Impact Of X's Debt Sale: Analyzing The Newly Released Financial Data

Table of Contents

Immediate Market Reaction to X's Debt Sale

The market's initial response to X's debt sale was largely positive, indicating a degree of confidence in the company's strategy. However, this initial optimism needs careful scrutiny.

- Stock price fluctuations: Immediately following the announcement, X's stock price experienced a modest increase of approximately 2%, before settling into a slightly volatile trading range.

- Analyst reactions: Several leading financial analysts upgraded their ratings on X's stock, citing the potential for improved financial flexibility and strategic opportunities. Others maintained a "hold" rating, highlighting the increased debt burden.

- Trading volume spikes: Trading volume significantly increased on the day of the announcement and the following days, suggesting heightened investor interest and activity. This increased market volatility underscores the significance of X's debt sale.

- Comparison to previous debt offerings: Compared to X's previous debt offerings, this sale was significantly larger, leading to greater market sensitivity and a more pronounced initial response. The market appears to have reacted more positively than to comparable events in the industry, suggesting confidence in X's management and future prospects.

(Insert chart visualizing stock price fluctuations and trading volume here)

Analysis of X's Newly Released Financial Statements

X's newly released financial statements reveal significant changes in several key financial metrics resulting from the debt sale.

- Changes in debt-to-equity ratio: The debt-to-equity ratio has increased noticeably, rising from 0.8 to 1.2, indicating a higher level of financial leverage. This change is directly attributable to the newly issued debt.

- Impact on credit ratings: While some rating agencies have maintained their current ratings on X's debt, others have issued warnings of potential downgrades if the company fails to meet its financial targets. This underscores the increased financial risk associated with X's increased debt load.

- Changes in interest expense: X's interest expense is projected to rise substantially, impacting profitability in the short term. This factor needs to be carefully considered in any long-term financial projections for the company.

- Effect on profitability and key financial ratios: While immediate impacts on profitability might be negative due to increased interest expense, the potential for strategic investments made possible by the debt sale could lead to long-term gains in profitability and improved financial ratios, such as return on equity (ROE) and net income.

Long-Term Implications of X's Debt Sale

The long-term implications of X's debt sale are multifaceted and require careful consideration.

- Opportunities created: The substantial capital raised through this debt sale provides X with significant opportunities for acquisitions, strategic investments, and research and development initiatives which could dramatically enhance its competitive position and fuel future growth strategies.

- Risks associated with increased debt levels: The increased debt levels expose X to greater financial risk. Higher interest payments could strain profitability, and a downturn in the economy could severely hamper its ability to service its debt obligations. This necessitates careful risk management.

- Impact on future investment decisions: The availability of substantial capital may incentivize X to pursue more aggressive growth strategies; however, it is crucial that these decisions are balanced against the risk of over-leveraging. This could potentially influence future investment decisions regarding product development and market expansion.

Comparison to Industry Peers and Competitors

To fully assess the impact of X's debt sale, it's essential to compare it to similar actions taken by competitors within the same industry.

- Review of comparable companies: Several of X's competitors have recently undertaken similar debt issuances. These sales vary in scale, and their subsequent impact has been diverse. This comparative analysis is essential to understand the overall market dynamics.

- Comparison of outcomes: While some competitors have seen positive impacts on their stock prices and financial performance following debt sales, others have struggled to manage the increased debt burden. Analysis of those case studies can provide valuable insights.

- Competitive position: X's debt sale could either strengthen or weaken its competitive position, depending on how effectively the raised capital is deployed. Successful deployment could significantly enhance the competitive advantage.

Conclusion

The impact of X's debt sale is a complex issue with both short-term and long-term implications. While the immediate market reaction was largely positive, the increased debt levels introduce significant financial risk. The success of this strategy will heavily depend on X's ability to effectively manage its debt burden and make sound investment decisions using the newly acquired capital. The long-term implications for X's financial health, growth strategies, and competitive position will depend greatly on future market conditions and the success of its strategic initiatives. To stay informed about further developments regarding X's debt sale and its ongoing effects, continue monitoring future financial reports and subscribe to relevant financial news sources. Ongoing analysis of X's debt sale and its long-term impact remains crucial for investors and market participants alike.

Featured Posts

-

Us Shoppers Bear The Brunt How Trump Tariffs Inflate Temu Prices

Apr 29, 2025

Us Shoppers Bear The Brunt How Trump Tariffs Inflate Temu Prices

Apr 29, 2025 -

Diamond Johnsons Next Stop Minnesota Lynx Wnba Training Camp

Apr 29, 2025

Diamond Johnsons Next Stop Minnesota Lynx Wnba Training Camp

Apr 29, 2025 -

Market Value Plunge Seven Stocks Lose 2 5 Trillion In 2024

Apr 29, 2025

Market Value Plunge Seven Stocks Lose 2 5 Trillion In 2024

Apr 29, 2025 -

Nyt Strands Hints And Answers For Tuesday April 29 Game 422

Apr 29, 2025

Nyt Strands Hints And Answers For Tuesday April 29 Game 422

Apr 29, 2025 -

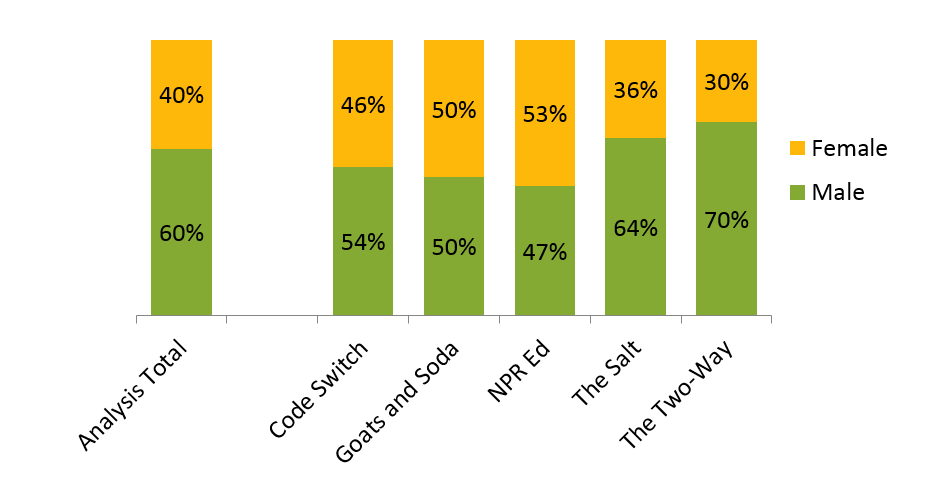

The Rise Of Older You Tube Users Data And Insights From Npr

Apr 29, 2025

The Rise Of Older You Tube Users Data And Insights From Npr

Apr 29, 2025

Latest Posts

-

Reviving Nostalgia Older Viewers And Their You Tube Habits

Apr 29, 2025

Reviving Nostalgia Older Viewers And Their You Tube Habits

Apr 29, 2025 -

How You Tube Is Attracting A Growing Audience Of Older Viewers

Apr 29, 2025

How You Tube Is Attracting A Growing Audience Of Older Viewers

Apr 29, 2025 -

London Real Estate Fraud British Court Upholds Vaticans Claim

Apr 29, 2025

London Real Estate Fraud British Court Upholds Vaticans Claim

Apr 29, 2025 -

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025 -

You Tube A New Home For Nostalgia And Classic Tv Shows For Mature Audiences

Apr 29, 2025

You Tube A New Home For Nostalgia And Classic Tv Shows For Mature Audiences

Apr 29, 2025