HMRC's New Side Hustle Tax Rules: A US-Style Snooping Scheme?

Table of Contents

H2: Data Collection and Monitoring: How HMRC is Tracking Side Hustles

H3: The Expansion of HMRC's Data-Gathering Powers: HMRC's ability to track side hustle income has significantly expanded. Gone are the days of relying solely on self-assessment. The tax authority now leverages data from various sources to monitor and assess tax liabilities. This shift towards a more data-driven approach has sparked debate about the balance between effective tax collection and individual privacy.

-

Bullet Points:

- Bank Transaction Data: HMRC can access bank statements, potentially flagging income from various sources that haven't been declared. This includes payments received via online payment platforms like PayPal or Stripe.

- Online Marketplace Data: Platforms such as Etsy, eBay, and Amazon are increasingly required to report sales data to HMRC, providing a clear record of income generated through these channels.

- Payroll Data: If a side hustle involves employing others, even on a limited basis, this information will be reported to HMRC through PAYE (Pay As You Earn) systems.

- Potential for Errors: Automated data analysis, while efficient, carries the risk of misinterpretation. Legitimate transactions might be incorrectly flagged as taxable income, leading to unnecessary investigations and stress for individuals.

- Data Privacy and Security: Concerns remain regarding the security and privacy of personal financial data shared with HMRC. Robust safeguards are crucial to prevent misuse or breaches of confidential information.

-

Keyword Integration: The section utilizes keywords such as "HMRC data collection," "side hustle tax monitoring," "online marketplace tax reporting," and "financial transaction tracking" naturally within the context of data gathering practices.

H2: The Impact on Freelancers and Gig Economy Workers

H3: Increased Tax Burden and Compliance Costs: The new rules place an increased administrative burden on freelancers and gig economy workers. What was once relatively straightforward self-assessment is now a more complex process.

-

Bullet Points:

- Accounting Software Costs: Many individuals now find themselves needing to invest in accounting software to manage their income and expenses effectively.

- Professional Tax Advice: Navigating the complexities of self-assessment and ensuring compliance with the new regulations often necessitates seeking professional tax advice, incurring additional costs.

- Disproportionate Impact on Low-Income Earners: The additional costs associated with compliance can disproportionately affect low-income earners, potentially reducing their already limited disposable income.

- Self-Assessment Complexities: The intricacies of self-assessment, particularly for those unfamiliar with tax regulations, can be daunting and time-consuming.

-

Keyword Integration: This section incorporates keywords like "gig economy tax," "freelancer tax burden," "self-assessment complexities," and "HMRC compliance costs" to improve SEO.

H2: Comparison with US Tax Enforcement Practices

H3: Similarities and Differences in Approach: The increased reliance on third-party reporting by HMRC bears a resemblance to practices employed by the IRS (Internal Revenue Service) in the US. Both aim to improve tax collection through data sharing.

-

Bullet Points:

- Third-Party Reporting: Both HMRC and the IRS increasingly rely on information from banks, online platforms, and employers to verify and track income.

- Differences in Legal Frameworks: While the methods share similarities, the underlying legal frameworks and taxpayer rights differ significantly between the US and UK systems. The US, for example, has a much more aggressive approach to tax enforcement, with harsher penalties for non-compliance.

- Rationale: The increased scrutiny in both countries stems from the growth of the gig economy and the challenge of accurately taxing income earned through non-traditional employment arrangements.

-

Keyword Integration: The section incorporates "US tax enforcement," "HMRC vs IRS," "third-party reporting," and "cross-border tax compliance" to enhance search engine visibility.

H2: Potential Consequences and Future Implications

H3: The Risk of Overreach and the Erosion of Trust: The expanded data collection and monitoring capabilities raise concerns about potential overreach by HMRC and the erosion of public trust.

-

Bullet Points:

- Risk of Misidentification: The automated systems might misinterpret legitimate transactions, leading to incorrect tax assessments and unfair penalties.

- Impact on Livelihoods: Incorrect assessments can have a devastating impact on individuals' finances and livelihoods.

- Deterrent to Side Hustles: The increased scrutiny might deter individuals from engaging in side hustles, potentially impacting the overall economy.

-

Keyword Integration: This section naturally incorporates keywords like "HMRC overreach," "taxpayer trust," "side hustle implications," and "future of side hustle taxation."

3. Conclusion: Navigating the New HMRC Side Hustle Tax Rules

This article has explored HMRC's new side hustle tax rules, highlighting the expanded data collection methods, their impact on freelancers and gig economy workers, and the parallels with US tax enforcement. The increased scrutiny, while aiming for greater tax compliance, raises concerns about potential overreach and the erosion of taxpayer trust. The additional compliance costs and complexities disproportionately affect low-income earners.

Understanding these new HMRC side hustle tax rules is crucial. Seek professional guidance to ensure you're compliant and avoid potential penalties. Don't wait; navigate the complexities of side hustle taxation today! Invest in proper HMRC side hustle tax advice and proactive side hustle tax planning to ensure a smooth and compliant future. Avoiding side hustle tax penalties is paramount.

Featured Posts

-

Philippines Us Missile System A Detailed Explanation And Chinas Reaction

May 20, 2025

Philippines Us Missile System A Detailed Explanation And Chinas Reaction

May 20, 2025 -

Dzhennifer Lourens I Ee Vtoroy Rebenok Poslednie Novosti

May 20, 2025

Dzhennifer Lourens I Ee Vtoroy Rebenok Poslednie Novosti

May 20, 2025 -

Kolme Muutosta Huuhkajien Avauskokoonpanossa Kaellman Sivuun

May 20, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanossa Kaellman Sivuun

May 20, 2025 -

Nagelsmann Names Goretzka For Germanys Nations League Squad

May 20, 2025

Nagelsmann Names Goretzka For Germanys Nations League Squad

May 20, 2025 -

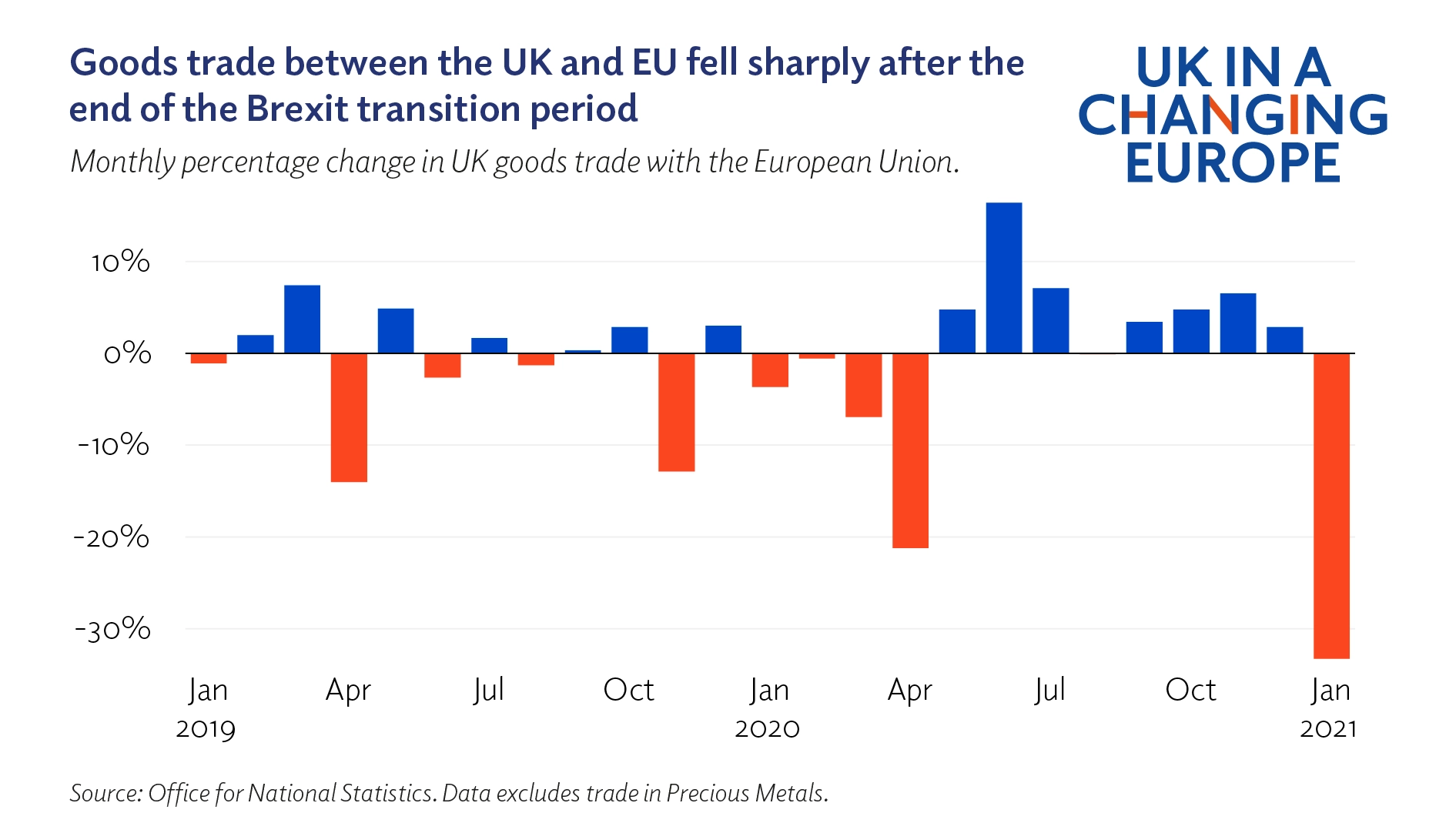

Slowdown In Uk Luxury Exports To The Eu A Brexit Consequence

May 20, 2025

Slowdown In Uk Luxury Exports To The Eu A Brexit Consequence

May 20, 2025