Important HMRC Communication: Your Child Benefit Payment

Table of Contents

Verifying Your Child Benefit Entitlement

Regularly checking your Child Benefit entitlement is vital. Your eligibility can change due to various factors, including alterations in your income, family circumstances (such as the birth of a child or a change in marital status), or changes in your address. Failing to update your information with HMRC could lead to underpayments or even overpayments, which may require repayment.

- How to check your entitlement online: Visit the official HMRC website and log into your online account. You'll find a dedicated section to manage your Child Benefit, where you can view your current entitlement and details.

- Contacting HMRC directly: If you prefer, you can contact HMRC directly via phone or post to verify your Child Benefit details. Their contact information is readily available on their website.

- Understanding the criteria for Child Benefit eligibility: Eligibility criteria are clearly outlined on the HMRC website. Key factors include residency status, the age of your child(ren), and your income. It's crucial to familiarize yourself with these criteria to ensure your continued eligibility. Understanding your Child Benefit eligibility is a key step to managing your payments effectively.

Understanding Your Child Benefit Statement

Your Child Benefit statement provides vital information about your payments. Knowing how to interpret this statement is crucial for ensuring accuracy and identifying potential issues.

- Decoding common abbreviations and terms: The statement may contain abbreviations and terms specific to HMRC. Familiarize yourself with these to avoid confusion. The HMRC website offers a glossary of terms to aid understanding.

- Identifying potential errors or discrepancies: Carefully review your statement for any errors or discrepancies in payment amounts, dates, or any deductions applied.

- Understanding what to do if information is incorrect: If you notice an error, contact HMRC immediately to report it. Provide them with all the necessary details from your statement and any supporting documentation.

Reporting Changes to HMRC

Promptly notifying HMRC about any changes in your circumstances is paramount. Failing to do so can result in overpayments, which you will be required to repay, or underpayments, leaving you potentially short of funds.

- Changes in income, address, or number of children: These are significant changes that must be reported to HMRC immediately. Delaying this could have serious financial consequences.

- How to report changes online or via phone: HMRC offers multiple channels for reporting changes, including online through your personal account and via telephone.

- The importance of keeping your contact details updated: Ensuring your contact information is current is vital. This allows HMRC to reach you easily with important updates and notifications about your Child Benefit payments. Keeping your details up-to-date simplifies the process of managing your Child Benefit.

Dealing with Child Benefit Overpayments or Underpayments

Receiving an overpayment or underpayment of Child Benefit can be unsettling. Knowing how to handle these situations is crucial.

- Contacting HMRC to discuss the issue: If you've received too much or too little, contact HMRC to discuss the matter. They will guide you through the necessary steps.

- Understanding the repayment process: If you owe money due to an overpayment, HMRC will outline a repayment plan tailored to your circumstances.

- Potential options for resolving discrepancies: HMRC will work with you to resolve any payment discrepancies, potentially through adjusted payments or repayment plans.

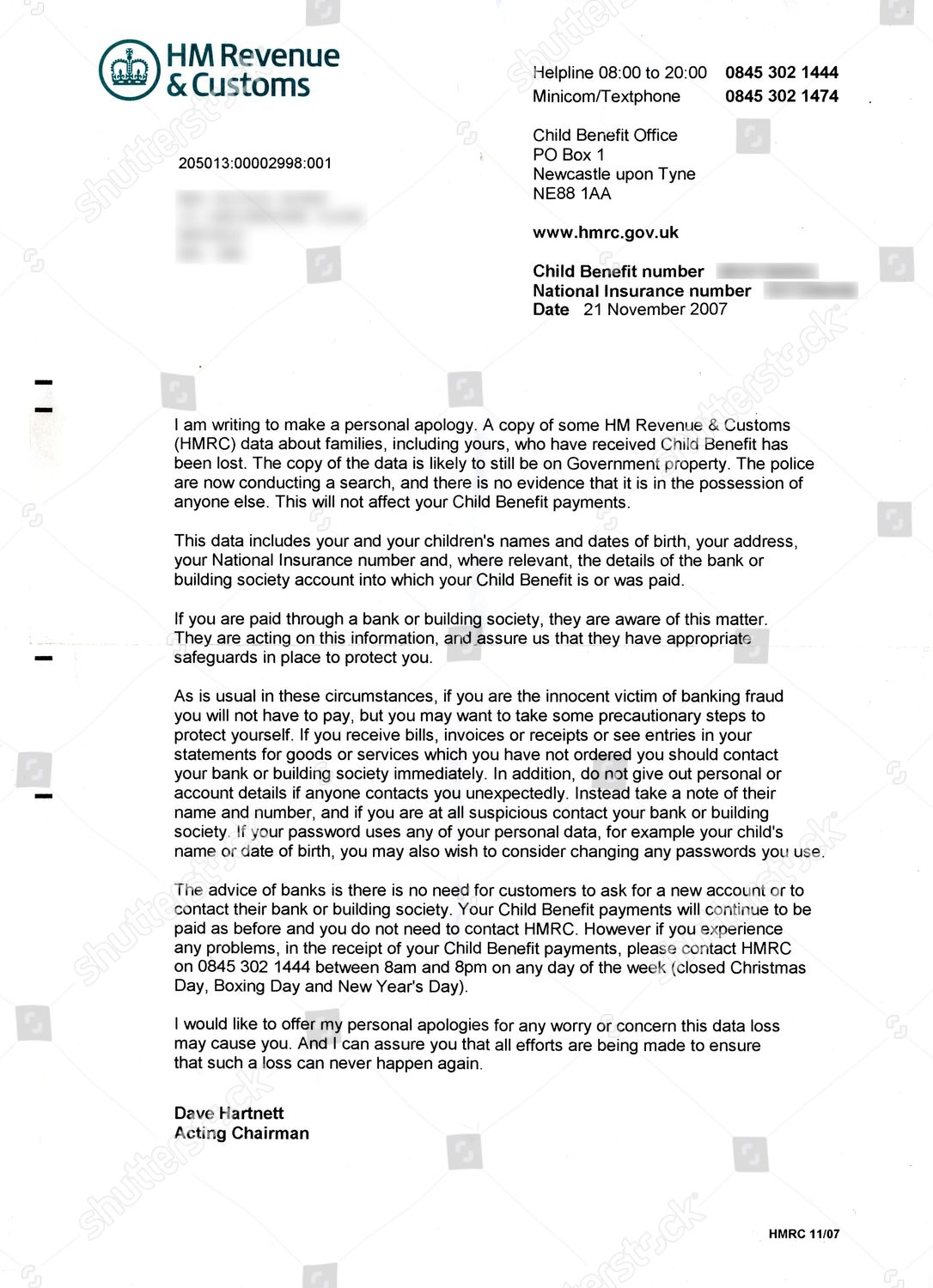

Recognizing Fraudulent HMRC Communications

Sadly, scams targeting individuals expecting Child Benefit payments are prevalent. It is vital to be vigilant and able to identify fraudulent communication.

- Identifying suspicious emails or letters: Legitimate HMRC communications will never ask for sensitive information via email or suspicious links.

- Never sharing personal information unsolicited: Never respond to unsolicited emails or phone calls requesting personal information regarding your Child Benefit.

- Reporting suspected fraudulent activity to HMRC: If you suspect fraudulent activity, report it immediately to HMRC through their official channels. Protecting your details is paramount.

Conclusion: Staying Informed about Your Child Benefit Payment

Managing your Child Benefit effectively involves verifying your eligibility, understanding your statements, promptly reporting any changes to HMRC, dealing appropriately with overpayments or underpayments, and protecting yourself from scams. Staying informed about your Child Benefit payments from HMRC is crucial for ensuring you receive the correct amount and avoiding potential complications. Visit the HMRC website to check your entitlement, update your details, and manage your Child Benefit proactively. Remember, proactive management of your Child Benefit ensures financial security for your family.

Featured Posts

-

Todays Nyt Mini Crossword Answer Cracking The Marvel The Avengers Clue

May 20, 2025

Todays Nyt Mini Crossword Answer Cracking The Marvel The Avengers Clue

May 20, 2025 -

I Tragodia Toy Baggeli Giakoymaki Mathimata Gia Tin Koinonia Mas

May 20, 2025

I Tragodia Toy Baggeli Giakoymaki Mathimata Gia Tin Koinonia Mas

May 20, 2025 -

Nyt Mini Crossword Answers For March 13th 2025 Full Solutions

May 20, 2025

Nyt Mini Crossword Answers For March 13th 2025 Full Solutions

May 20, 2025 -

Agatha Christies Towards Zero Why Episode 1 Delays The Murder

May 20, 2025

Agatha Christies Towards Zero Why Episode 1 Delays The Murder

May 20, 2025 -

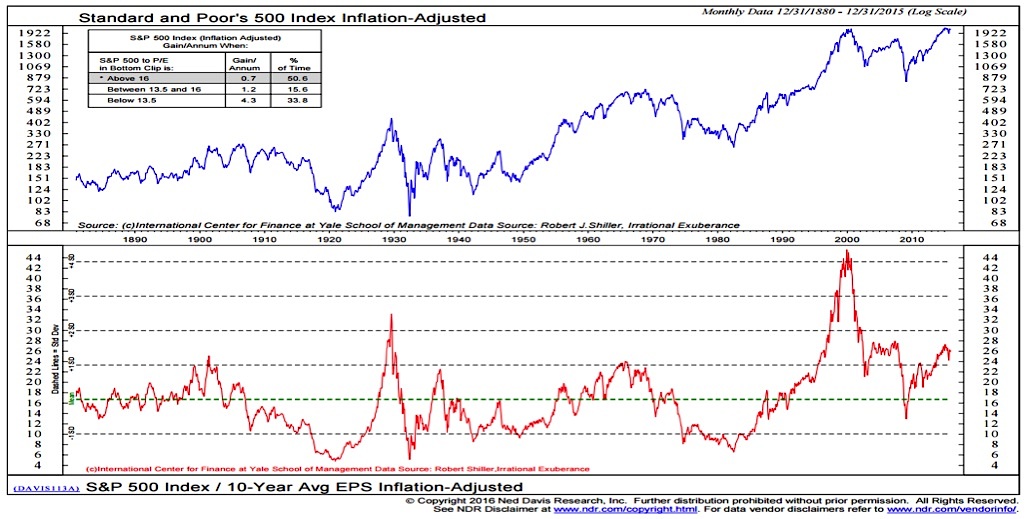

Bof A On Stock Market Valuations A Case For Investor Calm

May 20, 2025

Bof A On Stock Market Valuations A Case For Investor Calm

May 20, 2025