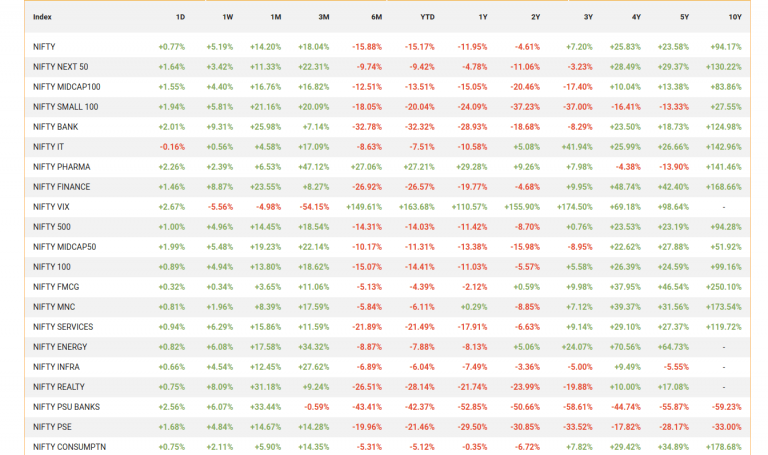

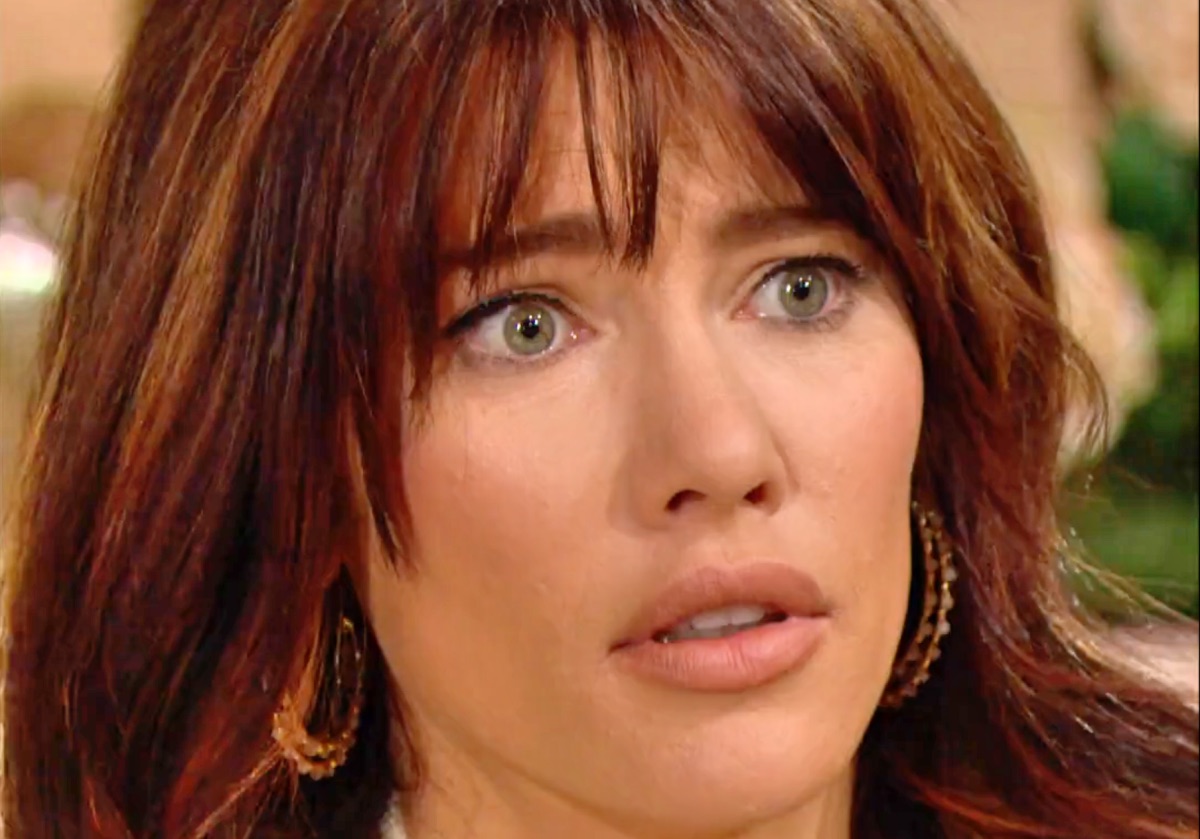

India Stock Market Analysis: Nifty's Robust Performance Explained

Table of Contents

Macroeconomic Factors Fueling Nifty's Growth

India's impressive economic growth story is a significant catalyst behind the Nifty's robust performance. Several macroeconomic factors contribute to this positive trend, creating a favorable environment for stock market investments.

Strong GDP Growth and Economic Reforms

India's consistent GDP growth, even amidst global economic uncertainties, is a cornerstone of its stock market strength. This sustained growth is further fueled by several government initiatives designed to boost the Indian economy.

- Consistent GDP Growth: India has consistently demonstrated robust GDP growth over the past few years, outperforming many other major economies. For example, [insert specific GDP growth figures for the last 2-3 years with source citation]. This consistent growth creates a positive sentiment among investors.

- Make in India Initiative: The "Make in India" initiative is designed to boost domestic manufacturing and reduce reliance on imports. This policy has attracted significant foreign investment and created numerous job opportunities, contributing positively to the Indian stock market.

- Infrastructure Development: Massive investments in infrastructure projects – roads, railways, ports, and renewable energy – are creating a strong foundation for future growth and attracting both domestic and international investments. Projects like [mention specific large-scale infrastructure projects] are key examples.

- Positive Economic Indicators: Favorable inflation rates (within the Reserve Bank of India's target range) and a steady increase in foreign direct investment (FDI) further bolster investor confidence and contribute to the overall positive sentiment in the Indian stock market.

Stable Political Environment and Policy Certainty

A stable political climate and predictable policy environment are essential for attracting both domestic and foreign investment. India's relatively stable political landscape in recent years has provided the necessary certainty for businesses to plan for the long term and for investors to feel confident in their investments.

- Predictable Policy Framework: Clear government policies and a streamlined regulatory framework minimize uncertainty for businesses and investors, encouraging long-term investment strategies.

- Positive Policy Decisions: Examples of positive policy decisions include [mention specific examples of pro-business policies and their impact on the market]. These policies showcase the government's commitment to economic growth and stability.

- Contrast with Previous Periods: A comparison with previous periods of political instability highlights the positive impact of the current environment on investor confidence and market performance. During times of political uncertainty, market volatility tends to increase significantly.

Sectoral Performance Driving Nifty's Upward Trend

The Nifty 50 index's upward trend is not just driven by macroeconomic factors; strong performance across various sectors also plays a vital role.

Technology Sector's Dominance

India's booming IT sector is a major contributor to the Nifty's performance. The sector benefits from both global demand for IT services and strong domestic growth.

- Global Demand: The global demand for software development, IT services, and outsourcing continues to fuel the growth of Indian IT giants.

- Prominent Companies: Companies like [mention prominent IT companies and their market capitalization] significantly contribute to the Nifty's overall value.

- Future Prospects: The future outlook for the Indian IT sector remains positive, with continued growth expected in areas like artificial intelligence, cloud computing, and cybersecurity.

Growth in Financials and Consumer Goods

The expansion in the financial and consumer goods sectors reflects a strengthening domestic economy and rising consumer spending.

- Financial Sector Growth: The growth in the financial sector is fueled by factors such as increasing credit availability, expansion of financial services, and a growing middle class.

- Consumer Goods Boom: The consumer goods sector is thriving due to rising disposable incomes, changing consumption patterns, and the increasing penetration of e-commerce.

- Successful Companies: Successful companies in these sectors, such as [mention specific examples], have significantly contributed to the Nifty's upward trajectory.

Infrastructure and Manufacturing Sector Growth

Government investment in infrastructure projects is a key driver of growth in related sectors, and the "Make in India" initiative is boosting the manufacturing sector.

- Infrastructure Investment: Massive infrastructure projects are driving growth in construction, cement, and related industries.

- Make in India Impact: The "Make in India" initiative is attracting foreign investment, creating jobs, and boosting domestic manufacturing.

- Future Infrastructure Plans: Future infrastructure development plans, such as [mention specific plans], will further stimulate growth in these sectors and contribute to the Nifty's performance.

Investor Sentiment and Market Dynamics

Positive investor sentiment, driven by both domestic and foreign investors, is crucial for the Nifty's strong performance.

Increased Foreign Institutional Investor (FII) Inflows

Significant FII inflows demonstrate confidence in the Indian economy's growth potential.

- FII Investment Trends: Analyzing FII investment trends reveals a sustained inflow of capital into the Indian stock market.

- Comparison with Other Markets: Compared to other emerging markets, India's attractiveness to FIIs is evident.

- Impact on Nifty: FII investments significantly contribute to Nifty's upward momentum.

Rising Domestic Institutional Investor (DII) Participation

Increased participation by DIIs reflects growing confidence in the Indian market.

- DII Investment Strategies: Analyzing DII investment strategies provides insights into the market's dynamics.

- Mutual Fund Investments: Mutual funds and other DIIs play a significant role in shaping market trends.

- Impact on Market: DII participation contributes to market liquidity and stability.

Retail Investor Participation

The growing participation of retail investors adds to market liquidity and stability.

- Factors Driving Retail Investment: Easy access to the market through digital platforms is driving increased retail investor participation.

- Impact on Nifty: Retail investor sentiment significantly impacts the overall market sentiment.

- Digital Platforms: Online trading platforms have made investing more accessible to retail investors.

Conclusion

The robust performance of the Nifty 50 index is a result of a confluence of factors, including strong macroeconomic fundamentals, impressive sectoral growth, and positive investor sentiment. Understanding these drivers is essential for informed investment decisions in the Indian stock market. While navigating the market always involves risk, the current trends suggest a promising outlook for long-term investors. To stay updated on the latest India stock market analysis and the Nifty's performance, continue to research and monitor key economic indicators and sectoral trends. For comprehensive Nifty 50 analysis and investment strategies, consult with a financial advisor. Remember, thorough research is crucial before making any stock market investments in India.

Featured Posts

-

Joint Venture Announced Saudi Arabia And India To Construct Two Oil Refineries

Apr 24, 2025

Joint Venture Announced Saudi Arabia And India To Construct Two Oil Refineries

Apr 24, 2025 -

Understanding High Stock Market Valuations Insights From Bof A

Apr 24, 2025

Understanding High Stock Market Valuations Insights From Bof A

Apr 24, 2025 -

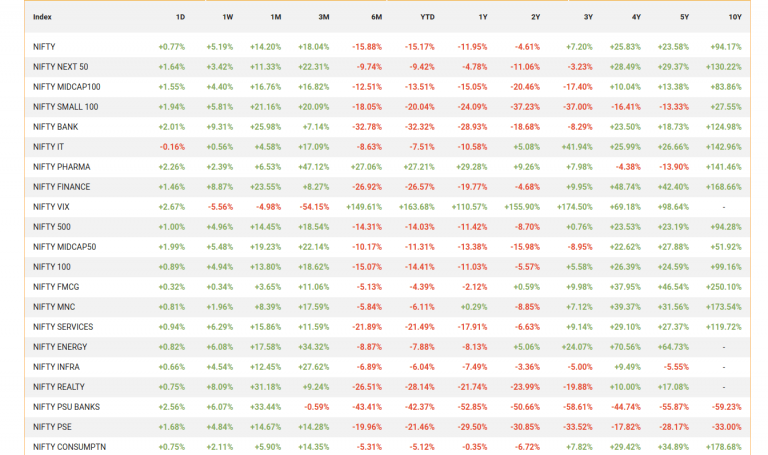

Klaus Schwab And The Wef An Exclusive Look At The Ongoing Investigation

Apr 24, 2025

Klaus Schwab And The Wef An Exclusive Look At The Ongoing Investigation

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Game Changing Move

Apr 24, 2025

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Game Changing Move

Apr 24, 2025 -

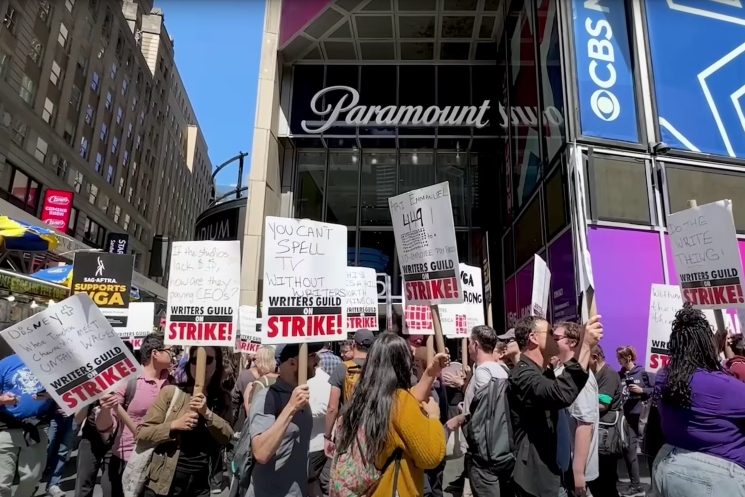

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 24, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 24, 2025