ProShares Announces XRP ETFs: No Spot Market, But Price Jumps

Table of Contents

Understanding the ProShares XRP ETF Launch

Before diving into the specifics, let's clarify what an ETF is. An ETF, or exchange-traded fund, is an investment fund traded on stock exchanges, offering investors diversified exposure to a specific asset class or market segment. ETFs are known for their liquidity, transparency, and relatively low expense ratios, making them an attractive investment option for many.

ProShares' XRP ETFs are futures-based, meaning they don't directly hold XRP. Instead, they track the performance of XRP futures contracts. This is crucial because, unlike many other cryptocurrencies, a regulated XRP spot market ETF is not yet available.

The significance of this launch is multifold:

-

Increased Accessibility: It provides investors with a regulated and relatively easy way to gain exposure to XRP, a cryptocurrency with a substantial market capitalization.

-

Market Validation: The launch signals growing institutional interest in XRP and its potential for future growth.

-

Regulatory Milestone: It represents a step forward in the integration of cryptocurrencies into traditional financial markets, although it falls short of a full spot market ETF.

-

No Spot Market: This means the ETF doesn't directly own XRP; it uses XRP futures contracts to track its price. This introduces different risk profiles than a spot market ETF would.

-

Futures-Based Mechanism: The ETF invests in XRP futures contracts, which are agreements to buy or sell XRP at a predetermined price on a future date. These contracts fluctuate in price based on market sentiment and expectations.

-

Potential Risks and Benefits: While offering accessibility, futures-based ETFs are subject to the risks associated with derivatives trading, including counterparty risk and potential for losses greater than the initial investment. Benefits include diversification and potentially leveraged returns.

-

Regulatory Landscape: The launch navigates the complex regulatory environment surrounding cryptocurrencies. The absence of a spot market ETF highlights the ongoing regulatory challenges faced by the crypto industry.

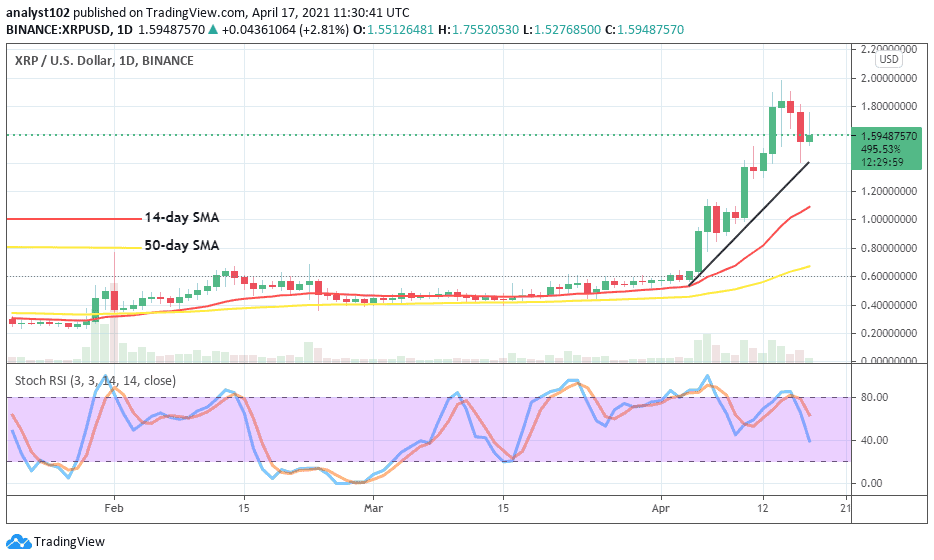

The XRP Price Surge: Causes and Speculation

Following the ProShares XRP ETF announcement, the price of XRP experienced a notable increase, climbing by [Insert Percentage]% within [Timeframe]. Several factors likely contributed to this price jump:

-

Increased Investor Demand: The availability of a regulated XRP ETF, even a futures-based one, attracted increased interest and investment from both institutional and retail investors.

-

Spot Market ETF Speculation: The launch fueled speculation that a spot market XRP ETF might be approved in the future, further boosting investor confidence.

-

Positive Sentiment: Positive legal developments regarding Ripple Labs (if applicable) also contributed to the positive sentiment surrounding XRP, influencing the price.

-

Price Data and Charts: [Include links to relevant charts from reputable financial sources showing the price increase].

-

Trading Volume Changes: [Report on the increase in trading volume for XRP].

-

Expert Opinions: [Quote analyses from market experts discussing the price surge].

-

Competing Products: [Mention any other existing XRP investment products and how they compare].

Investing in ProShares XRP ETFs: A Detailed Look

Investors interested in purchasing ProShares XRP ETFs can typically access them through major brokerage platforms.

- Brokerage Platforms: [List the major brokerage platforms where the ETF is available].

- Fees and Expenses: The expense ratio of the ETF will be crucial for investors to consider, along with any brokerage commissions. [State the expense ratio].

- Risk Factors: Investing in any cryptocurrency ETF carries substantial risk due to the inherent volatility of the crypto market. Futures-based ETFs introduce additional complexities and risk factors.

- Tax Implications: [Discuss potential capital gains taxes and other tax implications associated with investing in the ETF].

- Volatility: Remember that cryptocurrency investments are exceptionally volatile, meaning the price can swing significantly in short periods.

Alternatives to ProShares XRP ETFs

While the ProShares XRP ETFs offer a convenient entry point, investors should also consider alternatives:

- Direct Purchase: Buying XRP directly on cryptocurrency exchanges offers more control but also carries higher risks associated with self-custody and exchange security.

- Other Investment Vehicles: Other investment vehicles might provide similar or alternative exposure to the crypto market. These require individual research.

Conclusion

The launch of ProShares XRP ETFs marks a significant development in the cryptocurrency market, providing investors with increased accessibility to XRP exposure, even without a spot market ETF. The subsequent price surge reflects the market's positive reaction and the anticipation surrounding future regulatory developments. While offering a regulated and convenient way to invest in XRP, it's crucial to remember the inherent risks involved in cryptocurrency investments, particularly those using derivatives like futures contracts. Learn more about ProShares XRP ETFs and how they fit into your investment strategy, considering your risk tolerance and overall portfolio diversification. Remember to conduct thorough research and only invest what you can afford to lose. Responsible investing in cryptocurrencies is key.

Featured Posts

-

Report Browns Enhance Roster With Signing Of Veteran Wideout And Return Specialist

May 08, 2025

Report Browns Enhance Roster With Signing Of Veteran Wideout And Return Specialist

May 08, 2025 -

400 Up And Still Climbing Exploring Xrps Future Price Trajectory

May 08, 2025

400 Up And Still Climbing Exploring Xrps Future Price Trajectory

May 08, 2025 -

Angels Losing Streak Reaches Five As Mike Trout Exits With Knee Issue

May 08, 2025

Angels Losing Streak Reaches Five As Mike Trout Exits With Knee Issue

May 08, 2025 -

1 500 Bitcoin Growth Is This Realistic A 5 Year Forecast

May 08, 2025

1 500 Bitcoin Growth Is This Realistic A 5 Year Forecast

May 08, 2025 -

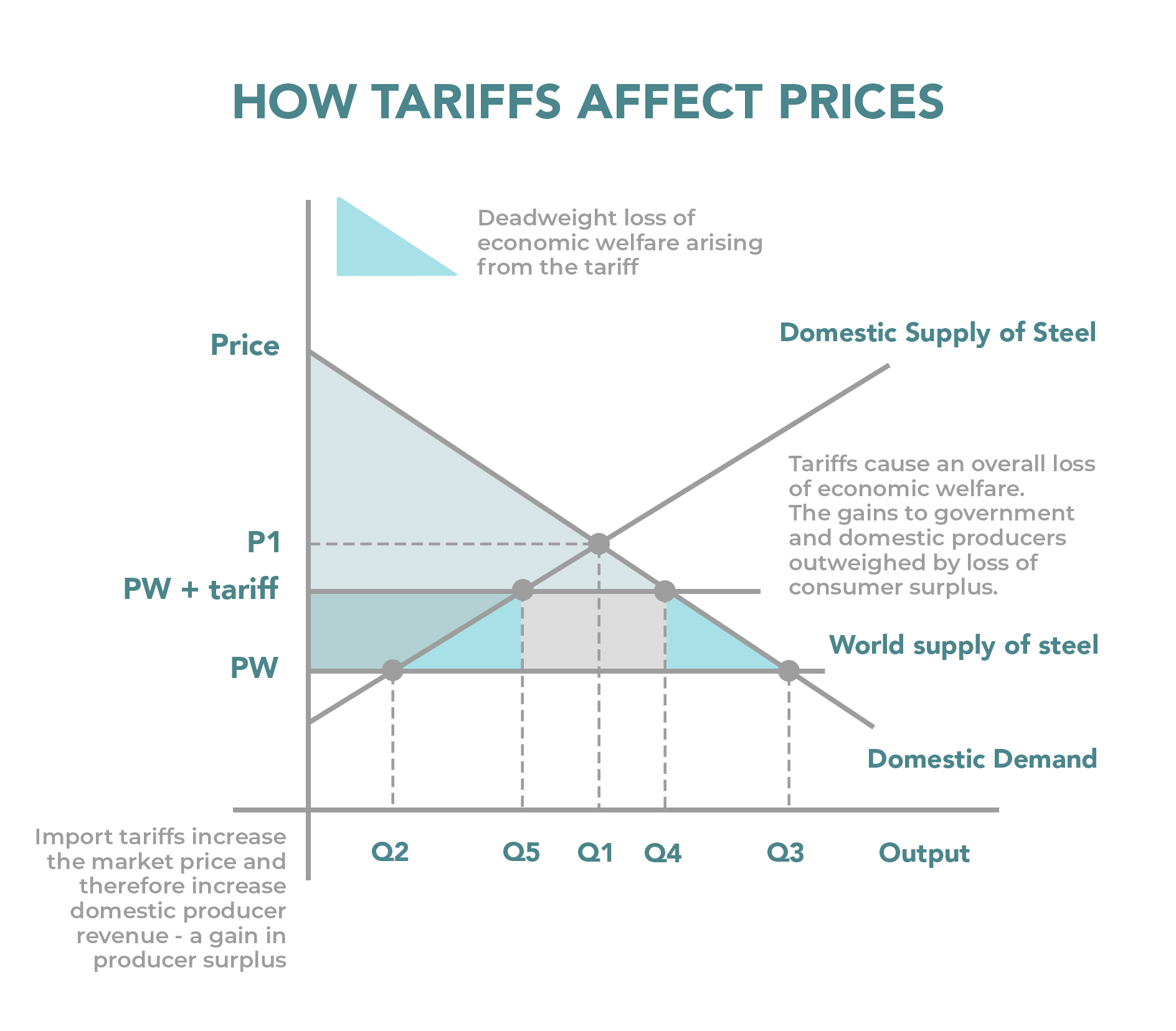

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025

Latest Posts

-

Mraksh Myn Kshty Hadthh Ansany Asmglng Ke 4 Mlzman Grftar

May 08, 2025

Mraksh Myn Kshty Hadthh Ansany Asmglng Ke 4 Mlzman Grftar

May 08, 2025 -

Mraksh Kshty Hadthe Awr Ansany Asmglng Myn Mlwth 4 Mlzman Grftar

May 08, 2025

Mraksh Kshty Hadthe Awr Ansany Asmglng Myn Mlwth 4 Mlzman Grftar

May 08, 2025 -

Expo 2025 Sufian Applauds Gcci Presidents Organizational Success

May 08, 2025

Expo 2025 Sufian Applauds Gcci Presidents Organizational Success

May 08, 2025 -

Sufians Acknowledgement Of Gcci Presidents Role In Expo 2025

May 08, 2025

Sufians Acknowledgement Of Gcci Presidents Role In Expo 2025

May 08, 2025 -

Report Jayson Tatums Bone Bruise Raises Concerns For Game 2

May 08, 2025

Report Jayson Tatums Bone Bruise Raises Concerns For Game 2

May 08, 2025