Infineon's (IFX) Disappointing Sales Guidance: Impact Of Trump Tariffs

Table of Contents

Deconstructing Infineon's (IFX) Revised Sales Projections

Infineon's revised sales projections paint a concerning picture. The company significantly lowered its revenue expectations, signaling a substantial decline compared to previous guidance and raising concerns about the overall health of the semiconductor market.

Lowered Revenue Expectations

Infineon's revised guidance reveals a [insert percentage]% decrease in projected revenue for [insert time period], compared to the previous forecast of [insert previous forecast]. This represents a considerable blow, impacting various key areas of the business.

- Automotive segment: A noticeable decline in demand for automotive chips, potentially driven by global supply chain disruptions and reduced car production.

- Industrial Power Control segment: Decreased orders in this sector, likely stemming from reduced industrial activity due to economic slowdown and tariff-related costs.

- Power & Sensor Systems segment: This segment also experienced a downturn, although possibly to a lesser extent than other areas.

This decline is projected to negatively impact earnings per share (EPS), with estimates suggesting a reduction of [insert estimated percentage] compared to prior projections. [Insert chart/graph visualizing the sales decline].

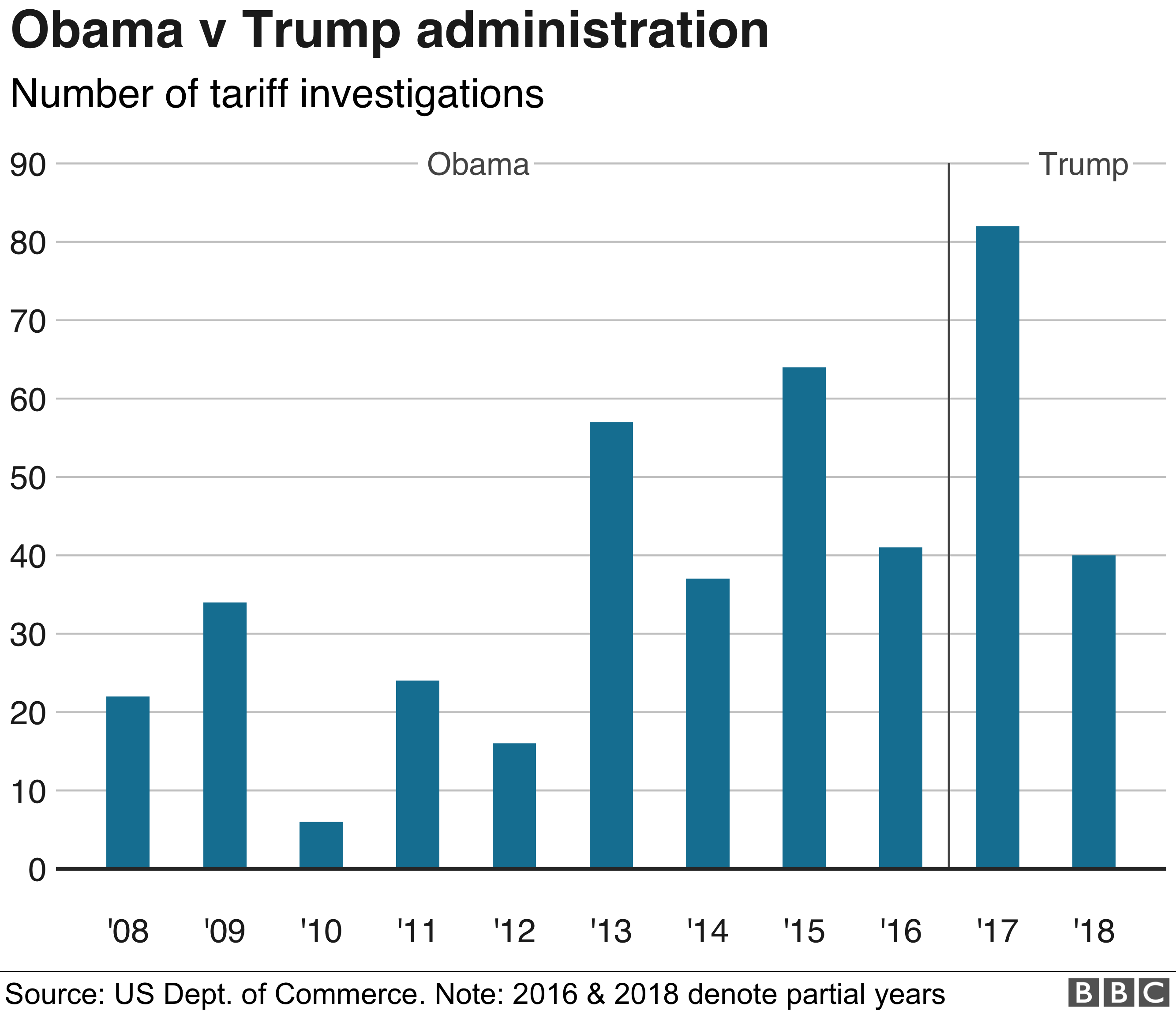

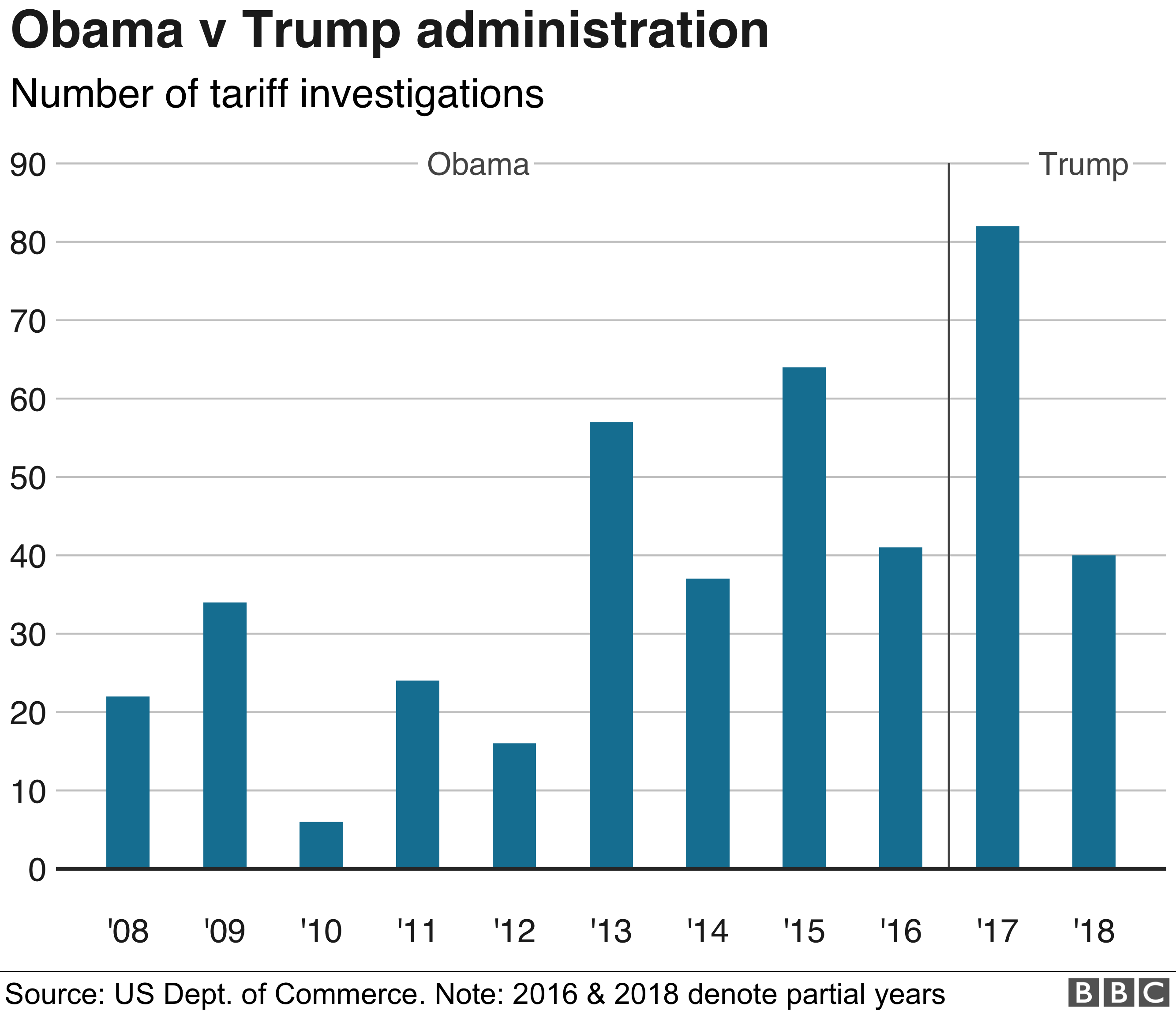

Geographic Impact of Tariffs

The impact of tariffs is not uniform across all geographical markets. Regions heavily reliant on trade with the US, particularly [mention specific regions like China, Europe etc.], have been disproportionately affected. This is because tariffs increase the cost of importing and exporting Infineon's products, impacting both sales and profitability.

- China: [Discuss the specific impact on sales in China, referencing any relevant data].

- Europe: [Discuss the specific impact on sales in Europe, referencing any relevant data].

- North America: Even North America, while potentially less directly impacted by export tariffs, experiences indirect effects through supply chain disruptions and increased input costs.

These tariffs have also led to shifts in supply chains, as companies seek to mitigate the increased costs associated with trade. [Insert data illustrating the impact of tariffs on specific regions].

Increased Production Costs

The tariffs directly contribute to increased production costs for Infineon. This is due to several factors:

- Increased import duties: Tariffs on imported components directly increase the cost of manufacturing.

- Higher transportation costs: Trade barriers can lead to longer and more complex shipping routes, increasing transportation expenses.

- Increased raw material costs: Tariffs on raw materials used in semiconductor production further inflate production costs.

This impact on production costs necessitates a re-evaluation of pricing strategies. Infineon might need to increase prices to maintain profitability, potentially impacting demand further.

The Broader Impact on the Semiconductor Industry

Infineon's struggle is not isolated; it reflects broader challenges facing the semiconductor industry due to the lingering effects of tariffs.

Ripple Effect on Semiconductor Supply Chains

The semiconductor industry is characterized by complex and interconnected supply chains. Tariffs disrupt this intricate network, leading to delays, increased costs, and uncertainty for all players. Infineon’s situation serves as a cautionary tale for other companies in the sector.

- [Mention other semiconductor companies potentially facing similar issues, providing links to relevant news articles].

- The interconnectedness of the supply chain means that even minor disruptions can have far-reaching consequences.

Geopolitical Considerations

The impact of tariffs extends beyond mere economic considerations. Trade wars and geopolitical tensions significantly influence the semiconductor industry's landscape. Infineon, like many other companies, is forced to adapt its strategy to navigate these complexities.

- Diversification strategies, such as establishing manufacturing facilities in multiple regions, are becoming increasingly crucial.

- The long-term implications of protectionist trade policies remain uncertain, creating risk and instability in the global semiconductor market.

Investor Response and Future Outlook for Infineon (IFX)

The disappointing sales guidance has had a significant impact on Infineon's stock price and investor sentiment.

Stock Market Reaction

Following the release of the revised sales guidance, Infineon's stock price experienced a [insert percentage]% decline. [Insert chart illustrating stock price movements]. Analyst ratings have also been adjusted downward, reflecting the increased uncertainty surrounding the company's future performance.

Infineon's Mitigation Strategies

Infineon is likely pursuing several strategies to mitigate the negative effects of tariffs:

- Cost-cutting measures: Implementing efficiency improvements and streamlining operations to offset increased costs.

- Price adjustments: Carefully evaluating and adjusting prices to maintain profitability while balancing demand.

- Supply chain diversification: Exploring alternative sources of components and manufacturing locations.

The effectiveness of these strategies remains to be seen and will depend on various factors, including global economic conditions and future trade policies.

Long-Term Implications and Predictions

The long-term impact of the tariffs on Infineon's performance remains uncertain. While the company is actively implementing mitigation strategies, the lingering effects of trade disputes and global economic uncertainty create significant headwinds. A cautious outlook is warranted, with ongoing monitoring of key economic indicators and geopolitical developments crucial for accurate forecasting.

Conclusion: Navigating the Challenges – Infineon's (IFX) Future in the Shadow of Tariffs

Infineon's disappointing sales guidance underscores the significant impact of Trump-era tariffs on the semiconductor industry. The lowered revenue projections, increased production costs, and negative investor response highlight the challenges facing the company. These challenges are not unique to Infineon; they represent broader concerns for the entire semiconductor sector. The ongoing effects of trade policies and geopolitical uncertainty create a complex and volatile environment for companies like Infineon. For investors, staying informed about Infineon's performance through careful analysis of its financial reports and industry analyses is crucial. Further research into Infineon stock analysis, the impact of tariffs on Infineon, and Infineon's future outlook is highly recommended to make informed investment decisions.

Featured Posts

-

Is Nigel Farages Reform Party More Than Just Criticism

May 09, 2025

Is Nigel Farages Reform Party More Than Just Criticism

May 09, 2025 -

Kiem Tra Va Xu Phat Nghiem Cac Co So Giu Tre Tu Nhan Co Hanh Vi Bao Hanh Tre Em

May 09, 2025

Kiem Tra Va Xu Phat Nghiem Cac Co So Giu Tre Tu Nhan Co Hanh Vi Bao Hanh Tre Em

May 09, 2025 -

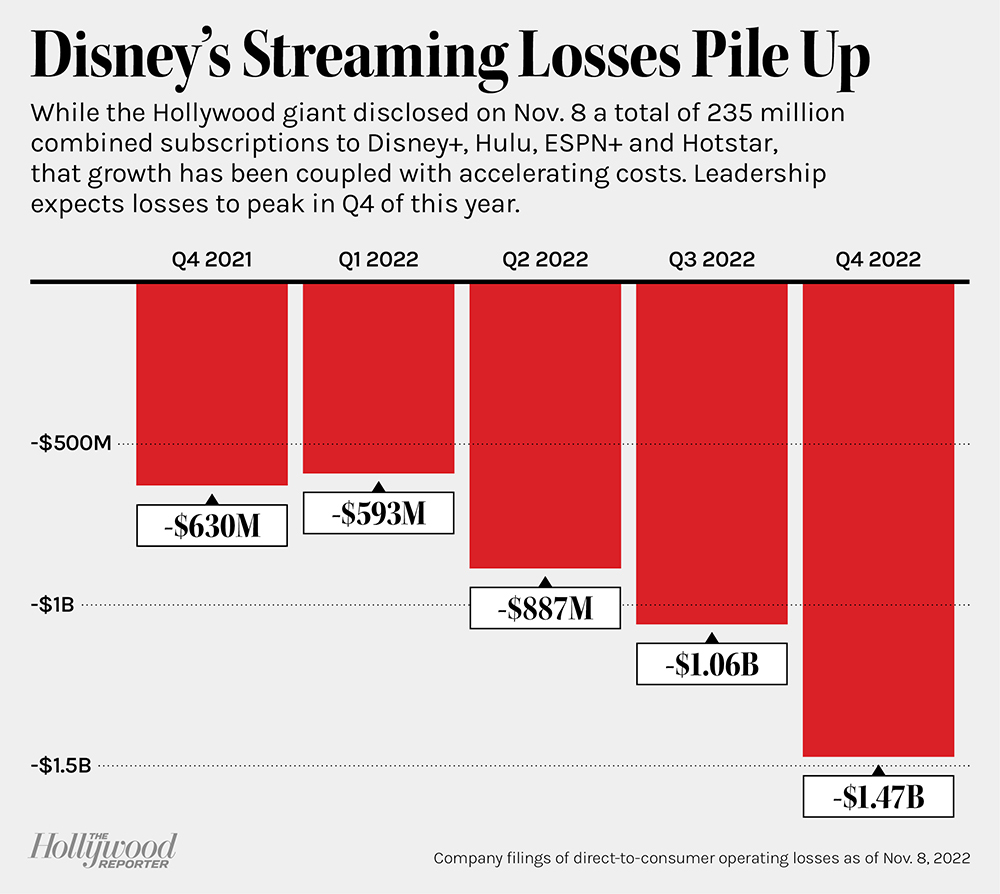

Positive Disney Profit Revision Thanks To Theme Parks And Streaming

May 09, 2025

Positive Disney Profit Revision Thanks To Theme Parks And Streaming

May 09, 2025 -

Indian Stock Market Soars 5 Key Factors Behind Sensex And Nifty Gains

May 09, 2025

Indian Stock Market Soars 5 Key Factors Behind Sensex And Nifty Gains

May 09, 2025 -

Trumps Billionaire Friends How Tariffs Impacted Their Fortunes After Liberation Day

May 09, 2025

Trumps Billionaire Friends How Tariffs Impacted Their Fortunes After Liberation Day

May 09, 2025

Latest Posts

-

Strictly Come Dancing Katya Joness Departure And The Wynne Evans Allegations

May 09, 2025

Strictly Come Dancing Katya Joness Departure And The Wynne Evans Allegations

May 09, 2025 -

The Best Celebrity Antiques Road Trip Episodes A Viewers Ranking

May 09, 2025

The Best Celebrity Antiques Road Trip Episodes A Viewers Ranking

May 09, 2025 -

Katya Jones Quits Strictly Wynne Evans Betrayal Implicated

May 09, 2025

Katya Jones Quits Strictly Wynne Evans Betrayal Implicated

May 09, 2025 -

Understanding The Celebrity Antiques Road Trip Format And Bidding Process

May 09, 2025

Understanding The Celebrity Antiques Road Trip Format And Bidding Process

May 09, 2025 -

Joanna Page Calls Out Wynne Evans On Bbc Show You Re So Trying

May 09, 2025

Joanna Page Calls Out Wynne Evans On Bbc Show You Re So Trying

May 09, 2025