High Stock Valuations: Why BofA Thinks Investors Shouldn't Panic

Table of Contents

BofA's Rationale: Why High Stock Valuations Aren't Necessarily a Red Flag

BofA's recent report argues against knee-jerk reactions to high stock valuations, presenting a nuanced view supported by several key factors. They contend that current valuations, while high, are not necessarily unsustainable or indicative of an imminent market crash. Their analysis points to several contributing factors:

-

Low interest rates supporting higher valuations: The prolonged period of low interest rates has made equities a more attractive investment compared to bonds, driving up demand and consequently, prices. This low-cost borrowing environment fuels corporate investment and expansion, contributing to higher earnings.

-

Strong corporate earnings justifying current prices: Many companies are reporting robust earnings, justifying, at least partially, the current elevated stock prices. This positive performance demonstrates underlying economic strength and supports the continued growth potential of these businesses.

-

Potential for future growth outweighing current valuation concerns: BofA analysts suggest that the potential for future earnings growth in many sectors could outweigh current valuation concerns. This forward-looking perspective emphasizes the long-term potential rather than solely focusing on present-day metrics.

-

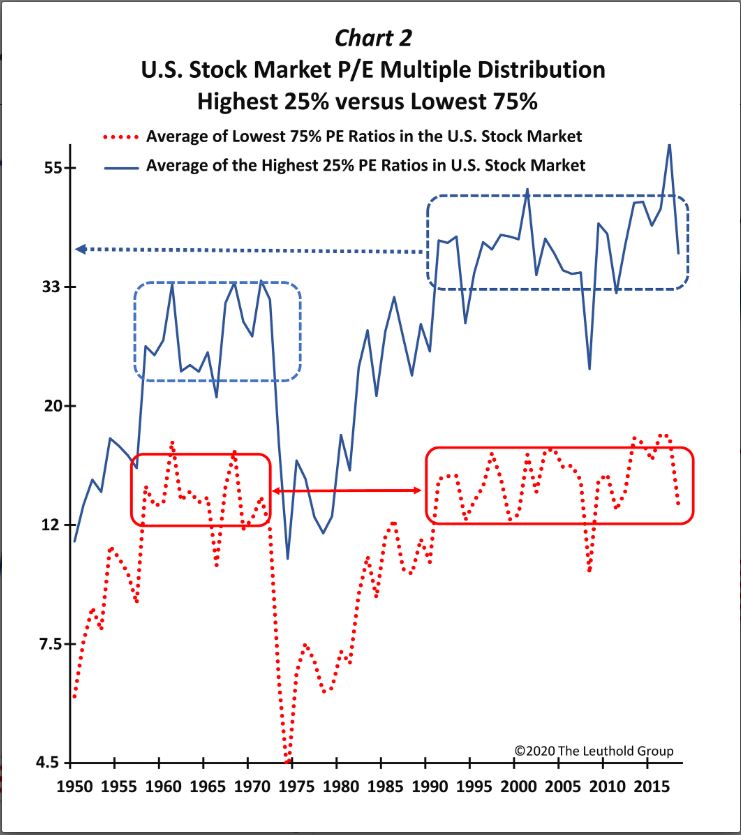

Comparison to historical valuations in similar market conditions: By comparing current valuations to historical data from periods with similar macroeconomic conditions, BofA aims to provide context and demonstrate that high valuations are not unprecedented. This historical perspective helps temper immediate concerns by showing that market corrections are a natural part of the investment cycle.

Understanding the Factors Driving High Stock Valuations

Several macroeconomic factors contribute to the current environment of high stock valuations. Understanding these factors is crucial for making informed investment decisions:

-

Impact of quantitative easing and monetary policy: Central banks' monetary policies, including quantitative easing (QE), have injected significant liquidity into the market, driving up asset prices, including stocks. This injection of capital has created a supportive environment for investment.

-

Role of low interest rates in boosting investment: Low interest rates encourage borrowing and investment, stimulating economic activity and boosting corporate profits. This, in turn, contributes to higher stock valuations as investors seek higher returns in a low-yield environment.

-

Influence of technological advancements and innovation: The rapid pace of technological innovation has fueled significant growth in certain sectors, driving up their valuations. These advancements often lead to increased productivity, efficiency, and ultimately, higher profits.

-

Effect of global economic growth (or slowdown) on valuations: Global economic conditions play a significant role. Periods of robust global growth tend to support higher stock valuations, while economic slowdowns can lead to decreased valuations and increased investor anxiety.

Strategies for Navigating High Stock Valuations

Based on BofA's perspective and general market wisdom, investors can employ several strategies to navigate the current environment of high stock valuations:

-

Diversification strategies for a balanced portfolio: A well-diversified portfolio across different asset classes and sectors can mitigate risk and reduce the impact of any single sector's performance.

-

Importance of long-term investment horizons: Adopting a long-term investment strategy helps weather short-term market fluctuations and allows investors to benefit from the potential for long-term growth.

-

Consideration of value investing versus growth investing: Depending on individual risk tolerance and investment goals, investors should carefully consider the merits of value investing (focusing on undervalued companies) versus growth investing (focusing on high-growth potential).

-

Regular portfolio review and rebalancing: Regularly reviewing and rebalancing your portfolio ensures that your asset allocation remains aligned with your risk tolerance and investment goals.

-

Seeking professional financial advice: Consulting a qualified financial advisor can provide personalized guidance and support in navigating complex market conditions and managing your investments effectively.

Addressing Investor Concerns About High Stock Valuations: Common Myths Debunked

Several common misconceptions surround high stock valuations, leading to unnecessary panic. Let's address some of these myths:

-

Myth 1: High valuations always precede a market crash: While high valuations can be a contributing factor to market corrections, they don't automatically predict a crash. Many historical examples demonstrate periods of sustained high valuations without subsequent market collapses.

-

Myth 2: High valuations mean immediate selling is necessary: High valuations don't necessarily signal an immediate need to sell. A long-term perspective is crucial, allowing for market fluctuations and potential future growth. Panic selling can lead to significant losses.

-

Myth 3: All sectors are equally overvalued: Valuation levels vary significantly across different sectors. Some sectors might be relatively overvalued, while others may still present attractive investment opportunities. Careful sector-specific analysis is essential.

Conclusion: High Stock Valuations: A Measured Approach

BofA's analysis suggests that high stock valuations, while warranting attention, shouldn't trigger immediate panic. Their rationale highlights the influence of low interest rates, strong corporate earnings, and the potential for future growth. This article has emphasized the importance of understanding the underlying factors driving these valuations, adopting a long-term investment strategy, and diversifying your portfolio. Don't let high stock valuations trigger knee-jerk reactions. Develop a robust investment strategy informed by the latest market analysis and seek expert guidance to navigate this phase effectively. Consider consulting with a financial advisor to tailor a strategy that aligns with your individual risk profile and financial goals.

Featured Posts

-

Finding Peace In The Pandemic A Seattle Woman And Her Green Space

May 24, 2025

Finding Peace In The Pandemic A Seattle Woman And Her Green Space

May 24, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025 -

The 10 Fastest Ferraris A Lap Around Fiorano

May 24, 2025

The 10 Fastest Ferraris A Lap Around Fiorano

May 24, 2025 -

Chainalysis Acquisition Of Alterya A Boost For Ai In Blockchain

May 24, 2025

Chainalysis Acquisition Of Alterya A Boost For Ai In Blockchain

May 24, 2025 -

Frankfurt Aktienmarkt Dax Entwicklung Und Futures Verfall Zum 21 Maerz 2025

May 24, 2025

Frankfurt Aktienmarkt Dax Entwicklung Und Futures Verfall Zum 21 Maerz 2025

May 24, 2025