GOP's New Plan: What Student Loan Borrowers Need To Know

Table of Contents

Key Proposals in the GOP's Student Loan Plan

The core of the GOP's student loan plan centers on reforming the current system, rather than broad-based forgiveness. This involves significant changes to income-driven repayment (IDR) plans and potential adjustments to interest rates. While specific details are still emerging, the general tenets include:

-

Proposed Changes to Income-Driven Repayment (IDR) Plans: The plan aims to overhaul existing IDR plans like REPAYE, PAYE, and ICR. This might involve adjusting the calculation of discretionary income, potentially leading to higher monthly payments for some borrowers. It could also alter the length of the repayment period, impacting the total interest paid over the life of the loan.

-

Caps on Loan Forgiveness Amounts: The GOP plan is likely to include limits on the amount of student loan debt eligible for forgiveness through IDR plans. This contrasts with previous proposals for widespread debt cancellation and will significantly impact the total amount borrowers can have forgiven.

-

Potential Interest Rate Adjustments: The plan may propose changes to interest rates for federal student loans. This could result in either increased or decreased interest rates depending on the specific details of the proposal, impacting the overall cost of borrowing for students.

-

Changes to Loan Consolidation Options: The GOP's plan may also modify the options available for consolidating multiple federal student loans into a single loan. This could affect borrowers' ability to simplify their repayment process and potentially negotiate better terms.

Impact on Borrowers with Different Loan Types

The GOP's student loan plan will likely affect different types of borrowers differently. Understanding these nuances is critical for assessing your personal financial situation:

-

Undergraduate Loans: Borrowers with undergraduate loans may experience changes in their monthly payments and overall repayment timeline depending on the adjustments made to IDR plans and interest rates. The proposed caps on loan forgiveness could also limit the amount of debt relief they receive.

-

Graduate Student Loans: Graduate students often carry significantly larger loan balances. The GOP's plan's impact on these borrowers will likely be more pronounced, particularly if forgiveness caps are implemented. Higher monthly payments could become a major challenge.

-

Parent PLUS Loans: The plan's impact on Parent PLUS loans is uncertain. The proposed changes to IDR plans and forgiveness may or may not affect these loans differently than other federal student loans. Clear clarification is needed.

-

Private Student Loans: It's crucial to note that the GOP's plan primarily focuses on federal student loans. Private student loans are generally not covered by federal programs and would likely remain unaffected by this legislation.

Potential Advantages and Disadvantages of the GOP's Plan

The GOP's plan presents both potential advantages and disadvantages for student loan borrowers. A balanced assessment is crucial before forming an opinion:

-

Potential Advantages:

- Increased Affordability (Potentially): Reforms to IDR plans could make monthly payments more manageable for some borrowers, although this is dependent on the specific changes implemented.

- Simpler Repayment Options (Potentially): Streamlining the repayment process through revised IDR plans might simplify the process for borrowers.

-

Potential Disadvantages:

- Reduced Forgiveness Opportunities: The proposed caps on loan forgiveness significantly reduce the potential for complete debt relief for many borrowers.

- Higher Monthly Payments for Some: Changes to IDR calculations could lead to increased monthly payments for some borrowers, particularly those with higher incomes.

- Increased Overall Repayment Costs: Higher interest rates, longer repayment periods, or both could substantially increase the total cost of borrowing for many borrowers.

-

Comparison to Existing Programs: Compared to existing student loan forgiveness programs like PSLF (Public Service Loan Forgiveness), the GOP's plan offers a potentially less generous approach to debt relief, focusing instead on repayment structure reforms.

Understanding the Political Landscape and Future Uncertainties

The success of the GOP's student loan plan hinges on its passage through Congress and the potential for amendments during the legislative process. Several factors influence its future:

- Political Dynamics: The current political climate and the level of bipartisan support will significantly impact the plan's likelihood of becoming law.

- Potential Amendments: The plan is likely to undergo significant changes during the legislative process, potentially altering its original proposals and overall impact on borrowers.

- Alternative Approaches: Alternative approaches to student loan debt relief, including different types of forgiveness programs or further modifications to IDR plans, may be considered as alternatives or compromises.

Conclusion

The GOP's new student loan plan represents a significant shift in the approach to addressing student loan debt. While it aims to improve affordability through reformed repayment structures, it also poses challenges for borrowers due to reduced forgiveness opportunities. Comprehending the plan's specifics, its impact on different loan types, and the uncertain political landscape is vital for all student loan borrowers.

Call to Action: Stay informed about the evolving details of the GOP's student loan plan and its potential impact on your personal finances. Actively research alternative options, and consult with a financial advisor to create a tailored student loan repayment strategy. Don't delay – proactively manage your student loan debt today.

Featured Posts

-

The Trump Marriage A Timeline Of Ups And Downs

May 17, 2025

The Trump Marriage A Timeline Of Ups And Downs

May 17, 2025 -

7 Bit Casino Review A Top Choice For New Zealand Players

May 17, 2025

7 Bit Casino Review A Top Choice For New Zealand Players

May 17, 2025 -

Analysis The Fortnite Item Shop Update And Player Reaction

May 17, 2025

Analysis The Fortnite Item Shop Update And Player Reaction

May 17, 2025 -

Exploring The Lumon Apple Analogy In Ben Stillers Severance

May 17, 2025

Exploring The Lumon Apple Analogy In Ben Stillers Severance

May 17, 2025 -

Novak Djokovic In Miami Acik Final Yolu Mac Oezetleri Ve Analiz

May 17, 2025

Novak Djokovic In Miami Acik Final Yolu Mac Oezetleri Ve Analiz

May 17, 2025

Latest Posts

-

Dallas Mavericks Jalen Brunsons Free Agency And The Luka Doncic Trade Aftermath

May 17, 2025

Dallas Mavericks Jalen Brunsons Free Agency And The Luka Doncic Trade Aftermath

May 17, 2025 -

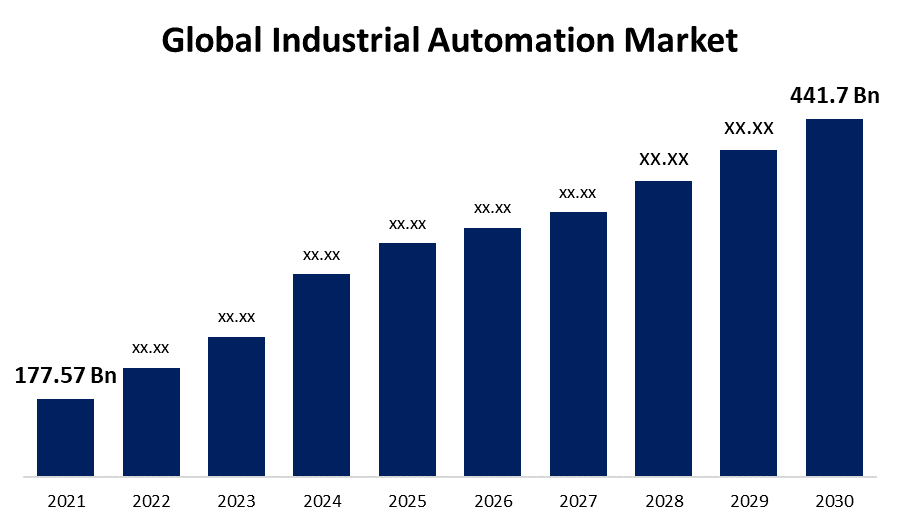

Market Update Rockwell Automation Leads Post Earnings Gains Alongside Other Big Winners

May 17, 2025

Market Update Rockwell Automation Leads Post Earnings Gains Alongside Other Big Winners

May 17, 2025 -

Knicks Overtime Loss A Wake Up Call

May 17, 2025

Knicks Overtime Loss A Wake Up Call

May 17, 2025 -

Analyzing The Knicks Overtime Defeat

May 17, 2025

Analyzing The Knicks Overtime Defeat

May 17, 2025 -

Rockwell Automations Strong Earnings Drive Market Rally Analysis Of Key Stocks

May 17, 2025

Rockwell Automations Strong Earnings Drive Market Rally Analysis Of Key Stocks

May 17, 2025