Slowdown In UK Luxury Exports To The EU: A Brexit Consequence

Table of Contents

Increased Trade Barriers and Bureaucracy

The departure from the EU single market has erected significant trade barriers, impacting the flow of UK luxury goods to the continent. These obstacles manifest in both tariff and non-tariff forms, significantly increasing costs and complexities for exporters.

Tariff and Non-Tariff Barriers

New tariffs, customs checks, and increased paperwork have dramatically lengthened export times and inflated costs.

- Increased Costs: Tariffs levied on luxury goods can be substantial, adding a significant percentage to the final price. Additional costs include customs brokerage fees, increased insurance premiums, and the expense of complying with new labeling and documentation requirements.

- Delivery Delays: Customs checks and inspections at borders cause delays, impacting the timely delivery of perishable or time-sensitive luxury items like fresh flowers or bespoke tailoring. These delays can lead to dissatisfied customers and lost sales.

- Administrative Burden: The increased paperwork and regulatory compliance required for exporting to the EU add a significant administrative burden to businesses, demanding extra staffing and resources. This administrative complexity disproportionately affects smaller luxury businesses. For example, high-end watchmakers face substantial delays in getting their products to EU markets due to the increased customs documentation required. This leads to decreased efficiency and higher operational costs.

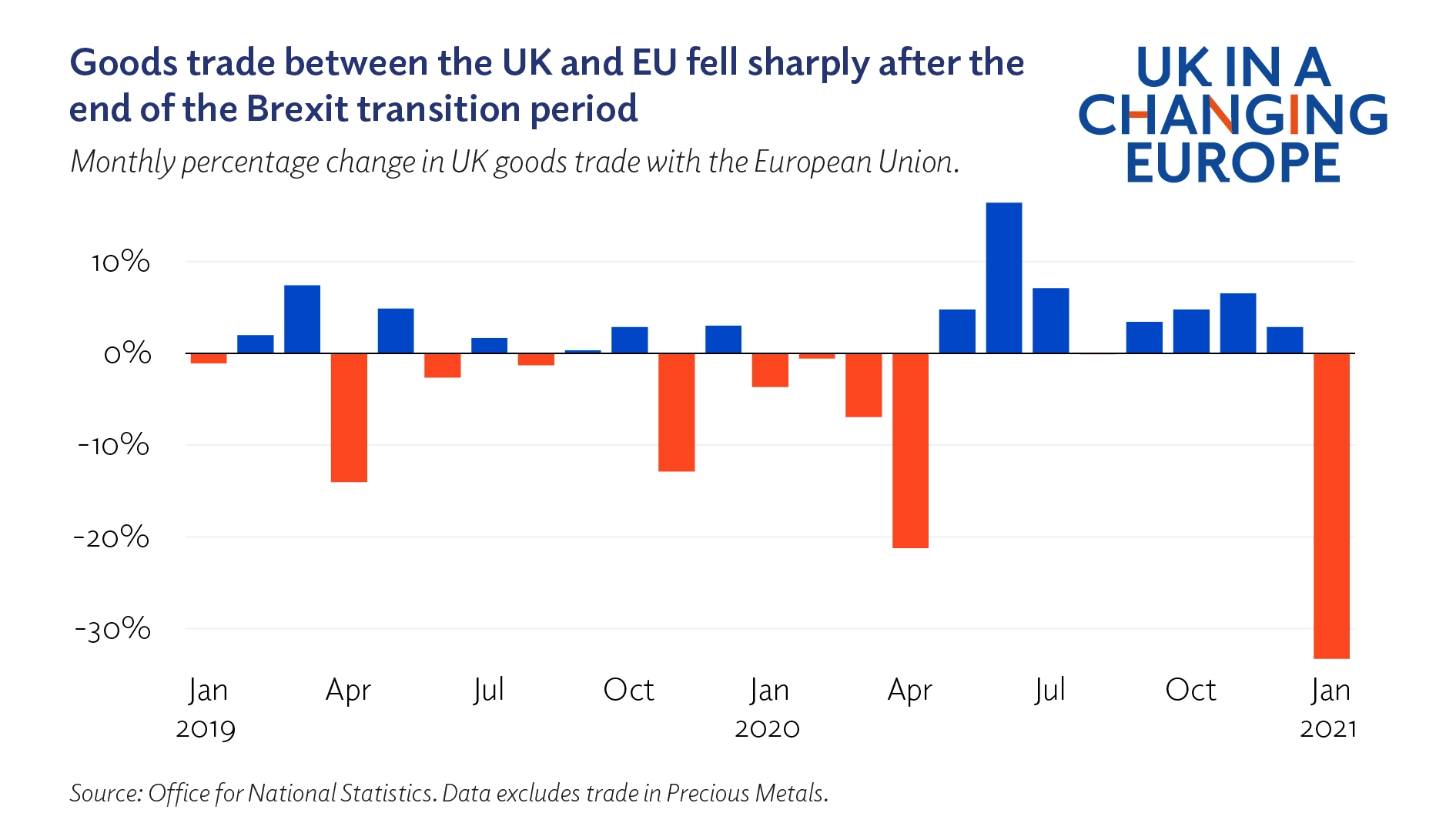

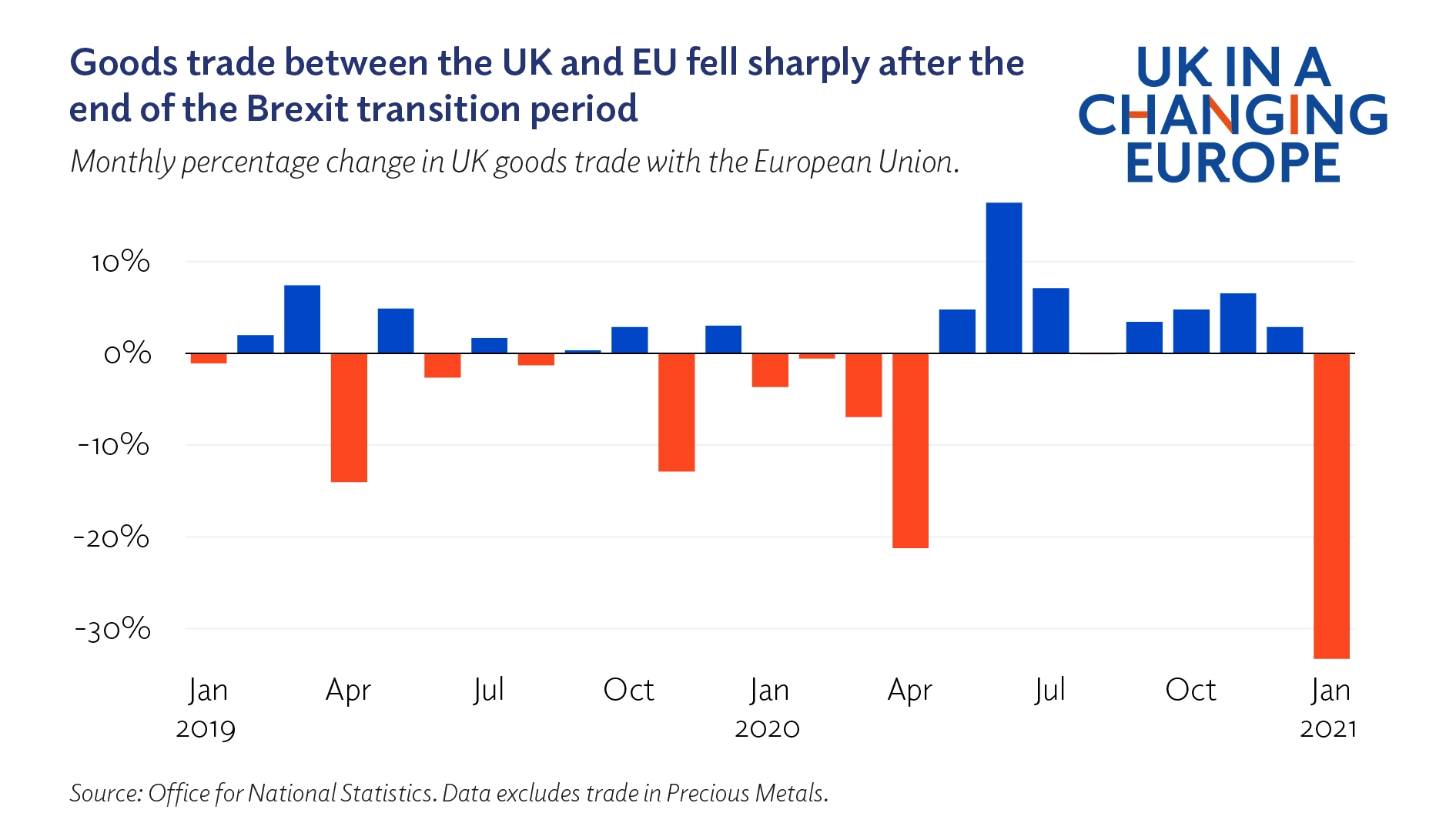

The impact is quantifiable. For instance, reports suggest that the cost of exporting certain types of luxury goods to the EU has increased by as much as 15-20%, making them less competitive against domestically produced EU alternatives.

Supply Chain Disruptions

Brexit has also created significant disruptions to the supply chains for UK luxury goods. Sourcing materials and delivering finished products to EU customers has become considerably more challenging.

- Longer Lead Times: Delays at borders and increased logistical complexities contribute to significantly longer lead times, impacting production schedules and potentially losing sales opportunities.

- Increased Logistical Complexities: Navigating new customs regulations and dealing with multiple intermediaries adds layers of complexity to the supply chain, increasing risk and operational costs.

- Stock Shortages: Delays and disruptions can lead to stock shortages at the point of sale within the EU, frustrating customers and damaging brand reputation.

Potential solutions include diversifying supply chains to reduce reliance on EU-based suppliers and pre-positioning stock within the EU to mitigate the impact of border delays.

Changes in Consumer Demand and Market Access

Brexit uncertainty and the increased costs associated with importing UK luxury goods have impacted consumer demand and market access within the EU.

Reduced Consumer Confidence

Brexit-related uncertainty and increased prices have eroded consumer confidence, leading to a decrease in demand for UK luxury goods.

- Reduced Sales Figures: Many UK luxury brands have reported significant drops in sales to EU markets since Brexit.

- Changes in Consumer Behaviour: EU consumers are increasingly choosing to purchase luxury goods from within the EU to avoid additional costs and delays associated with importing from the UK. This shift in consumer preference is threatening the market share of UK luxury brands.

- Impact on Brand Reputation: Delivery delays and difficulties accessing the EU market can damage the brand's reputation for reliability and timely service, negatively impacting future sales.

Data from market research firms show a noticeable decline in EU consumer spending on UK luxury goods post-Brexit.

Loss of Frictionless Trade

The loss of frictionless trade with the EU single market has created significant hurdles for UK luxury exporters.

- Difficulty in Accessing EU Markets: The increased complexities of exporting to the EU now present a significant barrier to entry for many UK businesses.

- Increased Competition from EU Producers: EU-based luxury brands now benefit from a more competitive advantage, gaining market share previously held by their UK competitors.

- Loss of Market Share: The cumulative impact of increased costs, delays, and reduced consumer confidence has resulted in a noticeable loss of market share for many UK luxury brands within the EU. Quantifying this loss precisely is difficult, but industry reports point towards a significant decline in export volumes.

The Impact on UK Luxury Brands

Leading UK luxury brands are feeling the full impact of Brexit, prompting various strategic responses.

- Examples of Impacted Brands: Numerous high-profile UK luxury brands across sectors – from fashion and jewellery to automotive and spirits – are grappling with the new realities of post-Brexit trade with the EU.

- Adaptation Strategies: To navigate the new landscape, some brands are implementing price adjustments to offset increased costs, while others are exploring new markets outside the EU or streamlining their supply chains. Others are investing heavily in logistics and customs compliance to mitigate delays.

- Case Studies of Successful Adaptation: While many are struggling, some brands have successfully adapted their strategies, providing valuable case studies for others to learn from. These successes often involve focusing on niche markets, building stronger relationships with EU distributors, and leveraging digital marketing to reach consumers directly.

Conclusion

The slowdown in UK luxury exports to the EU post-Brexit is a significant concern, driven primarily by increased trade barriers, supply chain disruptions, and changes in consumer demand. These challenges threaten the viability of many UK luxury brands and the long-term health of the sector. To address this critical issue, UK businesses and the government must work collaboratively to find solutions. This involves streamlining customs procedures, investing in infrastructure to improve logistical efficiency, and providing support and resources to businesses navigating the complex post-Brexit trade environment. Understanding the specific challenges facing UK luxury exports to the EU, and actively seeking solutions, is essential to maintaining the competitiveness of this vital sector in the European market. Explore government resources and industry support programs designed to help businesses adapt to the new trade landscape and regain lost ground in the EU market. The future of UK luxury goods exports to the EU depends on it.

Featured Posts

-

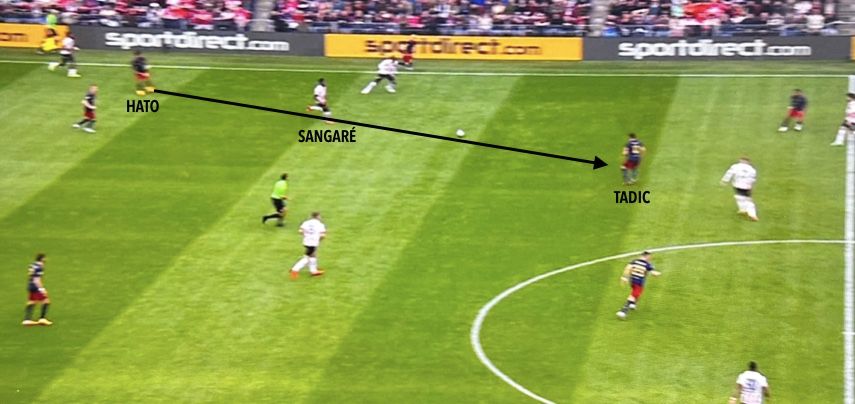

Fenerbahce Eist Strenge Maatregelen Na Tadic Contact Met Ajax

May 20, 2025

Fenerbahce Eist Strenge Maatregelen Na Tadic Contact Met Ajax

May 20, 2025 -

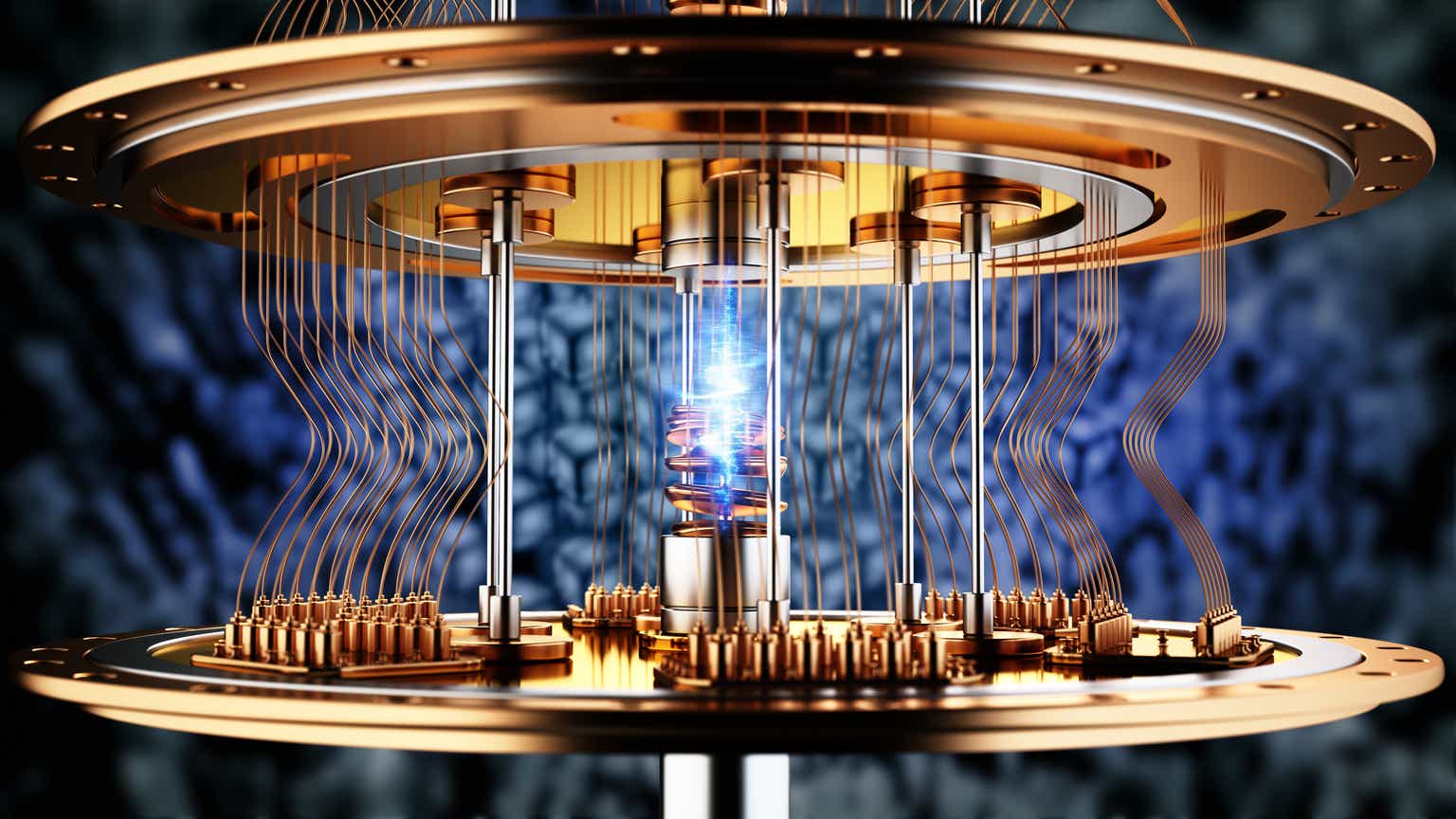

D Wave Quantum Nyse Qbts Stock Decline Analyzing Kerrisdale Capitals Critique

May 20, 2025

D Wave Quantum Nyse Qbts Stock Decline Analyzing Kerrisdale Capitals Critique

May 20, 2025 -

Ferraris Dilemma Prioritizing Hamilton Risks Alienating Leclerc

May 20, 2025

Ferraris Dilemma Prioritizing Hamilton Risks Alienating Leclerc

May 20, 2025 -

Chivas Regals Strategic Alliance With Charles Leclerc Boosting Brand Image

May 20, 2025

Chivas Regals Strategic Alliance With Charles Leclerc Boosting Brand Image

May 20, 2025 -

Best Wireless Headphones A Comprehensive Review Of New Models

May 20, 2025

Best Wireless Headphones A Comprehensive Review Of New Models

May 20, 2025