Impact Of Reduced Chinese Steel Production On Global Iron Ore Prices

Table of Contents

China's Diminishing Steel Production: The Driving Forces

Several factors contribute to the decline in Chinese steel production. Understanding these forces is crucial for predicting future iron ore price movements.

-

Environmental Regulations and Carbon Emission Targets: China's commitment to reducing carbon emissions has led to stricter environmental regulations targeting heavy industries, including steel production. The government is actively promoting greener steelmaking technologies and penalizing companies that fail to meet emission standards. This has resulted in production cuts and plant closures.

- Example: The implementation of the Carbon Neutrality Plan by 2060 has forced steel mills to invest heavily in cleaner technologies or face significant penalties.

- Example: Several provinces have imposed stricter limits on steel production during peak pollution seasons.

-

Government Policies Aimed at Controlling Overcapacity: For years, China battled with overcapacity in its steel sector. To address this issue, the government has implemented policies aimed at consolidating the industry, encouraging mergers and acquisitions, and phasing out inefficient steel mills. This has directly impacted Chinese steel output and overall steel capacity reduction.

-

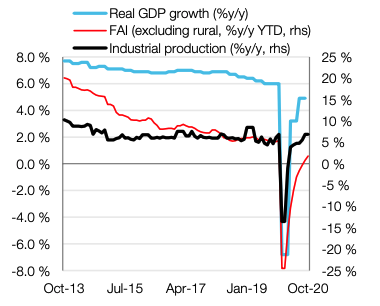

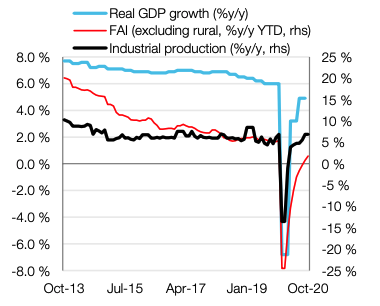

Weakening Domestic Demand Due to Economic Slowdown: The recent slowdown in the Chinese economy, coupled with the ongoing property market crisis, has significantly reduced domestic demand for steel. This decreased demand directly translates into less pressure on steel production, further contributing to the overall decline.

The Direct Impact on Iron Ore Demand

The relationship between Chinese steel production and iron ore demand is inextricably linked. Reduced steelmaking directly translates into decreased iron ore imports by China, the world's largest importer. This decreased demand creates significant pressure on global iron ore prices.

-

Reduced steel production means less iron ore is needed as a raw material.

-

This leads to a decline in iron ore imports from major suppliers like Australia and Brazil.

-

Statistics show a clear correlation: as Chinese steel output falls, so do iron ore imports. For example, [insert statistic showing decline in iron ore imports from Australia and Brazil]. Keywords: iron ore imports China, Australia iron ore exports, Brazil iron ore exports.

-

Quantitative Impact: The decline in Chinese steel production has resulted in a [quantifiable percentage] reduction in iron ore demand, impacting the global iron ore market significantly.

Consequences for Global Iron Ore Prices

The reduced Chinese demand has had a noticeable impact on global iron ore prices, creating significant price volatility.

-

Price Fluctuations and Trends: The global iron ore market has experienced [describe price trends, e.g., a downward trend, periods of instability]. This instability significantly impacts iron ore mining companies and their profitability. Keywords: iron ore price volatility, iron ore mining stocks, global iron ore market outlook.

-

Impact on Iron Ore Mining Companies: Reduced demand and price fluctuations have squeezed profit margins for iron ore mining companies globally, leading to [mention consequences like reduced investments, job losses etc.].

-

Price Scenarios: Different scenarios can be considered depending on China's future steel production levels. A continued decline could lead to [consequence A], while a stabilization or slight increase could result in [consequence B].

Implications for Other Steel-Producing Nations

The reduction in Chinese steel production doesn't exist in a vacuum. It has far-reaching implications for other major steel producers.

-

Global Market Share: Other steel-producing nations, such as India, Japan, and South Korea, may see opportunities to increase their global market share as Chinese steel production slows down. However, this also increases competition. Keywords: global steel production, steel industry competition, impact on steel producers.

-

Challenges and Opportunities: While increased market share is a potential benefit, it also presents challenges, such as the need to meet increased demand, manage price fluctuations, and ensure efficient production.

-

Specific Examples: [Give examples of countries and how they are affected. For example: India might see increased export opportunities, but it needs to ensure its steel meets international quality standards].

Conclusion: Summarizing the Impact of Reduced Chinese Steel Production on Global Iron Ore Prices

The reduced Chinese steel production has had a profound impact on global iron ore prices, highlighting the complex interplay between environmental regulations, economic factors, and global market dynamics. This analysis demonstrates a clear correlation between decreased Chinese steel output and reduced iron ore demand, resulting in price volatility and impacting stakeholders across the supply chain. Understanding iron ore price movements requires continuous monitoring of the Chinese steel industry and its influence on the global iron ore market. The future of iron ore prices hinges on the evolving interplay between environmental concerns, economic policies, and global steel demand. Stay informed about developments in the Chinese steel industry and global iron ore market to make informed decisions regarding investments and strategies—understanding iron ore price movements is crucial for navigating this dynamic market. Analyzing the impact of Chinese steel production on the broader iron ore market is essential for informed decision-making.

Featured Posts

-

Assessing Ag Pam Bondis Decision The Publics Right To Know Regarding The Epstein Files

May 09, 2025

Assessing Ag Pam Bondis Decision The Publics Right To Know Regarding The Epstein Files

May 09, 2025 -

Whats The Real Safe Bet A Comparative Analysis Of Investment Vehicles

May 09, 2025

Whats The Real Safe Bet A Comparative Analysis Of Investment Vehicles

May 09, 2025 -

Woman Claims To Be Madeleine Mc Cann Dna Test Results Released

May 09, 2025

Woman Claims To Be Madeleine Mc Cann Dna Test Results Released

May 09, 2025 -

Trumps Trade War Senator Warner On The Persistence Of Tariffs

May 09, 2025

Trumps Trade War Senator Warner On The Persistence Of Tariffs

May 09, 2025 -

5 Instances Where Morgans Intelligence Failed Him High Potential Season 1

May 09, 2025

5 Instances Where Morgans Intelligence Failed Him High Potential Season 1

May 09, 2025

Latest Posts

-

Edmonton Oilers Leon Draisaitls Expected Playoff Return Boosts Teams Chances

May 09, 2025

Edmonton Oilers Leon Draisaitls Expected Playoff Return Boosts Teams Chances

May 09, 2025 -

Leon Draisaitl Injury Update Oilers Star Expected For Playoffs

May 09, 2025

Leon Draisaitl Injury Update Oilers Star Expected For Playoffs

May 09, 2025 -

Nhl Playoffs Oilers Vs Kings Game 1 Predictions And Betting Picks

May 09, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Predictions And Betting Picks

May 09, 2025 -

Game 1 Prediction Oilers Vs Kings Nhl Playoffs Betting Odds

May 09, 2025

Game 1 Prediction Oilers Vs Kings Nhl Playoffs Betting Odds

May 09, 2025 -

Oilers Vs Kings Nhl Playoffs Game 1 Predictions Picks And Best Bets

May 09, 2025

Oilers Vs Kings Nhl Playoffs Game 1 Predictions Picks And Best Bets

May 09, 2025