High Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

BofA's Rationale Behind High Stock Market Valuations

BofA attributes the current high stock market valuations to several key factors, arguing that they aren't solely indicative of an impending market crash. Their reasoning suggests a more complex picture than simply "overvalued" markets.

Strong Corporate Earnings and Profitability

Robust corporate earnings and improved profit margins are significant pillars supporting higher stock valuations. BofA's research highlights sustained strength in corporate performance.

- Increased efficiency and productivity gains: Companies have implemented strategies to streamline operations, leading to higher productivity and lower costs, boosting profitability.

- Strong consumer spending and demand: Healthy consumer spending and robust demand for goods and services continue to fuel revenue growth for many companies. This positive consumer sentiment is a key driver.

- Strategic pricing power allowing companies to maintain margins: Many companies possess sufficient pricing power to offset rising input costs, protecting their profit margins even in inflationary environments. This is crucial for sustaining high valuations.

Low Interest Rates and Ample Liquidity

The prolonged period of low interest rates and ample liquidity in the market significantly impacts stock valuations. Cheap capital fuels investment and drives up asset prices.

- Lower borrowing costs for companies: Companies can borrow money at historically low rates, fueling expansion, acquisitions, and share buybacks, all of which can boost stock prices.

- Increased investor appetite for riskier assets: Low interest rates reduce the appeal of traditional, low-risk investments, encouraging investors to seek higher returns in riskier assets, including stocks.

- Continued quantitative easing programs (if applicable): While the extent of quantitative easing may vary over time, periods of monetary easing can inject significant liquidity into the market, contributing to higher valuations.

Technological Innovation and Growth Sectors

The rapid pace of technological innovation and the emergence of high-growth sectors are powerful drivers of market valuations. Investment in innovative sectors creates significant future potential.

- Investment in AI, renewable energy, and other future-oriented sectors: Massive investments flow into sectors perceived as having high growth potential, driving up valuations within these specific areas and impacting overall market sentiment.

- Attractive growth prospects attracting substantial investment: The potential for exponential growth in these sectors attracts substantial investment, further pushing up valuations.

- Long-term potential for significant returns: Investors are willing to pay a premium for companies in these high-growth sectors, anticipating substantial long-term returns.

Addressing Investor Concerns About Stock Market Overvaluation

Addressing the concerns of investors regarding high stock market valuations is crucial. BofA counters common anxieties with a balanced perspective.

Comparing Current Valuations to Historical Data

Analyzing historical market valuations offers a valuable context. Current levels, though high, are not unprecedented.

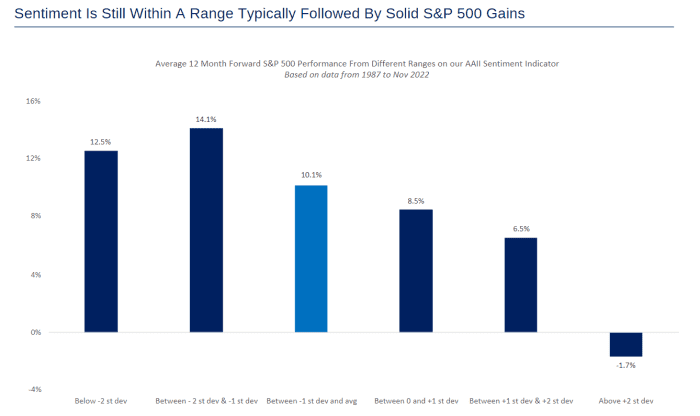

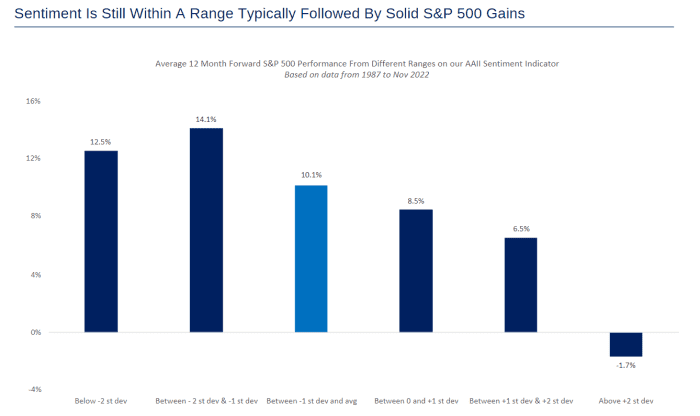

- Reference periods of similar high valuations and subsequent market performance: History shows periods of comparable, or even higher, valuations, followed by continued market growth. This historical perspective is critical to understanding current conditions.

- Contextualize current valuations within a long-term perspective: A long-term perspective helps to mitigate the impact of short-term market fluctuations and avoid knee-jerk reactions.

The Importance of Long-Term Investing

A long-term investment strategy remains crucial, even amidst market volatility driven by high stock market valuations.

- Avoiding panic selling in response to short-term market fluctuations: Short-term market movements are often driven by sentiment rather than fundamental changes in company performance. A long-term strategy helps weather these storms.

- Focus on fundamental company performance rather than short-term price movements: Focusing on the underlying strength of individual companies is paramount; short-term price movements are less indicative of long-term value.

Diversification and Risk Management

Diversification and effective risk management are cornerstones of a successful investment strategy.

- Spreading investments across different asset classes: Diversification reduces overall portfolio risk by mitigating the impact of negative performance in any single asset class.

- Regular portfolio reviews and adjustments: Regularly assessing and adjusting your portfolio based on changing market conditions is vital for maintaining a well-balanced investment strategy.

- Seeking professional financial advice when needed: Consulting with a qualified financial advisor can provide personalized guidance and support in navigating the complexities of investment management.

Conclusion: Navigating High Stock Market Valuations

High stock market valuations, while potentially concerning, do not automatically signal an impending market crash according to BofA's analysis. By understanding the contributing factors – strong corporate earnings, low interest rates, technological advancements, and long-term growth potential – investors can adopt a more informed approach. Remember, a long-term perspective, coupled with a well-diversified portfolio and a sound risk management strategy, is key to navigating market fluctuations. Don't let worries about high stock market valuations paralyze you. Instead, understand the contributing factors and develop a robust investment plan that aligns with your financial goals. Consider seeking professional financial advice to tailor a strategy that suits your individual needs and risk tolerance.

Featured Posts

-

Spk Nin Aciklamasiyla Kripto Piyasalarinda Yeni Bir Cag

May 08, 2025

Spk Nin Aciklamasiyla Kripto Piyasalarinda Yeni Bir Cag

May 08, 2025 -

Fetterman Addresses Ny Magazines Fitness To Serve Concerns

May 08, 2025

Fetterman Addresses Ny Magazines Fitness To Serve Concerns

May 08, 2025 -

Twins Sweep Angels Series As Hitters Strike Out 13 Times

May 08, 2025

Twins Sweep Angels Series As Hitters Strike Out 13 Times

May 08, 2025 -

Bitcoin Madenciligi Azalan Karliligin Gercek Sebepleri

May 08, 2025

Bitcoin Madenciligi Azalan Karliligin Gercek Sebepleri

May 08, 2025 -

160 Year Old Pierce County House To Become Park

May 08, 2025

160 Year Old Pierce County House To Become Park

May 08, 2025

Latest Posts

-

The Trade Wars Impact One Cryptocurrency Poised To Succeed

May 08, 2025

The Trade Wars Impact One Cryptocurrency Poised To Succeed

May 08, 2025 -

Wall Streets 110 Prediction Why Billionaires Are Betting Big On This Black Rock Etf

May 08, 2025

Wall Streets 110 Prediction Why Billionaires Are Betting Big On This Black Rock Etf

May 08, 2025 -

Black Rock Etf Billionaire Investment Poised For 110 Growth In 2025

May 08, 2025

Black Rock Etf Billionaire Investment Poised For 110 Growth In 2025

May 08, 2025 -

Bitcoin Conference Seoul 2025 Shaping The Future Of Bitcoin In Asia

May 08, 2025

Bitcoin Conference Seoul 2025 Shaping The Future Of Bitcoin In Asia

May 08, 2025 -

Bitcoin Madenciligi 2024 Ve Sonrasi Karlilik Analizi

May 08, 2025

Bitcoin Madenciligi 2024 Ve Sonrasi Karlilik Analizi

May 08, 2025