 18, 2025

Debate Heats Up Car Dealers And The Future Of Ev Mandates

May 18, 2025 -

Maneskins Damiano David Rocks Jimmy Kimmel Live Alt 104 5

May 18, 2025

Maneskins Damiano David Rocks Jimmy Kimmel Live Alt 104 5

May 18, 2025 -

Gold Plunges Amidst Trader Profit Booking On Us China Trade Optimism

May 18, 2025

Gold Plunges Amidst Trader Profit Booking On Us China Trade Optimism

May 18, 2025

Latest Posts

-

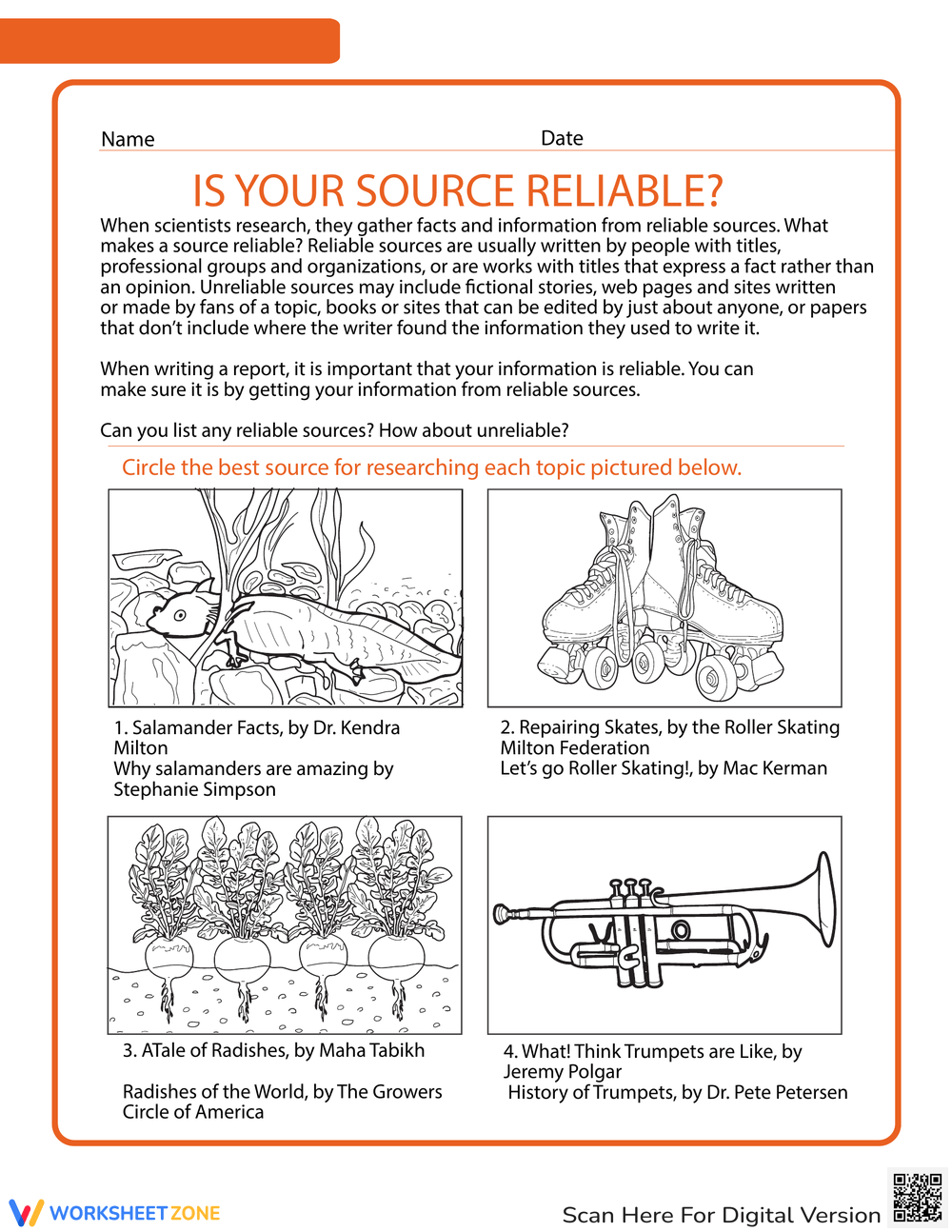

Find The Best Entertainment News Here Reliable Sources And In Depth Coverage

May 18, 2025

Find The Best Entertainment News Here Reliable Sources And In Depth Coverage

May 18, 2025 -

Snl Promo Walton Goggins And The Question Of Mortality

May 18, 2025

Snl Promo Walton Goggins And The Question Of Mortality

May 18, 2025 -

San Francisco Concert Spencer Brown At Audio Sf May 2 2025

May 18, 2025

San Francisco Concert Spencer Brown At Audio Sf May 2 2025

May 18, 2025 -

Rave Events And Their Contribution To Local Economies

May 18, 2025

Rave Events And Their Contribution To Local Economies

May 18, 2025 -

The Impact Of Tariffs On Southwest Washingtons Economy

May 18, 2025

The Impact Of Tariffs On Southwest Washingtons Economy

May 18, 2025