Wall Street's 110% Prediction: Why Billionaires Are Betting Big On This BlackRock ETF

Table of Contents

Identifying the BlackRock ETF

The ETF generating this significant buzz is the iShares CORE U.S. Aggregate Bond ETF (AGG). This popular BlackRock ETF focuses on U.S. investment-grade bonds, offering broad diversification across maturities and sectors within the investment-grade bond market. AGG aims to track the Bloomberg U.S. Aggregate Bond Index, a widely recognized benchmark for the U.S. investment-grade bond market. Its historical performance has generally mirrored the index, providing investors with relatively stable returns and lower volatility compared to equity markets.

- Key Holdings and Sectors: AGG holds a diverse portfolio of U.S. Treasury bonds, government agency bonds, corporate bonds, and mortgage-backed securities. This diversification across sectors helps mitigate risk.

- Expense Ratio and Management Fees: AGG boasts a low expense ratio, making it a cost-effective option for long-term investors. Check BlackRock's website for the most up-to-date expense ratio information. [Link to BlackRock AGG page]

- BlackRock Resources: For detailed information on holdings, performance data, and prospectus, refer to the official BlackRock website. [Link to BlackRock AGG page]

The 110% Prediction: Unpacking the Rationale

The 110% prediction hasn't come from a single source but rather emerges from a confluence of factors analyzed by several prominent financial analysts and firms. These predictions are largely based on forecasts of significant interest rate reductions in the coming years. The underlying assumptions revolve around expectations of a softening economy and potential future monetary policy responses by central banks.

- Predicted Interest Rate Changes: Analysts anticipate a substantial decrease in interest rates, leading to an increase in bond prices. As interest rates fall, the fixed income payments from bonds become relatively more attractive, driving up demand and prices.

- Inflation Scenarios: While inflation remains a concern, many analysts believe that current inflationary pressures will ease, allowing central banks to reduce interest rates more aggressively. The AGG ETF is considered relatively well-positioned to perform well in various inflationary environments, given its broad diversification.

- Geopolitical Factors and Economic Forecasts: Global economic forecasts and geopolitical events invariably influence bond yields. Current analyses suggest a more favorable environment for bond markets in the coming period.

Billionaire Investment Strategies and the ETF

Billionaires are attracted to the AGG ETF for several reasons. Its perceived safety, due to its investment in investment-grade bonds, is a major draw. Additionally, the potential for high returns in a falling interest rate environment is a compelling factor, especially for investors seeking diversification within their portfolios.

- Examples of Billionaire Investors: While specific holdings of individual billionaires are often kept private, the popularity of AGG within institutional investment portfolios suggests significant holdings by high-net-worth individuals and large financial institutions.

- Diversification Benefits: AGG offers valuable diversification within a broader portfolio, reducing overall risk. By investing in a diversified pool of U.S. investment-grade bonds, investors can mitigate the impact of any single bond default or sector-specific downturn.

- Risk Profile: While considered relatively low-risk compared to equities, the AGG ETF is not without risk. Bond prices are sensitive to interest rate changes, and a rise in rates could negatively impact the ETF's performance.

Risks and Considerations

It is crucial to understand that while the 110% prediction is intriguing, it is not guaranteed. Investing in AGG, like any investment, carries risks.

- Rising Interest Rates: A rise in interest rates would likely decrease the value of the bonds held in the AGG ETF, affecting its overall performance negatively.

- Credit Risk: Although the ETF invests in investment-grade bonds, there's still a degree of credit risk. While unlikely, there is a possibility of default from individual bond issuers.

- Due Diligence: Before making any investment decision, thorough research and understanding of the associated risks are essential. Past performance is not indicative of future results.

Conclusion

The significant interest in the iShares CORE U.S. Aggregate Bond ETF (AGG) is driven by a combination of factors, including the bold 110% prediction based on anticipated interest rate declines, the ETF's robust diversification strategy, and its attractiveness to billionaire investors seeking stable yet potentially high-growth investments. However, it's crucial to remember the inherent risks associated with any investment, including the sensitivity of bond prices to interest rate fluctuations. While this article explores the potential of the AGG ETF, conduct thorough due diligence, understand your risk tolerance, and consult with a financial advisor before investing. Learn more about the AGG and its potential by visiting [link to BlackRock resource]. Remember, past performance is not indicative of future results. Carefully consider your investment goals before investing in any BlackRock ETF, including the AGG.

Featured Posts

-

Polluter Reform Dbs Banks Perspective On A Necessary Transition

May 08, 2025

Polluter Reform Dbs Banks Perspective On A Necessary Transition

May 08, 2025 -

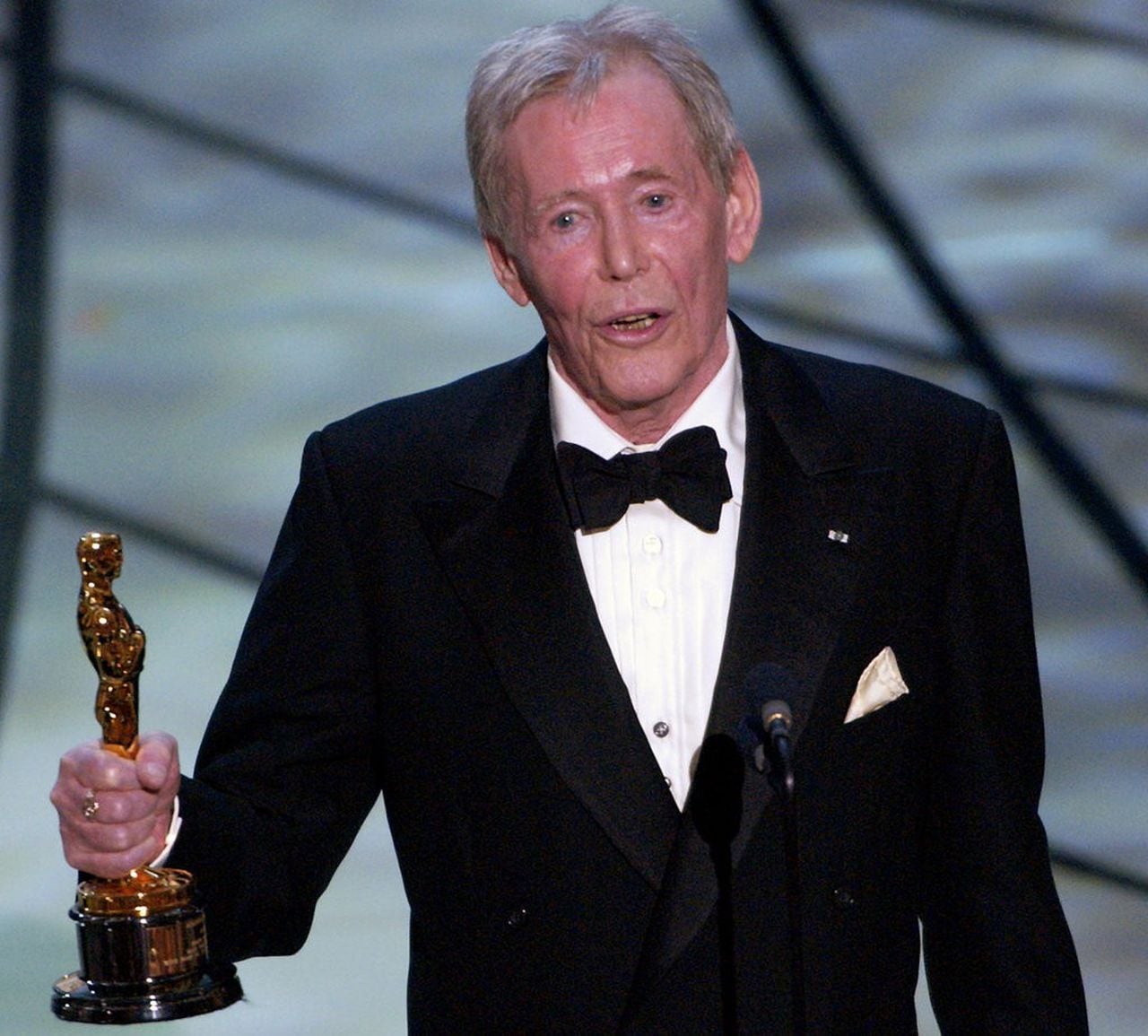

Biggest Oscars Snubs The Most Shocking Moments In Academy Awards History

May 08, 2025

Biggest Oscars Snubs The Most Shocking Moments In Academy Awards History

May 08, 2025 -

The Academy Awards Biggest Oversights Iconic Snubs

May 08, 2025

The Academy Awards Biggest Oversights Iconic Snubs

May 08, 2025 -

April 16 2025 Daily Lotto Results

May 08, 2025

April 16 2025 Daily Lotto Results

May 08, 2025 -

12 Dwp Benefits At Risk Verify Your Bank Details Now

May 08, 2025

12 Dwp Benefits At Risk Verify Your Bank Details Now

May 08, 2025

Latest Posts

-

Vaer Forberedt Pa Vintervaer Kjoreforhold I Sor Norges Fjell

May 09, 2025

Vaer Forberedt Pa Vintervaer Kjoreforhold I Sor Norges Fjell

May 09, 2025 -

Planlegg Vinterferien Trygt Veiforhold I Sor Norge

May 09, 2025

Planlegg Vinterferien Trygt Veiforhold I Sor Norge

May 09, 2025 -

Sikker Kjoring I Sor Norges Fjellomrader Om Vinteren

May 09, 2025

Sikker Kjoring I Sor Norges Fjellomrader Om Vinteren

May 09, 2025 -

Sno Og Vanskelige Kjoreforhold Viktig Informasjon For Sor Norge

May 09, 2025

Sno Og Vanskelige Kjoreforhold Viktig Informasjon For Sor Norge

May 09, 2025 -

Vinterfore I Sor Norge Sjekk Veimeldinger For Fjelltur

May 09, 2025

Vinterfore I Sor Norge Sjekk Veimeldinger For Fjelltur

May 09, 2025