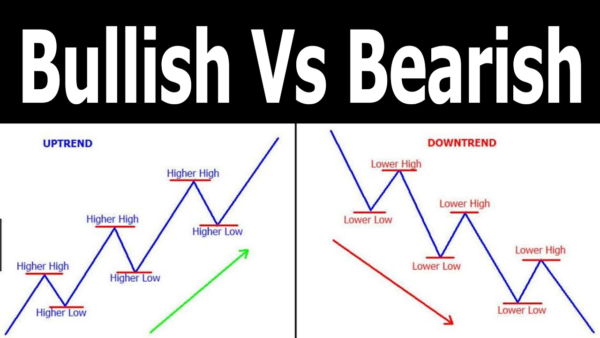

India Market Buzz: Nifty's Bullish Run Fueled By Positive Trends

Table of Contents

Strong Economic Fundamentals Driving the Nifty Bullish Run

The impressive performance of the Nifty index is strongly correlated with India's strengthening economic fundamentals. Several key factors contribute to this positive trend:

Robust GDP Growth:

India's consistent GDP growth, significantly outperforming many global economies, is a cornerstone of investor confidence. This robust growth fuels optimism and attracts both domestic and foreign investment.

- India's GDP growth in Q[insert quarter] [insert year] reached [insert percentage]%, exceeding expectations and marking [insert comparison, e.g., "a significant improvement over the previous quarter's growth"].

- The services sector, a major contributor to India's economy, showed [insert percentage]% growth, while the manufacturing sector recorded [insert percentage]% growth. This indicates a broad-based economic expansion.

- These positive India GDP growth figures contribute significantly to the positive Nifty index performance, demonstrating a strong link between macroeconomic health and stock market trends. The continued robust growth fuels expectations of strong corporate earnings, further underpinning the Nifty bullish run.

Positive Inflation Trends:

Easing inflation rates create a more stable macroeconomic environment, encouraging both investment and consumption. This stability is a crucial factor in the Nifty's upward trajectory.

- India's inflation rate in [insert month, year] stood at [insert percentage]%, within the Reserve Bank of India (RBI)'s target range of [insert range]. This demonstrates the effectiveness of the RBI's monetary policy.

- The easing inflation allows the RBI to maintain a relatively accommodative monetary policy stance, supporting economic growth without fueling excessive inflation. This positive inflation rate trend contributes to investor confidence and supports the Nifty 50 outlook.

- The impact of controlled inflation on interest rates is another significant factor. Lower interest rates make borrowing cheaper, stimulating business investment and consumer spending, both of which positively impact the Nifty.

Government Initiatives and Reforms:

Government policies and reforms aimed at boosting economic growth are fostering investor optimism and directly impacting the Nifty bullish run.

- Initiatives focused on infrastructure development, such as the ambitious [mention specific infrastructure projects], are creating significant investment opportunities and boosting economic activity.

- Reforms aimed at improving the ease of doing business in India are attracting foreign direct investment (FDI) and fostering domestic entrepreneurship. These government policies India are crucial in long-term economic growth.

- The government's focus on [mention other key policy areas, e.g., digitalization, skill development] is creating a more favorable business environment, contributing to overall economic strength and the Nifty's upward trajectory.

Increased Foreign Institutional Investor (FII) Interest

The influx of foreign capital into the Indian market is another significant driver of the Nifty's bullish run.

Global Capital Flows:

Increased foreign investment flowing into the Indian market is significantly boosting the Nifty. This indicates strong global confidence in India's economic prospects.

- Foreign Institutional Investors (FIIs) have invested [insert amount] in Indian equities in [insert period], reflecting a strong positive sentiment towards the Indian market. This FII inflow India is a key driver of the Nifty's performance.

- This influx of capital is partly driven by the relatively attractive valuation of Indian equities compared to other global markets, as discussed below.

- Global market sentiment, particularly regarding emerging markets, also plays a significant role. The current global landscape favors emerging markets like India, leading to increased FII investment.

Attractive Valuation:

Compared to other global markets, the Indian market, particularly the Nifty, is perceived as attractively valued, drawing foreign investors.

- The Nifty's Price-to-Earnings (PE) ratio is [insert current PE ratio], which is [insert comparison, e.g., "lower than" or "comparable to"] other major global indices. This makes Indian equities relatively inexpensive compared to their global peers.

- This attractive Nifty valuation, coupled with India's strong growth potential, makes it an appealing destination for global investors seeking higher returns.

- Other valuation metrics, such as Price-to-Book ratio and dividend yield, also contribute to the attractiveness of the Indian market for foreign investors.

Positive Investor Sentiment and Market Confidence

The Nifty's bullish run is also fueled by a surge in positive investor sentiment and increased market confidence.

Retail Investor Participation:

Increased participation by retail investors is boosting market liquidity and driving the Nifty higher.

- The number of retail investors in the Indian stock market has [insert trend, e.g., "increased significantly" ] in recent years, contributing to higher trading volumes.

- Factors such as increased financial literacy, the ease of access to online trading platforms, and the success stories of other retail investors are driving this increased participation in the stock market. This retail investor participation India is a key indicator of strong market confidence.

- This enhanced liquidity makes the market more efficient and helps to support the Nifty's upward momentum. Increased retail investor participation in Nifty 50 stocks is particularly noticeable.

Improved Corporate Earnings:

Strong corporate earnings are boosting investor confidence and fueling the bullish run.

- Many Indian companies have reported strong corporate earnings in recent quarters, reflecting the positive economic environment.

- Several sectors, including [mention specific high-performing sectors, e.g., technology, pharmaceuticals], have shown particularly strong growth in earnings, contributing to the overall positive sentiment.

- The improved company performance reinforces investor confidence in the Indian economy and further strengthens the Nifty bullish run. The strong performance of Nifty index constituents is a direct reflection of this improved corporate earnings trend.

Conclusion:

The Nifty's bullish run is a clear reflection of India's robust economic fundamentals, positive investor sentiment, and significant foreign investment. Strong GDP growth, easing inflation, and supportive government initiatives are all contributing to this positive market trend. While market volatility is always a possibility, the current indicators suggest continued optimism for the Indian stock market. To stay updated on the latest developments and capitalize on the opportunities presented by this Nifty bullish run, continue monitoring market trends and consider consulting with a financial advisor to make informed investment decisions. Stay tuned for further analysis on the continuing Nifty bullish run and its implications for the Indian market.

Featured Posts

-

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025 -

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6 Falsehoods

Apr 24, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6 Falsehoods

Apr 24, 2025 -

The Ted Lasso Resurrection Brett Goldsteins Perspective On Season 3

Apr 24, 2025

The Ted Lasso Resurrection Brett Goldsteins Perspective On Season 3

Apr 24, 2025 -

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 24, 2025

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 24, 2025 -

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 24, 2025

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 24, 2025