HMRC's New Tax Codes: Understanding Changes For Savers

Table of Contents

Key Changes in HMRC Tax Codes for the Tax Year 2024:

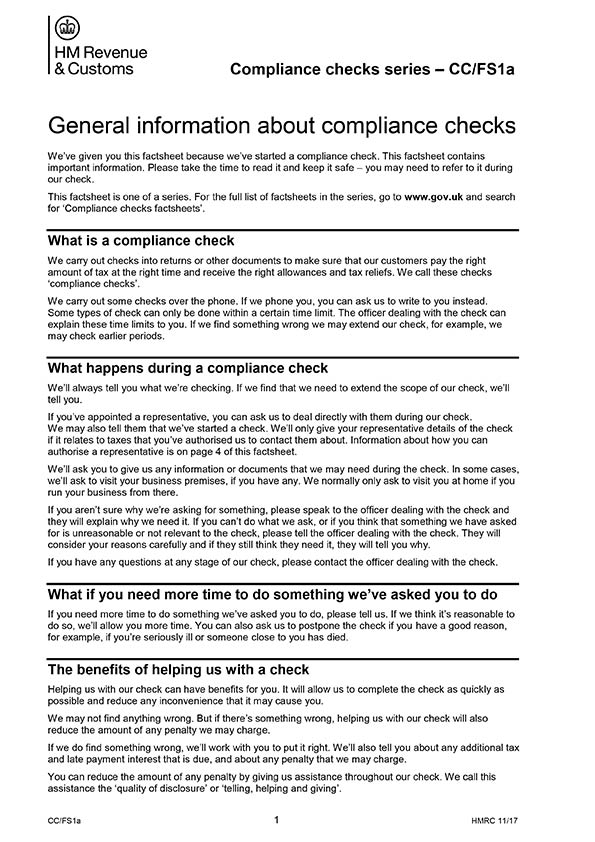

HMRC introduced several changes to tax codes for the 2024 tax year. These adjustments affect various aspects of savings, impacting how much tax you pay on your savings income. Understanding these alterations is crucial for maximizing your returns and remaining compliant with UK tax regulations.

- Changes to Personal Allowance: The personal allowance, the amount you can earn tax-free, may have been adjusted. This directly impacts how much of your savings income is subject to tax.

- Updated Tax Bands: The thresholds defining different income tax bands (basic rate, higher rate, additional rate) may have shifted. This affects the rate of tax applied to different portions of your savings income.

- Modifications to Savings Allowances: Certain savings allowances, such as those for ISAs, might have seen alterations to contribution limits or eligibility criteria.

These changes affect various savings vehicles differently. For instance:

- ISAs (Individual Savings Accounts): While the ISA allowance itself may remain unchanged, the tax implications of your overall income, considering the adjusted tax bands and personal allowance, could affect your overall tax liability.

- Pensions: Changes to tax relief on pension contributions might impact how much tax relief you receive, potentially influencing your retirement savings strategy.

- Savings Accounts and Bonds: The interest earned on these accounts is subject to tax, and the updated tax bands will determine the rate at which this interest is taxed.

Understanding Your New Tax Code:

Your tax code, found on your payslip or accessible online through HMRC's services, is crucial for understanding your tax obligations. It determines how much income tax is deducted from your earnings, including income from savings.

- Finding Your Tax Code: Access your tax code through your payslip or by logging into your HMRC online account.

- Decoding Your Tax Code: A typical tax code (e.g., 1257L) comprises a number and a letter. The number represents your personal allowance, while the letter signifies any additional adjustments. HMRC provides detailed guidance on interpreting your tax code online.

- HMRC Online Services: Utilizing the HMRC website and online services provides convenient access to your tax information, including your tax code and other relevant details. It's a quick and efficient method to stay on top of your tax responsibilities.

Impact of Changes on Different Savings Vehicles:

The HMRC tax code changes directly affect the tax efficiency of various savings vehicles:

ISAs (Individual Savings Accounts):

The new tax codes don't alter the tax-free status of ISA earnings, but your overall income, after adjustments, could change your tax bracket. This is important to understand when strategizing your savings.

Pensions:

Tax relief on pension contributions remains, but the changes in tax bands and allowances might subtly influence the net amount you contribute and the tax benefits you receive.

Savings Accounts and Bonds:

Interest earned from savings accounts and bonds is taxable, and the new tax bands will directly influence the amount of tax you pay on this interest. Higher earners may find their tax liability increased with the changes.

Potential Tax Planning Strategies for Savers:

While we cannot provide specific financial advice, understanding the changes allows you to make informed decisions. Consider:

- Diversifying Investments: Spreading your investments across different tax-efficient vehicles can help manage your tax liability more effectively.

- Maximizing ISA Allowances: Make the most of your ISA allowance each year to take advantage of tax-free growth.

- Regular Review: Regularly reviewing your savings and investment strategy, particularly in light of tax code changes, is essential to ensure you're optimizing your financial position.

Disclaimer: Always seek professional financial advice before implementing any significant changes to your savings and investment strategy. Tax laws are complex, and personalized guidance is essential to ensure compliance and maximize your returns.

Where to Find More Information and Support from HMRC:

For the most up-to-date information and support, refer to the official HMRC website: [Insert HMRC website link here]. You can also contact HMRC directly through their helpline: [Insert HMRC helpline number here]. They offer various resources and support channels to help you navigate these changes.

Conclusion: Mastering HMRC's New Tax Codes for Optimal Savings

Understanding HMRC's new tax codes for the 2024 tax year is crucial for savers. The changes to tax bands, allowances, and thresholds significantly impact how your savings income is taxed. By understanding your new tax code and the implications for different savings vehicles, you can make informed decisions to optimize your savings strategy. Utilize the resources provided by HMRC, and don't hesitate to seek professional financial advice to ensure you're making the best choices for your individual circumstances. Stay informed about HMRC's new tax codes and optimize your savings strategy today! [Insert links to HMRC website and other relevant resources here]

Featured Posts

-

Abidjan Accueille Ivoire Tech Forum 2025 Transformation Numerique En Afrique

May 20, 2025

Abidjan Accueille Ivoire Tech Forum 2025 Transformation Numerique En Afrique

May 20, 2025 -

Check Your Payslip Are You Due An Hmrc Refund

May 20, 2025

Check Your Payslip Are You Due An Hmrc Refund

May 20, 2025 -

Dzhenifr Lorns Maychinstvoto Za Vtori Pt

May 20, 2025

Dzhenifr Lorns Maychinstvoto Za Vtori Pt

May 20, 2025 -

Postpartum Glamour Jennifer Lawrences Breathtaking Backless Look

May 20, 2025

Postpartum Glamour Jennifer Lawrences Breathtaking Backless Look

May 20, 2025 -

Decoding Michael Strahans Interview Success Competitive Analysis In The Ratings Game

May 20, 2025

Decoding Michael Strahans Interview Success Competitive Analysis In The Ratings Game

May 20, 2025