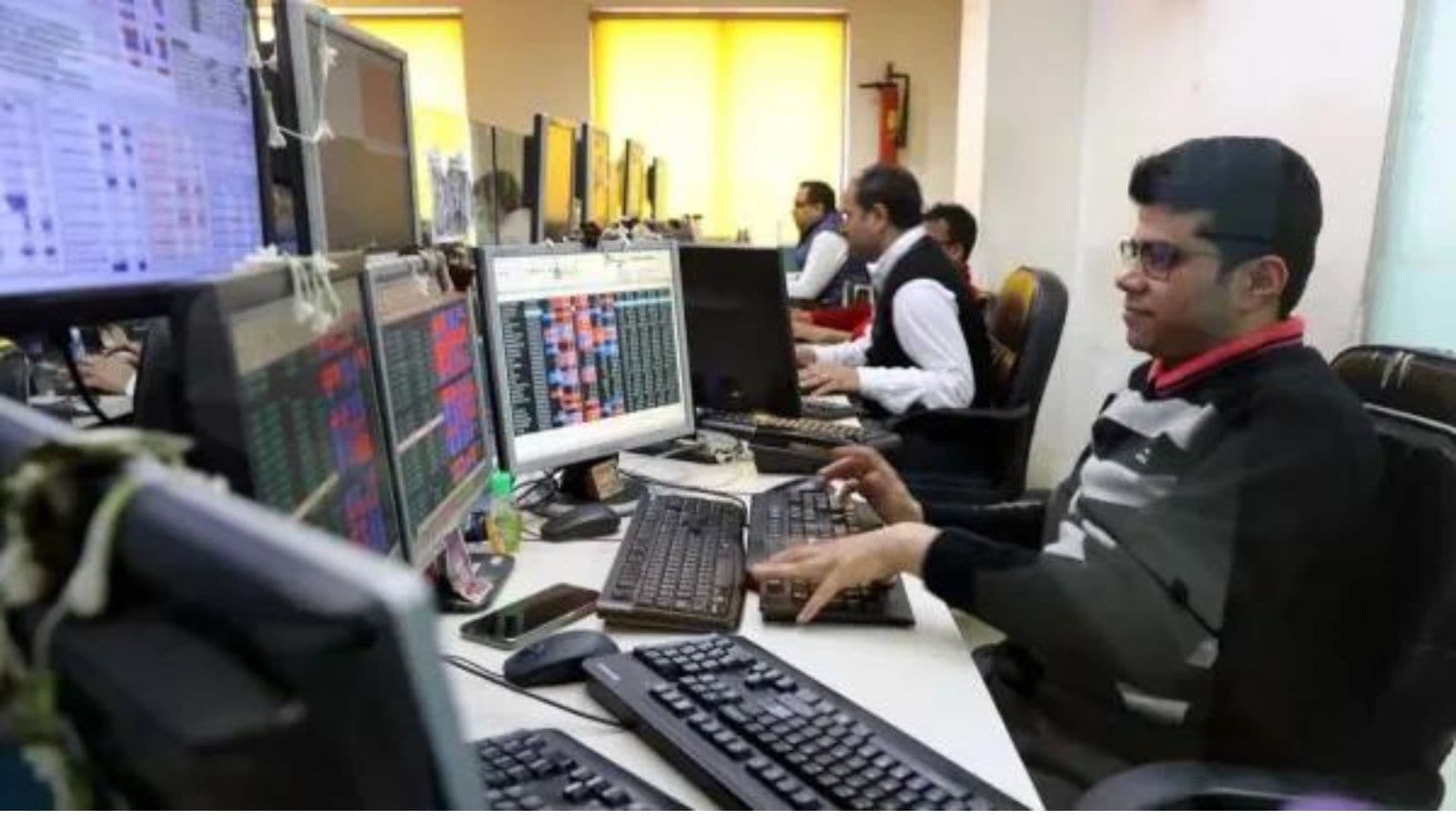

India Market Update: Tailwinds Driving Nifty Gains

Table of Contents

Robust Economic Growth as a Primary Driver

India's robust GDP growth is a primary driver of the Nifty's recent gains. The positive impact on the stock market is undeniable, with several key economic indicators pointing towards sustained expansion. This strong Indian GDP growth is translating into increased investor confidence and market activity.

- Increased Consumer Spending: A rising middle class and improved consumer confidence are fueling robust domestic demand.

- Rising Industrial Production: Several key industrial sectors are experiencing significant growth, contributing to overall economic expansion.

- Government Infrastructure Spending: Massive government investments in infrastructure projects are creating jobs and stimulating economic activity. This is particularly visible in sectors like construction and related industries.

- Positive Foreign Investment Inflows (FDI in India): India's attractive investment climate is attracting significant foreign direct investment, further boosting economic growth. This FDI in India is a major factor in bolstering market confidence.

Sectors like infrastructure, consumer goods, and technology are directly benefiting from this growth, experiencing significant upward trends in their stock valuations. Analyzing these Indian economic indicators provides a clearer picture of the market's strength.

Positive Global Sentiment and Foreign Institutional Investor (FII) Flows

Positive global sentiment plays a crucial role in driving Nifty gains. The global economic recovery, particularly in developed markets, has had a spillover effect on emerging economies like India. This positive global market sentiment increases foreign investment appetite.

- Global Economic Recovery: A recovering global economy is leading to increased capital flows towards emerging markets.

- Increased FII Investments in Indian Equities: Foreign Institutional Investors (FIIs) have significantly increased their investments in Indian equities, injecting substantial liquidity into the market. This FII investment in India is a significant driver of growth.

- Positive Outlook for Emerging Markets: India's strong fundamentals and growth prospects make it an attractive investment destination among emerging markets. This positive outlook on emerging market investment is fueling further inflows.

The influx of FII investment in India is directly correlated with the Nifty's upward trajectory, highlighting the interconnectedness of global and domestic market forces. The sustained inflow is a testament to the confidence in India's growth potential.

Government Policies and Reforms

Pro-growth government policies and reforms are further strengthening the Indian stock market. A series of initiatives aimed at improving the ease of doing business and boosting infrastructure development have significantly enhanced investor confidence.

- Ease of Doing Business Improvements: Streamlined regulations and simplified procedures have made it easier for businesses to operate in India.

- Infrastructure Development Projects: Massive investments in infrastructure are improving connectivity and creating a more conducive business environment.

- Tax Reforms: Tax reforms have simplified the tax system and made it more investor-friendly.

- Digitalization Initiatives: Government initiatives to promote digitalization are modernizing the economy and improving efficiency.

These India's economic reforms and government policies India are creating a positive feedback loop, attracting more investment and fostering further growth. The "Ease of Doing Business India" ranking improvements reflect this positive trend.

Strong Corporate Earnings and Improved Profitability

Strong corporate earnings and improved profitability are crucial factors underpinning the Nifty's performance. Listed companies are reporting increased profitability, driven by strong domestic demand and improving operational efficiencies.

- Increased Profitability of Listed Companies: Many major Indian corporations are reporting significant improvements in their bottom lines.

- Positive Earnings Growth Outlook: Analysts forecast continued earnings growth for many sectors, further boosting investor confidence.

- Strong Balance Sheets of Major Corporations: Many large companies have robust balance sheets, providing them with the financial strength to weather economic uncertainties.

Specific sectors like banking, pharmaceuticals, and technology are exhibiting particularly strong earnings growth, contributing significantly to the overall market performance. Analyzing the profitability of Indian companies provides a granular understanding of this positive trend. The Indian stock market performance is closely tied to this corporate profitability.

Conclusion: India Market Update: Sustained Growth Potential and Future Outlook

In summary, the recent Nifty gains are driven by a confluence of positive factors: strong economic growth, positive global market sentiment, supportive government policies, and robust corporate earnings. This India Market Update highlights the significant tailwinds propelling the Indian stock market. While the outlook remains positive, it's crucial to acknowledge potential risks and challenges. Geopolitical uncertainties and global economic fluctuations could impact the market.

However, the underlying strength of the Indian economy and the positive structural reforms underway suggest a strong potential for sustained growth. This presents compelling India market investment opportunities for those who are willing to do thorough research and assess their risk tolerance accordingly. Stay informed about the India Market Update, closely follow Nifty 50 Index analysis, and understand the broader Indian Stock Market trends to make informed investment decisions. Consider exploring the various Indian Stock Market trends and opportunities available to you.

Featured Posts

-

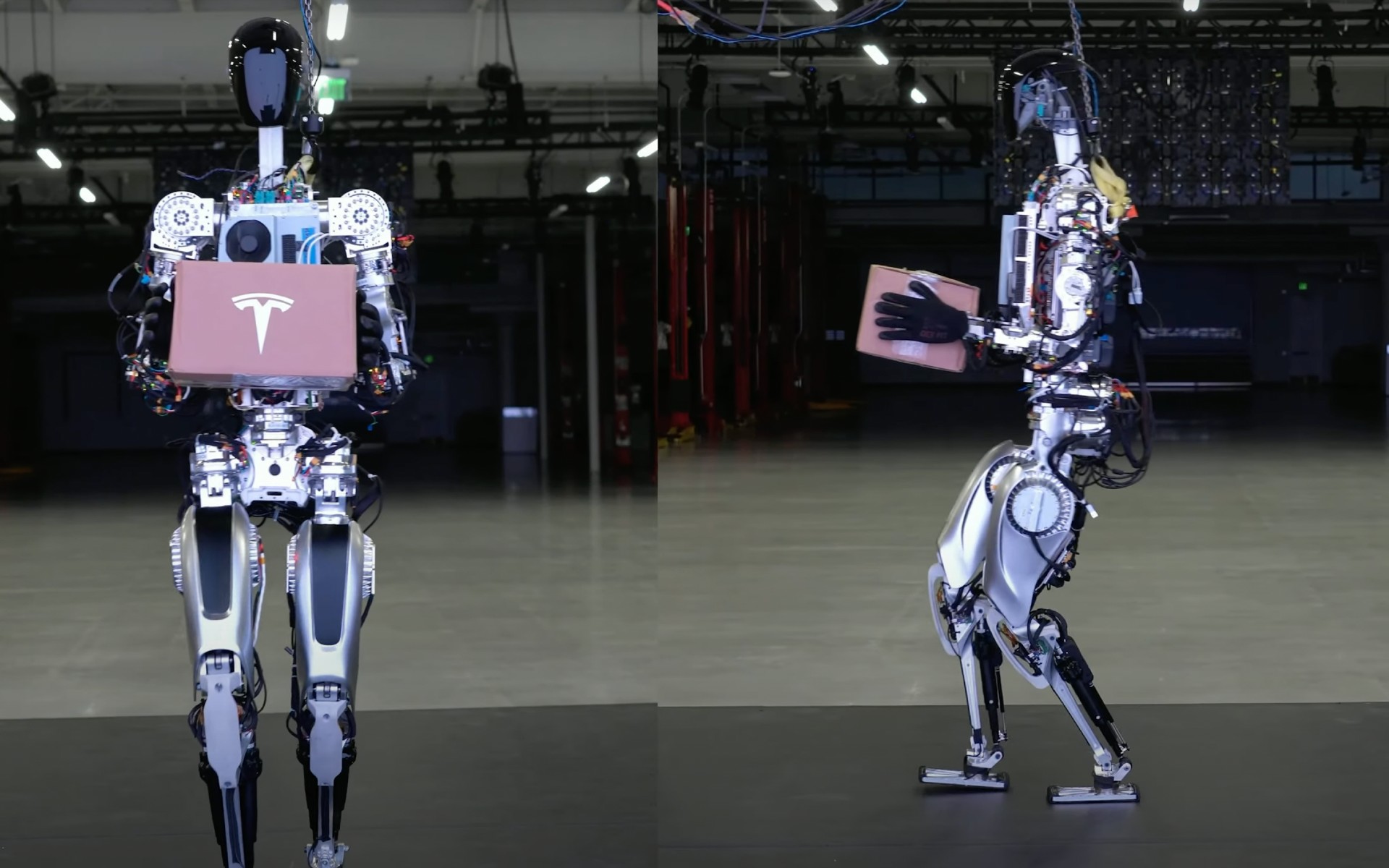

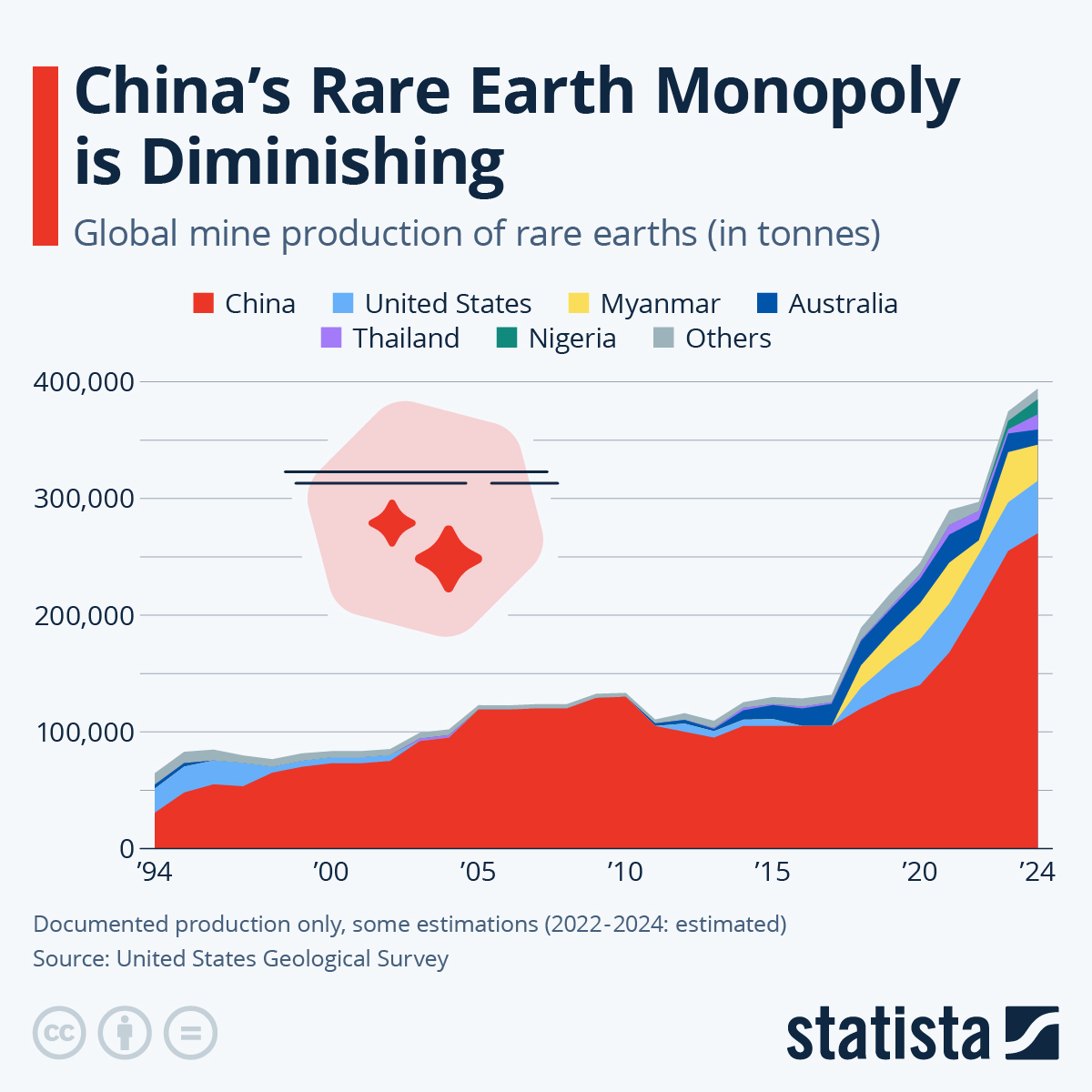

Optimus Robot Development Tesla Navigates Challenges From Chinas Rare Earth Policies

Apr 24, 2025

Optimus Robot Development Tesla Navigates Challenges From Chinas Rare Earth Policies

Apr 24, 2025 -

Betting On Natural Disasters The La Wildfires And The Changing Landscape Of Gambling

Apr 24, 2025

Betting On Natural Disasters The La Wildfires And The Changing Landscape Of Gambling

Apr 24, 2025 -

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025 -

Powell Job Secure Stock Futures React Positively To Trumps Remarks

Apr 24, 2025

Powell Job Secure Stock Futures React Positively To Trumps Remarks

Apr 24, 2025 -

John Travoltas High Rollers An Exclusive Preview Of Posters And Photos

Apr 24, 2025

John Travoltas High Rollers An Exclusive Preview Of Posters And Photos

Apr 24, 2025