Market Value Plunge: Seven Stocks Lose $2.5 Trillion In 2024

Table of Contents

The Seven Stocks Leading the Market Value Plunge

Seven major corporations experienced significant market capitalization losses, contributing substantially to the overall $2.5 trillion decline. This stock market crash impacted investor confidence significantly. Here's a breakdown:

- Company A:

- Approximate loss: $500 Billion

- Reason for decline: Aggressive interest rate hikes impacting borrowing costs and slowing consumer demand. [Link to relevant news article]

- Company B:

- Approximate loss: $400 Billion

- Reason for decline: Geopolitical instability leading to supply chain disruptions and decreased international sales. [Link to relevant financial report]

- Company C:

- Approximate loss: $350 Billion

- Reason for decline: Disruptive technological advancements from competitors leading to decreased market share. [Link to relevant news article]

- Company D:

- Approximate loss: $300 Billion

- Reason for decline: High inflation eroding consumer purchasing power and impacting profit margins. [Link to relevant financial report]

- Company E:

- Approximate loss: $250 Billion

- Reason for decline: Increased competition and shifting consumer preferences towards sustainable alternatives. [Link to relevant news article]

- Company F:

- Approximate loss: $200 Billion

- Reason for decline: Economic sanctions impacting international operations and revenue streams. [Link to relevant financial report]

- Company G:

- Approximate loss: $500 Billion

- Reason for decline: A combination of rising interest rates and a significant data breach impacting consumer trust. [Link to relevant news article]

Analyzing the Causes of the Market Value Plunge

Several interconnected factors contributed to this significant stock market crash and market value plunge.

Impact of Rising Interest Rates

The aggressive increase in interest rates implemented by central banks to combat inflation played a pivotal role. Higher interest rates increase borrowing costs for businesses, impacting investment and expansion plans. This, coupled with decreased investor confidence due to a riskier market environment, significantly impacts stock prices. The reduced appetite for risk led to a sell-off across various sectors.

Geopolitical Instability and Its Role

Geopolitical instability, including ongoing conflicts and escalating trade tensions, created significant uncertainty in the global markets. Economic sanctions, supply chain disruptions, and the resulting uncertainty impacted investor sentiment and led to significant stock market losses. The ripple effects of these events were far-reaching, contributing to the overall 2024 market downturn.

Technological Disruptions and Shifting Consumer Preferences

Rapid technological advancements and the evolution of consumer preferences disrupted established industries. Companies unable to adapt to these changes faced declining market share and diminished valuations. The shift towards digital platforms and sustainable solutions highlighted the need for businesses to innovate and remain competitive in a rapidly changing landscape.

Inflation and Supply Chain Issues

Persistent inflation, coupled with lingering supply chain disruptions, squeezed profit margins for numerous companies. The increased cost of raw materials and transportation impacted production costs, limiting profitability and affecting investor confidence. These issues contributed significantly to the overall market value plunge and 2024 market downturn.

Investor Implications and Strategies for Mitigation

The severity of the market value plunge underscores the importance of proactive investment strategies.

Diversification and Risk Management

Diversifying investments across different asset classes and sectors is crucial to mitigate risk. A well-diversified portfolio can help reduce the impact of losses in any single sector. Implementing robust risk management strategies, including setting stop-loss orders and regularly reviewing portfolio performance, is equally important.

Long-Term Investing vs. Short-Term Trading

A long-term investment strategy, focused on fundamental analysis and sustainable growth, often proves more resilient during periods of market volatility than short-term trading. Long-term investors can ride out market fluctuations and benefit from the long-term growth potential of their investments.

Seeking Professional Financial Advice

Consulting with a qualified financial advisor is strongly recommended. A financial advisor can provide personalized guidance based on your individual financial goals, risk tolerance, and investment timeline. Their expertise can help you navigate market uncertainty and make informed investment decisions.

Understanding and Navigating the Market Value Plunge

The $2.5 trillion market value plunge of 2024 was a result of a confluence of factors: rising interest rates, geopolitical instability, technological disruptions, inflation, and supply chain issues. The seven key stocks highlighted illustrate the impact of these challenges on individual companies and the broader market. Understanding these dynamics is crucial for mitigating risk and navigating future market volatility. It's vital to implement effective risk mitigation strategies, including diversification and long-term investment planning. Seeking professional financial advice can further enhance your ability to navigate market fluctuations and protect your investments. Stay informed about market trends and protect your investments by understanding the dynamics of market value plunges. Learn more about effective investment strategies to navigate future market volatility. [Link to relevant resources – e.g., financial news websites, investment guides]

Featured Posts

-

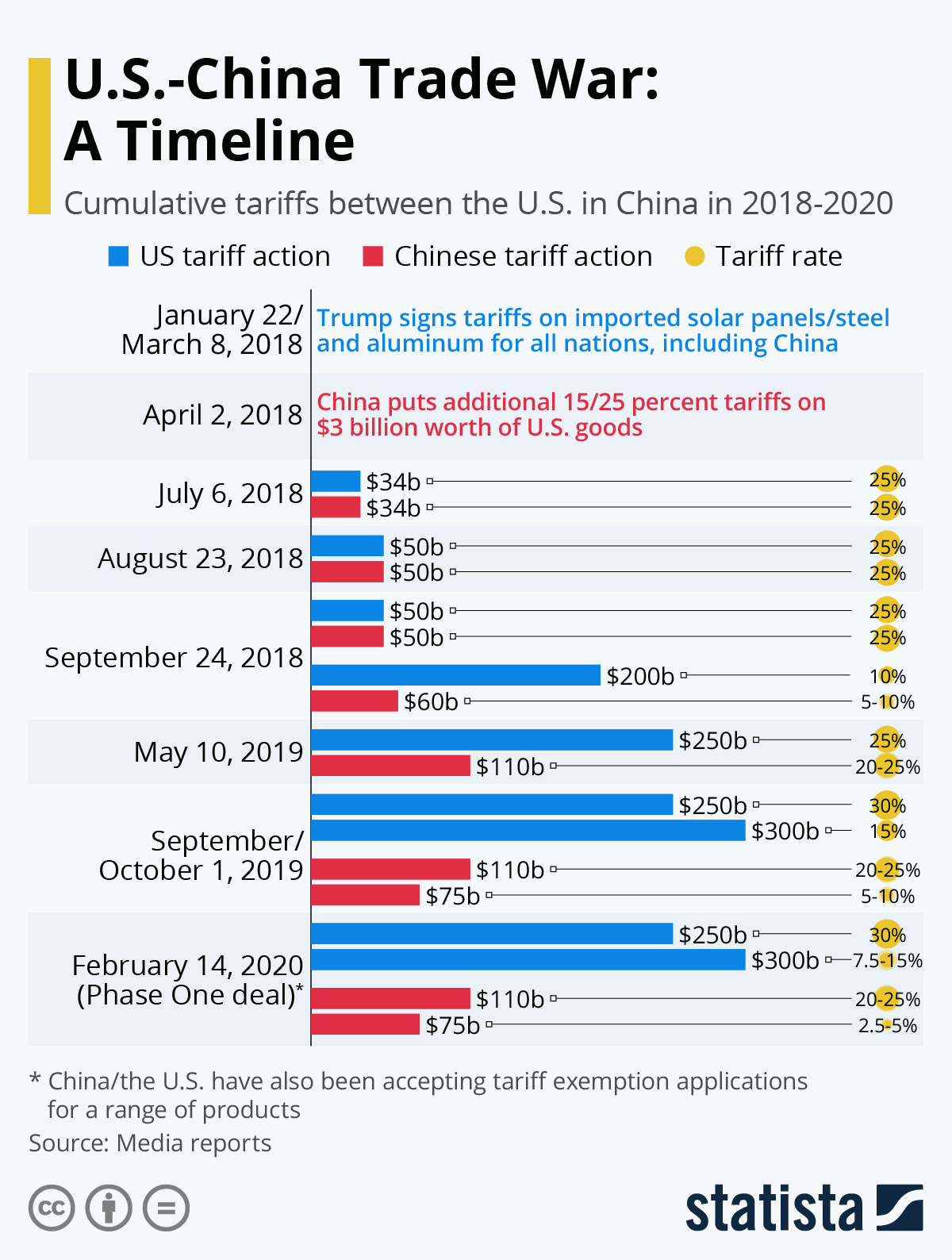

Analyzing Trumps Agenda The Next 100 Days Of Trade Deals Deregulation And Executive Power

Apr 29, 2025

Analyzing Trumps Agenda The Next 100 Days Of Trade Deals Deregulation And Executive Power

Apr 29, 2025 -

Trump Administrations China Tariffs Examining The Long Term Economic Repercussions

Apr 29, 2025

Trump Administrations China Tariffs Examining The Long Term Economic Repercussions

Apr 29, 2025 -

Arizona Boating Competition Speedboat Flips During Record Attempt

Apr 29, 2025

Arizona Boating Competition Speedboat Flips During Record Attempt

Apr 29, 2025 -

Georgia Deputy Killed Colleague Injured In Traffic Stop Shooting

Apr 29, 2025

Georgia Deputy Killed Colleague Injured In Traffic Stop Shooting

Apr 29, 2025 -

Analysis Trumps Tax Bill Faces Significant Republican Opposition

Apr 29, 2025

Analysis Trumps Tax Bill Faces Significant Republican Opposition

Apr 29, 2025

Latest Posts

-

Impact Of Xs Debt Sale Analyzing The Newly Released Financial Data

Apr 29, 2025

Impact Of Xs Debt Sale Analyzing The Newly Released Financial Data

Apr 29, 2025 -

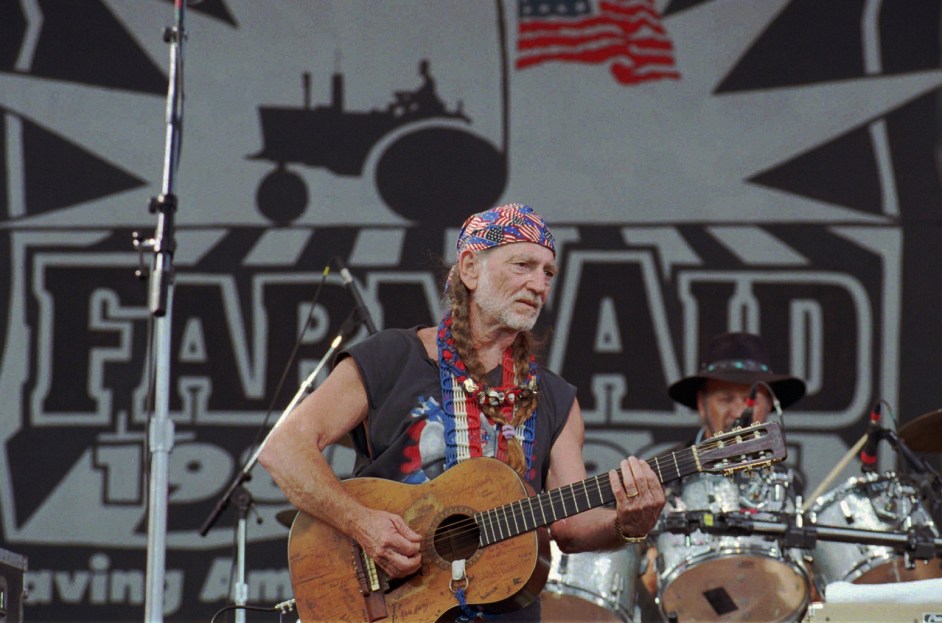

Willie Nelsons Documentary A Look At The Life Of A Dedicated Roadie

Apr 29, 2025

Willie Nelsons Documentary A Look At The Life Of A Dedicated Roadie

Apr 29, 2025 -

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025 -

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025 -

The Changing Face Of X A Look At The Financials Following The Debt Sale

Apr 29, 2025

The Changing Face Of X A Look At The Financials Following The Debt Sale

Apr 29, 2025